Why Canon, Sony and Fujifilm are driving the cameras recovery – for now

New data suggests all three have a bigger share of the camera pie

Camera sales have started to recover from their pandemic-induced slump in 2020 – and new global market share data suggests that Canon, Sony and Fujifilm have been the driving photographic forces.

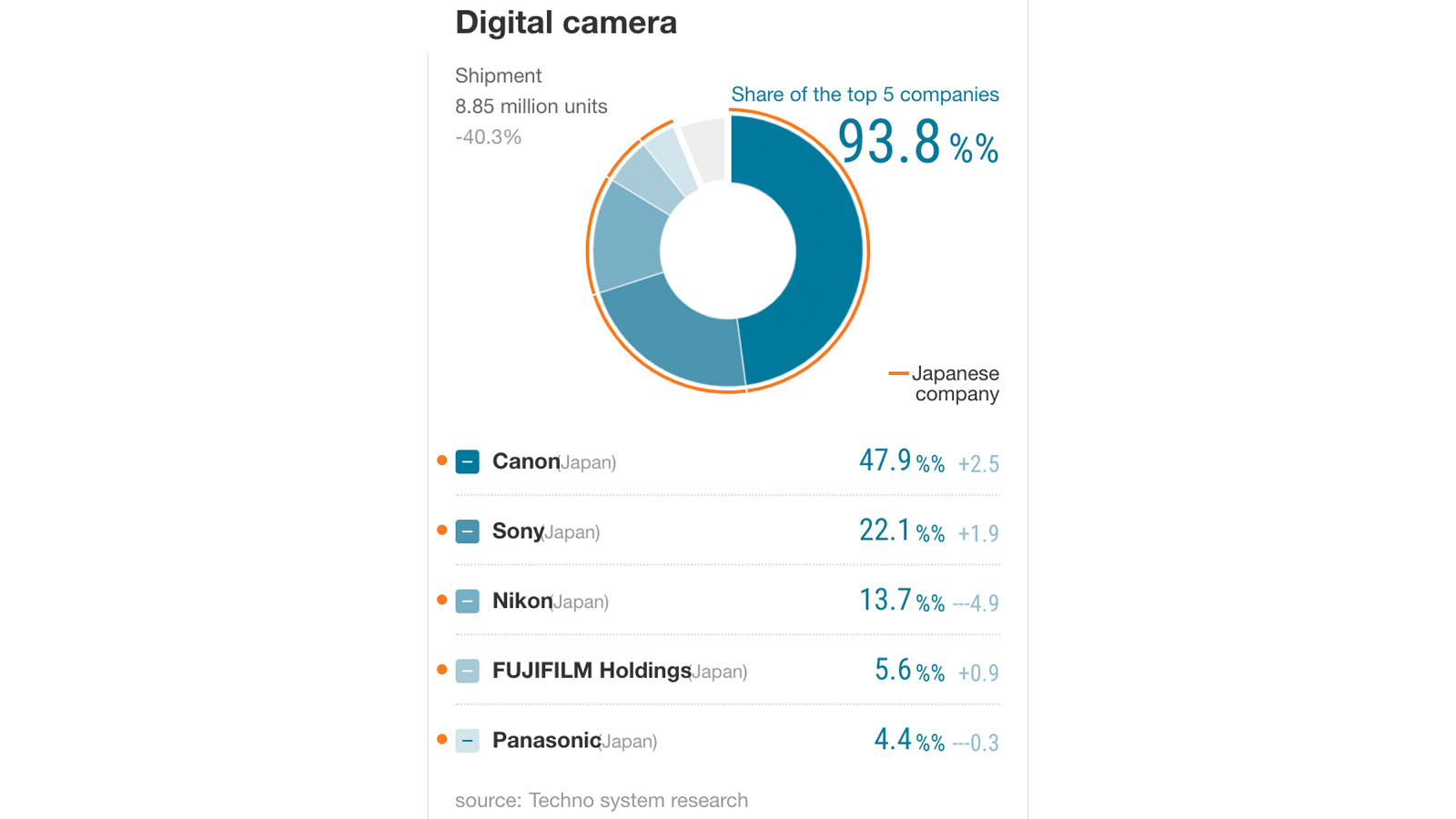

Some new stats from Japanese business publication Nikkei have revealed the global market share for digital cameras for 2020, and it makes interesting reading for photographers and camera fans.

Canon still leads the way by some margin with a 47.9% share of the global camera pie (up by 2.5% from 2019), while Sony has continued to pull away from Nikon in second place with a 22.1% share (a rise of 1.9% from the previous year).

- These are the best mirrorless cameras you can buy right now

- Or check out our guide to the best video cameras

- Should I buy a DSLR in 2021?

Only one other camera brand, Fujifilm, saw their market share rise in 2020 – the maker of X-series and GFX series cameras rose to 5.6% of global camera shipments, up by 0.9% from 2019.

By contrast, Nikon – which for so long sat in second place behind Canon and remained there until 2018 – saw its market share drop by 4.9% down to 13.7%. And Panasonic, which last year mainly focused on its full-frame S series, also saw a slight dip of 0.3% down to 4.4% of worldwide camera shipments.

All of the data is for 2020, a year when camera sales shrank by as much as 40% according to Japanese retailer BCN+R. But some more recent stats from CIPA (the Camera & Imaging Products Association) suggests that cameras have bounced back this year.

In June 2021, the shipment of digital stills cameras rose by 148.1% compared to June 2020, while shipments went up by 132.3% over the year. Of course, that's mostly a case of camera manufacturers recovering from a torrid 2020 rather than a long-term spike in demand, but it's an encouraging boost considering manufacturing issues have by no means been solved.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

We don't yet know what the market shares will look like for 2021, but last year's data follows a trend that's seen Canon and Sony emerge as the new 'big two' of the camera food chain – and recent camera launches give us a sense of how this might play out over 2021.

Launch pads

Why exactly have Canon and Sony pulled ahead of their rivals, with Fujifilm also grabbing a slightly larger slice of the camera pie? While the emergence of a new 'big two' is a long-term camera trend, some of it comes down to the vagaries of release schedules, too.

Canon and Sony both had massive years for big launches in 2020. Canon, in particular, updated most of its entire range – alongside the headline launch of the Canon EOS R5 and Canon EOS R6 (with some stellar RF lenses), we saw the arrival of two new DSLRs (the Canon EOS Rebel T8i / EOS 850D and pro-focused Canon EOS 1D X Mark III), the (albeit slightly disappointing) Canon EOS M50 Mark II for hobbyists, and even oddities like the Canon PowerShot Zoom.

Sony, meanwhile, went all-in on video-focused cameras. Last year, we witnessed the arrival of the best vlogging camera you can buy, the Sony ZV-1 (above), along with the world's best video camera in the Sony A7S III and its smaller Sony A7C sibling. Fujifilm's boost is also partially down to its busy 2020 for new cameras: it trotted out the Fujifilm X-T200, Fujifilm X-T4 (which still sits top of our best cameras guide), compact Fujifilm X100V and the impressive Fujifilm X-S10 for hobbyists.

These trends have not all continued in 2021. The photographic elephant in the room is Nikon – despite being one of the most recognisable bywords for cameras, its global market share dropped by 4.9% to 13.7% in 2020. But the signs are looking more promising this year – last week Nikon released its financial results for the first quarter of 2021, which revealed that its revenue from mirrorless camera revenues nearly doubled compared to 2020 amid a major recovery in digital camera sales overall.

Naturally, factors like exchange rates and accounting nuances can cloud the picture when it comes to financial results, but it seems reasonable to expect that Nikon will recover some of the ground it lost in 2020 – and that's backed up by interesting new launches like the Nikon Zfc.

Losing focus

What isn't yet clear, though, is how big the overall camera pie is going to be by the end of 2021 – and there are big concerns for the future. In a recent Q+A for investors, Canon said that "although the EOS R5 / R6 is doing well, we do not expect the camera market to recover significantly".

Worryingly, it added that although the global chip shortage has had an impact this year, saying "we do not anticipate that the number of cameras sold will increase steadily in the future, and we will focus on maintaining the current market share and market size".

In the short-term, then, camera fans could see a spike in new launches of mirrorless cameras like the Nikon Zfc, as the five big manufacturers battle it out for their slice of the camera pie. But there's no doubt that the best camera phones are shrinking the size of that market – and the photographic buffet could ultimately have less choice, if today's post-pandemic trends continue.

Mark is TechRadar's Senior news editor. Having worked in tech journalism for a ludicrous 17 years, Mark is now attempting to break the world record for the number of camera bags hoarded by one person. He was previously Cameras Editor at both TechRadar and Trusted Reviews, Acting editor on Stuff.tv, as well as Features editor and Reviews editor on Stuff magazine. As a freelancer, he's contributed to titles including The Sunday Times, FourFourTwo and Arena. And in a former life, he also won The Daily Telegraph's Young Sportswriter of the Year. But that was before he discovered the strange joys of getting up at 4am for a photo shoot in London's Square Mile.