Here’s how Nvidia might respond if its Arm acquisition falls through

If the Arm deal crumbles, where next for Nvidia?

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

With the passing of each week, the completion of Nvidia’s $40 billion acquisition of Arm appears less and less likely. What once was a deal slated as one of the industry’s greatest coups will surely now be consigned to the scrapheap.

The proposed merger has attracted a great deal of suspicion from regulators and competitors since it was first announced in September 2020. Broadly, the concern is that Nvidia might use its new position to meddle with Arm’s neutral licensing model or at least steer R&D activity in its own favor.

As a result, Nvidia and Arm owner SoftBank have faced an uphill battle to force the deal through, something that was originally expected to take only 18 months. Given the proposal is currently subject to antitrust investigations on multiple fronts, it is safe to say this deadline will not be met.

If the most recent reports are to be believed, Nvidia is actually now quietly preparing to bow out of the deal, even if the company’s public stance suggests otherwise. Analysts we consulted at both Forrester and Gartner, meanwhile, say the acquisition is effectively dead in the water.

If the Arm deal does fall through, there are plenty of questions to be asked. Was the acquisition destined to fail from the start? Who are the winners and losers here? And where does Nvidia go next?

The master plan

UK-based Arm operates upstream of Nvidia and its rivals, licensing out chip architecture to hundreds of different customers, including the likes of Intel, Samsung, Apple, Huawei and Qualcomm (and Nvidia, of course).

The company receives an upfront licensing fee from each customer, but also a per-unit royalty on all chips that incorporate its technology, typically worth 1-2% of the selling price. For context, upwards of 200 billion Arm chips have been shipped in the company’s lifetime.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Arm-based processors currently dominate the mobile computing landscape courtesy of Qualcomm’s Snapdragon line, and the success of Apple’s M1 series proves Arm has a promising future inside laptops and desktops too.

Crucially, however, the versatility of Arm IP means it’s designs also feature in chips for TVs, smart cars, drones, various IoT devices and data center servers. This is where Nvidia’s interest lies; the company wants to use Arm to open doors in sectors (IoT, mobile, CPU etc.) in which it has only a small or non-existent footprint, as well as to shore up its position in datacenter and HPC markets, where Nvidia GPUs are put to work training massive AI models.

When the deal was first announced, Nvidia CEO Jensen Huang said: “We are joining arms with Arm to create the leading computing company for the age of AI.”

“AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

However, the proposed acquisition has faced strong opposition from regulators from the start. The US Federal Trade Commission (FTC), UK Competitions and Markets Authority (CMA) and European Commission have all launched antitrust investigations. If these come to nothing, China is expected to raise objections of its own in an effort to avoid a situation whereby companies like Huawei (which faces restricted access to US products) are unable to utilize Arm IP.

According to Glenn O’Donnell, Research Director at Forrester, the energy behind regulatory action has been amplified by rapid changes in market conditions over the last year or so.

“I originally assumed it would be a long battle, but that it would eventually succeed. I now see it as very unlikely. Since the deal was announced, a lot has changed,” he told us.

O’Donnell cites the continuation of the global chip shortage, the campaign to onshore semiconductor fabrication in the US amid tensions with China, and the return of Pat Gelsinger to Intel, which is a competitor to both Nvidia and Arm.

“Collectively, these moves are getting people to take notice of the broader semiconductor landscape. As they do this, megamergers like [this one] attract more scrutiny. These dynamics bring more pressure from the FTC and other regulators around the world to oppose the Nvidia-Arm merger,” he explained.

“Regulators see consolidation as being anticompetitive. With all such issues, the truth is neither black nor white, but that doesn’t matter much. We now have an environment that is not conducive to such a merger.”

What now?

If the acquisition does collapse, we can expect smug celebrations at Intel, Qualcomm, Huawei and elsewhere. The UK will also benefit, because it’s guaranteed to keep one of its few world-leading tech businesses on home soil, even if Nvidia had pledged to invest in a cutting-edge AI center in the country.

At SoftBank, the picture will be different. Given the $40 billion agreement consists of $12 billion in cash and almost the entire remainder in Nvidia stock (at the September 2020 rate), the meteoric rise in the value of Nvidia means the deal is currently worth far more to the Japanese conglomerate than when first agreed. Reports suggest SoftBank would take Arm down the IPO route instead, if the agreement falls through.

Nvidia, meanwhile, will miss out on the opportunity to blend Arm IP more tightly with its own and configure Arm software in a way that regular customers are unable to. Another aspect is that Nvidia would no longer have had to pay the license fees, nor royalties on its Arm-based chips.

However, the story is not all doom and gloom. Nvidia may fail to purchase Arm outright, but it can still license Arm architecture like everyone else.

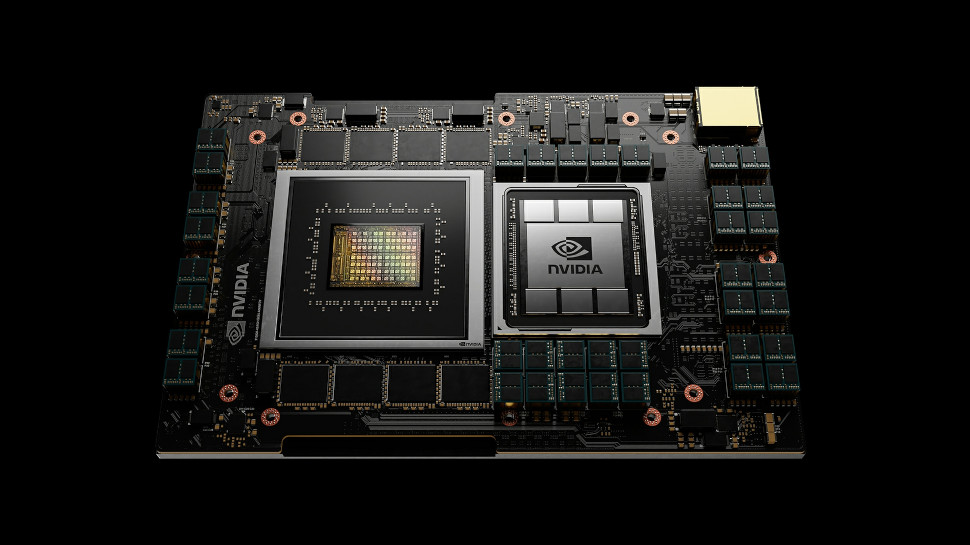

“Nvidia can still pursue its Arm based developments without the acquisition of Arm, and it could also work with Arm to make its GPU IP available to the Arm ecosystem,” noted Alan Priestley, Research VP at Gartner.

“Nvidia does not need to acquire Arm to develop CPUs and it can continue development of its Grace CPU irrespective of what happens with the acquisition.”

According to O’Donnell, meanwhile, Nvidia would also hunt down alternative candidates for acquisitions, albeit at a smaller scale. Asked whom and what sectors the company might target, he told us:

“The answers are all over the map, but Nvidia needs more depth in areas outside of its core processor line. Watch for moves in networking, sensors and specialized memory. Some of this will come via partnerships rather than acquisitions.”

O’Donnell even says it’s possible Nvidia might pursue its own manufacturing, which would see the company compete in the same arena as pure-play foundry TSMC, and integrated device manufacturers (IDMs) like Intel and Samsung.

“It may be heresy [to suggest Nvidia might enter manufacturing], but don’t rule it out. The probability is more than zero.”

- Also check out our lists of the best workstations and best mobile workstations

Joel Khalili is the News and Features Editor at TechRadar Pro, covering cybersecurity, data privacy, cloud, AI, blockchain, internet infrastructure, 5G, data storage and computing. He's responsible for curating our news content, as well as commissioning and producing features on the technologies that are transforming the way the world does business.