SIM only deals just keep getting cheaper - but have we hit the bottom yet?

Prices continue to fall across networks but when will it stop?

In recent years there has been a surge in the popularity of SIM plans and, with it, a rapid reduction in their price as networks compete to beat each other as the best value option.

And while those drops in price were relatively small at first, year after year we're seeing the average cost of SIM only deals come down rapidly - especially when compared to the cost of a traditional phone contract.

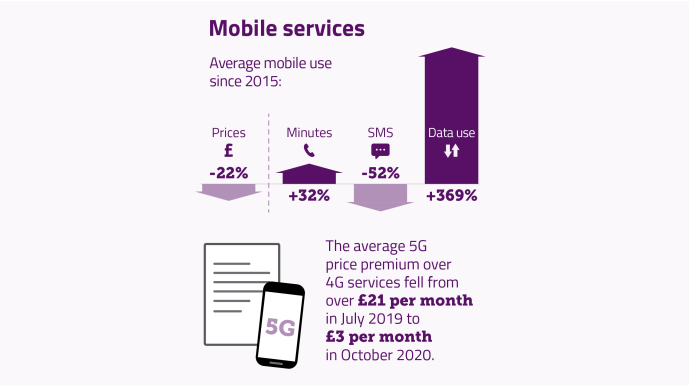

In Ofcom's 2021 pricing trends report, it found that the average cost of a SIM plan fell by 10% in 2020 despite an increase in use of data. The same report found those who were signing up to a phone contract were being charged up to 23% in interest compared to those buying SIM-free and SIM plans separately.

But as this prevalence of SIM plans bolsters and prices continue to fall, at what point will networks stand up and call a stop to it? Or, alternatively, how will anyone stand out in a crowded market of increasingly low prices?

An example from the Three network

While there are plenty of examples of networks slowly cutting the price of their SIM only deals, Three highlights it perfectly with its unlimited data SIM plan.

Each year over Black Friday, Three has dropped its prices significantly on big data plans. Each time, the network was introducing an incredibly persuasive deal with impressive levels of value, then the next year they would beat it.

- Black Friday 2018: 100GB data for £20 a month

- Black Friday 2019: unlimited data for £18 a month

- Black Friday 2020: unlimited data with 5G for £16 a month

If Three continues that trend, it will be down to £14 over Black Friday 2021 - a 30% decrease in price over just three years.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Three SIM | Unlimited data, calls and texts | £16 a month

Three's unlimited SIM plan has come down in price multiple times in its shelf life. While we've seen it as high as £22 a month, it has fallen all the way down to just £16 a month. That's the cheapest price we've seen an unlimited data SIM plan fall to in the UK and one we imagine Three will find it hard to beat.

More data and a change in buying methods

So prices are falling and the average purchase cost of mobile services has dropped by 10% in the past year, but are people's buying methods still the same or is this purely a reduction in price across the market?

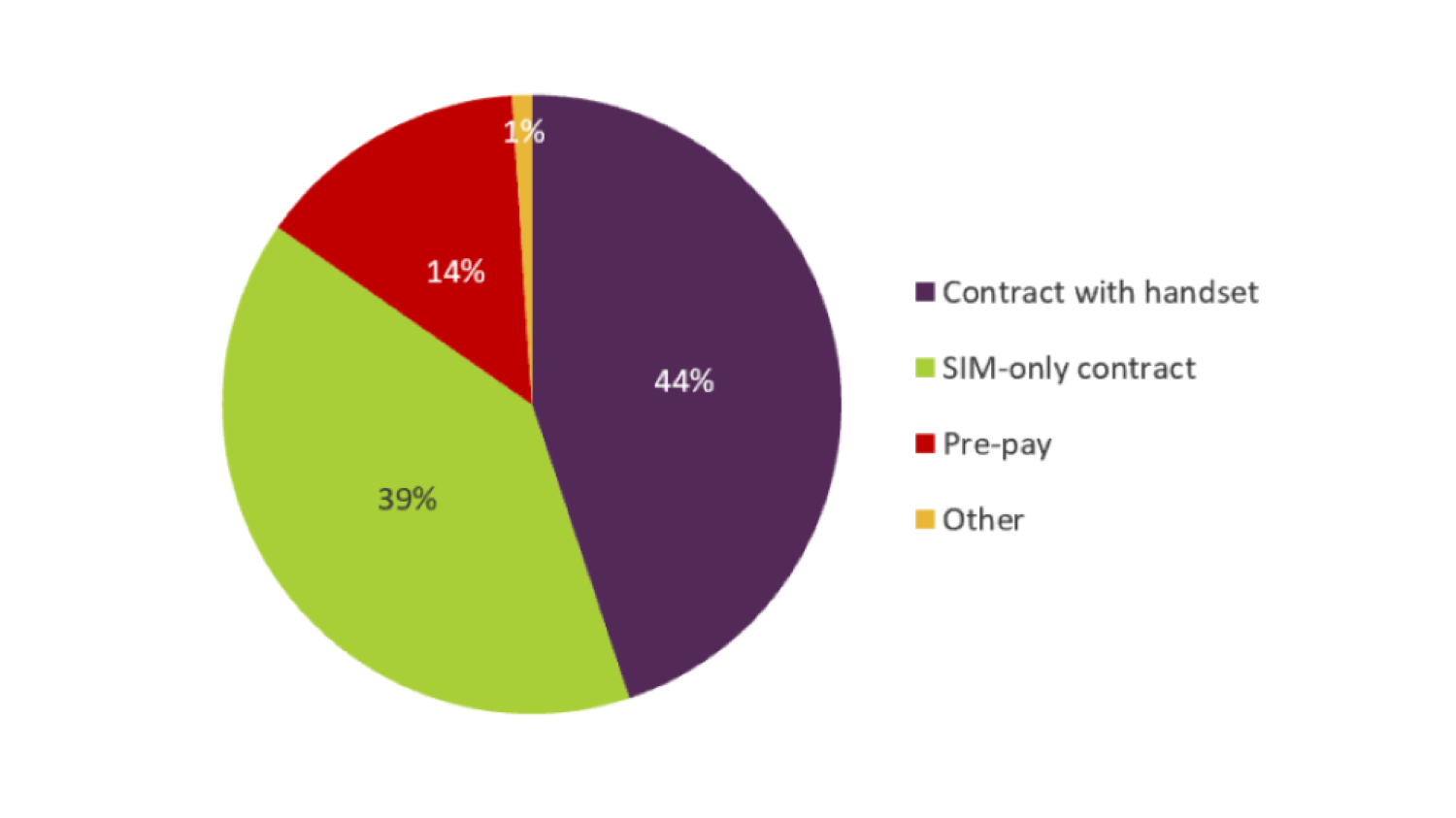

While 44% of people bought contracts between January and July this year, the number of people who invested in a SIM plan and SIM-free phone is on the rise with 39% of the population opting for this method.

Ofcom says that those people were getting an average saving of £7.12 a month.

That saving is due to a combination of the falling prices of SIM plans and the high interest charges found in contracts. And yet, despite prices looking more affordable than ever, 6% of households in the UK reported having issues with the affordability of a mobile plan.

This is likely due to the fact that, while prices on most SIM plans have fallen drastically, low-data tariffs have seen a price rise of at least 6% in the last two years as the demand for more data rises.

Packages with 10GB up to 100GB and more saw steep drops in price over the last few years but the lack of demand for anything less than 1GB means it is hard to get your tariff below £5 a month.

The future of SIM plans

All of this is obviously great news for consumers but the question remains: what does it mean for the networks competing to offer the best value possible? Can they really afford to cut prices further to get the edge?

The Ofcom report found that the UK has the cheapest standalone mobile prices overall compared to five other countries - France, Germany, Italy, Spain and the USA. That means UK networks are already vastly outperforming the rest of the world.

Instead, it is likely that we will now see networks looking for alternative ways to provide value. A representative from the retailer Affordable Mobiles explained: "UK mobile networks are already doing a great job at offering a broad range of great value tariffs to accommodate customers' needs.

"With that in mind, and given the incredible deals already out there, it's hard to see how they can get any more competitive in the way of price reductions. Instead, we might see more of a focus on the sharpening of tariff portfolios and benefits."

This is already something we're seeing occur from the core networks like EE and Vodafone but even more so from the rapidly growing list of MVNOs - Mobile Virtual Network Operators.

The rise of the MVNOs

Outside of the 'big four' UK networks - O2, EE, Vodafone and Three - the market has rapidly grown over the years with providers known as MVNOs dominating the market.

Put simply, these are brands that don't run their own networks and instead use the coverage of one of the aforementioned four. By not running their own infrastructure, they are able to offer other benefits including more flexible contracts, lower prices or special add-ons.

These MVNOs actually make up the vast majority of the market. Virgin, BT, Voxi, Sky, Tesco and giffgaff are some of the big names that fit into the MVNO group. Because they don't have to run their own infrastructure, these networks can charge much lower prices than the main carrier they borrow coverage from.

| Header Cell - Column 0 | Voxi | Smarty | BT | Lebara | Virgin | iD Mobile | Sky | Giffgaff |

|---|---|---|---|---|---|---|---|---|

| Does it have its own network? | No | No | No | No | No | No | No | No |

| What network does it use? | Vodafone | Three | EE | Vodafone | Vodafone | Three | O2 | O2 |

Smarty for example uses the Three network but is able to offer up the same amount of data for less than Three at most data points. The same happens with Virgin and EE, Voxi and Vodafone and with most MVNOs and the network they borrow from.

While each of these networks are very different in what they offer, a common theme we're seeing is around the length of the contracts they're offering.

Rajesh Dongre, the Commercial Director of Lebara Mobile explained: "Within the SIM Only category, customers increasingly want good value deals that don’t tie them into long contracts, so they have the choice to move their plan allowances up or down as per evolving needs."

Brands like Lebara, Giffgaff, Voxi, Smarty and iD Mobile are all now offering their customers 30-day rolling contracts allowing them to change if they need more data or it gets too expensive.

This flexibility is especially important as the core networks introduce above-inflation price rises for existing customers. Ofcom's report details BT and EE increasing prices by 3.9% in April 2021, Vodafone by 3.9% and Three by 4.5%.

Why stay with a network when it rises your price when you can skip a contract and jump to whichever network has the best price at any given time.

5G is no longer a premium

On top of affordable pricing and large data caps, the other major incentive networks have been pushing is the upgrade to 5G. However, while a year ago that was a competitive edge, it has quickly become the norm.

Other than a small collection of MVNOs, all of the major networks now offer 5G with most, if not all of their SIM plans.

In Ofcom's report, it found that the average 5G price across six mobile connections fell from over £21 per month in July 2019 (when only two operators offered 5G) to £3 per month in October 2020.

So what does the future hold for SIM only?

While prices could continue to fall slightly, it seems far more likely that we will see networks rely on their unique selling points and other factors to stand out in this crowded market.

Of course, every network is going to strive for the cheapest prices and the best amount of data but if all pricing becomes almost identical, it will be the added features that matter.

Voxi's unlimited use of social media and streaming for example helps it stand out, just like Lebara's inclusion of international calls, Giffgaff's frequent discounts for students or EE's position as the UK's fastest network and the long list of free subscriptions it throws in.

We would expect networks to really begin relying on these factors to stand out with less focus on bringing prices down. As Wayne Freeth, Online Trade Manager from Fonehouse, put it: "Whether there’s room for prices to get even cheaper, we’re not so sure in the short term, but there will always be great deals around".

Alex is a journalist who has written extensively about all things broadband, SIMs and phone contracts, as well as scouring the internet to land you the best prices on the very latest in gadgets and tech. Whether that be with the latest iPhones and Android handsets, breaking down how broadband works or revealing the cheapest SIM plans, he's in the know, and will help you land a bargain.