Best cloud storage of 2024

Looking for the best cloud storage services to store your pictures, files and data? We've got them all.

1. Best overall

2. Best lifetime value

3. Best for syncing

4. Best for security

5. Best for backups

6. Best for Windows file management

7. Best for ease of use

8. Best for users in Microsoft's ecosystem

9. Best budget option

10. Industry rankings

11. FAQs

12. How we test

It's May 2024 and, like clockwork, we've kept this page updated with the best offers we can find for the cloud storage services we most recommend.

Strictly speaking, you don’t need a cloud storage solution, but for peace of mind in an enterprise setting, it’s advised to back up data according to a ‘3-2-1’ backup strategy, and cloud backup is an affordable way to get there.

After all, per a nice aphorism we found online recently, there are two types of physical drives: those that have failed, and those that have yet to fail.

Back in March, in celebration of World Backup Day 2024, we published a new write-up with all the facts, and a discussion of why backups are important for sensitive data in a business setting, that should stand the test of time.

Cloud storage is also commonly bundled with online collaboration tools, such as Google Workspace and Microsoft 365, which have become commonplace amidst the Covid-19 pandemic.

In practice, it’s often more cost-effective, especially in an enterprise setting, to opt for these kinds of 'all-in-one' services when choosing cloud storage solutions for business. Offering plenty of storage capacity and more besides, they make it easy to secure, access, and share files, photos, and email wherever you are, online, on desktop, and on mobile.

However, you might have reservations about opting for a Big Tech company's cloud offering. That could be down to data privacy concerns, not wanting to put all of your eggs in one basket, or to feel more confident that pricing won’t gradually skyrocket.

Accounting for budget is so important to us, in fact, that we've listed the best free cloud storage services, plus lifetime cloud storage deals, which charge a large one-off sum for unlimited access to a hefty data allowance.

When reviewing the best cloud storage services, our main concerns while testing were ease of set-up, security, sync speeds, and sharing performance. We also checked file recovery and versioning options, so everyone’s on the same page.

1. IDrive: 10TB of storage for $4.98

Cloud storage veteran IDrive offers an incredible amount of online space for a small outlay across a wide range of platforms. 10TB of storage for $4.98 for the first year is unmatched, as is the support for unlimited devices and the extensive file versioning system available.

Preferred partner (What does this mean?)

2. pCloud: Save on lifetime cloud storage: pCloud is more expensive than the competition, but the one-off payment means that you won't have to worry about renewal fees that can be horrendously expensive. 2TB for life is $399 while the 10TB plan costs only $1,190.

Preferred partner (What does this mean?)

3. Reader Offer: $100 off Sync Pro

Sync delivers outstanding value for anyone looking for terabytes of cloud storage space, and the secure file sharing and collaboration features are an added bonus. Get $15 per user, per month for unlimited storage with this exclusive offer from us.

Preferred partner (What does this mean?)

The best cloud storage services of 2024 in full:

Why you can trust TechRadar

Best overall

Specifications

Reasons to buy

Reasons to avoid

✔️ You want a cloud storage service that is feature-rich: IDrive boasts a significant number of features, including Snapshots, which lets you store up to 30 different versions of your files and a physical recovery option.

✔️ Flexible backup options: With IDrive, users can back up an unlimited number of devices – computers, mobile phones, servers – to a single account.

✔️ You need cloud storage you can trust with your life: With IDrive’s end-to-end encryption protocols, you can be confident that any files you store are safe from prying eyes.

❌ You're on a strict budget: IDrive isn't the cheapest cloud storage on the market, with some of the more appealing price points only available for a “limited time only”

❌ You've got ambitious growth plans: There's no unlimited storage options, which could be an issue for some enterprises.

❌ You want a slick interface: The user interface of the desktop client does leave a little to be desired.

IDrive is a terrific cloud storage solution - a fantastic all-rounder with an easy-to-use backup option. It offers a great balance between security, usability and performance.

Check out our in-depth IDrive review for a closer look at the service, and see why it's our top cloud storage pick for 2024.

IDrive tops our best cloud storage charts with its appealing mix of easy-to-use desktop and mobile apps, excellent backup features, strong security and great value.

Signing up gets you from 10TB (personal) to 50TB (business) , but pure storage is just the start. Sync support keeps files up-to-date across all your hardware, and excellent backup features enable protecting everything from individual files and folders to full SQL, Exchange, SharePoint and other servers. We found this was very easy to use, and our tests revealed iDrive's performance was a close match to Google Drive and the other top contenders.

The service is strong on the security fundamentals, with end-to-end encryption and two-factor authentication to protect you from attack.

It also excels at extras, such as an option to transfer your data to iDrive on a physical device, ideal if you've a slow internet connection and 50TB to protect. IDrive sends you the drive, pays return postage (in the US), but it's still free once a year for personal users (three times for business plans.)

The free tier gives you a decent 10GB of storage, more than enough to try the apps and get a look at what iDrive has to offer. And if you like what you see, right now there's a spectacular deal offering 10TB storage for only $4.98 for the first year, amounting to little more than $0.01 a day.

Read our full IDrive cloud storage review.

Performance: This is an area where IDrive really shines. It boasts fast upload speeds and a file recovery feature that is especially handy if you think you’ve lost some important data. IDrive also provides block-level syncing when you are syncing files from a device, such as a smartphone or tablet, to the cloud.

Other backup features, including disk image backup, NAS backup and server backup, are useful additions depending on what you’re looking for from your cloud storage.

Security: IDrive is certainly no slouch on the security front. It comes with two-factor authentication and end-to-end encryption to protect your data. This works via a private key that is unique to you, so look after it!

There’s also the offer of standard encryption, which although not as secure as end-to-end encryption, still provides protection against most potential breaches. It also means a bit less responsibility for the end user as iDrive keeps hold of the encryption key, so you can restore your data whenever you need to, without having to remember a private key.

Expand to read our expert technical analysis of IDrive ↓

IDrive's Express service lets you put your data on all the best hard drives and post them off - for when you want the added protection that comes with physical storage.

Customer support: IDrive has several support options so you should be able to contact the company should an issue arise. There’s live chat functionality, as well as the option of contacting support via either telephone or email. As with many companies, some users have complained that response times vary, but we’ve been pleasantly surprised by some fast remediation whenever a problem emerged.

Features: IDrive offers users the possibility of backing up their files across an unlimited number of devices, from computers to mobile devices, as well as NAS drives.

Real-time syncing and backup scheduling, are both great for ensuring you never forget to back up the latest version of your files. You can also opt to receive desktop or email notifications informing you when your backups are completed.

Link-sharing is robust here. You can configure links to expire after a set period - up to a maximum of 30 days - or a number of downloads. All of your active share links are also visible through the IDrive dashboard so there’s complete clarity over what you’re sharing with, say, external partners.

Usability: IDrive does boat some good usability on the whole, although a revamp of its design and interface in certain areas could improve this. Menu and setting screens are pretty clear, so you shouldn’t have too much trouble configuring IDrive exactly to your liking.

There are some differences here depending on the type of device you are accessing IDrive through. For instance, there are fewer options if you’re using the iOS version.

While the Android app lets you backup SMS messages, this isn’t possible with the iPhone and iPad versions, which are limited to contact, calendar, photos and videos. While this may be more of an Apple issue than an IDrive one, it will still affect usability for certain users.

Price: IDrive offers 5GB of free storage, with no . After that, you’ll probably want to look at the Persona, which costs $59.62 a year for 5TB, and there’s the option of a $15 upgrade for twice the amount of storage (10TB).

If the Business plan is more likely to suit your needs, you can gain cloud storage fpr an unlimited number of users and devices. This is available from $74.62 a year for 250GB, increasing to $8699.62 for 50TB of space per user. Alternatively, there’s the Team plan, which comes in several versions. Here, the cheapest plan starts at $74.62 for one year.

It’s also worth remembering that TechRadar readers can get 10TB of cloud storage from iDrive for $4.98 for the first year. You can grab this exclusive deal by clicking here.

| Attributes | Notes | Rating |

|---|---|---|

| Design | A bit lacking in places - especially outside the desktop version | ⭐⭐⭐ |

| Ease of use | Not always the most intuitive, but worth the effort. | ⭐⭐⭐⭐ |

| Performance | Fast upload speed and great feature set. | ⭐⭐⭐⭐⭐ |

| Security and privacy | IDrive offers end-to-end encryption | ⭐⭐⭐⭐⭐ |

| Customer support | 24/7 live chat, telephone and email support | ⭐⭐⭐⭐⭐ |

| Additional features | Single sign-on, server cloud backup, remote computer management | ⭐⭐⭐⭐ |

| Time to upload 1GB | 4m22s - very fast | ⭐⭐⭐⭐ |

| Time to download 1GB | 2m27s - still very respectable | ⭐⭐⭐ |

| Platforms | PC, Mac, iOS, Android, Linux | ⭐⭐⭐⭐ |

| Versions kept | 30 | ⭐⭐⭐⭐ |

| Price | Not the cheapest but a great free plan | ⭐⭐⭐ |

Best lifetime value

Specifications

Reasons to buy

Reasons to avoid

✔️ You want a free plan without restrictions: pCloud implements zero limitations on file size or speeds for their plans.

✔️ You need social media integration: You can back up images and videos on your accounts, like Facebook and Instagram, directly within pCloud.

✔️ You want block-level syncing: This means upload speeds will be much quicker as only the parts of your files that have changed will be synced.

❌ You need a built-in document editor: This isn't included in pCloud, so if you need one you might be better off going with rivals like Google Drive or Microsoft Onedrive.

❌ You use a lot of devices: With pCloud, it's recommended that no more than five devices are connected to a single account - this may not be enough for individuals with a lot of devices on the go at once.

❌ The user interface is important to you: This can feel a little old-fashioned but there's a six-step wizard to help you get started.

pCloud is a great value cloud storage service with a fantastic free plan and the kind of social media integration that few of its rivals can match.

Check out our in-depth pCloud review to see why this cloud storage service is worth your consideration.

Swiss-based pCloud stands out from the cloud storage crowd for its hugely advanced file sharing features. If regular download links aren't enough, you can create special download pages with custom messages, build slideshows of shared images, even stream audio or video files directly from your storage space.

There's no monthly pricing model, but annual plans are fair value at $49.99 for 500GB (very economic, in our opinion), $99.99 for 2TB when we last checked in May 2024.

Even better, pCloud's lifetime plans give you 500GB forever for a one-off $199, 2TB for $399, or 10TB for $1190. There's a 10GB free plan, too, though beware: as with many providers, you must sign up friends, install the app and do other tedious tasks to get the full amount.

We found the service very easy to set up and use. Sample folders and files helped us immediately try out its powerful file management and sharing features. We had no issues connecting our account to Facebook, Instagram and other social media accounts, and backing up their content.

The desktop app adds a Dropbox-like virtual drive to your file manager, simplifying operations, but Internxt's mobile app can make life even easier by (optionally) automatically uploading pictures and videos direct from your phone.

There's also offline functionality, so you can access your shared files via your computer or mobile even if you don't have a working connection. Then, as soon as the connection is restored, there'll be an automatic sync. Browser extensions are also available for Firefox, Chrome, and Opera, allowing you to save audio, video and pictures directly from a web page to your pCloud account.

There's a lot to like here, but we also noticed one or two issues. The desktop interface is a little dated - not quite as slick as some of the competition. 2TB isn't a lot of storage by today's standards, either, and iDrive's Personal plans can give you up to 20TB for only a little more.

Read our full pCloud Cloud Storage review.

Expand to read our expert technical analysis of pCloud ↓

Performance: Our tests found that pCloud’s upload speeds fared well against competitors like iDrive, Internxt, and Apple iCloud.

File recovery also performed well, but it’s worth keeping in mind that the free version of pCloud only stores file revisions for up to 15 days. If you need longer than this, you’ll have to select a paid plan.

Security: All file transfers involving pCloud use a TLS/SSL encrypted channel for added protection and files are stored across five different server locations as a safeguard against data loss. In fact, pCloud is so confident regarding the security credentials that it offered a $100,000 reward for anyone that could crack their defenses as part of the 'pCloud Encryption Challenge'. No one was successful.

Customer support: This is an area where pCloud can find itself lacking. Response times can vary a lot and if you want to contact pCloud directly, you have to pick up the phone. Unfortunately, the head office is in Switzerland, so US customers have a sizeable time difference to battle against. You can also send an email, but the addition of a live chat option would help speed up their customer service.

Features: Sharing files is straightforward with pCloud and there are a couple of additional features worth talking about too. One of these is Extended History, which extends the time that pCloud retains deleted files to 360 days. Another is pCloud Crypto, which adds client-side encryption to your account. These features do have to be paid for, however, costing $80 a year and $50 respectively.

Usability: Some users have complained pCloud’s software is not short of a bug or two, which diminishes its usability significantly. When things are working well, however, the desktop client is pretty intuitive so as long as you aren’t scuppered by a technical mishap, this is a cloud storage platform that is pretty easy to get to grips with.

Price: A strong point for pCloud is its competitive price points. There’s a generous free plan offering 10GB of storage (although you will have to complete a few simple tasks to unlock the full amount, such as recommending friends).

In terms of paid plans, the Premium subscription comes with 500GB for $50 a year while the 2TB Premium Plus is priced at $100 a year.

Interestingly, pCloud also offers not just one-time 'lifetime' payment plans, but the ability to stack one lifetime allowance on top of others. That's certainly an investment, but we like that the option is there, because it could pay off over time with enough use.

| Attributes | Notes | Rating |

|---|---|---|

| Design | Some bugs aside, pretty intuitive | ⭐⭐⭐ |

| Ease of use | Clear, and a set-up wizard to get you started | ⭐⭐⭐⭐ |

| Performance | Holds up well against competitors, but versioning is restricted somewhat | ⭐⭐⭐ |

| Security and privacy | Good security protocols and confident about its safeguards | ⭐⭐⭐⭐⭐ |

| Customer support | Somewhat lacking. A live chat option would be handy. | ⭐⭐⭐ |

| Additional features | Extended History, crypto drive, file manager | ⭐⭐⭐ |

| Time to upload 1GB | 4m4s - very fast | ⭐⭐⭐⭐⭐ |

| Time to download 1GB | 1m15s - rapid | ⭐⭐⭐⭐⭐ |

| Platforms | All | ⭐⭐⭐⭐⭐ |

| Versions kept | - | Row 9 - Cell 2 |

| Price | Reasonable and the lifetime-options are a bonus. | ⭐⭐⭐⭐⭐ |

Best for syncing

Specifications

Reasons to buy

Reasons to avoid

✔️ You need a team-friendly platform: Microsoft 365 integration allows for live editing and there's strong control regarding who can see your files.

✔️ You need strong security protections: End-to-end encryption and two-factor authentication are both on offer with Sync.

✔️ You want a cloud platform that's easy to set up: Recently revamped desktop clients and mobile apps make it straightforward to get going with Sync.

❌ You want more advanced interface options: Aside from progress indicators and a recent changes list, there's not much going on with Sync's desktop dashboard.

❌ Single folder syncing is an issue: Some competitors provide block-level syncing but not Sync.

❌ You need reliable customer support: While there is user forum and knowledgebase to help with troubleshooting, the only way to directly contact Sync is via email.

Sync is a competitively priced cloud storage platform that has some solid features. It's only let down by limited customer support and the absence of block-level syncing.

Check out our in-depth Sync cloud storage review for insights on why this cloud storage platform offers such reliable out-of-the-box security.

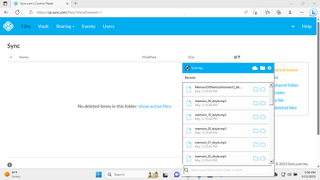

Sync.com may not have the range of features you'll see elsewhere, but, as the name suggests, it excels at simple file syncing, delivering an easy-to-use, speedy and secure service that works for personal and business users.

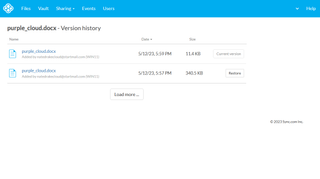

There's still plenty of power here. Sophisticated file sharing allows creating read-only, password-protected or expiring links, set download limits and more. Sync.com's versioning supports restoring files from at least the last 180 days (most providers stop at 30.)

The mobile apps can automatically sync photos and videos as you take them, while two-factor authentication and end-to-end encryption keep your account and data safe.

Elsewhere, we found Sync.com's apps and web interface slick and easy to use, and performance was a real highlight, with both upload and download speeds amongst the best we've seen.

Sync.com particularly impressed us with its team-friendly features, including the ability to add comments to file-sharing links, share folders with groups of people, open and edit Office documents direct from your Sync space (if you've Office 365) and manage all your users from a central console.

There are the rudimentary file and folder sharing features you'd expect here but there's also support for more advanced sharing controls, including the option of adding password protection and expiry dates on any links you do share.

In addition, if you subscribe to a team account, you'll find that your files gain added security from protocols like HIPAA, GDPR, and PIPEDA. PIN code locks are also provided for the Sync mobile apps.

Prices start higher than most providers, with a 2TB personal plan costing $96 a year. However, demanding teams can get unlimited storage for only $360 per user per year (minimum two users), which works out at $15 per user per month.

As of late April 2024, the company is offering $100 off annual bills for its Solo Professional and Teams+ Unlimited plans until May 6.

There's a 5GB free plan for you to try out, and you can expand this to 27GB by carrying out various tasks (some as simple as creating a folder. We're not huge fans of this kind of busywork generally, and always suggest buying in if you have a pressing need to store sensitive data at scale.

Read our full Sync cloud storage review.

Expand to read our expert technical analysis of Sync.com ↓

Performance: Sync offers some impressive upload and download speeds - although this is, of course, just for a single folder. A nice feature is the way it lets users control these speeds, throttling them where necessary. This means you can ensure that Sync doesn’t affect your other commuting tasks if you haven’t got the best connection. This added control you have over Sync’s performance is a handy addition.

Security: Sync takes cloud security very seriously. The service isn't interoperable with third-party apps (like collaboration tools) and doesn’t make its API available for others to use externally.

While this does prohibit potentially useful integrations, it also reduces the possible attack vectors for outside actors to exploit. Sync has even published a white paper explaining how it uses 2048 Bit RSA encryption keys to keep your data safe. Two-factor authentication is also easily enabled for your account.

Customer support: Starting with the positives, Sync does come with an extensive Help Center that provides support regarding setting up your account, creating shared folders and more. Unfortunately, finding help any other way is more of a challenge. There’s no community forum and you can only get directly in touch with Sync via an online form. When we did go down this route, however, we did receive a helpful response pretty quickly.

Features: On a fundamental level, Sync’s primary feature is the way it lets users maintain a single folder on their device, or devices, of their choosing that is automatically synced with the cloud. In terms of other features, versioning is offered but the length of time that files are kept for will vary depending on your subscription. The lack of more advanced features may disappoint some but Sync has chosen to focus on its core functionality instead.

Usability: Sync is an easy-to-use cloud storage platform with an intuitive interface. This is true of both the web and mobile versions, which although not the prettiest and clear and straightforward. There’s also an option to store files online only, without taking up space on any of your devices. This is also simple to employ and provides a handy way of saving more space.

Price: Sync’s free plan comes with 5GB, but does include the option of raising this to 27GB by inviting friends and completing other tasks.

Paid-up personal users can access 2TB of storage for $8 a month or 6TB for $20 per month (when paid annually).

For businesses, there’s a Teams Standard plan that offers 1TB at a cost of $5 per user per month. Enterprises may need the Teams Unlimited plan, however, which delivers unlimited cloud storage for $15 per user per month.

Best for security

Specifications

Reasons to buy

Reasons to avoid

✔️ You want advanced security features: Internxt is a zero-knowledge file storage service focused on absolute privacy

✔️ You need reliable customer support: Chat support is responsive and the Help Center is extensive.

✔️ You want an easy-to-use interface: An intuitive interface most users will be instantly familiar with.

❌ You want free storage without limits: The download limit on shared files, for example, isn't included in the free plan.

❌ You need more advanced features: Features like file versioning, offered by some rivals, aren't available here.

❌ If collaboration is important to you: In-app collaboration isn't on offer.

Internxt has a clean interface and first-rate security credentials. Although some advanced features are lacking, reliable support means this is a cloud storage platform well worth a look.

Check out our in-depth Internxt review for a closer look at this cloud storage platform's excellent security credentials.

Internxt is a security-focused cloud storage provider who applies multiple technologies to ensure your data stays safe. End-to-end encryption shields your data from snoopers; the service stores files in chunks spread around its networks, protecting it from hardware failures; a virus scanner checks your files for malware, a password generator to protect your accounts, and a temporary email.

You can be sure of this as, unlike other 'secure' cloud providers, Internxt is committed to open source. This means that the source code for their apps are available on Github so developers can check that end-to-end encryption and other features have been set up correctly.

Paid plans start at just €4.99 a month for 200GB, which is a very competitive price if you're looking to extricate yourself from a big tech provider like Google Drive.

You also get 2TB for a reasonable €9.99 per month, or annual and lifetime plans of up to 10TB, and checkout using various payment methods such as credit and debit cards (including Mastercard, VISA, American Express, and more), PayPal, bankcontact, iDeal, and SOFORT.

Business plans were available from Internxt for a time, but the company is, as of May 2024, directing users to sign up to an e-mail list to be notified when these become available again.

Internxt also offers up to 50% off of its lifetime plans occasionally - so the website's worth checking every now and then if you think you'll get value from the long term investment.

We found Internxt's well-designed web view and apps did a good job of helping us find and manage files. Windows Explorer and Mac Finder integration made uploading as simple as a drag and drop. Sync support keeps files up-to-date across all your devices, and you can share files with others via custom links.

Internxt can't quite match the advanced features you'll find with OneDrive or Dropbox, and it comes with a free plan with plenty of optional hassle built in.

By default, Internxt offers 10GB for free, but to get more without paying a dime, you must install both the desktop and mobile apps (1GB each), share a file via a link (1GB) and invite five friends. (1GB each). Really, regardless of provider, the measly extra capacity doesn't justify the effort in this day and age.

Still, Internxt's security-first approach and quality apps do appeal, and it more than deserves a place on your shortlist.

Read our full Internxt cloud storage review.

Expand to read our expert technical analysis of Internxt ↓

Performance: During our speed tests, Internxt held up well and it was especially impressive to find that the encryption process didn't have a detrimental effect on speed at all.

The upload of 625MB of data took just 1 minute 55 seconds, which holds its own against other cloud storage services we've reviewed that don't offer encryption.

Security: Perhaps the main reason you'll want to choose Internxt as your cloud storage platform. All of your data is instantly encrypted upon being transferred from your device, only being decrypted when it is downloaded back to the device in question.

Also, your data isn’t stored in a single location - it’s broken up and spread across multiple servers. This means even if a server was to suffer a data breach, your entire file won’t be compromised - making it of limited use to cyberattackers. Internxt has also passed an independent security audit by Securitum.

Customer support: Internxt users will find that the first port of call for customer support is live chat, which appears whenever you navigate to the Internxt site. For users that prefer to solve their challenges independently, the Internxt Help Center is on hand with numerous support articles.

On the other hand, if you’ve exhausted all your other options, the Internxt support team can be contacted by email 24 hours a day, offering support in English, Spanish, and Russian and the website is available in seven languages.

Features: Available on desktop, mobile, or tablet, Internxt comes with many of the basic features that users have come to expect from a cloud storage service. You can enjoy media streaming of your video and audio files without downloading the files to your computer.

There’s automatic syncing functionality and offline access, both of which will be much appreciated by business users who can’t afford to be without access to their files. Of course, security should also be mentioned here too as it’s one of Internxt’s features that received the most praise.

Usability: Set up is simple, and among the fastest processes we’ve experienced putting this guide together. There’s even an introductory guide to ensure you don’t experience a steep learning curve when getting to grips with the platform. The dashboard is clean and well-designed and the drag-and-drop process for uploads means there’s little opportunity for any issues to arise.

Price: The free plan on offer initially sounds too good to be true, giving users 10GB of storage for no cost, and I suppose it is. Reading the fine print reveals that the free plan offers “up to” 10GB of storage, but you’ll actually start with 2GB of storage and can unlock the rest by completing certain actions.

Many of these aren’t difficult, such as downloading the mobile or desktop app, but they are time-consuming. Then there are seven other subscription plans available, with businesses able to choose from price levels of €5, €10, and $25 a month for 200GB, 2TB and 10TB respectively.

| Attributes | Notes | Rating |

|---|---|---|

| Design | An intuitive interface that gives the user plenty of support | ⭐⭐⭐⭐⭐ |

| Ease of use | An introductory guide offered straight away | ⭐⭐⭐⭐ |

| Performance | Good speeds even with encryption enabled | ⭐⭐⭐⭐⭐ |

| Security and privacy | A real strong point. Robust encryption offered here. | ⭐⭐⭐⭐⭐ |

| Customer support | Email support on-hand 24/7 | ⭐⭐⭐⭐ |

| Additional features | Nothing of note, really | ⭐ |

| Time to upload 1GB | 4m24s - very fast | ⭐⭐⭐⭐ |

| Time to download 1GB | 2m29s - very respectable | ⭐⭐⭐ |

| Platforms | PC, Mac, Linux, iOS, Android | ⭐⭐⭐⭐ |

| Versions kept | 1 - "working on making that more competitive" | ⭐⭐ |

| Price | Free plan may be a little misleading, but lots of options herel | ⭐⭐⭐⭐ |

Best for backups

Specifications

Reasons to buy

Reasons to avoid

✔️ You want unlimited cloud backup: For just $6 per TB per month, you get unlimited cloud backup so you can keep all the files you need.

✔️ You need straightforward operation: Everything is simple and clear - even if you need to recover your entire computer.

✔️ Affordable pricing is important to you: Even before you commit, you can try Backblaze for free for 15 days without giving up any payment card information.

❌ You need fast backups: Backblaze isn’t particularly fast - although it does intentionally throttle its speeds to avoid user disruption - but this could be a problem for some.

❌ You need more than one device backed up: Backblaze works on a one-device-per-license approach. You can purchase multiple licenses, of course, but you won't receive a discount for doing so.

❌ You want support for network drives: These aren't included, although you can back up external hard drives and portable SSDs.

Backblaze is a great backup tool that is comprehensive and secure, working just as well for personal or business devices.

Check out our in-depth Backblaze review to find out more about this popular platform.

Backblaze is a high-powered cloud backup service that provides unlimited storage with no file size limits for a very fair price.

Install the Backblaze desktop app and it immediately scans for important files, and begins uploading them. You're able to take manual control, if you like, but we found it simpler to let Backblaze handle everything automatically.

The initial transfer of data to the web can take a long time, but our tests found impressive upload speeds kept delays to a minimum. And on the download front, if you need your data in a hurry, Backblaze will ship up to 8TB to your door on a USB drive.

The focus on backups means there's no file syncing, no clever collaboration tools, and only the simplest of file-sharing options. You can only protect one computer per account, too, and network drives aren't supported.

If you're just looking for an ultra-simple high-capacity backup service, though, Backblaze is a must-see. The pricing model for its cloud storage service is simple: $6 per TB billed monthly, a fifth of the cost of Amazon Web Services.

There's also a free 15-day trial, which you can access without having to hand over your financial details. After that, there's no free plan.

The Backblaze interface is another strength of the platform. While the options are somewhat limited, there’s a real clear focus apparent when engaging with the user experience.

This includes a useful file manager feature, which makes it easy to search and sort through the files you have stored in the platform. The interface is minimal, which is both a strength and a weakness - especially if you are used to some of Backblaze’s competitors that offer more advanced functionality.

If you also need a VPN to protect yourself online, you can alternatively get Backblaze completely free for a year when you sign up for our #1 favorite, ExpressVPN (and you get three extra months of ExpressVPN protection, too).

Read our full Backblaze review.

| Attributes | Notes | Rating |

|---|---|---|

| Design | A straightforward design with clear navigation. | ⭐⭐⭐⭐ |

| Ease of use | Simple and clear. | ⭐⭐⭐⭐⭐ |

| Performance | Not the quickest, possibly due to deliberate throttling | ⭐⭐⭐ |

| Security and privacy | Encryption and 2FA make this a strong point. | ⭐⭐⭐⭐⭐ |

| Customer support | Backblaze operates a ticket system, with business-hour live chat, and additional paid support options | ⭐⭐⭐⭐ |

| Additional features | Choose storage location (US and EU), | ⭐⭐⭐ |

| Time to upload 1GB | 7m21s - a little slow | ⭐⭐ |

| Time to download 1GB | 2m52s - not bad | ⭐⭐⭐ |

| Platforms | PC, Mac, iOS, Android, Linux | ⭐⭐⭐⭐ |

| Versions kept | Unlimited | ⭐⭐⭐⭐⭐ |

| Price | Competitive and zero discrepancy between personal and business users. | ⭐⭐⭐⭐ |

Best for Windows file management

Specifications

Reasons to buy

Reasons to avoid

✔️ You want reasonable pricing plans: IceDrive's pricing is attractive, with a 10GB free plan, in addition to three subscription tiers: Lite, Pro, and Pro+.

✔️ You need a virtual drive: Assigning itself the letter 'I:' in Windows, IceDrive can be used as a virtual drive, with all operations feeling as fast as they would for files on your own hard drive.

❌ You're a Mac or Linux user: IceDrive's virtual drive offering, one of its standout features, is only available with the Windows version.

❌ You need more collaboration features: IceDrive has little to offer in the way of collaboration, outside of setting passwords and expiry dates for shared content.

IceDrive is a decent cloud storage platform, boasting a virtual drive for Windows users to employ.

Check out our in-depth IceDrive review and see why this cloud storage platform is so highly rated.

UK-based IceDrive has only been in the cloud storage business for a very few years, but its groundbreaking file management features more than justify its place in our 'Best...' list.

Windows users can browse their storage space from Explorer, for example, moving, renaming, opening, and even editing files, just like working on a local drive. Install the Windows, Mac or Linux app and you can also preview documents and stream media files without having to download them first.

The clean and easy-to-navigate browser interface is so simple that even newbies will figure it out in moments. The desktop and mobile apps have similar functionality, but we found inconsistencies in design and layout made them a little more awkward to use.

Security is a highlight, with IceDrive encrypting data on your device before it's transferred, and its zero-knowledge approach ensuring only you can decrypt and view your data. We like the addition of two-factor authentication, which works with an authenticator or a physical key. SMS authentication is available to premium customers but we don't recommend using this, as text messages are far easier to intercept than one-time passwords generated by reliable authenticator apps.

A 10GB free plan gives you an easy way to get started despite some restrictions (no client-side encryption, plus a 3GB/ day bandwidth limit.) If you need more, annual plans range from $4.99 a month for 100GB, $7.99 a month for 1TB, and $14.99 for 3TB.

When we last checked in April 2024, these prices had been raised slightly, and previously available monthly/annual 10TB plans had been axed. There are savings to be had when buying in for a year or two, but the value of that depends on your usecase.

However, IceDrive is now once again offering lifetime plans after revising its pricing structure. Right now, 512GB of storage is a one-time payment of $299 will get you 512GB of lifetime storage, 2TB is $479, and 10TB is $1199.

Those prices are okay, but what we really like about this structure is that additional data allowances can be stacked on top with subsequent payments, currently $79 for an additional 128GB, 512GB for $199 and 2TB for $399.

This pricing scheme seems to be continually evolving, and we're fans, so we'll keep an eye on it.

Read our full IceDrive review.

Best for ease of use

Specifications

Reasons to buy

Reasons to avoid

✔️ You want a slick interface: One of the simplest cloud storage platforms to use, Nordlocker's drag-and-drop functionality makes this software extremely straightforward for novice or experienced users.

✔️ You like free storage: 3GB of storage is offered completely free of charge. And subscription plans are reasonable too.

❌ File recovery is important to you: There's no trash folder with NordLocker, so when files are deleted, they are gone for good.

❌ You need mobile access: Although there are now Android and iOS apps, these are somewhat misleading. In fact, these apps simply redirect users to a Safari-based browser portal. Users may find the lack of a dedicated mobile app disappointing.

NordLocker is a reliable feature-rich cloud storage platform that business owners will particularly enjoy.

Check out our in-depth NordLocker cloud storage review and see why its gaining rave reviews for its security and interface.

NordLocker is hard to beat for privacy in the cloud storage space: it comes from the people behind NordVPN, one of the best and most successful VPNs around.

We've reviewed more than 20 cloud storage platforms recently, and NordLocker is one of the easiest to use. The desktop apps enable uploading, downloading, and managing your files with little more than a drag and drop.

The mobile apps are a little more basic, just a browser that redirects to NordLocker's browser portal, but they're also easy to use.

The service scores well on the fundamentals. We found NordLocker's leading-edge encryption extremely quick, upload times were reasonable, and the addition of multi-factor authentication protects your account from attackers.

With its zero-knowledge encryption system, not even a NordLocker security worker can decrypt your stored files. But that shouldn't be a problem - such is NordLocker's confidence in its security protocols. In fact, the vendor even offered a $10,000 reward to any individual that could break into its encrypted locker.

Prices for the personal plans seem low at $2.99 a month (billed annually) for 500GB, $6.99 for 2TB, but beware: they leap to $4.99 and $14.99 on renewal.

As of late April 2024, Nordlocker is offering 53% off its 2TB plan when billed annually, coming to $6.99 a month, or 40% off 500GB billed annually for $2.99 a month.

A free plan gives you 3GB of storage to play with, but that's disappointing compared with the 5-10GB (or Google Drive's comparatively mammoth 15GB) allocated elsewhere.

Read our full NordLocker review.

Best for users in Microsoft's ecosystem

Specifications

Reasons to buy

Reasons to avoid

✔️ You're a big Windows user: Microsoft OneDrive offers close integration with Windows and Microsoft 365.

✔️ You value collaboration: That Microsoft 365 integration makes working on documents live, remotely, and with the help of its artificially intelligent (AI) Copilot tool a cinch.

✔️ Design is important to you: An excellent interface from the people that know a thing or two about what tech users like and what they don't.

❌ You're a macOS user: Although OneDrive does work with Apple's operating system, it's simply not as seamless.

❌ Free storage is important to you: Although the 5GB offered here for free isn't meagre by any means, it's beaten out by the flat rates offered by a good number of other cloud storage platforms.

Microsoft OneDrive is well-designed and is certainly worth a look if you're a big Windows user.

Check out our in-depth Microsoft OneDrive review to find out more about this popular cloud storage platform.

Microsoft OneDrive doesn't have the features of some of the cloud storage competition, but its Windows and Microsoft 365 integration, XBox support, and extreme ease of use, make this a great solution for anyone committed to the Microsoft world.

OneDrive comes built into Windows 10/ 11, for instance, so there's nothing to install. It shows up in Explorer, and you can drag and drop files to sync them to the cloud and your other devices.

Microsoft 365 support includes auto-saving to the cloud, and collaboration options include the ability to work on documents simultaneously with others, or share them via OneDrive-generated links.

Microsoft hasn't forgotten other platforms, but we found they delivered mixed results on the usability front. The web interface covers the basics, for instance, but doesn't have the simplicity or style of Google Drive or Dropbox.

The Mac client is more straightforward, though we found some conflicts with iCloud. The elegant and intuitive mobile apps are the real highlight, though, with strong photo and video syncing tools and solid security.

OneDrive's free plan offers only 5GB, half the allowance you'll get with some providers. You can pay $19.99 a year to upgrade, but that still only gets you 100GB. Microsoft 365 users get the best value, with Outlook, Word, Excel, and PowerPoint, and 1TB of OneDrive storage from $70 a year.

Read our full Microsoft OneDrive review.

Best budget option

Specifications

Reasons to buy

Reasons to avoid

✔️ You want a free online office suite: the likes of Google Docs and Sheets have become commonplace for firms that don't want to pay for Microsoft's proprietary software.

✔️ You want a large amount of free storage: Google Drive allows for 15GB of free storage - for some businesses, that may be enough.

✔️ You're looking for value per gigabyte - these, for our money, are some of the best price plans available for cloud storage right now. Given that Google is an absolute behemoth and able to sustain itself, this is unlikely to change.

❌ You don't want to be tied into Google's ecosystem: If you're more of a Windows or macOS user, this may not be the right cloud storage platform for you.

❌ You need top-level security: There's no end-to-end encryption offered with Google Drive, which may be a deal-breaker for some organizations.

Google Drive comes with a great pedigree and a name you can trust. Its generous free plan is another huge draw.

Check out our in-depth Google Drive review to find out more about the cloud storage offering from this tech giant.

Google Drive's Android and Google Workspace integration make it an ideal cloud storage platform for staunch Google users, but a generous 15GB free tier, and a host of desktop, mobile and Drive-supporting third-party apps, ensure it also has plenty of appeal for newcomers.

If you are thinking about subscribing to Google Workspace, you'll essentially gain access to all of Google's apps, including Drive and Gmail.

In terms of pricing, you can choose between 100GB or 2TB personal plans, which are priced at $2.49, $12.49, per user per month respectively, with up to 16% saved when billed annually. An 'AI Premium' plan offers 2TB of storage alongside access to Google's Gemini AI service, but it also costs $32.99.

Business Workspace plans are billed per user per month, require a one year commitment, and, in offering far more beyond cloud storage, cost anywhere between around $8 to $25. These provide up to 5TB of storage per user, and allow for large scale business meetings up to 1000 users, as well as in-domain live-streaming. It's comprehensive, but probably only worth it for large companies.

Enterprises are, in fact, encouraged to contact Google's sales team privately for trials and custom quotes.

Yet the service more than delivers on the cloud storage essentials, with versioning support, offline access, syncing, file sharing and more. Small team management is also on the cards, as you can share your allowance with up to five people.

Business users will love the Google Sheets, Docs and Slides integration, for instance, where you can create, edit and share cloud files with others, without ever downloading anything.

Whatever platform you choose, we found Google Drive to be intuitive and easy to use. The Android and iOS apps are a close match for the browser view, ensuring smooth operations even when you're regularly switching devices.

We've been a little disappointed by previous versions of the desktop apps, but the latest edition is just as easy to operate as Drive apps on other platforms.

Drive doesn't have end-to-end encryption, which means that, in theory, Google could see your files. And if you're not a Google fan, tying yourself so tightly into the company's ecosystem may not appeal. But for everyone else, it offers a slick and powerful free service, and plenty of benefits if you upgrade.

Read our full Google Drive review.

TechRadar's cloud storage rankings

There are hundreds of cloud storage platforms out there, and you've likely heard the names of many of the big hitters. Check out our rankings below of popular services and see some honorable mentions that can't currently compete with what's on offer with our top services.

| Provider | Summary |

|---|---|

| 1. IDrive | The overall |

| 2. pCloud | The best value |

| 3. Sync,com | The best out-of-the-box security |

| 4. Internxt | The best for security |

| 5. Backblaze | The best cloud storage for back ups |

| 6. Icedrive | The best cloud storage for Windows file management |

| 7. NordLocker | The best for security and ease of use |

| 8. Microsoft OneDrive | Best for Windows and Office users |

| 9. Google Drive | Best for Google Workspace |

| 10. Dropbox | Best for file-sharing |

| 11. Tresorit | Best for solid connection speeds |

| 12. Apple iCloud | Best for Apple fans |

| 14. Box | Best for admin tools |

| 15. Mega | Best free offerings |

| 16. TeraBox | Best for generous free storage |

| 17. G Cloud Unlimited | Best mobile app |

| 18. SugarSync | Best for unlimited device support |

| 19. Egnyte | Best for third-party integrations |

| 20. Degoo | Best for consumer focus |

| Cloud storage services | Free plan | Best plan | Storage capacity | Online editing and collaboration | Offline access | Device backup | File versioning | Platforms available |

|---|---|---|---|---|---|---|---|---|

| IDrive | 10GB | $3.98 for one year of 10TB storage | Up to 50TB | No | Yes | Yes | Yes | Web, Windows, Linux, iOS, Android |

| Internxt | 10GB | 2TB (90% off deals for personal and business users spotted as late as Black Friday 2023) | 20GB-20TB | Yes | Yes | Yes | Yes | Web, Windows, Mac, Linux, Android |

| pCloud | 10GB | $399 for 2TB for life | 500GB - 10 TB | Yes | Yes | Yes | Yes | Web, Windows |

| Sync.com | 5 - 27GB | Teams Unlimited ($15 per user a month), Solo Basic ($8 a month for one user) | 2TB-6TB for individuals, potentially unlimited for businesses | Yes | Yes | Yes | Yes | Web, Windows (64 and 32 bit), iOS, Android |

| Backblaze | 10GB | Free unlimited storage for a year with ExpressVPN | Potentially unlimited | Yes | Yes | Yes | Yes | Web, Windows, Mac, IOS, Android |

| Icedrive | 10GB | $15/month for 5TB | 150GB-10TB | Yes - local changes are synced | No | Yes | Yes | Web, Windows, Mac, Linux |

| Nordlocker | 3GB (personal plan), 2 week free trials for business plans | $19.99 for 2TB (Personal), $18.99 a month for 2TB (Business Plus) | 500-2TB - custom plans also available | No | No | Yes | Yes | Web, Windows, Mac, iOS, Android |

| Microsoft Onedrive | 5GB | A Microsoft 365 Personal subscription, 1TB for $70year | 100GB-6TB | Yes - with Microsoft Office files | Yes | Yes | Yes | Row 7 - Cell 8 |

| Google Drive | 15GB | 100GB for $15.99 a year for individuals and teams of up to 5 | 200GB-2TB, Unlimited Business Plans available | Yes | Yes | Yes | Yes | Web, Windows, Mac, IOS, Android |

FAQs

What is cloud storage?

Cloud storage is a remote virtual space, usually in a data center, which you can access to save or retrieve files.

It’s important to know a cloud storage service can be trusted with your files, so most providers go to a lot of trouble to make sure they’re safe. They’ll upload and download files via a secure encrypted connection, for instance. Maximum security data centers ensure no unauthorized person gets access to their servers, and even if someone did break in, leading-edge encryption prevents an attacker viewing your data.

There are dozens of services which are powered by some form of cloud storage. You might see them described as online backup, cloud backup, online drives, file hosting and more, but essentially they’re still cloud storage with custom apps or web consoles to add some extra features.

You won’t have to look far to find your nearest cloud storage service, though, because there’s a very good chance you have access to one already. Facebook and Twitter provide free cloud storage when they allow users to store photos and videos on their servers, for instance, while even the most basic free Google account gets you 15GB of cloud storage space via the Google Drive app.

Free vs Paid cloud storage: which is right for you?

If your backup budget is low (or non-existent) then opting for free cloud storage might appeal, but is it the right choice for you?

Capacities are often very low (NordLocker's free plan has just 3GB), which is likely to rule out free plans for any heavy-duty tasks. Some free options may have other limits, or leave out important features from the paid plans. IceDrive's 10GB plan looks generous, for instance, but you can only use 3GB bandwidth a day, and there's no client-side encryption.

These may not be deal-breaking issues, at least if your needs are simple, and you can do better with a little work. Signing up with one provider doesn't mean you can't use another, for instance: set up IDrive for one task, Google and OneDrive for a couple of others, and suddenly you've 30GB to play with.

Free plans aren't only useful for bargain hunters, though. However much you've got to spend, the real advantage of a free plan is it gives you time to try out different platforms before you commit.

Cloud storage jargon buster

Baffled by cloud storage babble? We've got all the key terms you need to know.

AES-256: one of the strongest encryption algorithms around, AES-256 is often used to protect cloud storage and ensure no-one else can access your data.

At-rest encryption: encrypts your data while stored on a device, protecting it from snoopers. See In-transit encryption.

Cloud: servers that are accessed over the internet, along with the software, databases, computing resources and services they offer.

Continuous data backup: a clever technology which automates backups by looking out for new and changed files, and uploading them as soon as they appear.

Data center: one or more physical facilities which house networked computers and the resources necessary to run, access and manage them: storage systems, routers, firewalls and more.

Egress: the transfer of data from a network to an external location, such as downloading a file from a cloud storage account. (See Ingress.)

End-to-end encryption: a method of communicating data which ensures no-one but the sender and receiver can read or modify it. In cloud storage terms, it means your files can't be intercepted and accessed by anyone, even your provider.

Ingress: the transfer of data into a network, such as uploading a file to a cloud storage account. (See Egress.)

In-transit encryption: encrypts your data before transmission to another computer, and decrypts it at the destination. Even if an attacker can intercept your communications, they won't be able to read your files. (See At-rest encryption.)

Private cloud: a cloud computing environment which offers services to a single business only. A business might use its own private cloud storage to ensure no other company gets to handle its data, for instance, improving security. (See Public cloud.)

Private encryption key: a method of encryption which means only you can access your encrypted files. This guarantees your security, but is also a little risky, because if you forget your password, the provider can't help you recover it, and your data is effectively lost.

Public cloud: a network of computers which offers cloud services to the public via the internet. Google and Microsoft are examples of public cloud providers. (See Private cloud.)

S3: A fast flexible cloud storage type invented by Amazon and used by major companies like Netflix, reddit, Ancestry and more.

Sync: the process of keeping a set of files up-to-date across two or more devices. Edit a file on one of your devices, for instance, and a cloud storage service which supports syncing will quickly upload the new version to all the others.

Two-factor authentication: a technology which requires you to enter an extra piece of information (beyond just a username and password) when logging into a web account: a pin sent by email or SMS, a fingerprint, a response to an authenticator app. It's an extra login hassle, but also makes it much more difficult for anyone to hack your account. Sometimes called 2FA or two-step authentication.

Versioning: the ability to keep multiple versions of a file in your cloud storage area. Accidentally delete something important in a document last Tuesday, and even if you've updated the file several times, you may still be able to recover the previous version.

Zero-knowledge encryption: a guarantee that no-one else, not even your cloud provider, has the password necessary to protect your data. That's great for security, but beware: if you forget your password, the provider can't remind you, and your files will be locked away forever.

How to choose the best cloud storage service

Finding your perfect cloud storage solution starts by thinking about your needs. What are you hoping the service will do?

If your goal is to protect all your data from harm, then look for a service with solid backup tools and the ability to access your files from anywhere.

If you'd like to share a group of files - photos, say - across multiple devices, then you'll need quick and easy syncing abilities.

If you're more interested in sharing individual files or folders with others, look for a platform that supports password-protected or time-limited links, anything that helps you stay more secure. Businesses will benefit from collaboration tools, too, allowing users to work on files together, add comments and more.

Pay attention to the figures. Most cloud storage keeps previous versions of your files for up to 30 days, for instance, but that's not always the case. If your provider says it supports 'versioning', that's good, but check the details, see how it really compares to the competition.

You'll want to consider a provider's cost and capacity, too, but be careful. Don't simply opt for a high-capacity plan just because it seeks better value: think about whether you really need that much space. And when it comes to price, browse the small print, look out for hidden charges or fees which jump on renewal, make sure you know exactly what you're getting.

Our experts have reviewed hundreds of cloud storage platforms and curated this list of the top services, but it's up to you to choose which one fits with your own needs and budget.

Given the number of cloud storage providers on the market today - from tech giants like Google to smaller, more niche players - choosing the solution that’s right for you isn’t easy. One of the first things you’ll probably want to consider is cost. While the capital expenditure for cloud storage is usually very low (or nonexistent), the operational expenditure can add up when you factor in additional storage requirements and premium features. Be sure to check your cloud contract carefully to ensure you don’t receive an unexpectedly large bill.

Credentials around service and security standards are also key. Look for a cloud storage provider that can boast the certifications that promise an SLA you can rely on - and safeguards that protect your data. In addition, make sure your storage provider offers the scalability you need should you grow - and a flexible pricing model to accompany it. Perhaps the best thing to do when choosing a cloud storage provider is simply to shop around. There’s bound to be a solution that suits your needs - but don’t simply go with the first cloud provider you find.

How we test

When we test a cloud storage provider, we look at the upload and download speeds of file transfers but this is a minor component of the overall rating as there are scores of other factors that affect your download or upload speeds that cannot be easily mitigated (contention rate, time of day, server load etc). We also check to see if the storage provider can recover deleted files, as well as if they keep multiple versions of files in case users need to undo changes

The other thing you’ll probably want to consider is cost. While the capital expenditure for cloud storage is usually very low (or non-existent), the operational expenditure can add up when you factor in additional storage requirements and premium features. Be sure to check your cloud contract carefully to ensure you don’t receive an unexpectedly large bill.

Credentials around services and security standards are also key. Look for a cloud storage provider that can boast the certifications that promise an SLA you can rely on - and safeguards that protect your data. In addition, make sure your storage provider offers the scalability you need should you grow - and a flexible pricing model to accompany it.

Last but certainly not least is the level of support that a cloud storage service will provide to its customers, whether it's 24x7 over the phone or web-based only. Our reviews include all this and more details including usability, and platform compatibility, and compare each cloud storage service to similar rivals, across key features and pricing, so you can make an informed decision based on as much data as possible when it comes to the time when you will choose the best cloud storage provider for you.

For more detailed coverage, read: Cloud storage reviews: how we tested them

Want to learn more about cloud storage?

To learn more about cloud storage, we have plenty of resources covering what it is and how we test it. We also have resources for free or lifetime deal offerings, unlimited cloud storage deals, and the best cloud document storage.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Désiré has been musing and writing about technology during a career spanning four decades. He dabbled in website builders and web hosting when DHTML and frames were in vogue and started narrating about the impact of technology on society just before the start of the Y2K hysteria at the turn of the last millennium.

- Barclay Ballard

- Luke HughesStaff Writer