Sinking Quickflix asks customers to buy shares

Quickflix's days could be numbered...

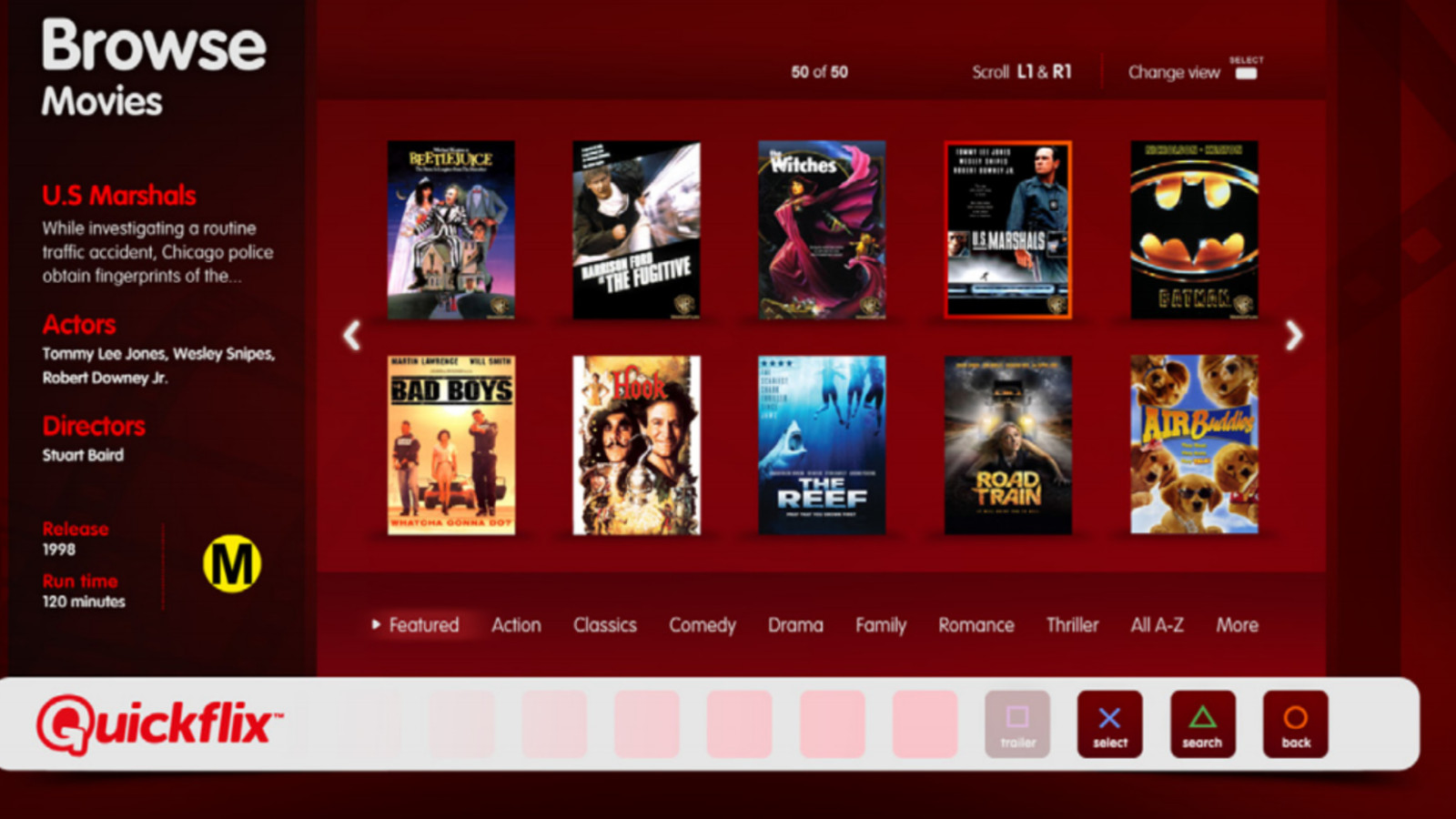

In a move that's unlikely to fill investors with confidence, Quickflix has asked customers to buy shares in the company in a bid to raise $1m.

The video streaming service is looking for a fast injection of cash after a recent attempt to raise $5.7m from investors only managed $650,000.

CEO Stephen Langsford has written a letter to customers asking them to buy shares at 0.003c each, claiming the cash will provide "working capital as well as in investment in content and marketing to achieve customer and revenue growth".

Quickflix has struggled to capture the imagination of the Australian public – often overshadowed by US competitor Netflix – and the announcement of Netflix's Australian launch scheduled for March 2015 will have done little to help Quickflix's situation.

From stream to tidal wave

The arrival of the US video juggernaut isn't the only factor turning up the heat in the local streaming space – 2015 will also see the arrival of the no-contract service Stan, while the Presto Movies Service has announced it will be expanding into television in early 2015 with Presto Entertainment.

Langsford's letter is a far cry from the statement he made in July of this year, when he effectively told Netflix to bring it on, saying: "We're used to competing against big players and we'd welcome Netflix to the market."

Challenging the US service to officially launch in Australia rather than relying on local customers using VPNs to get around geoblocking, Langsford said: "Just come through the front door, Netflix, and we'll happily compete on even ground."

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Now that Netflix's Australian arrival is imminent, it seems – for Quickflix at least – the battle may be over before it truly begins.

- Want a streaming service without the hassle? Foxtel Play is worth a look.