Is Australia ready for Apple Pay?

Visa and Mastercard are working with Apple

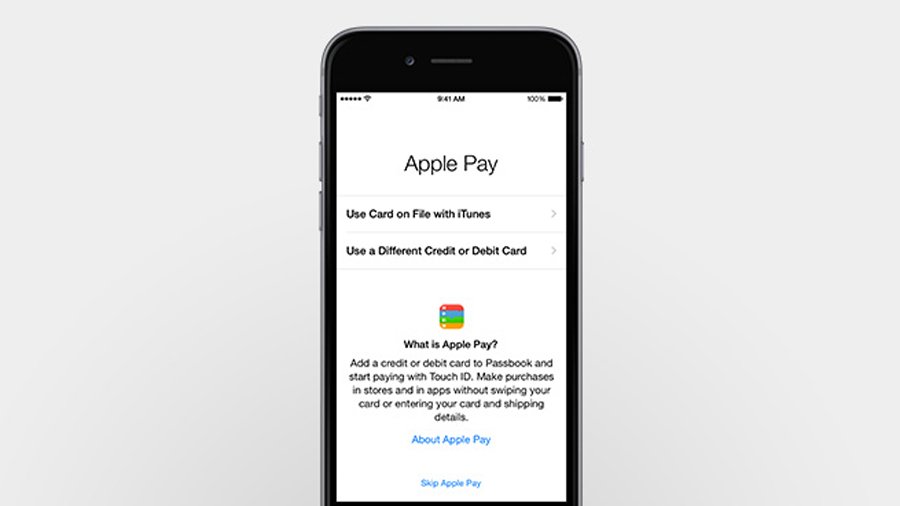

With the unveiling of the new iPhone 6, Apple also announced its own mobile payment platform Apple Pay.

Using NFC technology within the iPhone 6, iPhone 6 Plus and Apple Watch, Apple Pay will allow you to use your iDevice to pay for things, relying on Touch ID fingerprint recognition to authenticate payments.

Similar to Mastercard PayPass and Visa Paywave, you'll only be required to hold up your iDevice at point-of-sale contactless systems, with Apple storing only an account number, not your credit/debit card details - that info, along with what you buy and how much you spend, will remain between you and your bank or credit card company.

Unfortunately, Apple Pay will only be available in the US starting from next month, with no word yet on when it will begin rolling out the new service to other countries, but with contactless point-of-sale systems found across most of Australia, we may not need to wait to long.

Going contactless in Oz

Apple mobile platform will initially accept American Express, MasterCard and Visa, with businesses like Disney and McDonald implementing the necessary tech across the US.

The tech, or contactless point-of-sale systems (like Mastercard's PayPass and Visa's Paywave EFTPOS systems) have been available in Australia for some time now - and Visa noted that in just July this year, there were over 58 million Visa payWave transactions in Australia.

George Lawson, Visa's Head of Emerging Products and Innovation, said, "Australia is leading the world in its adoption of contactless payments", adding that in this country, "all the conditions exist to enable a mass shift to mobile payments in Australia.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

On the back of Apple's launch today, Visa has also announced the Visa Token Service, which will replace payment account information that is typically made available on plastic cards with a 'digital token' instead, so while the token will be linked to your info, it won't actually be stored on a device.

The new Visa Token Service will be rolled out in the US at about the same time as Apple Pay, and then rolled out globally starting 2015 - possibly hinting to Apple Pay being rolled out globally alongside it.

Banking on mobile

Beyond this, the Commonwealth Bank and Westpac have either leveraged NFC tech for created their own NFC enabled stickers to stick on the back of phones, allowing customers to simply tap their phone at a point-of-sale system instead of using a credit card.

"Australia leads the US and other countries in mobile contactless payments technology and we hope this announcement allows Apple users to join this trend," said David Lindberg, Chief Product Officer, Westpac Group.

"This type of mobile payment experience exists in Australia through multiple banks, and Westpac customers are today making Tap and Pay payments through the Westpac mobile banking application on Samsung's flagship smartphones."

Lindberg added that fingerprint login is also about to be launched through Westpac's mobile banking app.

So while we have the necessary tech already in Australia, and financial institutions already have mobile payment solutions, Visa, Mastercard, CommBank and Westpac Bank have all said only that they will be working with Apple for bring its payment platform to Australia.

Of course, this doesn't give us a firm idea as to when Apple Pay will land in Australia, but it does give us hope that it could be much sooner than we think.