India's smartphone shipments decline in Q2 of 2020 - for obvious reasons

And it's not just Covid-19

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

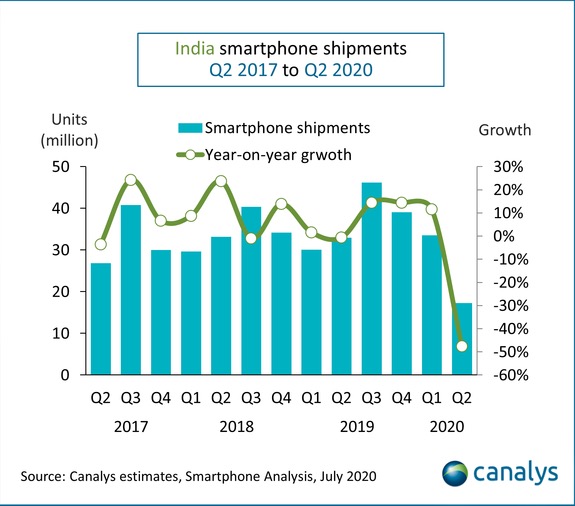

India's smartphone market is facing unprecedented times ever since the country was put in a lockdown in March to tackle the growing Covid-19 pandemic. Latest reports say that shipments fell by as much as 48% during the second quarter of 2020 compared to the same period a year ago, the biggest that a growing market has seen in a decade.

These were the findings based on a research conducted by Canalys with shipments falling to just 17.3 million smartphone units in the April-June period as against 33 million that were shipped during the second quarter of 2019 and the 33.5 million units that shipped during January to March 2020.

- Upcoming smartphones in India for July: Specs, launch date, price

- Why are smartphones in India suddenly getting expensive?

- Worldwide smartphone sales in a slump

- Smartphone makers unable to meet growing demand - here's why

Xiaomi continues to lead, Vivo is next

Xiaomi was the market leader in India, capturing 31% of overall market share, shipping 5.3 million smartphone units in the quarter, closely followed by Vivo which shipped 3.7 million units, and grew its market share to 21.3% from 19.9% in Q1 2020. Samsung was third, with 2.9 million smartphone shipments while Oppo edged out Realme to take the fourth position with 2.2 million units, compared to Realme’s 1.7 million.

Local production suffered in the early stages of Q2 with vendors like Xiaomi and Oppo importing smartphones to meet the demand. “It’s been a rocky road to recovery for the smartphone market in India,” said Canalys Analyst Madhumita Chaudhary. There was also a sudden trend of smartphones getting expensive.

The Covid-19 led issues

“While vendors witnessed a crest in sales as soon as markets opened, production facilities struggled with staff shortages on top of new regulations around manufacturing, resulting in lower production output. The fluidity of the lockdown situation across India has had a deep-rooted effect on vendors’ go-to-market strategies. Xiaomi and Vivo have undertaken an offline-to-online strategy to support their massive offline network. Online channels, too, while seeing a positive effect of the pandemic on market share, have seen sales decline considerably," she said.

The anti-China sentiments

Then there were the anti-China sentiments that resulted in a shift away from Chinese smartphones. Canalys Research Analyst Adwait Mardikar says, “There has been public anger directed towards China. The combinations of this and the recently announced ‘Atma Nirbhar’ (self-sufficient) initiatives by the government have pushed Chinese smartphone vendors into the eye of the public storm.”

Canalys estimates that over 96% of all smartphones sold in India during 2019 were manufactured or assembled locally. “Vendors are driving the message of ‘Made in India’ to consumers and are eager to position their brand as ‘India-first.’ Despite the overall anti-China sentiment, the effect on Xiaomi, Oppo, Vivo and Realme is likely to be minimal, as alternatives by Samsung, Nokia, or even Apple are hardly price-competitive,” Mardikar said.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

In comparison, the smartphone market in China, the largest in the world, saw just an 18% drop in shipments during the said quarter. Shipments in India grew by 4% in the first quarter of 2020 when the impact of Covid-19 wasn't really felt, as against a 13% decline globally.

Meanwhile, Apple was the least affected amongst the smartphone brands. iPhones command barely 1% of the Indian market and year-on-year, shipments only fell by 20% during the second quarter, the report said.

A media veteran who turned a gadget lover fairly recently. An early adopter of Apple products, Raj has an insatiable curiosity for facts and figures which he puts to use in research. He engages in active sport and retreats to his farm during his spare time.