Tech

Latest about Tech

Love your pool but hate cleaning it? The Dreame Z1 Pro robotic pool cleaner is here to change your life

By Jim McCauley published

Sponsored by Dreame

This little robot takes the drudgery out of owning a pool, and right now you can buy it with $400 off MSRP

Best Buy doesn't want the Memorial Day sales to end – here are the 28 top deals still available now

By James Pickard published

Even though the Best Buy Memorial Day sale is over, there are dozens of excellent tech deals at the retailer right now – here are my 28 top picks.

5 best tech reviews of the week: a phenomenal update to one of Dell’s popular laptops, and a Dyson hair dryer to blow you away

By Lewis Maddison published

Reviews Recap: a fantastic new laptop from Dell, and a brilliant new Canon camera for vloggers

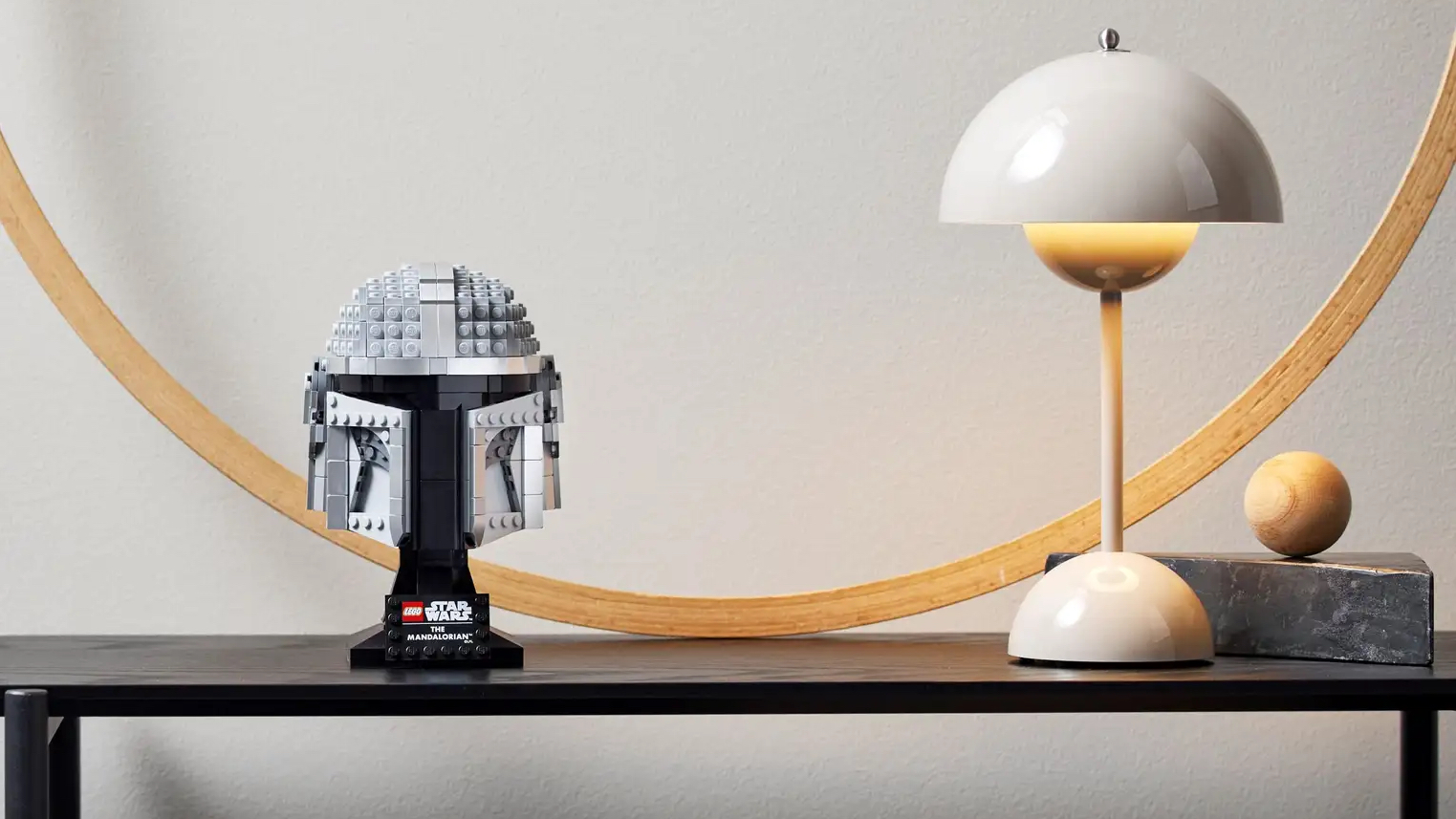

Memorial Day Lego deals start as low as $6 at Amazon – here are my 19 favorite sets, including Star Wars, Technic, and Botanical

By Jacob Krol published

Ahead of Memorial Day 2025, you can score epic Lego sets for as low as $6 on Amazon.

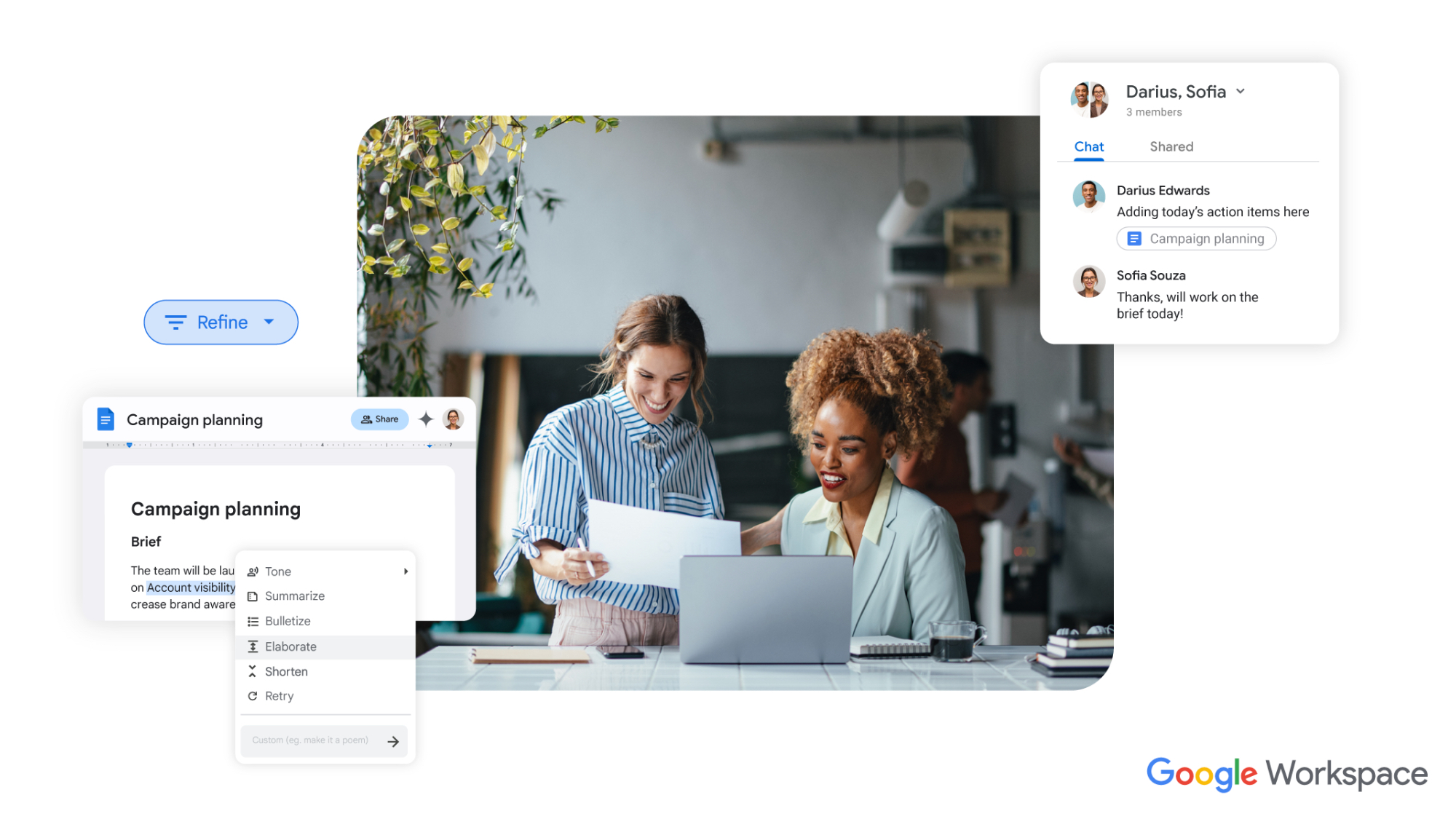

ICYMI: the week's 7 biggest tech stories from Google's impressive new AI to Dyson's weird little vacuum

By Hamish Hector published

The week's 7 biggest tech stories from Google, Fujifilm, Apple, and more for May 24, 2025.

What are you waiting for? Get 10% off at Gazelle with our link

By Paul Hatton last updated

What are you waiting for? Get 10% off at Gazelle with our link

Sony's new personal cooling device made me feel like a cyborg – but I don't think it's worth buying just yet

By Jamie Richards published

Sony’s Reon Pro personal temperature regulation system has some great ideas – I found its execution both awkward and technologically impressive.

5 outstanding tech reviews of the week: the sublime new Sony WH-1000XM6 headphones and Motorola's seriously stylish foldable

By Josh Russell published

Reviews Recap: Sony's innovative, feature-packed noise-cancelling cans and the most gorgeous clamshell foldable we've ever seen.

Get daily insight, inspiration and deals in your inbox

Sign up for breaking news, reviews, opinion, top tech deals, and more.