Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

You don’t build a platform that reaches half a billion eyeballs around the globe without taking a few risks.

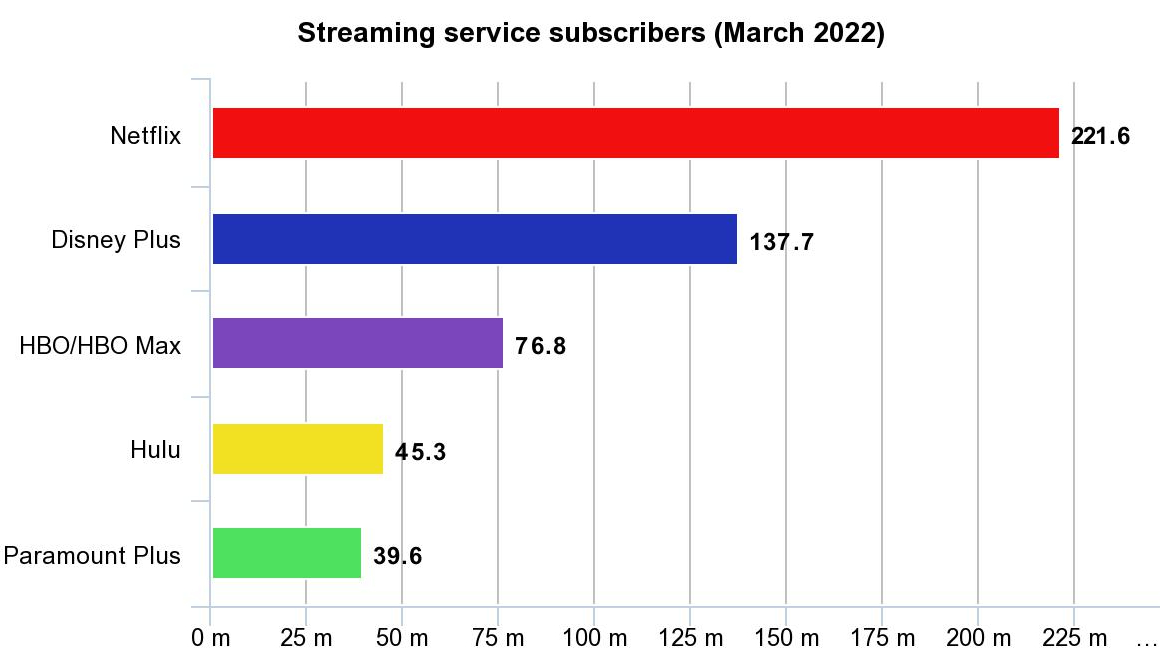

Netflix, the streaming service-turned-cultural behemoth whose subscriber count passed the 220 million mark at the turn of the year, achieved its success by betting against the mainstream: first with mail-based movie rentals and, later, internet-based streaming.

But recent years have seen legacy entertainment studios like Disney and WarnerMedia – owners of Disney Plus and HBO Max, respectively – board the streaming bandwagon with budgets and franchises to burn, encroaching on Netflix’s USP and threatening its once cosy dominance of your evening hours.

It was only a matter of time, then, before the company’s decade-long period of growth came to an end. In the three months following that year-end milestone, Netflix hemorrhaged 200,000 paying customers, a figure that’s expected to exceed two million come the end of June. If the trend continues, analysts at Ampere Analysis predict that Disney’s platform will overtake Netflix as the most-subscribed streaming service in less than two years.

Netflix CEO Reed Hastings has attributed the company’s decline to increased competition, password sharing, and its failure to diversify subscription packages. Others have called out the streamer’s untimely price increases, waning content quality and so-called woke agenda. Whatever the reason, Netflix finds itself needing to take new risks in 2022 – and its recent move into mobile gaming may prove a shrewder power play than many first thought.

Levelling up

Netflix began its courtship of the games industry back in 2016, partnering with developer BonusXP on a Stranger Things-inspired mobile title (imaginatively named Stranger Things: The Game) released in tandem with the second season of its hit drama series. Two more Stranger Things-branded titles followed, and all three were made available to purchase on iOS and Android devices at various different price points.

Those baby steps turned into a full-blown rollout of proprietary titles on the Netflix app late last year, with five games – Stranger Things: 1984, Stranger Things 3: The Game, Shooting Hoops, Card Blast and Teeter Up – becoming available for all Netflix subscribers to download and play on their mobiles and tablets at no additional cost (the former Stranger Things title was rebranded and made exclusive to Netflix as part of the move).

Sign up for breaking news, reviews, opinion, top tech deals, and more.

In a press release accompanying the announcement, the company’s game development chief, Mike Verdu, warned that it was still “early days” for the brand’s gaming ambitions – but Netflix bigwigs seem a touch more confident.

Speaking in January of this year, CEO Hastings appeared to throw caution to the wind when telling investors that the company's goal is to “amaze members by having the absolute best [games] in the [mobile] category.” Admittedly, this very public enthusiasm came before its first quarter spiral, though it’s hard to believe that, even in January, Netflix executives weren't aware of the choppy waters ahead.

In the months since that initial rollout, Netflix has regularly added more mobile games to its app library, growing the platform’s offering to a modest 18 titles at the time of writing. None are particularly groundbreaking – most are variations on the tried-and-tested formats you’ve been playing for years – but they nonetheless represent 18 more games than any other entertainment service has developed for its respective streaming apps.

Let’s be clear: nobody is expecting Netflix to shake up the hundred billion-dollar mobile gaming industry with fewer titles than the James Bond franchise has movies. Both Apple’s App Store and Android’s Google Play equivalent each boast around a million downloadable games, and Netflix doesn’t have designs on replacing those established platforms with its own virtual storefront.

The goal, instead, is much simpler: to offer new and existing customers a form of entertainment they won’t find on comparable streaming services. Granted, that offering is limited right now, but it’s only set to improve in the months to come; while other streamers are hoovering up movie studios, Netflix is busy acquiring independent game developers like Night School.

The company has hired serious senior talent, too. In addition to former EA and Oculus VP Mike Verdu, Netflix has added PlayStation veteran Roberto Barrera and former Riot Games director Leanne Loombe to its ranks in recent months. That’s an Avengers-esque lineup of gaming brains to make even the world’s foremost industry heavyweights take note.

"I think it’s smart what [Netflix is] doing," Xbox CEO Phil Spencer told the New York Times earlier this year. "They’re buying some studios. They’re learning about the creative process of interactive entertainment. And I think it’s a very smart way for them to move into the [gaming] space." Talk about a seal of approval.

Retention over revenue

It’s also worth clarifying that Netflix’s mobile gaming strategy isn’t about generating direct revenue from the games themselves. Every title released thus far is free to download, free from advertising, and refreshingly uncluttered by in-app purchases. Subscribers aren’t charged more for the pleasure of accessing Shooting Hoops or Card Blast in the Netflix app; these games are simply another way to entertain – and, crucially, retain – those who are already invested in the brand’s ecosystem.

In theory, that independence from monetization grants Netflix the creative freedom to deliver on its promise of making “the absolute best” mobile games. As Greg Peters, the company’s COO and Chief Product Officer, said in 2021: “Our subscription model yields some opportunities to focus on a set of game experiences that are currently underserved by the sort of dominant monetization models in games. Really, we can do what we’ve been doing on the movie and series side, which is just hyper, laser focused on delivering the most entertaining game experiences that we can.”

But read between the lines and there’s another, much more important motive at play: data. Just as the popularity of the company’s movies and TV shows determines its future content slate, the user-based decision-making going on inside Netflix games will likewise be tracked and used to inform creative decisions around its intellectual property (IP).

For instance, the frequency with which playable characters are selected in Stranger Things 3: The Game could influence the screen time of their real-life counterparts in future seasons of Stranger Things the show, while story-focused games like This is a True Story might be adapted into award-winning series should they prove a hit with players.

COO Peters has admitted that Netflix will “learn and grow and refocus investment based on what [it sees] is working” with its games, building another important cog into the company’s already labyrinthine algorithmic machine.

Hot property

Of course, Netflix’s existing IP slate will inform its mobile gaming titles as much as the latter influence the former. While the brand doesn’t have a Disney-like vault of beloved animated classics to remix into new content, Netflix has managed to establish its own string of commercially successful entertainment franchises that could easily provide the foundations for a stellar games library.

As Al Berry, a senior executive at London-based creative studio Green Rock, told us in an interview: “Netflix has the ability to create cultural phenomenons. Period. It also knows that once it has created these huge fan bases, audiences are going to crave more engagement in the worlds they love. This is an opportunity for Netflix to develop that IP in the gaming space and stop leaving it up to anyone else. Would Lego have created The Lego Movie if it hadn't first created licensed products from franchises such as Star Wars or Pirates of the Caribbean? No, probably not.”

Raj Shah, Managing Partner at digital consultancy Publicis Sapient, echoed Berry’s enthusiasm in a separate conversation with TechRadar. “Building a good game breaks down into two big pieces – having the technical skill to build it and having the IP around which to do so. On the first, Netflix is actively buying up mobile gaming companies, and probably has its eyes on game studios that can move it into the console space.

“On the second,” Shah continued, “Netflix has a huge catalog of owned IP – from drama to action. A play-along Squid Game? A Money Heist action platformer? A Stranger Things RPG? All possible, and all highly likely to keep fans glued to the Netflix app.”

Having only announced its grand gaming ambitions a handful of months ago, Netflix isn’t yet anywhere close to maximizing the potential of its IP – a couple of Stranger Things titles are the only franchise-based games you’ll recognize in the current Netflix library – but it’s not beyond the realms of possibility that we might see mobile game adaptations for each of its tentpole franchises before the year is out.

If, that is, the company’s subscriber losses haven’t derailed its plans entirely.

In response to last month’s very public, very damaging hemorrhage, Netflix has already condemned several in-development shows and movies – many of them from its animation division – to its ever-growing scrap heap of cancellations. This now infamous reputation for pulling the plug on projects that fail to provide instant returns doesn’t bode well for Netflix’s chances of producing “the absolute best [games] in the [mobile] category”, as CEO Reed Hastings proclaimed it would do at the turn of the year, nor for the fortunes of the developers under the company’s control.

We reached out to employees at Riot Forge, the subsidiary of League of Legends developer Riot Games responsible for bringing Hextech Mayhem to the Netflix app, for comment on whether the streamer’s subscriber losses have dented its hopes of continuing a working relationship with Netflix, but the topic was “[not] something [they were] willing to comment on at this time”. Netflix itself likewise failed to respond to comment requests.

Ashkan Karbasfrooshan, CEO and founder of video production behemoth WatchMojo, told TechRadar that he believes hubris lies at the heart of Netflix’s current woes; but the entrepreneur, whose own entertainment brand serves 42 million subscribers on YouTube, doesn’t believe that its current predicament will spell the end for Netflix’s mobile gaming ambitions.

“The main benefit of this is humility,” Karbasfrooshan told us. “I have a ton of respect for Reed Hastings and Ted Sarandos. But in a few years they went from scrappy outsider to central command for hubris in Hollywood. Snap Inc. [the company behind Snapchat] used to be a cocky place, then when Facebook copied its product, founder Evan Spiegel was served some humble pie – which we all need. So while [Netflix’s] losses will, in the short term, make [company executives] question themselves – which is a natural feeling for humans – long-term this’ll make Netflix a more formidable competitor, one that will appreciate that success isn't a fait accompli nor its god-given right. I realize I may not be accepted to Netflix parties in the future for saying that…”

It’s a sentiment we’ve echoed here at TechRadar – positive change must necessarily come to Netflix as a matter of urgency. Those recent subscriber revelations may have rocked the stock market's faith in the company's lasting value, but they could also serve as the catalyst needed to ensure that Netflix remains the supreme streaming service for years to come.

Yes, subscribers will soon be charged for sharing account passwords, but the inconvenience looks likely to come in exchange for more control over what those subscribers pay to watch (in the form of bespoke subscription packages), and a renewed focus on producing much higher-quality original content – mobile gaming included.

Go big or go home

So what does that mean in practice? According to WatchMojo's Karbasfrooshan, Netflix will have to break out the checkbook. “Historically, companies approach opportunities through a mix of build, buy, partner – and Netflix has already bought some smaller studios,” he told us. “I can see it making a run for larger companies, because gaming expertise is really not [something] in its backyard. My guess is that, for gaming to become a material contributor alongside its core business, Netflix will have to do it all: buy, invest, partner and build. Once [Netflix executives] see what works, they will then focus on that.”

And make no mistake, industry insiders like Karbasfrooshan believe that gaming is the future for a host of different sectors, not just entertainment. “You have a whole generation who has grown up with gaming,” he added. “All organizations have a future that will be rooted in, or tangentially involved in, gaming. Netflix is already way too large to go niche – it needs to somehow figure out how to go wide and deep. It's not easy, and the company may need fresh thinking to be able to do that, but this is where gaming comes into play.”

Perhaps, then, mobile gaming is of equal importance to Netflix’s growth strategy as the myriad movies and TV shows heading to its screens in the next few years. That may not seem the case right now – 18 proprietary titles will hardly have the competition quaking in its boots – but this is a company that knows the value in walking before it can run.

In 2007, Netflix launched the first incarnation of its online streaming service, offering subscribers a choice of 1,000 movies. At the time, that figure was dwarfed by the brand’s 70,000-strong physical DVD library. Less than a decade later, DVDs were dead, and Netflix’s online offering had quintupled to become the largest of its kind.

Could gaming be the next frontier for the entertainment industry’s biggest risk-taker? At this very early stage, nobody can know for sure – but stranger things have happened.

Axel is TechRadar's Phones Editor, reporting on everything from the latest Apple developments to newest AI breakthroughs as part of the site's Mobile Computing vertical. Having previously written for publications including Esquire and FourFourTwo, Axel is well-versed in the applications of technology beyond the desktop, and his coverage extends from general reporting and analysis to in-depth interviews and opinion.

Axel studied for a degree in English Literature at the University of Warwick before joining TechRadar in 2020, where he earned an NCTJ qualification as part of the company’s inaugural digital training scheme.