How Apple became the world's richest company

Apple rose like a phoenix. But how?

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

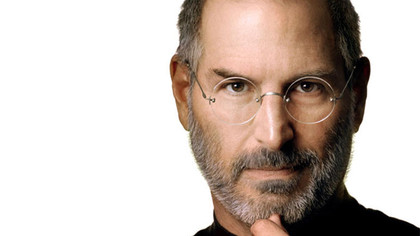

In 1996, the exiled Jobs told PBS's Wall Street Week programme what he felt was wrong with the firm he had co-created. "Apple stood still," he said, arguing that "people have caught up with it, and its differentiation has eroded, in particular with respect to Microsoft… the way out is not to slash and burn, it's to innovate. That's how Apple got its glory, and that's how Apple could return to it."

When Jobs returned to Apple in 1997, he simplified everything from Apple's range of products to the number of advertising agencies it used, and he also changed the company's focus. Jobs knew that trying to compete with Windows PCs was a race to the bottom, so he didn't even try to compete in that market.

There's a famous quote by hockey star Wayne Gretzky: "A good hockey player knows where the puck is. A great hockey player plays where the puck is going to be." Jobs wanted Apple to be great, not good, so he bet Apple on where he though the puck was going to be: the internet and digital media.

The 1998 iMac transformed Apple's fortunes, becoming the most popular personal computer in America. By 2000, Apple's finances had recovered, and Jobs told BusinessWeek that "we should be in an incredible place as this convergence of computing and communications explodes in the next few years. I think it's ours to lose."

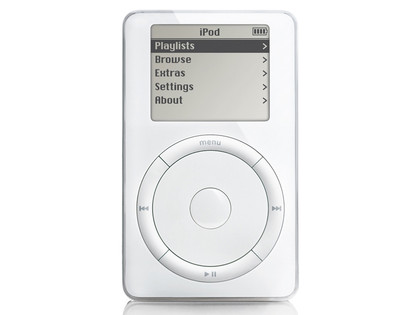

Apple didn't lose: a year later, it had the iPod. The iPod wasn't the first MP3 player, but it was the most desirable. Where other firms loaded their devices with every conceivable feature and option, Apple kept it simple and beautiful and sold shed-loads.

The iPod wasn't just significant for its industrial design, though: tight integration with iTunes and later, the iTunes Music Store offered an overall experience that rivals, such as Microsoft's PlaysForSure partners, simply couldn't deliver. Factor in some truly wonderful marketing, as well as packaging that made you feel that you'd bought something truly valuable, and it's clear that where other firms were making gadgets, Apple was making objects of desire.

By 2005, the iPod 'halo effect' was a recognised phenomenon: in a 2005 survey by Morgan Stanley, some 43% of iPod owners said they were considering a Mac as their next computer. Apple's market share of the PC market has continued to grow, and today it has more than 10% of the traditional PC market.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Beware of cannibals

Cannibalisation is when a new product destroys the market for an existing one. Apple hasn't suffered from it so far, largely because Apple is its own cannibal: Steve Jobs was quick to see that the biggest threat to the iPod was the smartphone, so rather than try to protect the iPod, Apple created a smartphone with an iPod in it.

The iPhone, of course, has done very well. According to ComScore, Apple has 30% of the US smartphone market - and according to Asymo.com, while Apple only has 9% of the global market it rakes in 75% of the profits. The iPhone business alone is bigger than Microsoft.

Apple is also cannibalising the PC. The iPad is starting to take a big chunk out of PC sales, and it's destroying the market for netbook PCs. Despite the best efforts of rivals, the tablet market is almost entirely Apple's - and if you class the iPad as a PC, then Apple is already the largest PC manufacturer on Earth.

Apple learned valuable lessons from the bad old days of the 90s, when it had Macs it couldn't sell and orders it couldn't fulfill. Under the auspices of Tim Cook, Apple closed its factories and warehouses, outsourcing production and cleaning up what CNN called "the atrocious state of Apple's manufacturing, distribution and supply apparatus."

Cook described his approach as being like that of the dairy business: "If it gets past its freshness date, it's a problem." Cook didn't just reduce inventory and outsource manufacturing, though. He also arranged deals that give Apple enormous competitive advantage. So, for example, when Apple launched the iPod nano, he pre-paid suppliers and effectively bought the world's supply of suitable Flash memory.

Apple signs similar deals for other crucial components, such as TFT displays, and it even helps its suppliers finance new manufacturing facilities: in 2011 it announced that it would pay nearly $4 billion for "inventory component pre-payments and capital expenditures" over the next two years. $4 billion is a lot of money, but it's worth a lot to Apple: it gets enormous economies of scale that keep prices low, and it gets guaranteed supplies of crucial components.

That can make life exceptionally difficult for rivals, so, for example, nobody so far has been able to make anything as good as the iPad at the same price as the iPad. As an industry source told BusinessInsider, "If it weren't for Tim Cook, the iPad would cost $5,000".

Can it last? There certainly don't appear to be any dents in Apple's armour. Each quarter's financial results are more staggering than the previous one's, and while rivals may have caught up with Apple in some sectors, such as smartphones, Apple's still the innovator, the firm whose products people love rather than like. In 2000, Jobs said that the market was Apple's to lose; 12 years on, it still is.

Contributor

Writer, broadcaster, musician and kitchen gadget obsessive Carrie Marshall has been writing about tech since 1998, contributing sage advice and odd opinions to all kinds of magazines and websites as well as writing more than twenty books. Her latest, a love letter to music titled Small Town Joy, is on sale now. She is the singer in spectacularly obscure Glaswegian rock band Unquiet Mind.