Best business laptops of 2024

Combining professionalism and performance with the best business laptops

Quick list

1. Best overall

2. Best on a budget

3. Best MacBook

4. Best for creators

5. Best 2-in-1

6. Best rugged

7. Best Windows

8. Best modular

9. Best for travelers

The best business laptops are built around performance, productivity, and professionalism. We benchmarked the top models to see which is best for the office, home office, and which will survive the commute.

Reliable business laptops aren't like even the best laptops for the home. They're usually more powerful, constructed with durable materials, kitted out with extra audio-visual and security features that professionals demand. Like the best business computers, they may not all be sleek and beautifully designed, but performance typically far outweighs consumer models. Many, like the best Lenovo ThinkPad laptops we tested, even include comfortable, ergonomic keyboards for more fluid writing experiences.

But while the Lenovo ThinkPad, Dell Latitude, and Apple MacBook Pro ranges are popularly hailed as the best laptop computers for business, they're not the only options for professionals. Our team of experts put all the options on the table, comparing specs, checking performance and speed, and assessing overall portability to help you find the best laptop for working from home and those rugged enough for the commute and office.

The quick list

This is a remarkable laptop with impeccable build quality, an excellent keyboard, fantastic ports, security baked in, making it the obvious top pick.

Though cheap, this budget business laptop boasts a 14-hour battery life, an aluminum-magnesium alloy body, and a lightweight machine.

Though just a larger MacBook Air 13-inch, this model's brilliant bigger screen gives business users a lot more screen real estate to multitask in.

A unique laptop for creatives, this also boasts great ports, a powerful processor, and fantastic smart features on top of that extra half-display.

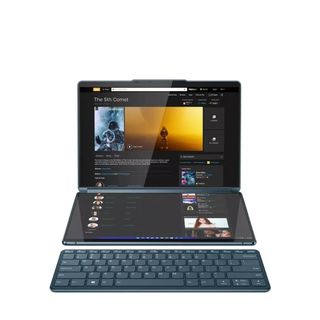

The best implementation of that dual-screen tech, the Lenovo Yoga Book 9i is ideal for multitaskers who need a lot more screen real estate.

This military-grade rugged model is the best laptop for business professionals who spend a lot of their time on the field, getting their hands dirty.

Load next products

Hitting that sweet spot between design, functionality, and features, this convertible delivers on performance and battery life as well.

A top modular business laptop that can be adapted to fit your needs. Using the AMD Ryzen 7040 Series processor, we found it offers oustanding processing power and efficiency for longer battery life.

The perfect business laptop may not exist, but we reckon the HP Dragonfly G4 comes closes. Performance is exceptional, the screen is stunning, and It easily thrived on a month-long tour of Europe.

What are the best business laptops in 2024?

Why you can trust TechRadar

Best business laptop overall

Specifications

Reasons to buy

Reasons to avoid

When it comes to the best rated work laptops, you can't go wrong with a ThinkPad. Any ThinkPad, really. They're sturdy laptops, built to last years, with the best keyboards you'll find on pretty much any laptop (despite Lenovo changing the design and shortening the key-travel in the bid for thinner designs). If you don't mind aging specs and your workloads are light, even older models still pack a punch.

For an excellent modern model, we love the Lenovo ThinkPad X1 Yoga Gen 8. It might not be much to look at - few great laptops for business are. We were impressed by its high-quality build and durability. This is the kind of laptop that will stick with you through thick and thin. And, beyond that durability, it’s quite versatile as well since it has that 2-in-1 form factor.

Even the basics are done well. The keyboard is comfortable and easy to type on, the trackpad is accurate and responsive, and it has all the ports a businessperson on-the-go could want. Plus, it comes with a stylus.

The 16:10 screen is a joy to work on and has more than enough power for everyday productivity making this an ideal laptop for business. Of course, it won’t work for niche purposes like photo or video editing as it doesn’t have that kind of power. And, it’s expensive, considering that it’s not high-powered or stuffed with a bunch of extra features. But, it’s perfect where it needs to be.

Read our full Lenovo ThinkPad X1 Yoga Gen 8 review

Best budget business laptop

Specifications

Reasons to buy

Reasons to avoid

There are a lot of compromises with the Acer Travelmate P4. When testing, we found that some parts, particularly the SSD, had some issues that could prove frustrating. And, it’s a mostly plastic affair inside that could affect its durability, though it at least keeps the weight down. Yet, for all its faults, this laptop is worth consideration for those that are on a budget.

To start, it’s much more affordable than a lot of the competition while offering enough power for most people to get through their work without issue. The battery life is also pretty good, providing enough juice to last through a whole work day and then some. And, the included Thunderbolt port gives some flexibility when using this portable with other peripherals such as an external monitor.

One of the biggest surprises for us with the Acer Travelmate P4 is the fact that it’s easy to upgrade. Since the parts aren’t soldered in, once you’re able to get inside, it’s quick work to put in a new SSD or RAM to really make the most of this laptop.

All these factors, especially the price, battery life, and upgradability, make this an ideal option for someone who needs a business notebook but has limited funds.

Read our full Acer Travelmate P4 review

Best MacBook for business

Specifications

Reasons to buy

Reasons to avoid

MacBook Pro laptops are great laptops for work, but if you want a lightweight, portable option, check out the MacBook Air. It is a bit of an anomaly when compared to the rest of Apple’s options. It’s bigger than the 13-inch version yet is essentially the same inside, starting with the same M2 chip, 8GB of RAM, and 256GB SSD. But, some people just want something a little less cramped than a 13-inch screen when getting through the workday and this laptop is for them.

Even though it doesn’t separate itself from its little brother performance-wise, we were still very impressed. After all, Apple has managed to squeeze some good performance out of those specs. On top of that, the larger 15.3-inch Liquid Retina display is gorgeous to look at, offering a crisp 2880 x 1864 resolution with wide P3 color coverage that makes it perfect for getting some photo editing done.

While this is a larger laptop, its slim design still makes this Apple laptop fairly portable, even if it’s not quite as easy to carry around as its little brother. And, since it sports those same internals, it comes with a fairly generous price tag, at least by Apple standards. So, if you want to stay in the Apple ecosystem for work and don’t want to spend the money on one of the Pro models, this 15-inch MacBook Air may be the ideal option for you.

Read our full Apple MacBook Air 15-inch (2023) review

Best business laptop for creators

Specifications

Reasons to buy

Reasons to avoid

The ASUS Zenbook Pro 14 Duo OLED is a step forward in the next generation of laptops thanks to its unique two-screen setup. Taking Apple’s controversial touch bar concept and adding a larger second screen right above the keyboard, this Asus laptop manages to make its unique setup indispensable for getting work done.

In fact, we were impressed by how versatile that second screen was. Not only is it angled for easy viewing, but it has touch capability so we were able to turn it into a gigantic touchpad when necessary. That would be just a gimmick if it weren’t for the quality of the main OLED display, which is HDR capable and has the kind of color coverage that photographers need when editing their photos.

Beyond the two displays, we found the Asus Zenbook Pro 14 Duo OLED to have more than enough power to get through most productivity and creative work, thanks to the robust GPU it came with.

Of course, the battery life is not the best considering this laptop is trying to power two screens. And, the trackpad is a little wonky with its strange placement off to the side. Outside of that, this is a stellar laptop with a premium feel and, of course, a unique setup that’s great for complicated workflows like those that creatives have to deal with.

Read our full ASUS Zenbook Pro 14 Duo OLED review

Best 2-in-1 laptop for business

Specifications

Reasons to buy

Reasons to avoid

The Lenovo Yoga Book 9i may just be the most elegant, most effectively designed dual-screen laptop we've ever tested. It boasts two displays, but it manages to pull that off while still maintaining that beautiful, thin and lightweight form factor that Lenovo is now known for.

It certainly makes that dual-screen format so incredibly seamless to use with several special functionalities, keyboard shortcuts, and very responsive touchscreen capabilities. Not to mention that it's an absolute game-changer when it comes to multitasking.

What's more, the Intel Core i7-1355U powering it is specifically designed for ultra-thin portables, allowing it to stay relatively cool despite not having a lot of breathing room and to last an entire work day. It has proven to be very capable during testing, running multiple apps and multiple browser tabs without experiencing any slowdowns. It's also shown during testing that it's capable enough to perform some light hi-res photo editing on Lightroom and Photoshop.

We also appreciate the comfortable keyboard and mouse that comes included in the box as they offer a great alternative if interfacing with a virtual keyboard and a virtual trackpad is taking a while to get used to. It's a little expensive, and there's only one configuration available at the time of writing, but it's more than a worthy investment, especially if you're the type who regularly multitasks like we do.

Read our full Lenovo Yoga Book 9i review

Best rugged business laptop

Specifications

Reasons to buy

Reasons to avoid

Business professionals who spend a lot of time out on the field need a more robust laptop that can handle such things as inclement weather, hard knocks and drops, and dirt and dust. And for such a need, we vote the Getac B360 Pro (2023), a solid portable (if you can call it that) that built to take the hardest knocks and the worst environments and can pretty much handle anything.

The B360 Pro is sold as military-grade and mission-ready, with an outer shell that can withstand being dropped six feet and temperatures from -29°C to +63°C (-20°F to 145°F). It also has MIL-STD-810H, MIL-STD-461G and IP66 certifications.

We can't claim that this is the perfect laptop. The port layout could have been better, and it needs a better Gen 4 NVMe drive installed. But it's a highly customisable platform that comes with two hot-swap replaceable batteries as standard and can charge up to eight batteries. It also has a wide selection of accessories to mount it to a vehicle or dock it in the office.

That's not to mention impressive performance and battery life that can keep up. Looking at the GTX 1650's speed in our 3DMark, GeekBench OpenCL and PCMark10 tests, the only machine we’ve seen recently that can beat the B360 Pro is the Dell Precision 5470 with its more powerful RTX A1000 discrete video.

Read our full Getac B360 Pro (2023) review

Best Windows laptop for business

Specifications

Reasons to buy

Reasons to avoid

The Dell Latitude line-up is vast - with corporate, enterprise, and education laptops padding out the market. They're more than powerful enough for a daily driver in the office, home, or on-the-go, and in our experience the keyboards are generally fine for long hours, even if they don't quite match the natural comfort of the ThinkPad keys.

The 2-in-1 Dell Latitude 9440 2-in-1 may be the best value laptop we've tested. It hits that sweet spot between design, functionality, and features - so much so it's nearly perfect in our book.

The features, of course, help justify that high price tag. There's the Haptic Collaboration touchpad, multi-connection network technology, and an expansive screen that gives users a lot more screen real estate.

What's remarkably impressive part of this laptop is that it can actively be connected to two networks at once and switch between them as needed for the best connection. And this feature has proven to be impressive during testing, especially for power business users who take vital calls and can't risk losing connection.

But once you take this out for a spin, you'll realize as well that its phenomenal performance helps. It certainly hit all our marks in what to expect from a professional business laptop on test, and we found its battery life just as impressive.

Read our full Dell Latitude 9440 2-in-1 review

Best modular business laptop

Specifications

Reasons to buy

Reasons to avoid

Framework offers a unique approach to Laptops where modularity is paramount, and the customer can easily specify what they want to see in external ports. What’s fascinating about this concept isn’t that the module ergonomics of the Laptop 13 aren’t amazingly complicated or revolutionary. Instead, modularity is also focused on the customer's needs, not merely as a means for making cheaper laptops.

The Ryzen 7040 Series is a sub-set of the Laptop 13 models that uses the latest Zen mobile processors, providing impressive processing power and efficiency for longer battery life. Framework offers three SKUs, or customers can go with a DIY option to define a laptop that is personal to them.

All the internal parts are also modular, not just the external ports, and that should make these machines easy to service and fix should they have a problem. The downside to this increased flexibility is that Framework only offers a single year of warranty, and the cost of these machines is slightly above what the exact specifications would cost in a machine that wasn’t modular.

But for those who want a beautifully engineered laptop where the ports can be easily changed as needed, there aren’t many other options available today.

Read our full Framework Laptop 13 7040 Series review

Best business laptop for travelers

Specifications

Reasons to buy

Reasons to avoid

“Brilliant - and not just for business” is how we described the HP Dragonfly G4 when we took this laptop out for a spin. The perfect laptop may not exist, but in our view, the mighty HP Dragonfly G4 sure comes pretty damn close.

This one's a bit of a rarity in the world of business laptops - it looks and feels neither business-y or bulky. We absolutely love the design and build, which is robust, lightweight, and seemingly tailored for travel or hybrid working. During our review, we travelled around Europe for a month with the Dragonfly G4. It not only survived – it thrived. And the battery easily held an all-day charge. During our tests, it hit an average 12 hours and 44 minutes. Not quite as long as a MacBook Pro, but great for everyday users.

Performance is equally impressive. Even opening an unhealthy number of tabs in Chrome, running multiple apps, and batch-editing images in Photoshop and Lightroom, slow-downs were non-existent. The screen is ideal for photo editing, as it happens. A stunning 13-inch 1280p display boasting 391 nits and 113.3% sRGB coverage, and an average Delta-E color accuracy of 0.14 (these numbers are based on our benchmark results). However, we were disappointed to see the weak 80.2% DCI-P3 coverage means it’s not the best for video editing.

It’s a minor niggle for a laptop chiefly designed for professionals on the go. Earning a TechRadar Recommends badge, this is an incredibly lightweight, portable, and robust laptop – making it the perfect travel companion.

Read our full HP Dragonfly G4 review

Best business laptops: FAQs

What are the best laptops for business?

It will depend on what sort of business tasks you're undertaking, but generally, the best Dell laptops, MacBook Pros, and Windows are ideal for all-round professional use. These laptops for business purpose are fast, robust, and reliable. The best HP laptops are great if you're working to a budget, and many at the lower end of the range are absolutely perfect for running Microsoft Office, Google Docs, and general web browsing.

What features should I look for in a business laptop?

We asked Zach Noskey, Director of Latitude Product Management at Dell Technologies, what he thought

There are many important features that differentiate a business laptop from a traditional consumer laptop. Specific capabilities to consider when purchasing a fleet of PCs will depend on the type of business and the role and responsibilities of employees, but below are a few broad areas to prioritize:

- Collaboration: With the growth of hybrid work, employees need the capabilities to collaborate and connect from anywhere. Business workers rely on best-in-class video and audio features for frequent conference calls. Look for a minimum FHD camera for quality picture, top firing speakers for improved sound, and Wi-Fi 6E and 5G for a variety of connectivity options.

- Design: Workers need mobile and flexible form factors for working on-the-go. Business laptops should ideally be lightweight and small, but also include a 16:10 aspect ratio display for an optimal front of screen experience. Plus, they should be made with durable and premium materials built to last.

- Performance: Performance is a given for maximum productivity. Choose business laptops equipped with the latest generation of processors available to run applications smoothly when multi-tasking and preserve battery life. CPU and GPU specifics, such as discrete graphics, will depend on the demands of a worker’s role. Finally, look for systems with a minimum of 16GB of dual-channel memory and at least 512GB of SSD drive space.

- Security and support: It’s not only about the end user experience. IT departments need enterprise-level hardware/firmware and software security features to prevent, detect and respond to threats wherever they occur. Plus, IT needs reliable service and support options for their fleet of PCs. Depending on the size of the business, companies might consider an all-in-one IT support option that handles all elements of hardware management, or choose a flexible offering that helps simplify deploying the latest PCs.

What are the key differences between the best business laptops and laptops for home?

We asked Eric Ackerson, Senior Product Marketing & Brand Manager, Acer America

There are significant design and hardware differences between consumer and business laptops. In most cases, business models are made with more durable materials and construction to withstand the rigors of travel and toting the laptop to and from the office. This means they’re typically built with more metal in the chassis as compared to plastic that’s often used in consumer models. Many are MIL-STD 810H-certified with spill-resistant keyboards and touchpads to protect internal components from liquids. Shock-resistant features and semi-ruggedized designs help protect them from short drops. Business laptops focus on durability, reliability, performance and life span, which often means a long battery life and the ability to upgrade the laptop over time. Consumer laptops have more focus on style and value for today’s computing needs.

Another key difference is in the software installed on the systems. Business laptops will come with Windows 11 Pro vs. Windows 11 Home. Windows 11 Pro has many features supporting business management and deployment, which aren’t necessary for consumer computers. These laptops will typically have other manageability features built-in to aid IT departments in diagnosing, updating systems remotely and deploying to their workforce. In contrast, consumer laptops are often loaded with entertainment-focused applications for social media, gaming and digital hobbies that business workers do not need and IT departments may see as security risks. Simplifying the software pre-load for large quantities of business laptops purchased in bulk eases setup, deployment and management of these laptops.

In addition, Windows 11 Pro provides extra security features through hardware-based security, such as TPM 2.0, virtualization-based security (VBM) and hypervisor protected code integrity (HVCI). Software-based security adds advanced encryption, robust network and system security and intelligent safeguards, which improve over time against ever-evolving threats. Laptops designed for business may also come with sensors that detect people based on range and movement. These laptops can lock the screen when the user steps away and also blur the screen to off-angle viewing to prevent someone seeing the screen’s content over a user’s shoulder.

Another factor differentiating business models is the warranty. Consumer laptops typically have a one-year warranty, while commercial warranties may last up to three years and cover on-site service from a technician and the provision of spare parts.

Finally, business laptops are more conservative in style and color in comparison to consumer versions, to keep a low profile and blend in commercial settings. Consumer models, particularly those designed for gaming, may come in bright colors and with multi-colored RGB keyboards.

In conclusion, there are significant differences between consumer and business laptops. While each type of laptop serves its purpose, it is important to consider needs and priorities before making a purchase. Whether you are looking for advanced security features or budget-friendly options, there is a laptop on the market to meet your needs.

How to choose the best business laptops

Finding the best laptop for you is all about deciding what you consider most important and focusing on those needs before considering other requirements. If you work in an office, battery life might not be critical, but it might be vital for those working away from a desk.

Laptop makers offer many devices, each aimed at a specific user and usage profile. Therefore it's essential to consider the role this system will play in the office and what it needs to support that. You should also check if your company has a preferred operating system - many like to use Windows, but some of the best MacBook Pro laptops are perfect for business use.

Here are some of the aspects that we consider the most important.

Performance

The performance available from a modern laptop can be awe-inspiring. Many more expensive models have potent processors, NVMe storage, and discrete GPUs.

Typically, cheap machines come with an Intel Celeron or Core i3 class processor, and they're only suitable for relatively light office tasks. Above them are devices that use the Intel Core i5 or AMD Ryzen 5, and these are the workhorses that can cope with most tasks by having lots of processing cores and multi-threaded processors. And on the top rung are the Intel Core-7 and Core-i9 mobile processors and the AMD Ryzen 7 class CPUs. These powerhouse systems can be used for very intensive tasks often allocated to desktop computers, and they can come with discrete GPU technology allowing them to play games and be used with the best 3D modeling software.

For integrated GPUs, the lesser machines have the old Intel UHD Graphics module, and in newer Intel chips, this has been supplanted by the Iris Xe GPU. Conversely, AMD systems have either the older Radeon Graphics or, the better Radeon 680M.

The discrete GPU options are usually based around either Nvidia RTX or AMD RX technology, with various performance tiers available. What's important to understand is that mobile GPUs aren't comparable to desktop equivalents. Therefore, don't expect an Nvidia RTX 3060 mobile GPU to perform like that same designation in a PCIe card for a desktop system.

Because of power limitations and heat generation, mobile GPUs tend to be cut down from the desktop regarding shaders, memory buses, and clock speeds.

Battery Life

The extent of battery life depends on several factors, not least the battery capacity and how efficiently the system uses the stored power.

While having a bigger battery is suitable for how long it will last without mains power, it tends to increase the machine's weight, and depending on the charger, it can take longer to recharge.

One of the downsides of more powerful processors is that they will consume more power, and the same is true for discrete GPUs over integrated, high-performance NVMe drives and exceptionally bright displays.

How this translates into the working life of batteries isn't easy to calculate. Still, the difference between a machine using power-saving mode with reduced screen brightness and another using performance settings with an intensive task can be substantial.

The better machines running standard office tasks or playing YouTube videos can last longer than ten hours, and the worst under four.

It is worth pointing out that the newest technology, i.e., Intel 13th Gen and AMD Ryzen 7000 processors, are much more power efficient than previous technologies. Older tech might be cheaper, but it won't last as long on battery, doing the same jobs as something with more modern silicon, as a rule.

Connectivity

Having plenty of port selection is critical if you're hooking up a lot of different devices, from the best business monitors to the best office keyboards. However, This aspect is essential for those considering any of the best Ultrabooks and 2-in-1 designs especially often have limited external ports.

The solution to the limited port selection is to use a docking station. The very best laptop docking stations provide both port extensions and simultaneously charge a business laptop - ideal when working on-the-go.

In our experience, Thunderbolt is best, but the laptop must have at least one of these versatile ports to connect both power and data over a single connection. Achieving similar functionality over USB 3.2 Gen 2 USB-C is possible, but the bandwidth is less. That reduction impacts the flexibility, as the number of peripherals it can handle and the number of downstream ports is less.

If you can afford a machine with a Thunderbolt port(s) and a Thunderbolt docking station, then whatever other ports are on that laptop are largely unimportant.

One point about docking stations: they are usually rated for the watts they can deliver to an attached laptop, i.e., 65W or 83W. Some of the larger mobile workstation designs can draw up to 100W or more, and while these will charge on a docking station that can deliver 65W, it will take longer to charge fully.

Network connections are often Wi-Fi, but some machines have an Ethernet adapter. However, if you have USB 3.2, a USB-to-Ethernet adapter is an inexpensive but valuable accessory.

As for Wi-Fi, some cheaper machines have Wi-Fi 5, but the better ones have Wi-Fi 6 or 6E. If you intend to connect over Wi-Fi, it might be helpful to know the Wi-Fi routers' technology and a specific system design to work best with them.

Survivability

It might seem an obvious thing to mention, but laptops get broken every day. They fail due to a manufacturing mistake, the owner being clumsy, unexpected vehicle accidents, and flood damage. The number of ways they can cease to be useful is a remarkably long list.

Cheaper machines tend to use an aluminum frame with plastic panels attached that aren't best suited to survive a drop or being doused with hot coffee, not least being outside in the rain. Higher-end machines tend to use more metal, making them intrinsically more likely to handle some abuse.

But, if you intend to work outdoors, in a wet or dusty environment, or have the skill of a lucky dip machine, then the best rugged laptops offer a robust and sturdy alternative. No machine is beyond being damaged by the creative things people do with them, but some are better suited to brush off accidents that would kill cheaper systems instantly.

How we test the best business laptops

We've tested hundreds of professional-use business laptops, like the best laptops for programming, the best laptops for engineering students, and the best laptops for photo editing.

Before we get to benchmarks and their ilk, when testing the best business laptops we usually go through a familiarisation protocol. This is where we’ll use the machine for a few days for general tasks to establish if it is all working as intended and highlight any potential issues that the designers overlooked.

During this phase, we’ve seen many problems, like hinges that cover up ports or trackpads unsuitable for adult-sized hands. Those issues are less common since many designs are derivatives of previous models with new motherboards rather than entirely new hardware.

After testing the trackpad and keyboard, we usually remove the back of the machine to see inside the case unless we know a sticker is denying us access to the inside. In that scenario, it is usually possible to get a manual that reveals what we’d see, and that is crucial for us to determine if the laptop can be user upgraded, stickers or not.

Many of the thinner Ultrabook and 2-in-1 models are now surface mounting memory, stopping that from being upgraded by the owner. But even those tend to have an M.2 slot for the NVMe drive that allows larger enterprises to be used. For those that have run the same system for many years, it might also be helpful to see what the spec of the battery pack is for that to be potentially replaced when it becomes worn out.

After we’ve done that investigation and put the machine back in one piece, we begin our testing protocol, where we go through a selection of benchmarks that test different aspects of the hardware. These benchmarks include many synthetic tests like 3DMark, PCMark10, GeekBench, CineBench23, CPU-Z, CrystalDiskMark 8.04, and other real-world tools.

These give a good oversight on single and multi-core processing, GPU performance, NVMe speed, and battery life.

The battery test is part of PCMark10 that requires the screen to be dimmed to 120 nits and the performance setting of the machine put into a power-saving mode (but with the screen always active). The screen brightness is confirmed with the DataColor calibrator, and the test runs until the battery from total hits 20% of its capacity. From this test, it is possible to provide a ballpark time for how long a laptop will last without mains power.

Exactly how it performs will depend on how it is used and how demanding those tasks are. Still, the calculated time should reveal if a fully working day on battery power is possible.

All this data is then cross-checked with that collected from other testing sessions to establish where the machine fits into our bigger picture, specifically against other hardware that uses the same processor platform or against a previous model in the same series.

You can learn more about our testing process in How we test laptops and desktops: our reviewing process explained.

Are you a pro? Subscribe to our newsletter

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Michelle Rae Uy is the former Computing Reviews and Buying Guides Editor at TechRadar. She's a Los Angeles-based tech, travel and lifestyle writer covering a wide range of topics, from computing to the latest in green commutes to the best hiking trails. She's an ambivert who enjoys communing with nature and traveling for months at a time just as much as watching movies and playing sim games at home. That also means that she has a lot more avenues to explore in terms of understanding how tech can improve the different aspects of our lives.

- Bryce HylandContributor

- Desire AthowManaging Editor, TechRadar Pro

- Collin Probst