Here's how Netflix spends its money - and here's why that's going to have to change

Netflix will have to rethink its spending to remain king of the streamers

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

It’s hard to remember now but when Netflix launched House of Cards in 2013 it was making a big statement: that the internet can do TV every bit as high quality as… well, regular old TV.

Until then, video content made for the internet was widely assumed to be stupid viral clips or, at best, low budget and forgettable. Sure, Netflix was growing, but it was just recycling content made by traditional broadcasters and studios, repackaging it to squeeze some extra cash out of studio back catalogues.

But with House of Cards, Hemlock Grove and Orange Is The New Black (OITNB), which both followed shortly after, Netflix proved that it could make something that wouldn’t look out of place on American premium cable network HBO, which had long been the gold standard of high production values and critical acclaim.

We all know the story from this point: both House of Cards and OITNB shows were hits (though the less said about Hemlock Grove, the better). As a result, the years that followed saw Netflix plough increasingly ludicrous sums of money into its original programming. In 2014, the company spent $3bn on original shows - and steadily increased. This year that figure is expected to hit an eye-watering $15bn.

Original content is clearly working for Netflix: in the same period of time the company has gone from having just under 40m paying subscribers to a reported 148.9m at the end of Q1 2019.

Looking at what specifically Netflix has been paying for in that time suggests that, like the House of Cards investment, it has still been focused on buildings its credibility as a provider of quality content. This is evident from the trophy shelf: In 2013, Netflix shows received 14 Emmy nominations and won three. In 2019, it was nominated for 112 - and won 23.

For every schlocky Adam Sandler comedy like Murder Mystery, Netflix has been careful to balance it with a critical darling like The Ballad of Buster Scruggs - the latter almost certainly not attracting as many eyeballs, but also earning the company three Oscar nominations and some serious credibility with Hollywood.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

However - this equilibrium is all set to change.

Tightening the purse strings

Last week, it was reported that the company’s head of content, Ted Sarandos, had met with a bunch of middle ranking executives at the company and had instructed them to tighten the purse strings. He reported said that "any upcoming projects need to bring in large numbers of viewers, and will no longer be able to float by due to being loved by critics or earning the company more credibility", specifically pointing to Triple Frontier as the sort of expensive clunker that he would no longer countenance.

So what explains this about-turn in strategy?

Depending on how charitable you are, there are several related explanations.

The first is that Netflix doesn’t need to prove itself anymore. In a few short years, Netflix is not only a big dog in the entertainment industry - it is one of the biggest, rivalled by maybe only Disney, Warner Bros and Universal. The company’s explosive growth means that it now controls the television habits of millions of people. Increasingly for many people, Netflix is the default place to go when looking for something to watch. It has proven that streaming is a viable mechanism for delivering content.

Behind this, it has transformed the entertainment industry: it has smashed down the existing power structure, by advocating for simultaneous cinema and streaming releases. It has enabled millions of people to become “cord cutters” and cancel paying for cable or satellite TV - and in many cases, enabled millennials to not ever bother in the first place. It’s even starting to buy up cinemas for some reason.

Secondly, there is the more prosaic reason: much of Netflix’s enormous content spend is financed by a ton of debt. Despite all of the subscription revenue, this still isn’t enough to satisfy the company’s desire for more content, so it is spending money it doesn’t have - hoping that it will help them continue to pile on subscribers. And these debts are huge: In 2018, the company reported it had $8.34bn in long term debt - up 71% in 2017. Eventually, it is going to have to start paying it back. In other words, it needs to make more sure-fire hits, rather than waste money on content that nobody is watching.

The third reason is perhaps the most important: that Netflix is becoming a mature company, and this changes the context in which it operates. This was an observation made by Matthew Ball, an investor who used to work as the head of strategy for arguably Netflix’s closest competitor, Amazon Video.

He argues that Netflix has reached a point where it no longer needs to scale its content offering: The first few years were all about filling up Netflix’s catalogue with as much to watch as possible so that people would want to subscribe, and the quickest way to do this was to buy content in that was made by other companies.

Laughing all the way to the bank?

Today, however, Netflix has successfully developed its own “pipeline” of self-produced shows and production deals with lots of big names of its own, so it can afford to be picky about what it makes. Essentially, Netflix has gone from a “beggars can’t be choosers” situation, having earned the credibility to pick and choose who it works with.

Maturity could also affect how Netflix thinks in other ways too. Now that Netflix is the streaming king, it sees its place rather differently. In its fourth quarter results, which were released in January we got a hint of this as they contained this nugget: “We compete with (and lose to) ‘Fortnite’ more than HBO”.

This was restated even more forcefully by CEO Reed Hastings, who earlier this year was asked about competing with Amazon and HBO by Recode, and said “we’re competing with sleep”.

In other words, Netflix is competing for our attention with more than just its traditional rivals. The most valuable commodity we have is time - and so Netflix wants to lock in existing customers by maximising the amount of Netflix its users consume, as then they’re guaranteed your subscription revenue for life.

And ultimately, this might explain the shift in strategy. According to one set of figures, by minutes watched, the most watched shows on Netflix are not Stranger Things or Black Mirror, but Friends and the American version of The Office.

Both shows are rather old but this makes sense – they're massively popular, rewatchable and bingeable classics – and perhaps shows how by shifting to more populist strategy, Netflix can wedge itself into our lives even more firmly. What these two shows - which have been endlessly rerun in the years since they were first made - suggests is that what viewers want is more of what I’d describe as ‘comfort viewing’: Not everyone wants to watch prestige drama all of the time, or even something that is new and critically acclaimed: Instead, viewers want something they can put on that is warm and familiar, and which doesn’t require intense concentration.

In other words, we can probably expect Netflix to start making more shows that are mainstream, broad and accessible.

Want something that isn’t going to be challenging that you can put on and phase in and out of while messing around on your phone? These shows fit the bill perfectly - so it is easy to imagine why they are winning in terms of viewing minutes.

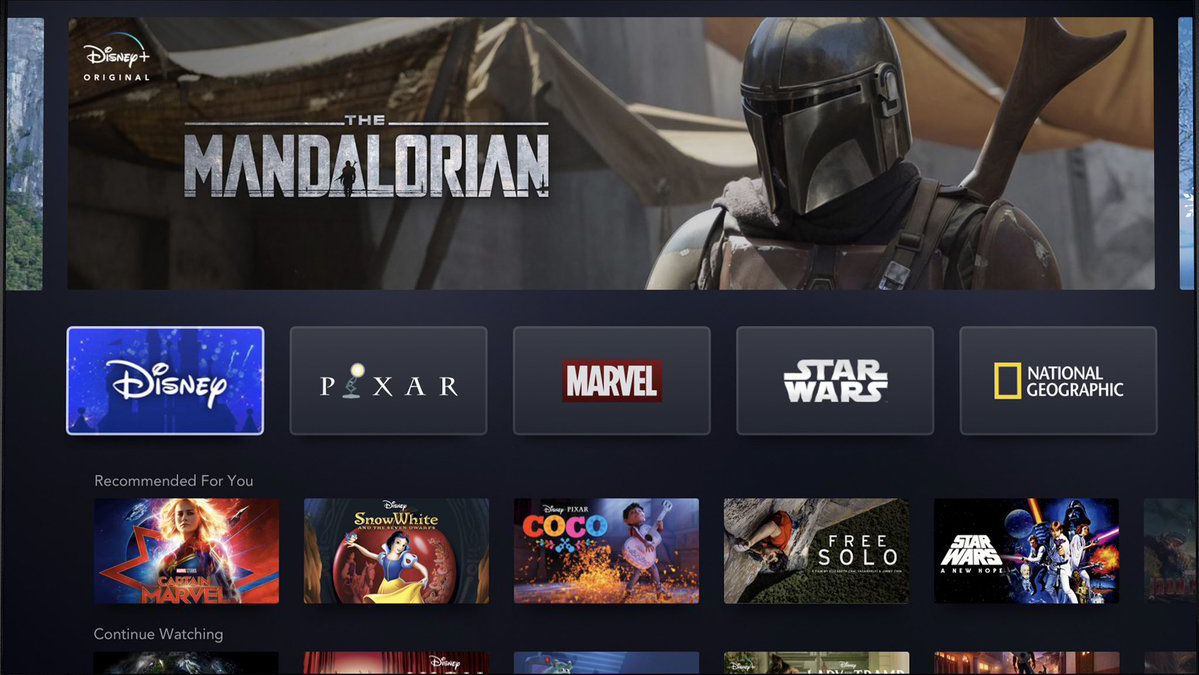

And if Netflix can use shows like this to wedge itself into our lives more firmly, then that should position it well to become our “default” TV service. The streaming video market is about to become more crowded, with the launch of both Disney+ and Apple TV+, and both will no doubt pick up plenty of subscribers for their specific and niche offerings. But ultimately, if we want somewhere to reliably find something relaxing to pass the evening? Then Netflix wants to make sure that we choose Netflix.

- The best Netflix series you can watch now