Can telematics make your car insurance cheaper?

Black boxes in cars promise to reward safe drivers with cheaper insurance

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

Ever feel as though you're paying over the odds for your car insurance because of your age, job title, or because everyone else drives like an idiot while you're a model driver?

Telematics could help lower your premium. This in-car tech uses GPS and a mobile data connection to monitor your driving style – speeds at which you drive, time of day you make your journeys, and so on – and then feeds this data back to your insurance company. Your insurer can then use this information to adjust your premium according to the way you drive.

If you don't drive at peak times, or you're a safe driver in what an insurance company perceives to be a high risk occupation, a telematics-based policy could save you some money.

When you take out a telematics-based policy, your insurance company will fit a 'black box' to your car and then you're good to go. Another advantage of the system is that because the box tracks your location, it'll help the police locate your car if it gets stolen.

There are a number of companies offering telematics policies in the UK, including AA Drivesafe, Autosafe, Bell from Admiral, Coverbox and Insure the Box. Some policies are based on the number of miles you drive, with bonus miles awarded for safe driving, while others reduce your premium if you drive safely, and at safer times of the day. Most also offer an online dashboard where you can monitor your performance.

But can telematics make your car insurance cheaper? After all, the last thing you want to do is sign up for a telematics-based policy only to discover that your spirited dash up the motorway has tripled your premium.

Trying telematics

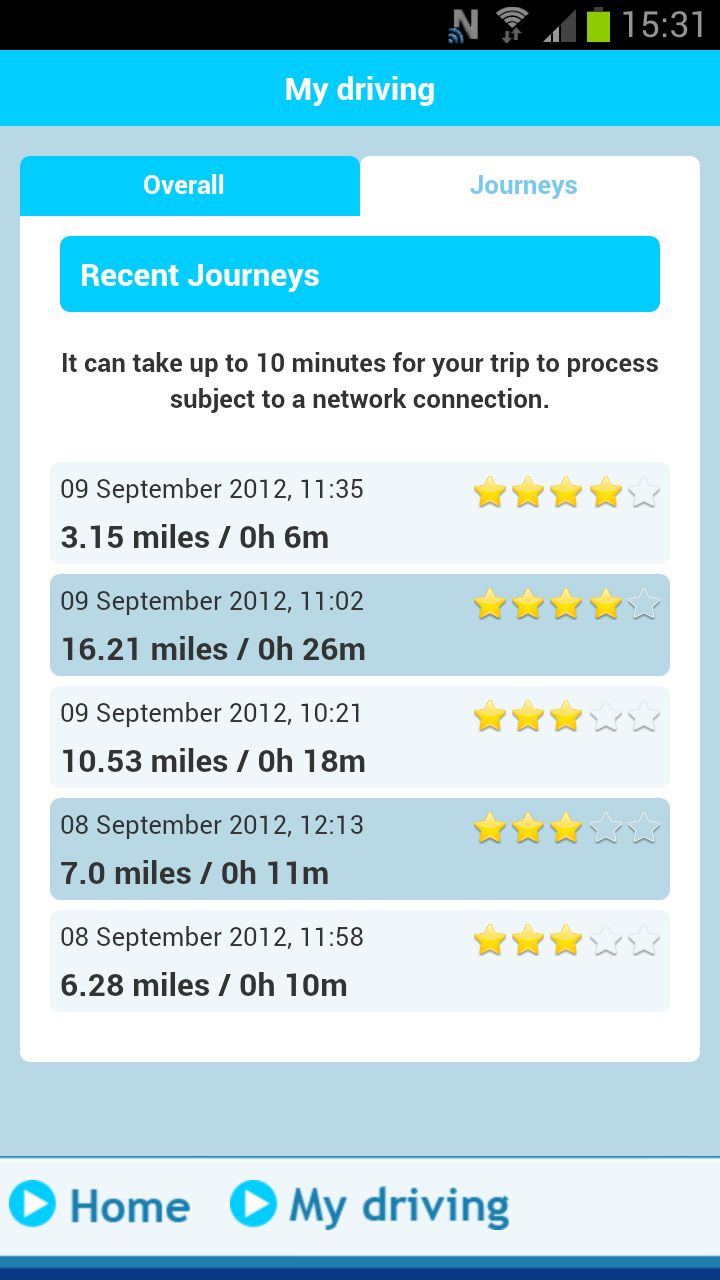

To give you a taste of the technology Confused.com recently launched Motormate, a free app for Android and iPhone. Once downloaded, simply run the app each time you drive your car and you'll be given a rating out of five for each journey you make.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

TechRadar lived with Motormate for a couple of weeks to try to gauge how a telematics box might affect our insurance policy.

Once installed, the app is simple to use – make sure GPS is switched on, put the phone in a cradle on your dash or windscreen and launch the app. Then press the big green button before you start your engine and press the red button to stop the app once your journey has ended.

At the end of each journey, you'll be given a score out of five. The scoring system certainly motivated us to try to improve the rating, but without detailed feedback after each journey it's hard to know where you need to improve.

It's also worth noting that the scores that are returned after each journey can change the following day, presumably once the data has been uploaded to Confused.com and analysed, so we were relieved to see that one journey that was scored with a rather shocking two stars did creep up to a slightly more respectable three stars the next time we checked.

Final scores

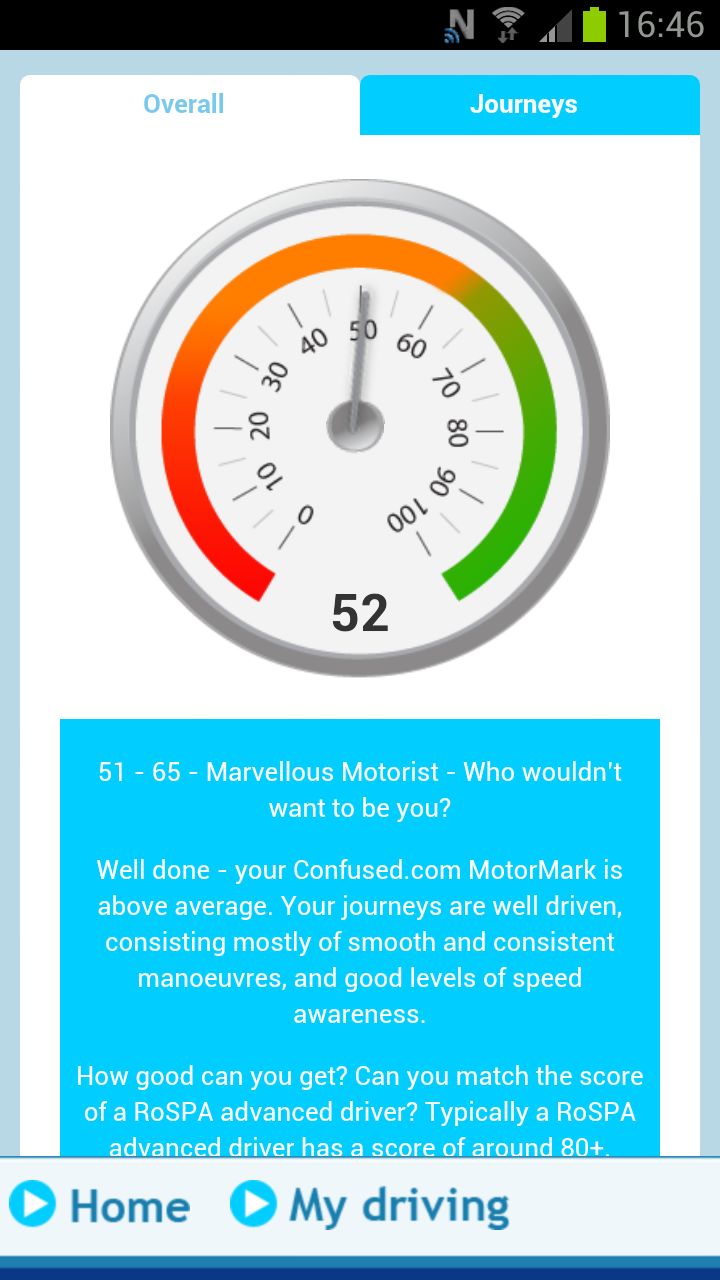

Motormate also promises that after 250 miles you'll get a more detailed report, so with the lack of per-journey feedback beyond the five-star system, we were hoping for more guidance on where we could improve to be revealed in this report.

Unfortunately, the final report didn't provide that information but it did at least give us the final score of 52 – which, apparently, is above average, meaning that we might benefit from a telematics-based insurance policy.

A RoSPA advanced driver typically has a score of 80+, the app pointed out, lest we feel too smug about our slightly above average status.

After watching War Games and Tron more times that is healthy, Paul (Twitter, Google+) took his first steps online via a BBC Micro and acoustic coupler back in 1985, and has been finding excuses to spend the day online ever since. This includes roles editing .net magazine, launching the Official Windows Magazine, and now as Global EiC of TechRadar.