The UK is reclaiming its video game identity, but we need to do more

One year of tax relief takes effect

It's been exactly a year since the Government began allowing UK video game companies to start claiming tax relief.

Under the scheme, companies are allowed to claim back up to 25% of a game's production costs so long as they meet certain "culture test" criteria.

Canada and France have offered tax relief for several years, encouraging video game makers such as Ubisoft to set up studios where there's financial incentive.

The good news is that tax breaks are having a largely positive effect on the UK already. In the last year, the number of full time creative staff employed in studios across the UK has risen to a record high of just below 11,000 with the number of studios now sitting at 664.

"The whole thing is encouraging and the anecdotal evidence is showing a lot of studios are finding the whole thing is beneficial," Richard Wilson, CEO of UK game industry representative TIGA told techradar. "Recruitment companies in the UK are not witnessing a loss of development staff in the last 12 months in the way they were previously".

'Steady, sensible growth'

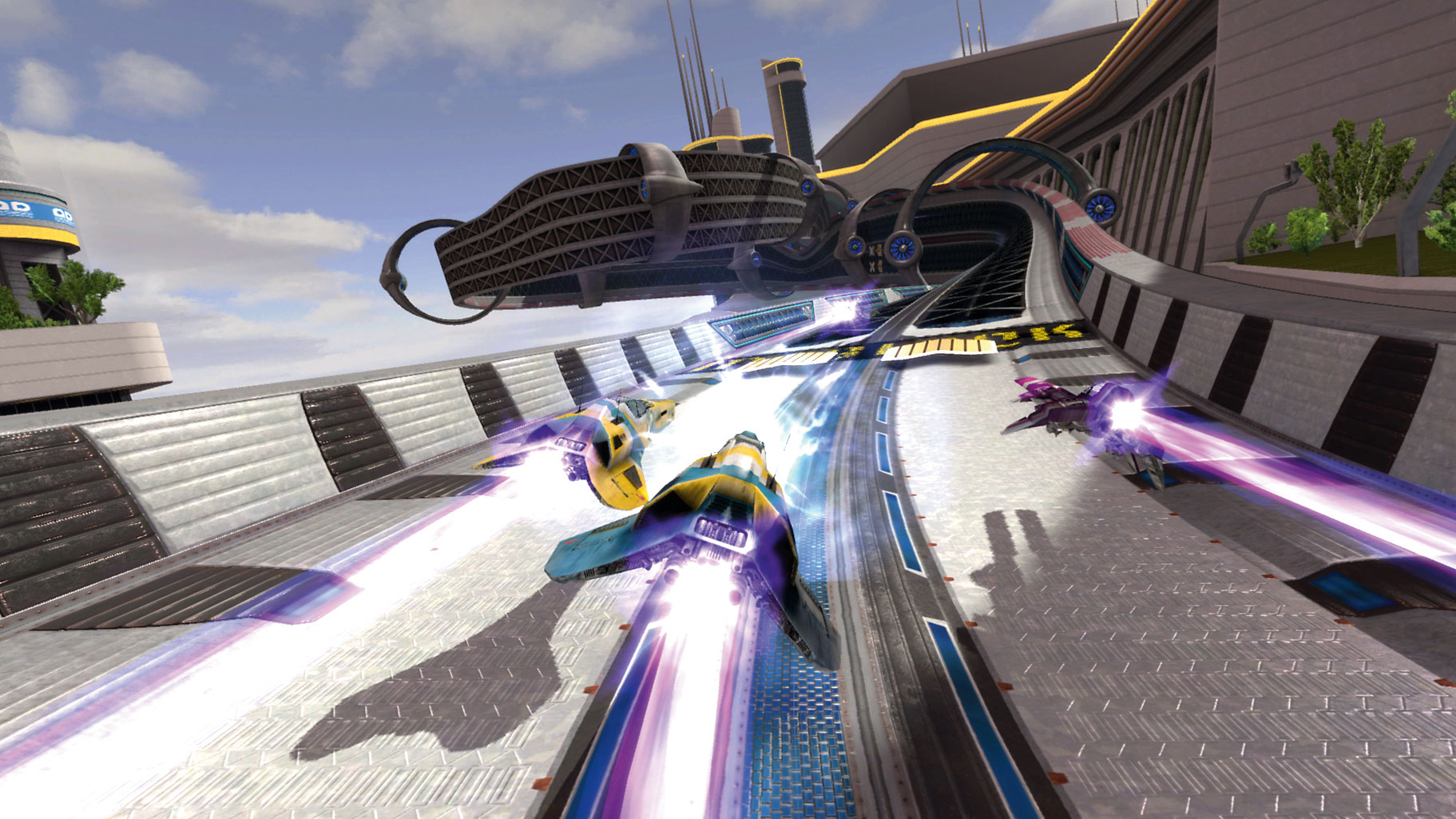

The UK has been responsible for birthing some of gaming's biggest franchises - Burnout, Grand Theft Auto, Tomb Raider, LittleBigPlanet - but its importance in this exponentially-growing medium has arguably been eroded over recent years.

"The trajectory was a slow decline of our industry but now I think we have an increase," said Jason Kingsley, TIGA Chairman and founder of gaming studio Rebellion. "I think the decline has been stopped in its tracks and we'll see a steady, sensible growth. We haven't had a million studios set up, that would be too much like a bubble. Sustainable growth is what we want."

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Gaming might not yet create the sorts of celebrity names that Hollywood does, but Richard Wilson says that the introduction of tax relief proves that the higher-ups are paying more attention to this thriving industry.

TIGA also lobbied for there to be no minimum spend threshold, ensuring that developers of low budget games can qualify for the relief. In France, there is a 150,000 Euro minimum spend demand. "We could have pushed for a threshold quite easily, but we pushed for some of the smaller studios… we managed to ensure the smaller business can benefit from it" said Wilson.

But there is still plenty of work to be done. In Quebec, for example, developers can get a 30% tax break for games produced in French (English-speaking games only get 24% following a cut last year).

"We still have a challenge, the battle is not won yet," said Kingsley. "I have again heard that other jurisdictions are looking very seriously in introducing it outside the EU. They've seen the success of Canada - and the UK [population] is much bigger than Canada."

"I think our tax breaks are not as generous still," he added, "but they are still meaningfully generous without distorting the market. As somebody believes in most aspects of the free market, I think it's important these breaks don't distort the market."

Hugh Langley is the ex-News Editor of TechRadar. He had written for many magazines and websites including Business Insider, The Telegraph, IGN, Gizmodo, Entrepreneur Magazine, WIRED (UK), TrustedReviews, Business Insider Australia, Business Insider India, Business Insider Singapore, Wareable, The Ambient and more.

Hugh is now a correspondent at Business Insider covering Google and Alphabet, and has the unfortunate distinction of accidentally linking the TechRadar homepage to a rival publication.