The end of cash

No more fumbling for coins or even waiting in queues

Adam Theobald needed a caffeine fix, but the long queue at his favourite cafe put him off. There had to be a better way.

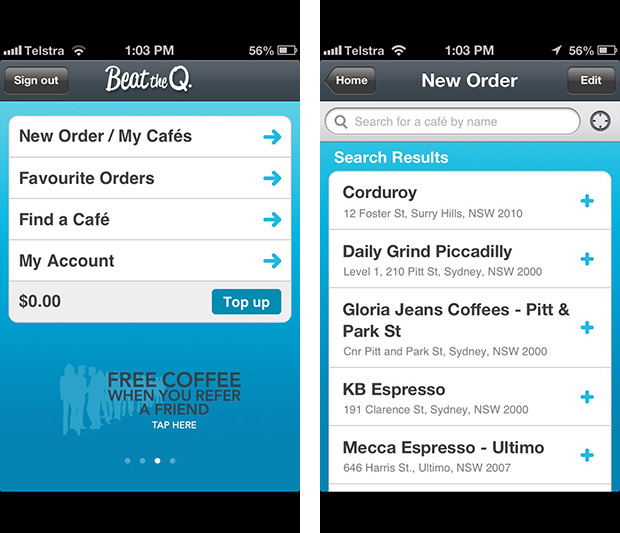

Theobald set up Beat the Q, a service that allows people to order and pay for their morning coffee from a mobile phone. To use the service, people register online for an account and top up their account balance using PayPal.

They can then order and pay for their coffee from their desk or when they're still on the train, have their order accepted by the cafe and collect the coffee a few minutes later.

It means no more queuing and fumbling for coins when you want to buy your morning coffee.

The service is currently available in 80 cafes around Australia and Theobald claims 10,000 registered customers. Cafe owners in the scheme pay a licence fee and a clip on the ticket price of each coffee, but Theobald claims they get a better cashflow and don't miss out on orders that might otherwise just walk past.

However, this service isn't the only example of mobile payments at work. Say you want to make a payment to your babysitter. You don't know her bank account details, but you do have her mobile phone number — you might simply open an app on your smartphone, tap in the mobile number and the amount you want to pay, and click send. It's already possible.

Or on your way to dinner you remember it's BYO and pop into a bottle shop, select a nice pinot and pay for it by waving your mobile over a payWave EFTPOS terminal. That's already possible.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Or you might be on the train browsing Facebook on your smartphone and decide to do some banking without ever leaving the social network. That will be possible by early 2013, says the Commonwealth Bank, which has a Facebook banking app under development.

It started with banking apps

The advent of Near Field Communication (NFC) technology and improvements in the security of networks used to facilitate mobile payments means the smartphone is about to go head to head with cash.

Smartphones can now serve as digital equivalents of credit cards, loyalty cards, travel tickets and loose change.

The banks already provide apps for accessing your bank account. For instance, ANZ pioneered mobile payments back in September 2010 with an iPhone app called goMoney. The next frontier is to turn your smartphone into a digital wallet, where you pay directly at the counter when you're buying something.

Clive Whincup, the group chief information officer of Westpac and St George, believes that all it will take for mobile phones to become widely accepted as digital wallets is for consumers to develop the 'muscle memory' that makes us reach for our smartphone instead of our wallet when making a payment.

Westpac is working on building up that muscle — it has a trial running that will turn a smartphone into a contactless payment device using NFC technology.

That's the technology that's currently used in Visa payWave and MasterCard PayPass cards — it lets you simply tap or wave your credit or debit card over an NFC-enabled card reader. Those credit cards feature a special NFC chip.

The first bank to go this route was the Commonwealth Bank, which launched its Kaching payments application in 2011. It announced that iPhone users prepared to fork out $54.95 for an iCarte (a case for the iPhone with a built-in NFC chip) could use the iPhone to make contactless payments (for items up to around $100) by waving the phone over an NFC payments terminal.

The iCarte was always seen as a stop-gap measure, with Apple expected to launch an NFC-enabled iPhone. Even after the launch of the iPhone 5, we're still waiting.