Computing

Welcome to TechRadar’s computing channel. Here, you’ll find all the latest news, reviews, guides and more for anything computer related. We’re not just talking about laptops and PCs (although we have loads of content on them), but also MacBooks, Chromebooks, peripherals (such as mice and keyboards) and the software they run.

The computing landscape is constantly and rapidly changing, which can be both exciting and baffling. An increasing number of us are either working from home or embracing hybrid ways of working, which means picking the best laptop for your needs is essential. Meanwhile, the rise of Artificial Intelligence (AI) chatbots, such as ChatGPT and Google Bard, has given us a tantalizing glimpse of what the future of tech holds.

There’s never been a more exciting time in computing, so let us help you make sense of it all.

Explore Computing

Latest about Computing

NYT Wordle today — answer and my hints for game #1677, Wednesday, January 21

By Marc McLaren last updated

Looking for Wordle hints? I can help. Plus get the answers to Wordle today and yesterday.

Past Wordle answers – every solution so far, alphabetical and by date

By Marc McLaren last updated

Knowing past Wordle answers can help with today's game. Here's the full list so far.

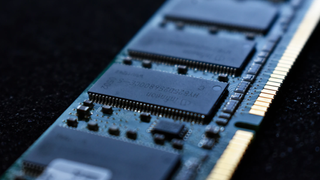

RAM price hike crisis could get even worse as US threatens 100% tariffs

By Darren Allan published

Consumers in the US now face an additional danger in terms of factors that could seriously hike the price of laptops and PCs.

Quordle hints and answers for Wednesday, January 21 (game #1458)

By Johnny Dee published

Looking for Quordle clues? We can help. Plus get the answers to Quordle today and past solutions.

NYT Strands hints and answers for Wednesday, January 21 (game #689)

By Johnny Dee published

Looking for NYT Strands answers and hints? Here's all you need to know to solve today's game, including the spangram.

Is your AI chat history public? These 198 iOS apps just leaked user data

By Alex Blake published

Apps with over 20 million users have exposed 380 million private chat messages into the wild, research shows.

The best laptop deals in January 2026

By James Pickard last updated

I've searched around and gathered all the best laptop deals in one place to suit a range of budgets and needs.

Nvidia N1X chip could arrive in laptops soon with a powerful integrated GPU

By Darren Allan published

Nvidia's N1X chip could debut in laptops within the next couple of months, with next-gen N2 CPUs rumored to follow later in 2027.

Sign up for breaking news, reviews, opinion, top tech deals, and more.