Phones

Smartphones are the most personal devices we own, keeping us connected at all times and acting as the heart of our tech lives. We may not spend much time actually speaking on them these days, but we use a phone for virtually everything else.

Smartphones today typically fall into one of two categories: iPhone or Android. iPhones are the most popular smartphones overall and offer entry into the much coveted Apple exosystem, where they can be paired with Apple Watches, iPads, and MacBooks for greater inter-device connectivity.

Android phones, meanwhile, are more numerous combined and often offer higher specs than iPhones on measures such as charging speed and camera quality, while offering integration with a wider variety of devices including Chromebooks and Windows laptops. They also tend to be cheaper.

Our industry-leading phones coverage serves up news, reviews, features and tutorials covering all kinds of devices, from the best smartphones overall to more budget offerings and all points in-between.

Explore Phones

-

Acer Phones

-

Android

-

Asus Phones

-

BlackBerry Phones

-

Google Pixel Phones

-

HTC Phones

-

Honor Phones

-

Huawei Phones

-

LG Phones

-

Microsoft Lumia

-

Motorola Phones

-

Network Providers

-

News about Phones

-

Nokia Phones

-

Nothing Phones

-

OnePlus Phones

-

Oppo Phones

-

Phone Accessories

-

Phone Buying Guides

-

Phone Deals

-

Phone How Tos

-

Phone Reviews

-

Realme Phones

-

Samsung Galaxy Phones

-

Sony Xperia Phones

-

Windows Phone

-

Xiaomi Phones

-

ZTE Phones

-

iOS

-

iPhone

Latest about Phones

The Ikko MindOne Pro is like a Galaxy Z Flip 7 without the flip

By Jamie Richards published

The Ikko MindOne Pro promises a cool new design for small phone lovers

The best Visible Wireless deals and coupon codes for January 2026

By Alex Whitelock last updated

TechRadar deals Simply the best Visible Wireless deals, coupons and free trials, here to help you save money on a superb carrier.

The best Mint Mobile deals for January 2026

By Alex Whitelock last updated

TechRadar deals We've rounded up this week's best Mint Mobile deals and coupons into one handy place to help our readers save on their new prepaid phone plan.

I'm a lifelong iPhone user, but a few months with Gemini on Android have shown me exactly why Apple and Google's AI partnership is what everyone needs

By John-Anthony Disotto published

For the first time in years, I’m excited about the future of the iPhone. And that excitement is coming from Google, not Cupertino.

Samsung Galaxy S26 camera predictions: every rumored lens for all three models

By James Rogerson published

Between leaks, rumors, and past form, we've come up with predictions for every camera on every Samsung Galaxy S26 model.

Ending tomorow: get $200 when you switch to Verizon

By Alex Whitelock published

Verizon's excellent bonus gift for new customers ends tomorrow - don't hesitate to switch if you want a $200 egift card for cheaper bills.

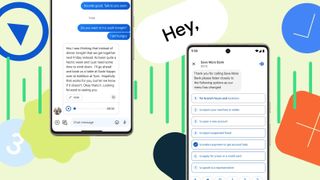

Google Messages is getting more handy tools – keep an eye out for these 3 new features

By Rowan Davies published

This is the year that Google Messages finally gets group chat mentions, and a more advanced long-press menu.

Do we really need an iPhone 17e?

By Jamie Richards published

The iPhone SE was never a yearly release, instead getting a refresh every few years – the rumored iPhone 17e could see Apple change this pattern, but should it even bother?

Sign up for breaking news, reviews, opinion, top tech deals, and more.