Apple: To Pay or not to Pay?

A closer look at Apple's new financial service

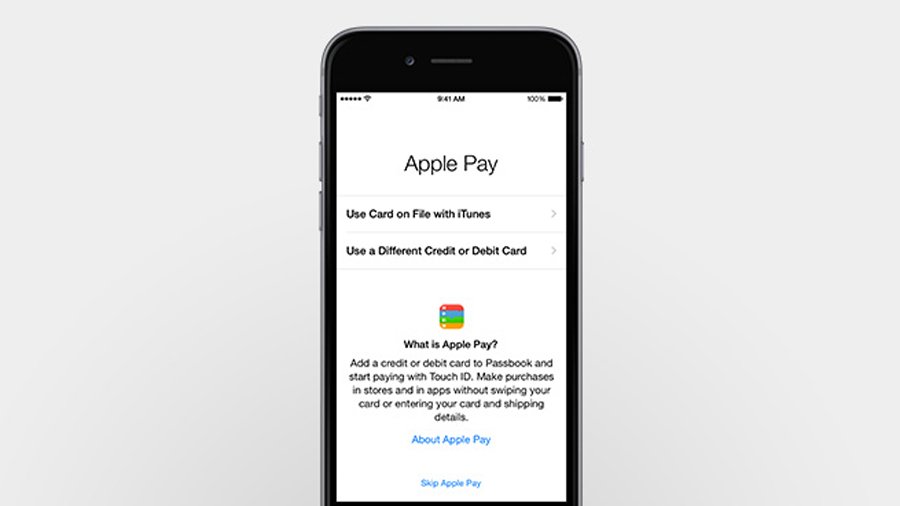

Apple Pay is Apple's first foray into payments. Available on the iPhone 6, iPhone 6 Plus and Apple Watch, Apple Pay will give users the ability to pay for things using their phone or smartwatch either in stores, using NFC terminals, or online through certain Apple Pay enabled applications. Apple's decision to enter payments will impact consumers, merchants and – of course – Apple's own business.

For consumers the news seems pretty straightforward; we all like choice and so a new way to pay that is fast and convenient is going to be good news, especially if it means speed at the checkout, and not always needing to carry a wallet or card to pay at a physical store.

Consumer adoption of Apple Pay, however, will be impacted by security and tokenization, which are key in ensuring confidence. Credit cards will be stored in Passbook. Traditional card account information will not be stored or used in Apple Pay, as tokens will be used instead.

- Check out everything businesses need to know about Apple Pay on our sister website, ITProPortal.com

A distinct device token is assigned, encrypted and stored in a dedicated chip in the iPhone 6, iPhone 6 Plus and Apple Watch. Then when a transaction occurs, a dynamic security code is generated for that transaction.

From a merchant perspective, the payments market has been inundated with new wallets and technologies in recent years. With no clear winner among consumers, many merchants have found it difficult to decide what payment offerings to invest in, and when.

This could change, however, as Apple has worked cooperatively with the major players in the payments ecosystem such as Visa, MasterCard and the card issuers. In addition, China Union Pay which is the largest card issuer in the world, has already announced its support for Apple Pay.

While the technology has been available for some time, the scale at which Apple operates means that this has the potential to be a tipping point for mobile payments both in the physical and digital worlds.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Apple Pay may be launching in the US to begin with, however, it already has 220,000 stores ready to accept payments and a large number of partners signed up to accept Apple Pay; from Macy's, Toys R Us and Bloomingdales to Subway, McDonalds and Whole Foods – plus, of course, Apple's own retail stores. Other larger retailers like Walmart and BestBuy have decided not to support Apple Pay for the moment.

Based on its ease of use, hardware integration and unique form factor (the compatibility with Apple Watch), the existing installed global iTunes base and consumer excitement, I believe that Apple Pay is well positioned to gain widespread adoption.

Increased usage of mobile wallets should accelerate the transition from cash to electronic forms of payments. This will benefit the networks, acquirers and POS hardware providers as merchants continue to upgrade their existing hardware to become NFC-enabled.

For Apple, this certainly looks like a timely move. The company has been laying the foundation for this kind of initiative for some time. It introduced its Touch ID fingerprint sensor with its last iPhone launch and its iBeacon system of Bluetooth transmitters has now been available for about a year.

Apple is well positioned to carve itself a slice of the global mobile payments market. Gartner estimated the market to be worth $235 billion in 2013.

If Apple can succeed in this space, and offer a ubiquitous solution, it could help simplify the landscape for many merchants. Ultimately, however, Apple Pay's long-term prospects will depend on how it will continue to work with existing payment technologies and, of course, global user.

- Souheil Badran is Senior Vice President and General Manager at Digital River World Payments