Apple self-driving car: everything you need to know

Apple's driverless car plans emerge from the shadows

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

What does the market say?

But the opposition believed that Apple would need to assemble a team of this size only in order to set the wheels in motion for much larger, battery-operated projects, such as an all-electric vehicle, for example.

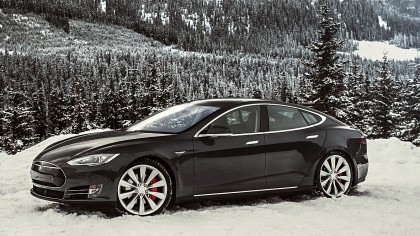

We approached Tesla when our Apple Car article was first published in 2015 about the potential poaching of staff, but were met with a brick wall. "As it's not a Tesla-specific article, I will struggle to get buy-in from the US on this occasion," said a UK-based Tesla spokesperson.

"I'm afraid that we don't offer comment on wider industry topics. Our spokespeople would only be able to talk about Tesla product specifically," they added.

Money in the bank

The overarching argument in favor of Apple completely tearing up the automotive rulebook generally related to money.

In 2015, the Cupertino corporation was estimated to have a total market capitalization of $750 billion, which is more than Daimler, Volkswagen, Renault, Peugeot, Fiat Chrysler, Ford and General Motors put together.

Paul Horrell, an automotive writer for Top Gear Magazine, estimated that launching a mass-market car from scratch would cost around $25 billion, which is chump change for Apple.

But this is before you consider the extensive dealership and support network required to sell vehicles and keep them on the road.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

"If Apple really wanted to, it could buy out most of the automotive manufacturers currently in existence," argued Mike Ramsey of the Wall Street Journal during a recent chat.

"Apple doesn't build iPhones, it doesn't build iPads. The company has always approached things from a design and engineering angle, and the same could be true if it produced cars.

"I would speculate that Apple would simply pay another manufacturer to build the car that they have designed."

The industry reacts

Although tech heads across the globe would love to see an Apple Car cruising the streets, most within the automotive industry feel it just won't happen. There are simply too many barriers and hurdles the company would face if it wished to succeed.

Apple has zero experience in building and marketing cars, for a start, and no matter how many employees it pinches from rival companies; nothing can better years of hard graft invested in an industry.

"I'd certainly be worried about any new competitor coming into the market, but where Apple is concerned I would have to ask whether they could get the scale to make it profitable," says Phil Crossman, managing director for Honda UK.

"Tesla build a small amount of cars but get a disproportionate amount of PR from them. Apple most certainly would do the same and I think it might be great for California, but would the rest of America get into it? Would Europe buy into it? I don't know?" he adds.

Let's look at Tesla; the company only recently hit its stride with when it comes to manufacturing electric vehicles that meet consumer demand. Furthermore, electric cars are yet to replace the internal combustion engine as a global choice of transport.

Even Honda, a company that has built a reputation on innovation, has moved away from the all-electric car, instead favoring hydrogen as a more sustainable source of energy.

BMW, Nissan and Renault offer pure electric vehicles, but those companies are recouped the losses that come with blazing a trail thanks to an extensive and popular line-up of top-selling petrol and diesel cars.

Just look at sales of the Renault Zoe or the Nissan Leaf, impressive for a completely new technology but nowhere near enough to start winding down production of its gas-powered motors.

But the automotive industry must innovate to survive, and even a relatively old-school automotive manufacturer such as Mercedes-Benz is dabbling with new ideas.

However, even Mercedes head honcho Dieter Zetsche didn't see Apple as a threat in the automotive industry. He told journalists from Australia's Motoring.com.au at a product launch event: "If there were a rumor that Mercedes or Daimler planned to start building smartphones then they (Apple) would not be sleepless at night. And the same applies to me.

"And this is full of respect for Apple."

Zetsche also reiterated a question posed by many industry insiders, as to why Apple would consider entering a market in which they weren't top dog – a market where the profit margins are not as favorable as those in the consumer tech industry.

"Why (Apple) with this kind of margin would now go into this business? I think investors will hate it because they don't like conglomerates, they want focused management on what they understand.

"Perhaps some neighbouring fields, but not somewhere different. The fact you can listen to iTunes in a car doesn't make it in itself consistent.

"I don't know their strategy and I do not know what they are doing, but I would be very surprised if that proved to be right," he added.

Phil Crossman, managing director for Honda UK, echoed the thoughts of most within the industry, telling us: "The smart thing for Apple to do would be to work alongside manufacturers and concentrate on what they are good at, infotainment. We are good at making cars and they are good at consumer electronics. It's as simple as that"

Michelle was previously a news editor at TechRadar, leading consumer tech news and reviews. Michelle is now a Content Strategist at Facebook. A versatile, highly effective content writer and skilled editor with a keen eye for detail, Michelle is a collaborative problem solver and covered everything from smartwatches and microprocessors to VR and self-driving cars.