Rumour: Microsoft considering Netflix bid

Netflix stock up 13 per cent

Wall Street is awash with rumours that Microsoft is preparing an offer for video streaming giant Netflix.

Netflix stock rose 13 per cent on Friday following chatter that Redwood is willing to pay $90 a share for the rental company.

Although the speculation is likely just that, and perhaps a sneaky bid by investors to jolt stock prices, the timing is quite telling.

Netflix CEO Reed Hastings has just vacated his seat on the Microsoft board, which according to Forbes, might be an indicator that there's more to this than just Wall Street gossip.

Disappointing quarter

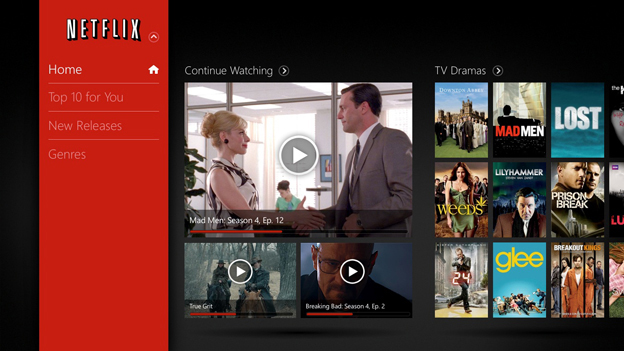

A Netflix acquisition would give Microsoft control of a streaming service they could use to compete with the likes of Amazon, Google and Apple in the tablet and smartphone game, but also for its growing Xbox Live entertainment portfolio.

From that standpoint it would seemingly make sense, but Netflix didn't exactly set the world on fire with its latest quarterly earnings report last week and isn't the attractive, can-do-no-wrong titan it once was.

The company had forecast 7 million new subscribers in 2012, but those expectations have now been lowered to 5.4m. Before yesterday's surge shares were at less than half of the company's 52-week high.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Microsoft currently has $69 billion in cash and investments burning a hole in Steve Ballmer's pocket so, with a market cap of $3.7 billion, snapping up Netflix wouldn't put too much of a dent in that stash.

Via Forbes

A technology journalist, writer and videographer of many magazines and websites including T3, Gadget Magazine and TechRadar.com. He specializes in applications for smartphones, tablets and handheld devices, with bylines also at The Guardian, WIRED, Trusted Reviews and Wareable. Chris is also the podcast host for The Liverpool Way. As well as tech and football, Chris is a pop-punk fan and enjoys the art of wrasslin'.