How to choose your perfect small business payroll software

Choosing the right payroll software can make or break how smoothly your small business runs

If you're an employer, then picking the right small business payroll software will pay dividends. Whether you've only got one other person on the books or you've got a whole team working for you, your statutory requirements will be the same, so staying compliant with HMRC rules is a must.

But with so many payroll tools available, from really basic payslip generators to fully automated systems, it can be difficult to know not only which is best for you, but which advanced features are worth it.

Save time and unlock growth with integrated business tools and AI automation all in one place. See our plans and pricing here. No commitment, cancel anytime and free human product support.

Choosing the right payroll software is more important than you think, because it reduces administrative workload and ensures accuracy all in one, keeping you compliant with HMRC's rules and preventing potential penalties.

What is payroll software?

Payroll software is about giving your workers the right amount of compensation in a legal and compliant manner. It's an absolute must for anyone who employs other workers, because it's their right to get paid on time.

Paying a worker isn't as simple as sending some cash over via a bank transfer – it'll have to go through the correct channels, and you'll need to make all the right deductions and contributions, like tax and student loan repayments.

It'll also connect that earner's details straight to their National Insurance number so that they're eligible for state benefits like healthcare and pension.

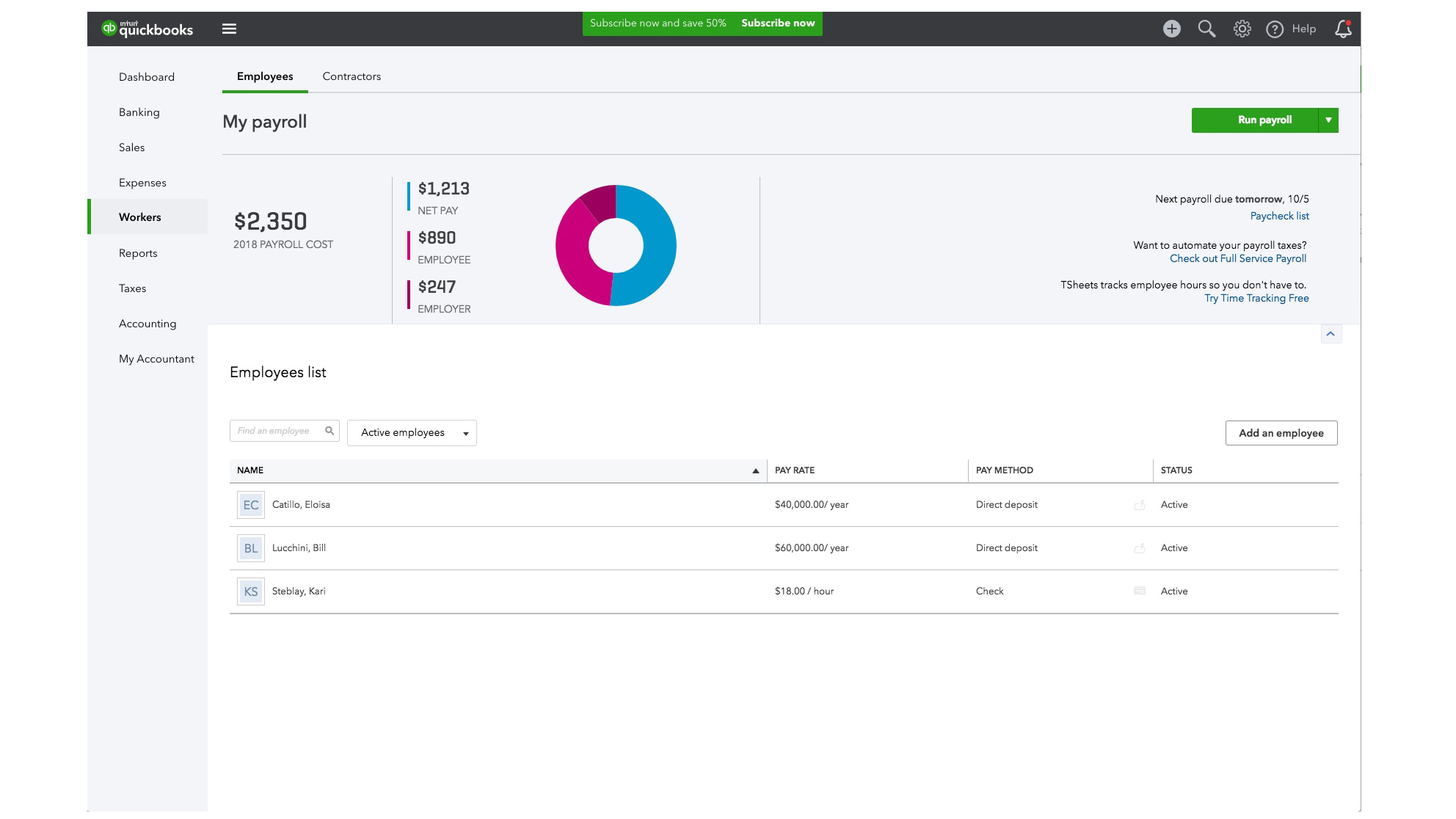

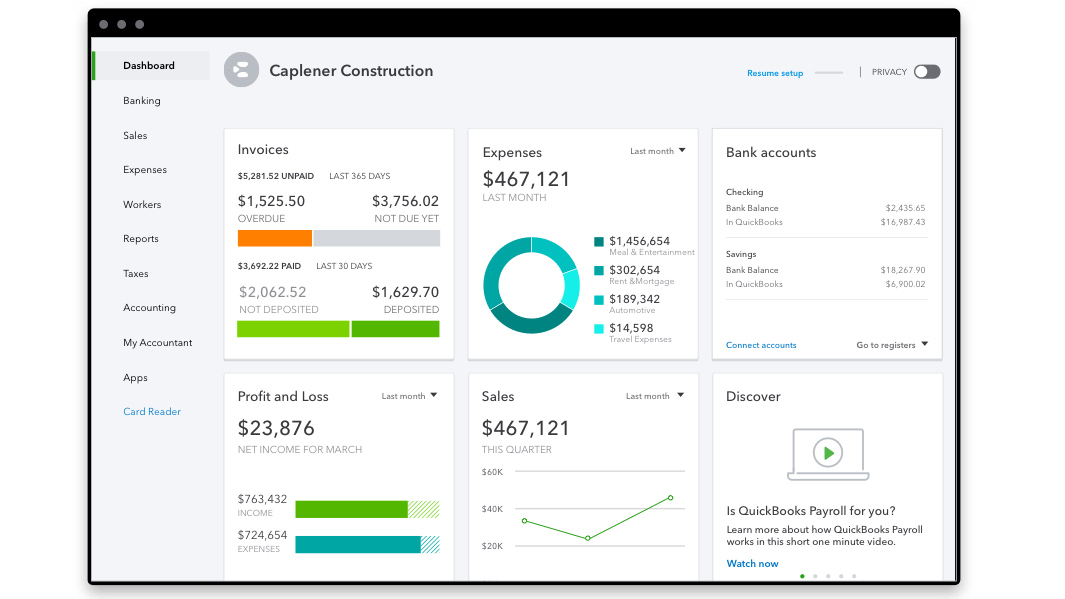

From a business perspective, payroll software helps managers calculate salaries, hourly pay, and overtime, and it puts all of the data into a clear payslip for effective record keeping.

Many tools will also include holiday tracking and sick pay calculations for the more irregular fluctuations, plus a host of other features we'll explore below.

Why choosing the right payroll software matters

As an employer, you've got responsibilities to both the Government and your workers. It's all about delivering money and reporting to the right people, and at the right time.

However, many small businesses don't have endless resources, and choosing the right payroll software can have further benefits, like a reduction in admin time related to data entry.

Software developers are also tasked with staying on top of HMRC guidelines, so you don't have to. Automated tax calculations in line with this information reduce the risk of underpaying or overpaying staff, for example.

What are the key features to look for

Automatic tax calculations

Nobody's asking you to be a tax expert. An accountant will certainly help, but accountancy fees can be high, so having tax-ready information to hand before you pass over your finances to a third party is a good place to start.

Good software will calculate PAYE, National Insurance, student loan repayments, and other statutory payments.

RTI submissions to HMRC

The Government makes RTI, or Real Time Information, submissions mandatory. So look for software that submits payroll data to HMRC, sends reminders before deadlines, and confirms successful submissions.

This is so that the tax agency can make sure tax codes are correct, reducing the need for any adjustments (extra payments or refunds) at the end of the year.

Payslip generation

Payslips aren't only a legal requirement, but they're also perfect for record-keeping. Good payroll software will create digital payslips, email them to employees, and store them securely in case the business (or employee) needs them in the future.

Pension auto-enrolment

If you employ staff in the UK, you must enrol eligible workers into a pension scheme and offer contributions alongside what your workers decide to set aside.

This private pension is separate from any state pension, but your software should still automate or simplify this.

Employee self-service

Although much of payroll is a one-way interaction, sometimes employees need to access lost information or update their details.

It's a relatively easy task, but it often gets added to the bottom of the administrative list. Self-service portals let them download payslips and P60s in one place.

Holiday and sick pay tracking

If you're new to employing people, it's easy to forget that workers won't fully complete their contract of 'x' hours every single week.

Sometimes there will be sicknesses, sometimes there will be authorised annual leave, and sometimes there will be unforeseen absences. Adjusting pay and factoring in statutory sick pay is a must.

Security and data protection

This software handles a lot of very personal and sensitive information – employee details and how much they earned are all in one convenient place.

Look for software with strong encryption (at rest, not just in transit) and GDPR compliance. Protecting your account with two-factor authentication also serves to block out any prying eyes.

How much does payroll software cost?

Free payroll software isn't overly common, but the Government does offer its own 'Basic PAYE Tools' package for very small companies with fewer than 10 employees.

You'll be able to do everything that's legally required of you, but this suite lacks any advanced reporting and many of the features mentioned above.

Be wary of companies that want to charge you per employee, as the cost can quickly mount up, and there's no real cost involved with adding more heads apart from some negligible storage space. Some might charge you extra for year-end filing costs, so look at the total cost of ownership (TCO) and don't just settle for the cheapest.

Summary

Choosing the right small business payroll software can save you time on admin, reduce errors, and most importantly, keep you compliant with HMRC regulations.

Most platforms will automate calculations, handle RTI submissions, and simplify pension duties, but the best stand out for advanced security, powerful employee self-service, and ease of use.

So remember, when choosing your perfect small business payroll software, know that nearly any solution will cost you, and that it should have the flexibility to grow with your business and make the job of an HR operative less stressful.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

With several years’ experience freelancing in tech and automotive circles, Craig’s specific interests lie in technology that is designed to better our lives, including AI and ML, productivity aids, and smart fitness. He is also passionate about cars and the decarbonisation of personal transportation. As an avid bargain-hunter, you can be sure that any deal Craig finds is top value!