TechRadar Verdict

1st Money’s free payroll and HR platform offers a solid, no-cost or low-cost solution for UK businesses, focusing on those with under 10 employees. It’s HMRC-recognised, user-friendly, packed with functionality and supported with well-structured videos and support channels. While not ideal for growing teams or complex needs, it’s a strong fit for those who are just starting out.

Pros

- +

Accurate HMRC tax processing to the penny

- +

Attractive and intuitive user interface

- +

Great support channels

- +

Paid option for expansion

Cons

- -

Only free for the smallest companies

Why you can trust TechRadar

1st Money describes itself as “the UK’s most beautiful payroll & HR”, and that’s apparent from the moment you load the web page which is very clearly designed with accessibility and visual attraction in mind.

We’ve talking bold, clean fonts, simple infographics and a logical layout – all signs of things to come with 1st Money’s platform.

It’s a free payroll & HR platform based in the UK, designed specifically for smaller businesses with fewer than 10 employees on the books.

The company itself is actually a market newcomer, founded in 2020 by a group of colleagues who built a call centre together. Since then, it’s also launched some US-based features.

With its free tiers offering strong value for micro-businesses plus some paywalled advanced features, it’s a customisable option that startups can use as they scale before they head off into fully-fledged payroll software.

- Our guide to the best payroll software

1st Money: Plans and pricing

1st Money’s selling point is that it’s a free product, but there are two separate free subscriptions to consider.

The first, free for unlimited people, includes HR and people management, expense claims, timesheets, shift scheduling and more. You can also link in with third-party accounting integrations like QuickBooks.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Free+, for one to nine payrolled people and unlimited unpaid people, does the heavy lifting for you. HMRC tax filing, P60s, P45s, payslips, P11Ds, expense reimbursements, pension auto-enrolment and more.

You can easily get away with using the free versions of 1st Money to run your micro-business, but Pro (£1.49 per payrolled person per month, with a 10-person minimum) adds even more, with hourly pay rates, weekly and fortnightly payments, and pension calculations and filing.

The company says that having “the world’s lowest pricing” helps it become the world s best money services platform. No annual contracts are available with savings, so you’ll have to pay monthly.

1st Money: Features

1st Money might be a free product, but it’s a mighty impressive one that would be worth the money if it were a paid product. Obviously, the core limitation is that it’s only free for nine or fewer employees, but even the monthly charge for more workers is extremely affordable.

The platform consists of comprehensive payroll and HR tools for micro-businesses, including support for employees, zero-hour workers, off-payroll workers, contractors, directors and non-paid workers, all in one unified platform that’s extremely easy to use (more on that below).

At the time of writing, 1st Money boasts 62 different features, including automatic emailing of P45s and P60s, pay slip generation and automatic calculations.

The site also boasts that it uses 15 different taxpayer scenarios to exactly match all 13,000 of HMRC’s model tax calculations, which means it can match tax calculations to the penny and get 100% correct calculations.

Being the modern solution it is, the platform also gets the benefit of artificial intelligence. Some core AI assistant features include accepting resignations, adding disciplinaries, adding sick leave, adding expense claims and terminating people.

1st Money: Ease of use

1st Money is all about being easy to use, and that starts with the website. It sets out exactly what you need to know about the platform, what you can expect from the different tiers, and how you can go about using them.

Right at the top of the home page, the company claims to be the UK’s most beautiful, user-friendliest, most powerful, most reliable, most accurate, most intuitive, fastest, lowest cost, easiest and best supported payroll & HR platform. Big claims, but we think ones it can live up to.

The interface is incredibly easy to navigate, and the conversational language makes it easier to engage with than more traditional systems.

Other features like automated onboarding and document management also simplify the setup process for new hires.

1st Money: Support

Just when you think things couldn’t get better, 1st Money support channels are spot-on too.

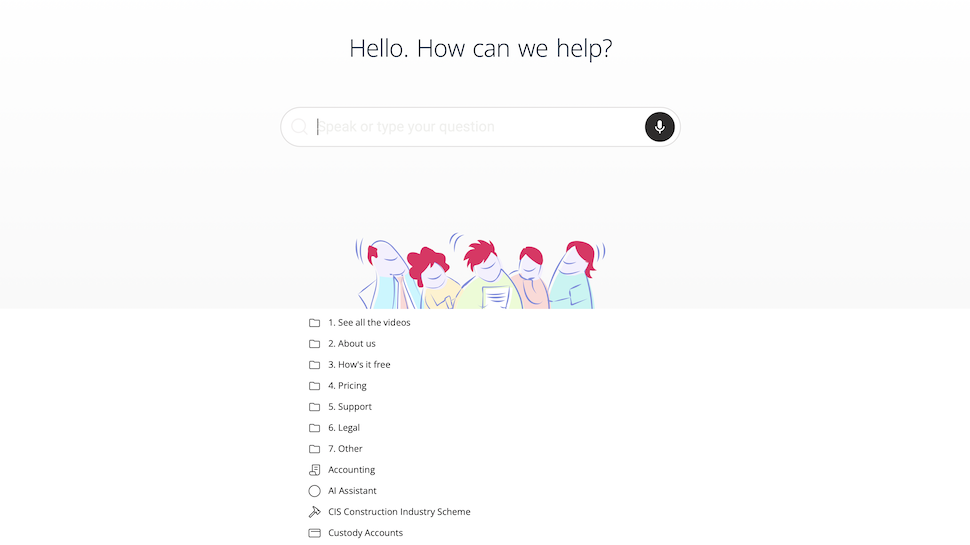

All plans, free or paid, come with unlimited support and connections to real humans. There’s chat support during weekday office hours, but you can also send off an email to the team for a response out of hours.

1st Money’s knowledge base goes well beyond the usual articles and guides with full video demos, and you can select individual features on the website to jump to precise timestamps for brief overviews and quick explanations.

Time will tell how these age and whether the company will keep its video library up-to-date as the platform evolves, but with such an extensive support base even in its earlier years, it’s a real positive.

1st Money: Final verdict

1st Money’s free payroll and HR platform stands out as a genuinely no-cost payroll solution for UK micro-businesses, offering HMRC-recognised compliance without over-complicating things.

For companies with fewer than ten employees, including directors, contractors and zero-hour workers, it delivers reliable payroll processing, auto-generated statutory documents like P45s and P60s, and well-integrated HR functions.

It’s a great option for those who might not be so experienced, because the automatic handling of PAYE and National Insurance just makes everything that little bit easier.

The addition of a paid plan for adding more workers and more features is a real selling point for smaller companies that are in the midst of growing, making it a genuinely viable option not just in the intermediary, but also longer-term.

1st Money’s simplistic interface, conversational language and endless support videos help new-starters get to grips with HR and payrolling even if they’re totally unfamiliar with it.

While it may not suit every team, it’s a smart and streamlined entry point for micro-businesses with its own paid upgrade to support expansion.

With several years’ experience freelancing in tech and automotive circles, Craig’s specific interests lie in technology that is designed to better our lives, including AI and ML, productivity aids, and smart fitness. He is also passionate about cars and the decarbonisation of personal transportation. As an avid bargain-hunter, you can be sure that any deal Craig finds is top value!

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.