Why you can trust TechRadar

Where it works

Apple's NFC digital wallet works in more than just McDonald's. Apple Pay retailers include Walgreens, Whole Foods, Macy's, Toys R Us, Subway and, yes, the Apple Store.

Actually, Apple's own store is kind of a big get for the company. Passbook showed up in 2012 as an all-encompassing loyalty and coupons app after being demoed with an Apple gift card at WWDC. Turns out, many of the Passbook items demoed that day, including ones for Apple's own store, weren't ready at the iOS 6 launch later that year.

That's not the case here. Charging your life's savings against everything the Apple Store has to offer is feasible from day one. It's also possible to pay for Apple Store items within the app.

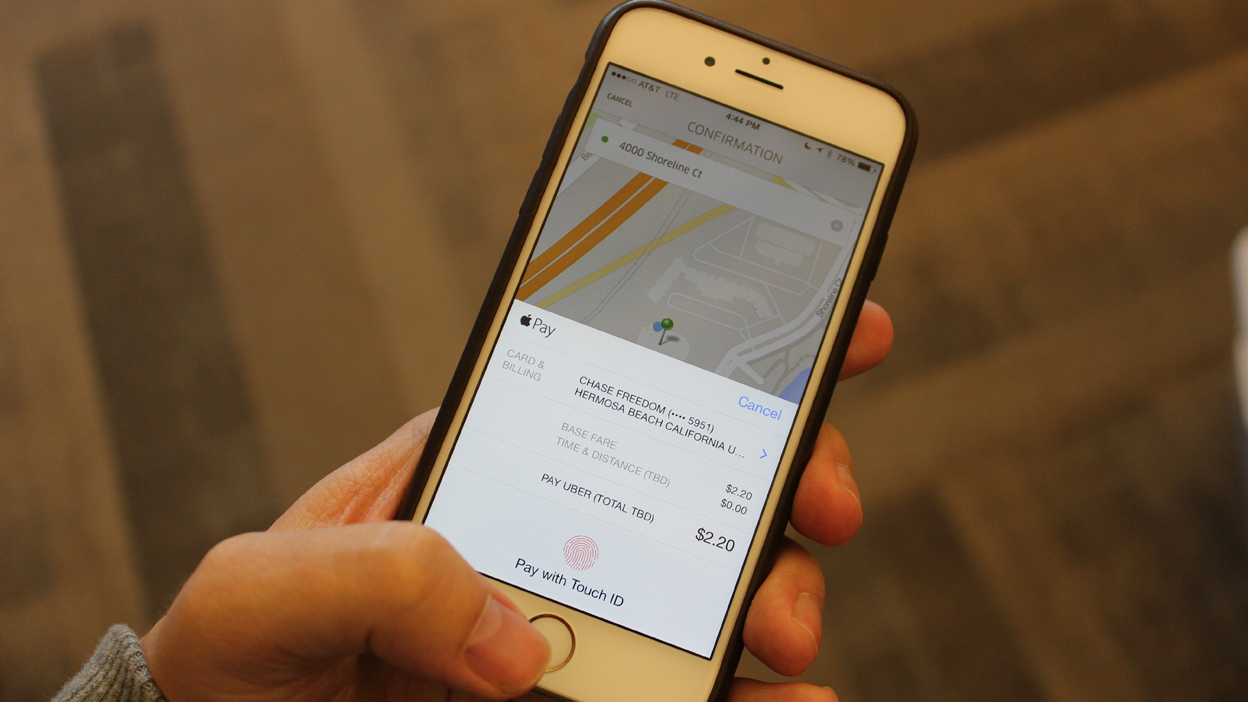

Opening up the Target, Uber, Lyft, Groupon and Panera Bread apps do the same from within. Just because the Groupon small business merchant or that part-time Uber driver doesn't have an NFC base station doesn't mean they can't accept your wireless transaction. In this way, Apple Pay rivals Paypal and WePay.

Stores adding their name to this growing list of merchants include Staples, Disney theme parks, Starbucks, MLB, AirBnB, Ticketmaster and StubHub. There are 220,000 stores accepting or readying this contactless payments system, according to Apple. Money is drawn from the three major US credit card companies, Visa, MasterCard and American Express, and over 500 participating banks.

Apple Pay has also now expanded to the UK, where it's available in hundreds of stores- anywhere with the Apple Pay or contactless logo in fact. Eleven UK banks also support it, specifically American Express, First Direct, HSBC, Halifax, Lloyds Bank, NatWest, NationWide, MBNA, Royal Bank of Scotland, Santander and Ulster.

Problems

Apple Pay isn't a perfect contactless solution for mobile payments. Sure, it captured my credit card numbers with accuracy in all but one test and the transaction time is mighty quick. It was actually difficult to snap photos of the process, it was that fast.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

But what happens when your battery runs out? This is a problem that iPhone 6 owners with battery issues know all too well. For this reason, Apple Pay isn't a viable solution to eliminate the need for credit cards. It's just a convenience if you already have your phone out.

We liked

Wallet captures credit and debit card information and instantly moves you away from swiping these plastic cards. Not completely away, but it's a safe distance. Its use of proximity-sensing NFC adds to that convenience because Wallet doesn't require you to bring up a specific app to make purchases. A simple magic-wand-like motion with the new iPhones and iPads automatically surfaces your logged cards in front of NFC terminals.

Touch ID authentication and the ability to stay anonymous in front of the cashier gives me peace of mind when using Apple Pay. No one can steal my iPhone and rack up charges the same way they could by forging my signature. It's locked behind biometrics. Given the rash of US credit card data thefts recently, Apple Pay could be a game changer one day.

We disliked

Apple Pay doesn't significantly solve real-world problems compared to swiping a credit card. Even though the iPad event keynote highlighted Apple Pay as a major part of the iOS 8.1 update, it's not a good enough reason to buy a new iPhone or iPad over previous models or an Android that uses the very comparable Google Wallet.

Verdict

Apple Pay is money when it comes to convenience and security. You hardly need to lift a finger to pay for something with Apple Pay. In fact, you aren't even required to press a button to buy something. An effortless placement of your Touch ID finger on the home button executes purchases after Wallet detects an NFC card reader.

That made the McDonald's ordering process go from fast food to faster food. Well, unless you count the cashier's confusion when I asked to use Apple Pay to buy an apple pie. "Yes, you can buy an apple pie. How will you be paying for it?" No, the iPhone wasn't able to place our order to avoid the language barrier between early adopters and everyone else.

Apple Pay is likely to solve other barriers thanks to NFC and Touch ID: card reading errors, credit card skimmers and lost or stolen debit cards could be a thing of the past. Apple's making a bigger, more focused push compared to the 2011 Google Wallet rollout on Android, but there's no guarantee Apple Pay will pay off any more than it did for Google.