Smartphone markets grew globally in 2021 - the first since 2017

On the back of record iPhone shipments

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

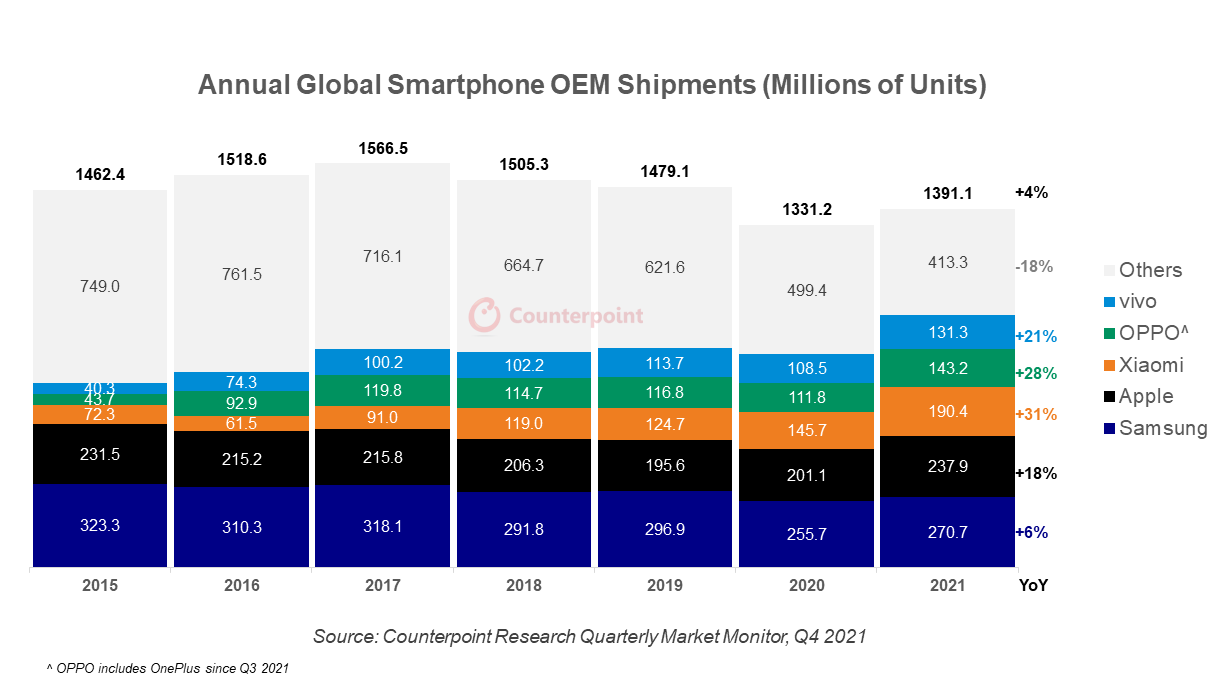

The overall global smartphone market grew for the first time since 2017 with annual shipments touching 1.39 billion units in 2021, spurred on by the highest ever growth from Apple's flagship iPhone 12 series.

Sharing the information via a press release, Counterpoint Research's Market Monitor said in spite of the annual 4% growth in the market size of smartphones, the annual shipments continued to languish at pre-pandemic levels due to the combined impact of Covid-19 as the resultant component shortages.

Senior Analyst Harmeet Singh Walia at Counterpoint Research said the latest spurt was fuelled by the pent-up demand in North America, Latin America and India that came after a slump in 2020. Growth in the U.S. was driven by the iPhone 12 series from Q1 through Q4 via Black Friday and holiday season promotions.

India saw higher replacement rates combined with better availability and attracting financing options in both the mid-range and premium handsets. However, things did not pan out well in neighboring China as supply-side constraints over components and longer replacement cycles put paid to overall sales.

Singh Walia said, “the market recovery could have been even better if not for the component shortages that impacted much of the second half of 2021. The major brands navigated the component shortages comparatively better and hence managed to grow by gaining share from long-tail brands.”

How the brands performed in 2021

- Samsung shipped 271 million units in 2021, up 6% from 2020, mainly due to increased demand for its mid-tier A and M series smartphones. While shipments grew YoY to reach 67 million in the last quarter, the growth was limited by intensifying competition from Apple and Chinese brands in India and Latin America.

- Apple’s global smartphone shipments grew 18% YoY to reach a record 237.9 million units in 2021 due to the iPhone 12 series. It registered robust growth in markets such as US, China, Europe and India. In China, it overtook Samsung in Q4 of 2021.

- Xiaomi’s global smartphone shipments grew 31% YoY to 190 million units, the bulk of which came in the first half. It was driven by regions such as India, China, South-East Asia and Europe.

- OPPO was another of the top smartphone players to achieve record 2021 shipments, growing by 28% YoY to 143.2 million units. Its performance in China remained strong in the first half of the year, while it grew in Europe, the Middle East and Africa and South-East Asia in the second half.

- Vivo grew by 21% YoY to reach annual shipments of 131.3 million units in 2021. In Q4, it declined by 9% YoY, losing its top spot in the Chinese smartphone market to Apple.

Motorola and Realme make a case

Among other brands, Motorola emerged as the fastest-growing brand among the top 10 OEMs. It benefitted from LG's exit from the US and via some timely launches in countries such as India, especially in the mid-tier and the affordable segments.

Realme got into the top-five Android handsets for the first time, banking on their affordable 5G handset strategy. The company did well in India with record sales and were even nominated most trusted brand among Chinese handset manufacturers.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

India’s smartphone market registered highest shipments ever during the past 12 months, crossing 169 million units in 2021. It registered a 11% year on year growth that indicated a higher level of resilience while facing the second pandemic wave that triggered supply-side disruptions and price hikes.

- Check out our list of phone launches in India

Want to know about the latest happenings in tech? Follow TechRadar India on Twitter, Facebook and Instagram

A media veteran who turned a gadget lover fairly recently. An early adopter of Apple products, Raj has an insatiable curiosity for facts and figures which he puts to use in research. He engages in active sport and retreats to his farm during his spare time.