How POS payment systems support every area of your business

Learn how POS payment systems support every area of your retail or hospitality business.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

Point of Sale (POS) payment systems have been around for decades. But, in recent years, they’ve moved on from being simple POS terminals to sophisticated business support systems.

A typical POS system is made up of hardware, such as a touchscreen, software supplemented by peripherals like credit card machines and receipt printers. Today, the majority of retail stores operating in a physical capacity and online will typically have screens, some peripherals such as card payment terminals, and then a basic software system connecting it all up on a central computer.

With modern, cutting-edge POS payment systems, however, you can not only accept payments, but also track sales, keep an eye on costs, monitor inventory and even manage employees. Some of the best POS systems even help streamline your business operations, making admin-heavy processes more efficient and contributing to a healthier profit and loss statement.

Let’s take a look at how you can benefit from POS payment systems supporting key areas of your business. As a helpful follow up guide, we recommend reading how to choose the right point of sale (POS) system for your business, next.

How POS payment systems help with accounting

Accounting has a reputation for being a largely manual process that can frequently involve errors. However, with POS system automated accounting, your processes should become easier to manage and hopefully headache-free.

The key here is to integrate your POS system with your accounting software. And don’t worry, most POS payment systems are compatible with leading accounting packages that small and medium-sized businesses typically use. QuickBooks and Xero are two prime examples. What’s more, the integration itself is very quick and easy to set up, it usually only takes a few clicks!

Read our review on Quickbooks POS vs. Shopify POS system: What's the difference and which is best for my business?

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Via this POS accounting integration, data will automatically sync between your two systems, usually on a daily basis. This synchronisation process allows all of your sales and inventory data to be input directly into your account reporting.

With this POS accounting set-up, you can literally save hundreds of hours in manual data entry and minimise inaccuracies too. These are benefits that quickly contribute to your bottom line through more accurate financials and tighter controls on spending.

Not only that, but by connecting your POS system with your accounting software, you can run reports at the click of a button. This in turn will make end of quarter or end of year tax reporting much easier to get through.

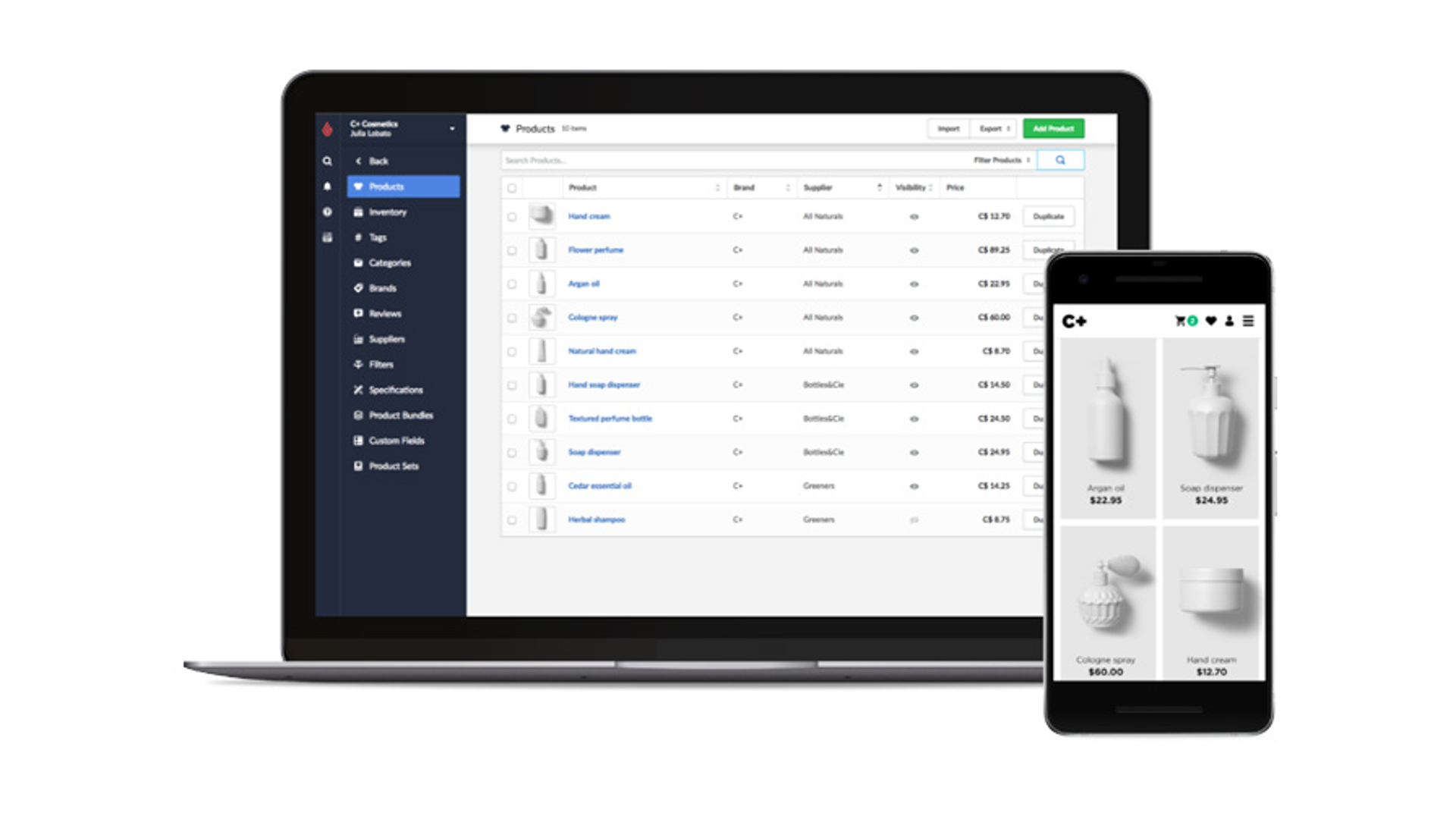

POS supports back-of-house admin and inventory management

Any good retail or hospitality business knows that back-of-house inventory databases are critical to successful operations. They ensure good stock management, guarantee sufficient supply and prevent overspending. They’re also a great way to identify past trends and forecast future demand, especially in retail and hospitality businesses where seasonality is king.

However, what you might not know is that POS systems also offer support where inventory management and back-of-house processes are concerned. They do this by effectively automating the end-to-end process, connecting what’s happening front-of-house with customers and with what’s going on behind the scenes.

For example, POS systems will automatically update your stock levels when a sale takes place. That means no more manual stock checking or daily reconciliations.

Daily or weekly stocktaking then becomes a breeze with a POS inventory system, saving you and your team hours of admin work. Furthermore, this automated inventory management helps to reduce waste because you can identify upcoming product expiry dates more quickly, rotate stock and run customer offers more effectively.

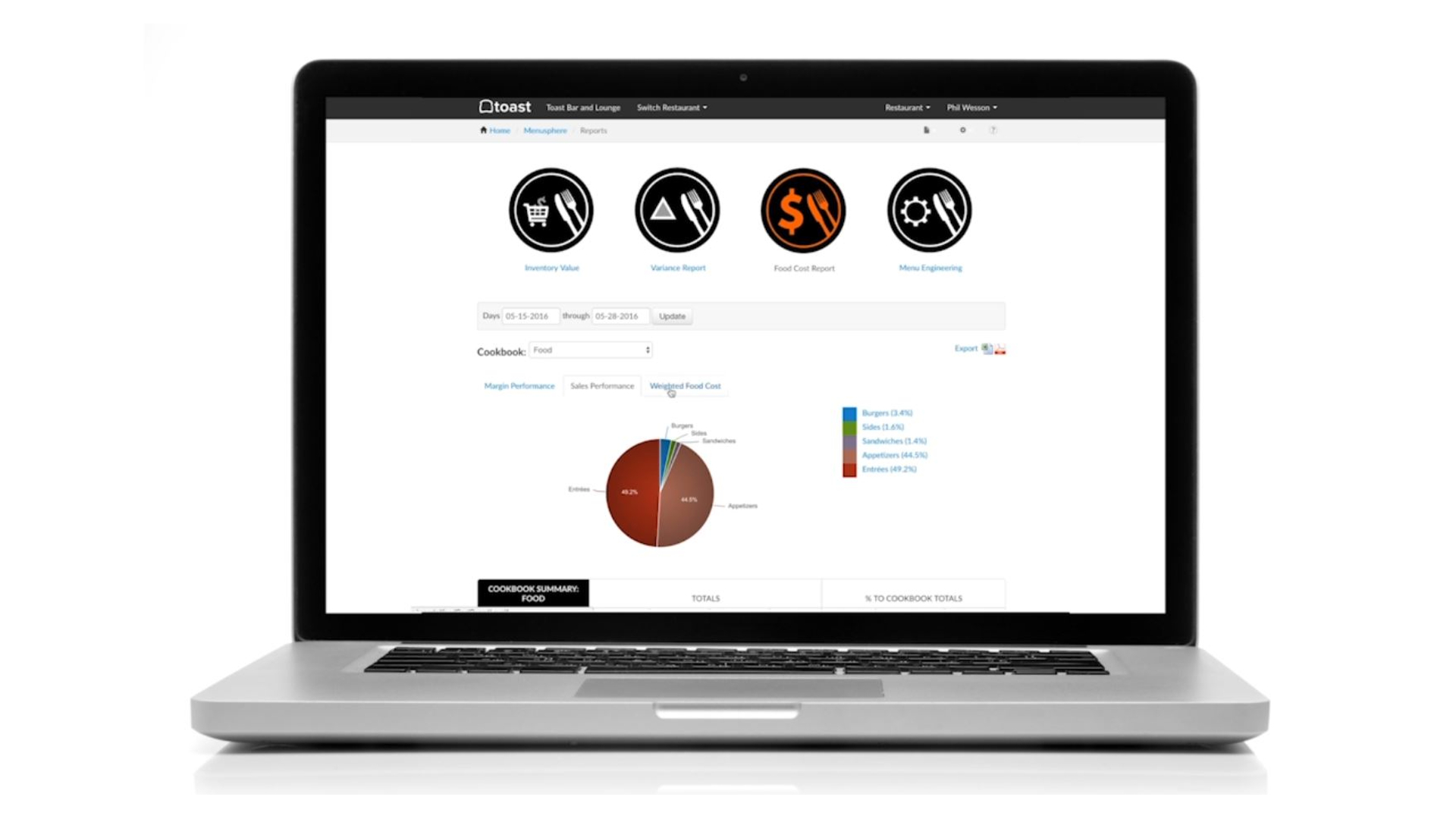

When it comes to end of week or end of month reports, a POS inventory system allows you to monitor stock and costs at the click of a button. You can see the cost of goods sold (COGS) for all your products and services, and even drill down into specific products to scrutinise their profitability.

Typical reports from POS inventory systems are frequently comprehensive. In fact, some POS inventory systems go one step further, letting you add your usual suppliers to the system and allowing you to set up automatic alerts and reorders for products that hit low stock levels.

All of this can help your business make huge time savings and offer much closer controls over spend. These are things that retail and hospitality businesses need by the bucketful right now!

How POS systems help manage payroll and staff costs

We all know that happy employees lead to happy customers. However, managing staff is a significant expense for many retailers and hospitality businesses, and it’s one that just keeps growing.

Luckily, help is at hand via your trusty POS system. Yes, you read that right! Your POS payment system is a great tool for managing payroll and staff costs, allowing you to pay your existing staff more efficiently, budget more effectively for labour costs and, ultimately, reap the rewards on your P&L. Having your POS system integrated with your payroll or HR system results in simplified wage and tax calculations, more accurate commissions, better tracking of shift scheduling and so much more.

But it doesn’t end there. A POS system has far-reaching benefits when it comes to wider staff management processes and the impact this has on customer interactions. Here are just a few examples:

✔ Easier time tracking

POS systems enable employees to clock in and out, often with a secure PIN too. This helps you to minimise time fraud and monitor staff working hours more closely. Some POS systems even allow staff to declare tips before clocking out.

✔ Streamlined scheduling

Not only can you track employees’ hours, but you can also accept or reject time off requests and even make on-the-spot updates and changes to your staff rota. In turn, having it all centrally managed subsequently makes it easier for your staff to see these changes too. So, hopefully there'll be no more confusion about who is meant to be working which shifts!

✔ Detailed employee activity reporting

Integrated POS systems often allow for what’s called ‘case management’ reporting. This helps to minimise employee theft, but also identify and reward your top employees, making staff performance reviews easier and a lot more data-driven.

✔ Improved customer skills and interaction

The inherent mobile capabilities of POS systems allow for more opportunities for your staff to interact with customers and streamline the whole customer experience. POS system vendors are also great at providing training, so your employees can get onboarded to new technologies and systems quickly and easily, again resulting in improved customer interaction.

All in all, an integrated POS system has wide-ranging benefits when it comes to staff management. From the simple, more executional tasks like payroll and scheduling, to the more strategic, people-related processes such as performance monitoring and reviews, a POS system holds a veritable treasure trove of benefits for both the short and long-term running of your business. Read more in our article on 7 POS integrations to help you run a more efficient business.

The small business option: third-party POS payment providers

Usefully, there’s an option available for businesses that don’t want to set up their own ‘merchant accounts’ to help with payment processing and POS systems.

Third-party payment providers give merchants the ability to accept payments (usually online) without requiring a merchant account. In effect, they have their own merchant account, which they use to process payments for end business owners.

The process is pretty simple. Once you’ve registered an account with the POS payment processing platform, a payment page will be installed on your website. Payments that go through this page are processed on the server of the payment gateway. This means that it’s not the business owner who is responsible for the security of the transaction, but the processing company.

The advantages of this option are low or no monthly fees, lower risk, faster integrations and easy verification. However, to account for all of this, transaction fees can be slightly higher.

Third party payment providers are a good solution for start-ups and small businesses though. This is because when you open a merchant account, commissions can make up a large percentage of the payment amount. If you have a subscription business, or large transaction volumes, then this can end up being quite costly.

Nevertheless, even for those retail or hospitality businesses that already have merchant accounts and POS systems enabled, the world of POS system integrations can seem daunting. It’s important to remember that you don’t have to tackle all areas of your business in one go. Your best option is to prioritise which area of your business is causing you the most headaches at the moment and start with that. If it’s staff management, then explore HR software integration. If it’s your accounting processes, then start there.

Alternatively, your existing POS system may already be capable of these extra features and functionalities - you just don’t know it yet! In both scenarios, your best next step is to talk to either your existing payment provider, or a new one if you’re thinking of a system overhaul.

You can get a good idea of which providers to speak to by reviewing the best POS systems available in the market today. To help you in your search, we've broken these providers down into the best POS systems for retail, our pick of the right POS systems for restaurants, the best POS systems for food trucks and the top POS systems for small businesses. Here you’ll not only find the pros and cons of each provider, but you’ll also be able to see at a glance what deals they are running and what fees they charge.

POS systems are the support your business needs

POS payment systems aren’t just about taking payments. In fact, they support a wide range of business areas from payroll to accounting, and more!

Through clever integrations and by taking advantage of many of the additional features that the best modern POS systems now offer, retail and hospitality businesses can save time, reduce admin costs and even see hefty returns to their operating profits.

For small and medium-sized businesses used to juggling tasks and balancing the books, it could mean the difference between having a mediocre turnover business and a growing, profitable one.

Further reading

You may also like our guide on the best POS systems, along with our articles on how does a POS system work? and how to choose the right POS system for your business.

Emma is an experienced technology writer covering everything from Point of Sale (POS) systems to Voice over Internet Protocol (VoIP) business phone systems. As well as Techradar, she has written for IT Builder, Soldo, and CArd Payment Guru.