Apple Pay gets a big upgrade to speed up your impulse buys in third-party browsers and apps

Apple Pay gets even more dangerously convenient

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

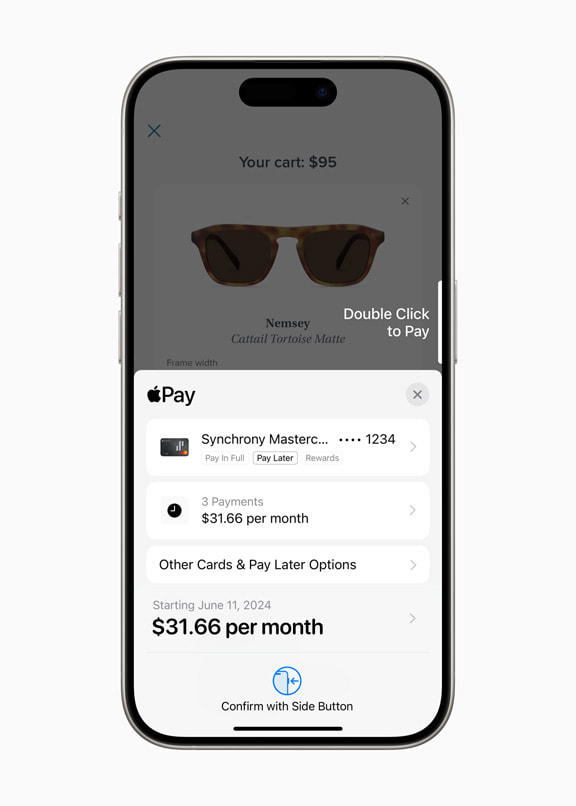

Apple Pay is getting the ability to give users a way to access installment payment loan services and view and redeem rewards when making a purchase online in iPhone and iPad apps.

Many websites support the ability to make payments with Apple Pay, with it being very easy to pay via an iPhone – tapping on an Apple Pay option will trigger the native Apple Pay interface letting payments be charged to the selected or default credit or debit card and approved via a double-click of the home button and Face ID. But they offer only cash transactions rather than allow more options, such as paying in installments.

Announced at WWDC 2024, the tweaked Apple Pay means users will be served up the option to now pay in installments and select other ‘Pay Later’ options within apps and browsers; that’s providing they are using an Apple Pay-enabled bank and are within supported markets.

The same is true when it comes to redeeming rewards, as I’ll let Apple explain: “The ability to redeem rewards for a purchase with Apple Pay will be available beginning in the US with Discover and Synchrony, and across Apple Pay issuers with Fiserv. The ability to access installments from credit and debit cards with Apple Pay will roll out starting in Australia with ANZ; in Spain with CaixaBank; in the UK with HSBC and Monzo; and in the US with Citi, Synchrony, and issuers with Fiserv. Users in the US will also be able to apply for loans directly through Affirm when they check out with Apple Pay.”

There's also the new ability to use Apple Pay in any third-party web browser and computer by simply scanning a code with an iPhone and then using Apple Pay to securely complete the transaction.

All this expands the capabilities of Apple Pay, but also arguably makes it almost too easy to indulge in impulse purchases – buying things with but a few taps can make it trivially easy to jump on a sudden bargain without necessarily really thinking it through if you need the thing that caught your eye.

Tap, tap and away

A less eye-brow raising pair of new Apple Pay and payment-related features come in the form of Tap to Provision and Tap to Cash.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

The former lets you add eligible credit or debit cards to Apple Wallet by simply tapping your card to the back of their iPhone, which seems a lot slicker than trying to awkwardly frame a card in the Camera app's viewfinder or manually input a load of card details.

The second, Tap to Cash, lets users send and receive money held on an Apple Cash digital card by holding two iPhones together – all without having to share phone numbers.

“For example, Tap to Cash can be used to pay someone back at dinner or buy something at a garage sale,” explained Apple.

As a fan of Apple Pay and its blend of easy use and security, I’m happy to see the folks at Cupertino expand out their payment services. But I do need to be aware that just because something is easier to buy, it doesn't mean I have to get it.

You might also like

Roland Moore-Colyer is Managing Editor at TechRadar with a focus on phones and tablets, but a general interest in all things tech, especially those with a good story behind them. He can also be found writing about games, computers, and cars when the occasion arrives, and supports with the day-to-day running of TechRadar. When not at his desk Roland can be found wandering around London, often with a look of curiosity on his face and a nose for food markets.