How to transfer money to your friends and family

Paying back your friends and family doesn’t have to be painful – here are a few options for taking the stress out of transferring funds.

We’ve all been in that situation where a large group all goes out for a meal, one person picks up the tab and everyone promises to pay them back, only for the weeks to go by without any sign of the money showing up.

Well, for those little payments between friends and family, there’s really no excuse any more, as technology has made it incredibly easy to transfer cash. Here we’re going to highlight some of our favorites:

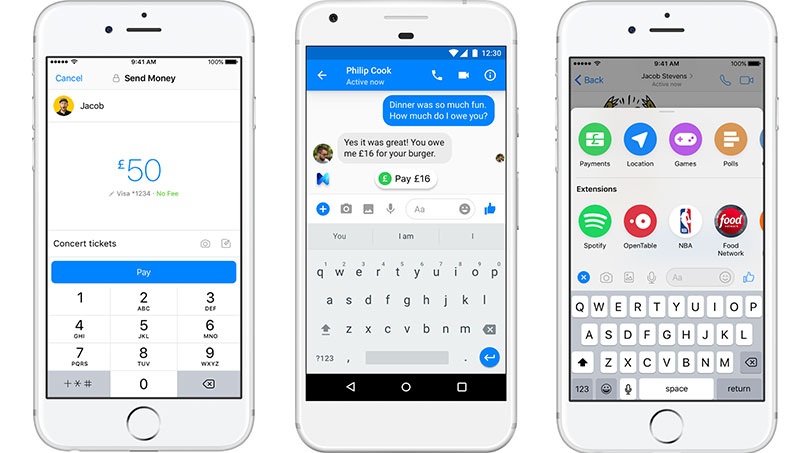

Messenger

Facebook’s Messenger has had peer-to-peer payments since 2015 in the US, and has recently brought the successful feature to the UK. In typical Facebook style, the service is completely free to use.

At present you can only do payments between debit cards in the UK, with both debit cards and PayPal accounts supported in the US.

The real benefit of the Messenger app for payments is the seamless integration into your conversations as they’re already happening. This means someone can remind you about the money you owe them, and with a few taps you’ve paid them back, without leaving Messenger. Plus, M (Messenger's AI) will prompt a payment if money is being discussed, meaning you don't have to.

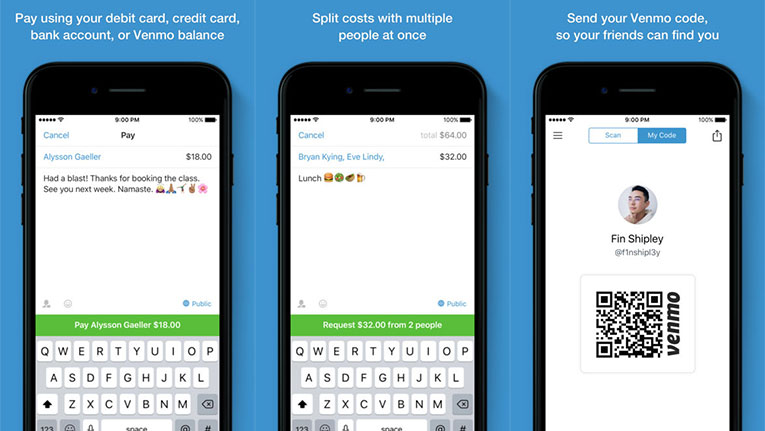

Venmo

The big name in peer-to-peer payments in the US, Venmo was created by PayPal, and allows for transfers between Venmo accounts, debit cards, credit cards, cashback credit cards and even allows you to pay for things online.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

For Venmo account payments, online transactions and debit card transfers there is no charge, and for any credit card transfers there is a 3% charge.

The real benefit of Venmo comes in the form of its PayPal integration, meaning that when you’re shopping online you don’t have to put your bank details into numerous different websites, potentially putting your financial security at risk. You just tap the PayPal option at the checkout and then complete the payment using Venmo.

Note that Venmo can only be used by US residents.

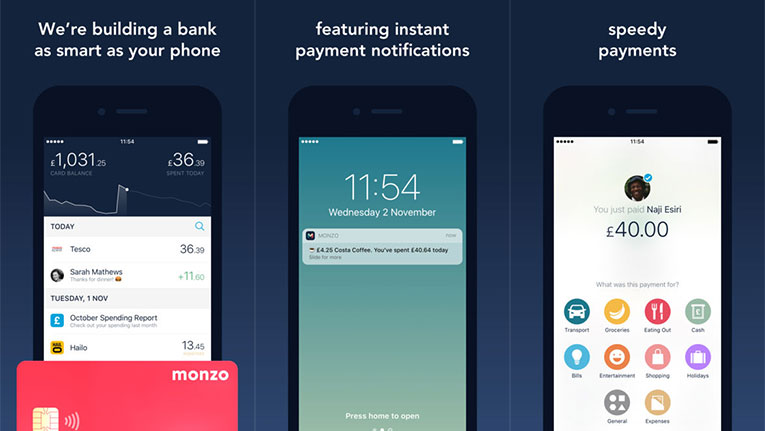

Monzo

Monzo is one of the key players in the digital banking revolution taking place at the moment. It’s an entirely digital bank based in the UK, meaning there’s no branch for you to go into to deposit a cheque even if you wanted to. That means you can use your Monzo card to pay abroad without paying fees, but must be a UK resident to sign up in the first place.

Thankfully, the methods for transferring funds are remarkably simple. For those with a Monzo account, transferring funds is as simple as selecting your friend and the amount you want to send them.

A really cool feature with Monzo is that it’s super easy to pay into a Monzo account even if you aren’t an account member yourself. The account holder simply gives you a URL that is the dedicated website for making payments to them and you put in your card details.

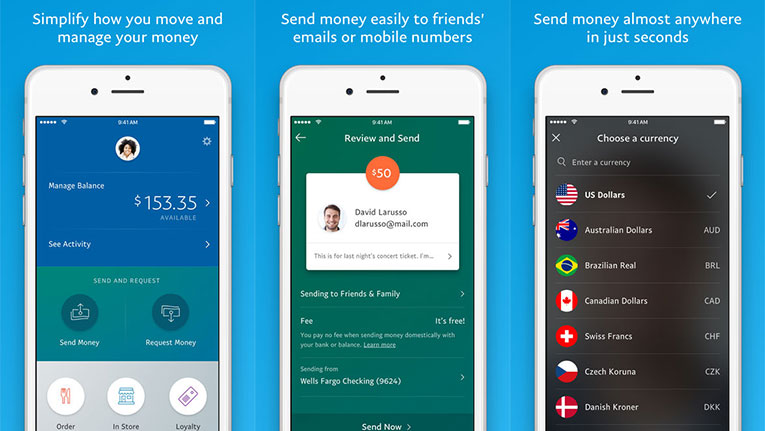

PayPal

If you’re outside the US and like the sound of Venmo, the PayPal app may be for you. Supported in over 200 different markets around the world, the PayPal app allows you to make transfers between PayPal accounts, and make online payments on any website that supports PayPal.

Using the PayPal app will require having a PayPal account, and you will have to transfer any funds from your account to your bank if you want to spend the money offline. That said, PayPal does support Android Pay, so if you want to do contactless payments using your phone, PayPal will help you do that without another app having your bank details.

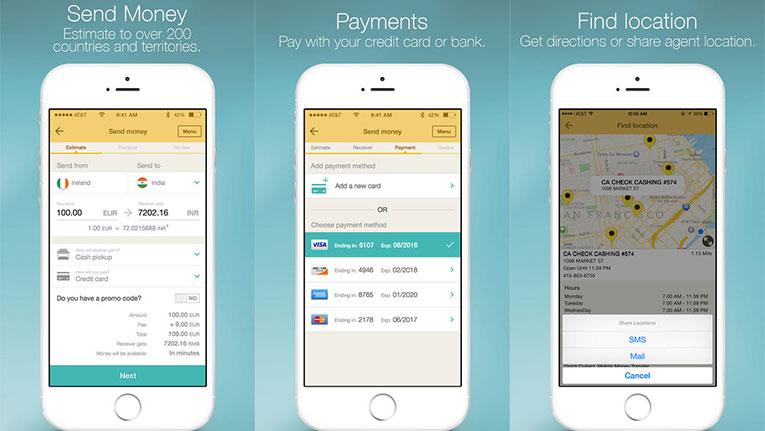

Western Union

Want to send someone some cold, hard cash? There’s an app for that. Western Union, along with allowing you to send money to bank accounts and online wallets like the apps above, also allows you to send money to your friends and family to pick up from over 500,000 agent locations in over 200 countries across the globe.

Payment between bank accounts is free, with there being small fees for a transfer to mobile wallets or for cash pickup. Inside the app you can instantly check all the fees and exchange rates, plus the app is really swift. It has card scanning capabilities to save you the hassle of putting in your card details manually, and allows you to transfer in seconds with one-touch fingerprint login.

Banks

While these were a few of our favorite apps for transferring funds, of course there is always the option to do it the old-fashioned way, using your bank. Pretty much every bank out there will have a service for transferring funds, and some of them have better apps than others. If none of the apps we've shown you here are calling to you, it's worth checking out your own bank's service.

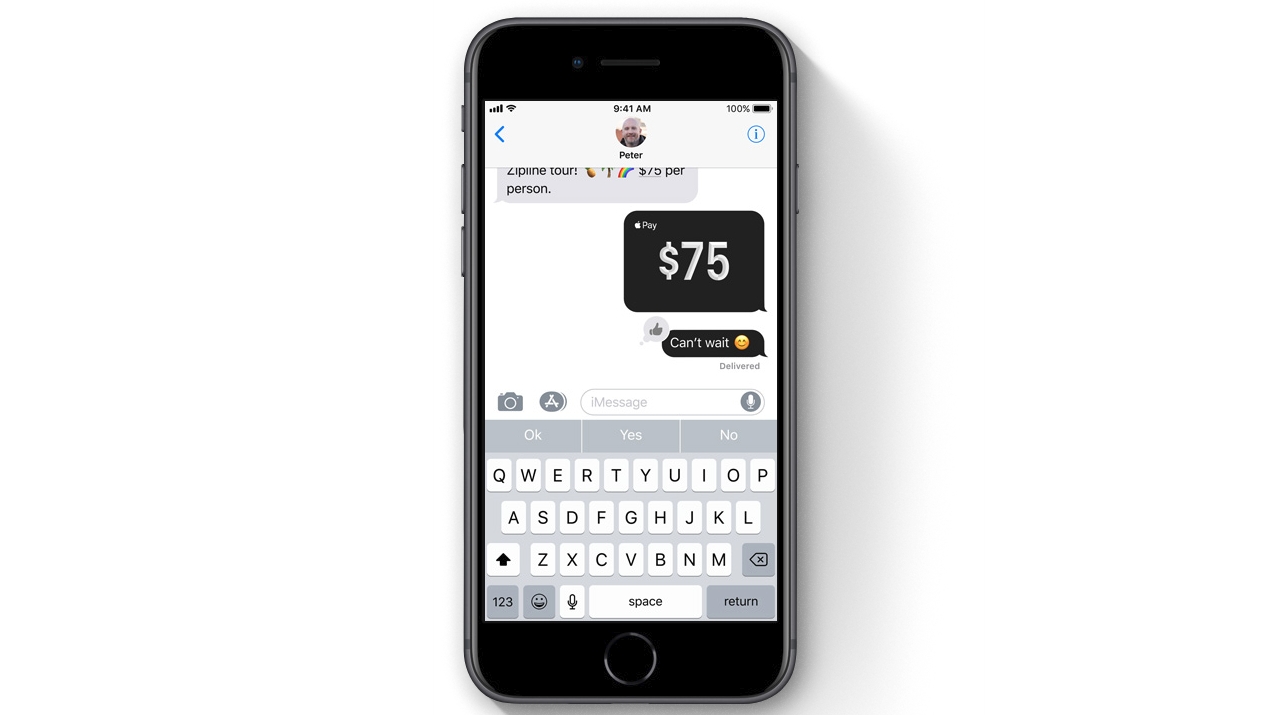

Apple pay and Android pay

If you'd rather not use an app, most smartphones nowadays will have the function to use either Apple pay of Android pay which have p2p payment functionality, dependent on region. Currently, neither of them service the UK.

Whatever you choose to do, there's really no excuse in the 21st Century to leave a debt unpaid.

Andrew London is a writer at Velocity Partners. Prior to Velocity Partners, he was a staff writer at Future plc.