India smartphone shipments cross 150 million in 2020 - But there's an asterisk

Xiaomi, the market leader in Q4

On the one side, there was pandemic and economic recession. On the other, the work from home and e-learning norms triggered fresh demand for smartphones.

In the end, pandemic may have been the winner as it had a negative impact on the sale of smartphones in India. But only just. For, India’s smartphone shipments declined by a modest 4% on its year-on-year numbers.

Overall, it reached over 150 million units in 2020, according to a research report from Counterpoint’s Market Monitor service.

India’s mobile handset market declined 9% YoY in 2020 due to a decline in feature phone shipments. The feature phone market registered a 20% YoY decline in 2020 as consumers in this segment were the worst hit by the lockdowns.

The Indian smartphone market grew 19% YoY in Q4 2020 as the festive season offers got extended.

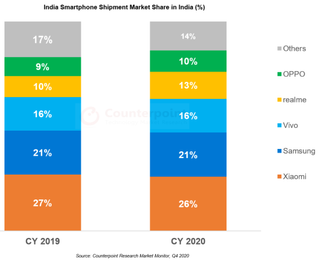

In a year of anti-Chinese sentiments in India, Chinese brands held75% market share.

- Apple phone-makers in India commit to $900 million investment

- Apple, Samsung among 16 companies get govt. approval to Make in India

The performance of various brands

Xiaomi recaptured the top spot in Q4 2020 with 13% YoY growth. Strong demand for the Redmi 9 and Redmi Note 9 series, and aggressive offers during the festive season led to a strong quarter for Xiaomi.

Get daily insight, inspiration and deals in your inbox

Get the hottest deals available in your inbox plus news, reviews, opinion, analysis and more from the TechRadar team.

Samsung eased to the second slot in Q4 2020 but exhibited a strong 30% YoY growth.

Vivo was the top offline player in 2020. However, it declined 13% YoY due to high exposure to the offline market, which was impacted by the pandemic.

Realme grew 22% in 2020 and crossed the 20 million units mark for the first time. It's the highest growth rate among the top 5.

Oppo shipments grew 11% YoY in 2020 while remaining flat in Q4 2020, driven by the demand for its recently launched A12 and A53 models.

Poco crossed 5 million smartphone units for the first time in Q4 2020 driven by its M2, M2 Pro and C3 models.

Transsion Group brands (Itel, Infinix and Tecno) registered their highest-ever shipments in a single quarter at over 9 million units. Transsion brands remained strong in Tier 3 and Tier 4 cities, and rural India to capture the third position in the overall handset market.

OnePlus sees 200% YoY growth in Q4

Apple captured the sixth spot in Q4 2020 with 171% YoY growth in Q4 and 93% YoY growth in 2020.

OnePlus saw 200% YoY growth in Q4 2020 driven by its mid-range Nord series and the newly launched 8T series.

In 2020, 5G smartphone shipments crossed 4 million units in India. These shipments were driven by two brands – OnePlus, the only brand with a 100% 5G portfolio, and Apple, which launched the iPhone 12 series with 5G connectivity.

5G smartphone shipments are expected to increase by more than nine times to reach 38 million units in 2021.

Via: Counterpoint

Over three decades as a journalist covering current affairs, politics, sports and now technology. Former Editor of News Today, writer of humour columns across publications and a hardcore cricket and cinema enthusiast. He writes about technology trends and suggest movies and shows to watch on OTT platforms.

Most Popular