How to buy a TV: 10 tips for buying a new screen

From screen size to speakers, don't buy a TV without reading this first because we have all the tips you need to make the choice that's right for you

You'd think that to buy a TV would be a pretty straightforward experience. After all, surely all you need to do is head to your nearest electronics store, pick a TV, pay for it and take it home. Job done. Right? Well, not exactly. With so many TV's on the market in 2022, the days of it only taking a few moments to choose one are well and truly behind us.

But, that doesn't mean that you need to spend hours weighing up the pros and cons of every TV that you come across. While it's true that choosing the best TV is a little more complicated than it used to be with so many unique combinations of panel technologies, processing speed, algorithms, HDR TV support, resolutions and more, armed with a little bit of background knowledge, you'll be kicking back in comfort in front of your new screen before you know it.

Whether you're looking to buy the best 4K TV or you're determined to treat yourself and invest in one of the best 8K TVs, there's no one-size-fits-all screen, but thankfully, that's where we come in. When it comes time to buy a TV, you'll find this guide super helpful in running you through the most important questions to ask yourself when buying a new screen. From screen size to sound, you name it, we've thought of it.

So, regardless of whether you're looking to buy a TV to watch those all important summer sports matches or you just want to enjoy the best Netflix shows and best Amazon Prime Video movies on a screen that makes you feel like you're there, by the time you've finished this guide, you’ll be a TV salesperson’s worst nightmare: a customer who actually knows what they’re talking about.

How to buy

1. Pick a screen size

The range of screen sizes available today is immense, taking in everything from 14-inches to more than 100-inches. So how do you figure out the right size for you when it comes time to buy a TV?

There are a few more common sizes to, uh, size up first. 55-inch is the flagship TV size these days, meaning most new TVs come in a 55-inch model. The best 65-inch TVs are pretty in demand too, with a select few in 75-inch sizes and above, though you'll really need a lot of space for them. Smaller sizes like 32-inch and 40-inch are easier to fit in more cramped spaces, and won't dominate your home as much.

We recommend taking a tape measure to your living room wall (or wherever you plan to put it) to ensure the dimensions of this TV are going to fit where you want it. (The number of inches is the diagonal length of the TV screen, from the bottom corner to the upper corner on the other side.)

Get daily insight, inspiration and deals in your inbox

Get the hottest deals available in your inbox plus news, reviews, opinion, analysis and more from the TechRadar team.

The distance you'll be sitting from the TV is important, too. We recommend making sure your screen size is about double the distance between the set and your seat. For a 40-inch TV, you'll want to be sat around 6-7 feet (80 inches) away, for instance. For a 65-inch TV, that goes up to 10-11 feet; for a 55-inch TV, that's 9 feet.

You can certainly cram a bigger screen into a smaller space – these calculations are pretty conservative – though keep in mind it might be pretty dominating.

2. Wall-mounting

Many people think they’d like to wall-mount their new flat TVs. However, research suggests that when it comes down to it, precious few of us actually do.

If you’re positive this will work for you, though, there are a few things to consider. Firstly, remember that the TV will be right up flat to the wall – and therefore a bit further away from any seats – so you might want to go up a screen size.

Secondly, think about TVs designed to be used with ultra-low-profile mounts, so that they stick out as little as possible from the wall.

Or, given that many TVs don’t ship with wall mounts included, if you want to be able to choose from a wide selection of mounting options at a range of price points, look for a TV with wall mount screw positions compatible with the ‘VESA’ industry standard.

One other thing to bear in mind if you’re thinking of wall-mounting a TV is a set’s realistic viewing angles – especially vertical viewing angles if you’re thinking of mounting a TV above a fireplace (which is not something we’d typically recommend).

3. Panel technologies

There are two types of TV technology you need to understand: LCD and OLED. And there are a couple of important variations on the LCD side.

LCD/LED TVs

A key point to consider if you decide to buy an LCD TV is how the LCD panel is lit, since this can have a big impact on the contrast the screen is capable of.

Some use lights mounted on the edge of the screen firing across it (aka edge-lit panels), while some use lights mounted directly behind the screen. Generally speaking, TVs with lights behind the screen deliver better contrast than edge-lit models. But these models don’t generally feature such slim designs, tend to cost more, and often use more power.

One final option to consider with LCD TVs is local dimming. This sophisticated feature allows a TV to output different amounts of light from different sections of its edge or direct lighting arrays, and can dramatically improve contrast.

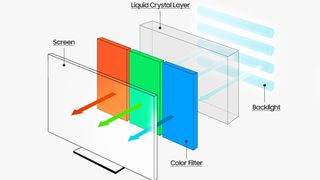

LCD/LED TVs use panels of liquid crystal pixels illuminated by external light sources. The liquid crystals rotate round to let through the amount of light needed to illuminate pictures correctly, with external filters creating color.

The main advantage of LCD TVs are brightness, affordability and durability. Their main disadvantages are limited viewing angles and difficulties controlling light in the picture due to the use of external light sources.

There are two types of LCD panel: IPS and VA. IPS types are predominantly made by LG Display, and feature in all of LG’s LCD TVs, plus some (usually affordable) models from other brands too. VA panels are more widely used, and are made by a variety of manufacturers.

IPS panels offer slightly wider viewing angles than VA panels, but struggle with contrast. VA panels up to this point feature narrower viewing angles, but generally produce much better contrast.

If you're after more information, check out our guide to OLED vs LED vs LCD.

Quantum dots (QLED)

Some (usually high-end) LCD TVs use Quantum Dot technology to deliver wider color ranges than you can get with normal LCD panels. Quantum Dots are tiny particles ranging from two to 10 nanometers in size, with each size capable of emitting a different color. Using them allows LCD TV makers to avoid color filters and white LED Backlights – two things that typically limit an LCD TV’s color performance.

Samsung is the biggest advocate of Quantum Dot technology. Its QLED models using a new metal-coated type of Quantum Dot that can produce a much wider color range, more brightness and a wider viewing angle than traditional Quantum Dots. Quantum dot TVs are generally markedly more expensive than normal LCD TVs, though.

There are alternatives to Quantum Dots when it comes to expanding color range. Some TVs – including Sony’s Triluminos models – use wide-range phosphors. LG, meanwhile, will be using Nano Cells in its high-end LCD TVs. These alternatives to Quantum Dot technology use same-sized dots just one nanometer wide in conjunction with normal color filters – a combination which LG claims enables its Super UHD TVs to deliver better contrast and more balanced colors.

Read more: What is QLED?

OLED TVs

The best OLED TVs use a system of organic phosphors in self-emitting pixels to enable each pixel to generate its own light, completely independent of its neighbours. This allows for vastly superior contrast and light precision to what you can get with even the most advanced LCD TV.

It also means OLED TVs can be watched from much wider viewing angles than LCD TVs without color or contrast reducing. These features have made OLED popular with many serious AV fans.

However, there are issues with OLED TVs. First, while prices have dropped over the past couple of years, they’re still substantially more expensive than typical LCD TVs (though some are now cheaper than high-end LCD TVs).

Second, OLED TVs currently can’t get as bright as LCD TVs, something that could become an issue with HDR content.

Finally, there have historically been issues with lifespan and image retention (where bright image elements can ‘burn’ into the screen’s phosphors if left on for too long). However, LG, the main manufacturer of OLED screens, claims to have fixed these lifespan/image retention issues, and we haven’t seen any evidence recently that might counter those claims.

Read more: What is OLED?

4. Resolution and HDR

There are two resolutions to choose from right now: Ultra HD (also known as 4K), and HD. Ultra HD TVs carry 3840 x 2160 pixels, while HD TVs carry 1920 x 1080 pixels. This means Ultra HD TVs have four times as many pixels as HD ones, and so can deliver pictures with much more resolution.

With native 4K sources starting to become more common now (Netflix, Amazon, Ultra HD Blu-ray and Sky Q in the UK) and the prices of 4K TVs plummeting, we’d generally recommend that you buy a 4K TV even if you don’t currently have any access to 4K content, especially if you’re looking at a TV of 50 inches or more.

While we’d recommend 4K for a main living room TV now, though, HD TVs can be good bargains for second screens.

But what of HDR? High dynamic range (HDR) TVs are able to produce pictures that contain much more brightness and contrast than normal TVs, so long as they are fed HDR content that contains this extra luminance data.

All current HDR TVs also support wider color spectrums (often described as wide color gamut, or WCG – essentially meaning that) than most non-HDR TVs - which is handy, as pretty much all HDR content also carries wide color spectrum picture data.

There are currently three types of HDR. HDR10 is the industry standard, and all TVs support this. Dolby Vision adds an extra layer of information that tells a TV how to render pictures on a scene by scene basis. Only some brands – most notably LG, Vizio, TCL and (via an upcoming firmware update to some models) Sony – support this.

Finally there’s Hybrid Log Gamma (HLG), designed for HDR broadcasts. The majority of TV brands have pledged support for this via firmware updates in the course of 2017.

5. Connections and ports

These days the main connections you need to look for are HDMIs, USB ports and multimedia support.

With HDMIs you’re talking about the number (try and get at least three) but also the specification. With 4K TVs, try and get a TV with v2.0 HDMI 2.0s rather than v1.4 HDMIs – as most will naturally – to guarantee the widest compatibility with current and upcoming source equipment. To future-proof for 8K content or make sure you can get 4K gaming at high frame rates (120Hz) you'll want at least one HDMI 2.1 TV port too.

USBs ports are useful for both playing back multimedia (especially photos and videos) stored on USB drives, and, with some TVs, recording from the TV’s tuners to an attached USB hard drive. Look for at least two, and ideally three USB ports.

Most TVs now have built-in Wi-fi and Ethernet ports so that you can connect them to the internet. Not all TVs, though, also let you use these network connections to access multimedia stored on other devices on your network. So if this is a feature you want, make sure the TV you buy supports it. Note, too, that some TVs additionally support Bluetooth communication with external devices.

6. Speakers and sound

The sound quality of flat TVs can vary immensely. So if you’re not intending to use some sort of external sound system, this is something you should pay attention to.

Most brands quote a number of watts of power for their TV speaker systems, but this is seldom helpful in deciding how a TV is likely to sound.

Look instead, for instance, at how many speakers a TV has, and the configuration of those speakers. For instance, a ‘2.1’ configuration would indicate stereo main speakers with the ‘.1’ bit pointing to a dedicated bass speaker. Or a 3.1 configuration would point to a dedicated centre or dialogue channel alongside stereo and bass speakers.

Subwoofer speakers for bass are always welcome given how much TV speakers generally struggle with the lower end of the sound spectrum.

Another audio issue is that the lack of room available to speakers in thin TVs means they usually have to fire their sound downwards, which can lead to an indirect, muffled, weedy sound. TVs that manage to provide forward-firing speakers tend to sound much cleaner and more powerful.

Some TVs of late have even gone so far as to ship with soundbars that either hang off their bottom edge or sit separately below the main screen frame.

One final word of warning here is that you should treat the claims of TVs to offer DTS or Dolby Digital surround decoding with scepticism. No TV can deliver anything close to a proper surround sound experience from its own speakers without using actual rear speakers, and many sound pretty horrible if they try. Experience shows that a good stereo sound – especially with a subwoofer to add bass – routinely trumps a half-baked pseudo-surround sound system or mode.

If you're not satisfied with your TVs built-in speakers, here's a guide to the best soundbars around

7. Smart TV platform

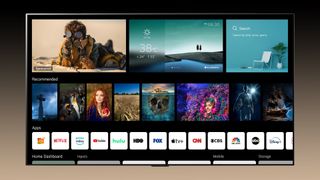

Almost every TV these days can be added to your broadband network to enable the use of online features or, in some cases, access media files stored on other storage devices – mobile phones, tablets, NAS drives etc. This sounds great on paper, but in reality, the quality and usefulness of such ‘smart’ features can vary greatly.

Generally speaking, if you have a number of personal smart devices in your home, TVs that can access content on other devices in your home – including via Bluetooth as well as Wi-fi – are worth looking out for.

Where online features are concerned, don’t be seduced by app quantity. The vast majority of TV apps are borderline pointless, and just clutter up the smart interface.

App quality is much more important. In fact, for many households, the only online features that really matter are online streaming/catchup services. Especially Amazon Prime, Netflix, and catch-up services for your region’s broadcasters, such as BBC iPlayer in the UK.

Finally, the simplicity of a smart TV interface plays a key role in how much you might use it. Currently, LG’s webOS and Panasonic’s Home Screen 2.0 systems handle their content most effectively.

For a full breakdown of how the various manufacturer's smart TV interfaces stack up check out our best smart TV platform guide.

8. Brightness

If your TV is going into a fairly bright room, sets that stand out in brightness terms on a shop floor can give you some idea of how their pictures will hold up when you get them home.

A lack of brightness is a particularly common problem with relatively small TVs. It’s also recently become a big deal for the big-screen marketplace, though, with the arrival of high dynamic range technology.

Without sufficient brightness a TV won’t produce well the bright white and color highlights that are so important to a successful HDR picture. They’ll look washed out, flat and short of detail – as if they’ve been bleached of color tone detail.

TVs that aren’t really bright enough for HDR will also create HDR pictures that look unnaturally dark and/or which leave dark parts of the picture looking too dominant and ‘hollow’. A good test of a TV’s HDR brightness is to put a shot on the screen that shows a dark object with lots of detail foregrounded against a bright backdrop. With TVs that are struggling for brightness, the dark object may lose all of its subtle shading and detailing, so that it just looks like a silhouette.

As a side note here, though, bear in mind that TVs which excel for brightness can struggle more than lower brightness TVs when it comes to black level, contrast and backlight stability/uniformity. In other words, don’t just assume that lots of brightness alone will get the job done; look at brightness and contrast issues as a balancing act.

9. Viewing angles

How well a TV can be watched from an angle can be a big deal in a lot of living rooms. To check this on a TV you’re interested in, pause an image on the screen that contains a bright, ideally colorful object against a dark backdrop, and start walking round it from straight opposite to down its sides while looking for the following:

- Significant greyness over parts of the picture that look black when viewed straight-on

- Colors losing vibrancy

- The increased appearance of backlight clouds, stripes or halos.

Once one or more of these issues becomes distractingly obvious, note roughly the angle you’re looking at the screen from and apply that to your living room seating positions.

10. Motion

TVs can suffer with two motion problems: judder and blur. Look for both, ideally with 60Hz (console game) content, 50Hz (broadcast) content and 24Hz (Blu-rays, UHD Blu-rays).

Do camera pans stutter along? Do fast-moving objects look blurred, short of detail or even leave a smeary trail behind them? Do you see momentary ‘freezes’ during action scenes? Do vertical lines in the picture suffer ‘doubling’ during camera pans?

Most TVs offer some sort of motion processing to counter blur and judder issues, so try and check these out. However, these processing systems can cause their own problems, specifically shimmering halos around moving objects, flickering over areas of really fast motion, and a tendency to smooth out judder so much that pictures – especially 24-frames-a-second movie pictures – are left looking unnaturally fluid.

Bear in mind that most TVs offer different ‘strengths’ of motion processing, so try adjusting the settings to get a more comprehensive idea of a TV’s motion performance.

When to buy

When should you buy a TV?

TV prices vary a lot over the course of the year. While it can be tempting to rush out and buy the latest and greatest sets when they're hot off the production line, like many other consumer electronics it can pay off big time if you're willing to hold off on your purchase for a few months.

There are a couple of key points to consider when trying to get a TV for the best possible price. You might have to be a little more patient, but if you're willing to play the long game you can end up with an astonishing TV at a fraction of the price it would have been new.

Last year's sets can be a bargain

Unlike headphones or speakers, which tend to have models that stick around for a few years before their manufacturers replace them, television line-ups tend to be replaced like clockwork once a year.

However, while sets do tend to get better from year to year, often the changes are incremental. This means you can get a very similar experience by opting for last year's televisions.

You'll have to be careful if you choose to go down this route, because while a lot of changes in TV tech are incremental, there are a couple of key areas that are anything but.

Take HDR as an example. Certainly, the technology existed a few years ago, and the difference between older HDR and 2020's is nowhere near as big as the difference between HDR and SDR.

However, back in 2016 or 2017 fewer sets were equipped with the technology in the first place, meaning you have to pay slightly closer attention to the specs than you'd have to with a modern set.

The simplest way to do this is by looking out for the Ultra HD Premium specification, which will ensure that any television you buy is compatible with the next generation of TV technologies.

So long as it meets the UHD Premium requirements, a set that's a few years old can prove to be an absolute bargain.

Timing is crucial

Aside from which year's televisions you buy, there are also a key couple of periods throughout the year when retailers are very keen to discount their wares.

With televisions these periods often come around the start of major sporting tournaments, where retailers will discount televisions that they advertise are the best way to watch the action.

However, when it comes to televisions, the biggest day of the year is undoubtedly Black Friday, when retailers often discount this year's models to lure in customers and, in the US at least, to clear out stock post-Thanksgiving.

Amazon Prime Day is also another source of some tasty bargains, so be sure to keep an eye out to see if any of your preferred sets receive a discount.

The amount of deals scrambling for your attention on these days can be overwhelming, but keep your eyes trained on TechRadar where we'll be hunting around for the best deals on the day.

Always check historical pricing

Retailers will often happily boast about what a saving they're offering compared to a television's initial price, but often these sets were heavily discounted before they were technically in a sale.

This isn't necessarily a problem if the price is still good, but what's especially important is finding out whether the set has actually been discounted by more in the past. In these cases you might be best off waiting to see if it hits that same price again.

In all cases, it's never a bad idea to check what price the television has been sold for in the past. The site CamelCamelCamel is excellent for this purpose. Just put in the URL of a product you're thinking of buying, and the site will tell you how cheap it's been in the past.

If you're prepared to wait, then you can even use CamelCamelCamel to set up price alerts to have it automatically notify you when a television drops to a certain price.

Don't just buy a television because the retailer says it's discounted. Always do your research first to work out how good a discount is really being offered.

Henry is a freelance technology journalist, and former News & Features Editor for TechRadar, where he specialized in home entertainment gadgets such as TVs, projectors, soundbars, and smart speakers. Other bylines include Edge, T3, iMore, GamesRadar, NBC News, Healthline, and The Times.