Best accounting software for small business of 2026

Manage your spending now

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

We list the best accounting software for small business, to make it simple and easy to bookkeep your expenses and discover your tax liabilities.

While there are standalone options for invoicing software and tax software for small businesses, you'll generally find that dedicated accounting platforms will be more comprehensive.

Pick the right software and you'll find that everything relating to your business activities can be done within one core package, which should reduce workload and increase efficiency.

Additionally, while there are some very good paid-for accounting programs around, there are a few free accounting software solutions out there. Some of these are simply free tiers that come as part of a paid software package, but others are freeware programs.

That means you can download and use them without charge, which can help with budgeting. There are also time management apps and these can be used by consultants or freelancers who are more likely to charge by the hour.

No cost options can be very helpful for start-ups who want to keep their accounts organized without committing to a solution, while also reducing initial costs. Other businesses might simply prefer them because they often allow for a greater control of your data, by running locally on your own machines rather than on third-party clouds.

The best accounting solution should ideally integrate with the best ecommerce platforms, regardless of the theme installed.

Below we list the best accounting software currently available on the market, and also include some further options to consider, as you can opt for specific expense tracker apps or even customer accounts.

Reader Offer: 75% off for 3 months

FreshBooks' accounting software features double-entry accounting tools, expense tracking, and automatic mobile receipt scanning. It connects to your bank or credit card and provides detailed reports on profitability, cash flow health, and spending for comprehensive financial management.

Preferred partner (What does this mean?)

The best accounting software for small business of 2026 in full:

Why you can trust TechRadar

Best all-round small business accounting software

Specifications

Reasons to buy

Reasons to avoid

Rippling is often praised as an all-in-one HR cloud platform; however, in terms of accounting, its separate feature Rippling Spend is gunning for the best accounting software in the marketplace. Using the aggregated employee data, Rippling Spend provides real-time integrated financial visibility across your company. It offers easy tracking for receipts, company cards, general expense tracking, and much more.

All of the expense management takes place in a single centralized dashboard offering great visibility to the accounting team. From here, you can easily create granular reports that can encompass a single employee, a team of people, or even a whole department.

Moreover, what sets Ripppling apart is the ability for users to set up powerful automations using simple if/then workflows. All of the expense management can be broken down into these rules, which then automate the entire process.

We’re not fans of pricing not being transparently shown on the website. Although there is considerable nuance in what a company actually needs from the sprawling Rippling ecosystem, it’s probably difficult to pinpoint a single price for the majority of users. Nevertheless, Rippling Spend represents the best all-rounder in the marketplace.

Best small business accounting software for extra features

Specifications

Reasons to buy

Reasons to avoid

Xero might grab your attention with its low-cost Early plan account but look closely and limitations soon become apparent – like being restricted to sending a maximum of five invoices, entering five bills, or reconciling only 20 bank transactions. We think most users will outgrow these limitations far too quickly. Furthermore, to combine it with payroll from Gusto increases the costs further for an additional $40/month making us think we may be better off with another solution that is one price with payroll already integrated.

Still, for those that can live with those restrictions, there are some pluses here. The service offers smart expense tracking and management, optionally on your mobile with Xero's excellent app for Android and iOS. There are dozens of configurable reports, simple budgeting, and no limits at all on additional users or the accountants you might want to access the data. It also a snap to capture bills and receipts with Hubdoc, and we like the included 24/7 support available online.

On the topic of support, we should mention that it is essentially a self help knowledge database, along with a support portal. We disappointingly did not find more options for direct support, such as chat, a phone number, or direct email address.

If these invoice, bank or billing limitations are are an issue then the Xero Growing plan looks like a better deal. It's a lot more money, but you can issue as many invoices and enter as many bills as you like without worrying about these artificial restrictions.

Xero offers plenty of functionality for any small business, including a handy "convert your QuickBooks files" service to help you get started, and it's certainly easy to use. But if you don't quite need all that power, there's better value to be had elsewhere.

Read our full Xero review.

Xero - Best SMB accounting software for extra features

Xero has built up its cloud-accounting services substantially in recent years and how has an easy to use package that can be tailored to suit the needs of small business owners, accountants and bookkeepers alike. Central to its universal appeal is a simplistic dashboard design that lets multiple users makes use of its many and varied features and functions. The accountancy package is additional appealing thanks to several extra features that include expense and project tracking. Start a 30-day free trial.

Best comprehensive small business accounting software

Specifications

Reasons to buy

Reasons to avoid

QuickBooks is an instantly recognizable name in the world of accountancy and bookkeeping. It’s owned by Intuit, which also has other options for small business and large ones too, with a diverse portfolio that includes Turbotax, Mint and Proconnect. QuickBooks also comes in numerous different varieties, from desktop editions through to the hugely popular Online edition.

Depending on your requirements, there is no shortage of options. You can choose from QuickBooks Online, QuickBooks Self-Employed, QuickBooks Online Advanced, QuickBooks Live Bookkeeping, QuickBooks Desktop for Mac, QuickBooks Desktop Pro, QuickBooks Premier and QuickBooks Enterprise. However, it is possible to create a custom package using the help of the QuickBooks team if you need a more bespoke option.

Due to the sheer expanse of QuickBooks-based products it’s best to check out the website in order to get the latest update on pricing, versions available and also any deals that Intuit has on this vast range of accounting solutions. While there is no free tier, we like the number of features that QuickBooks has, even on the lowest plan. This includes mileage tracking, receipt capture, free guided setup, and the ability to connect a sales channel. We also appreciate the direct contact available for support via the online support portal.

Read our full QuickBooks review.

QuickBooks - Best accounting software for all SMB needs

QuickBooks benefits from having the muscle of Intuit behind it, a large software company that has helped it become one of the leading lights in the world of accountancy software. While there’s cloud-based convenience there are also variations on the theme, depending on what kind of business accounting needs you have. Small and medium-sized businesses will find it comes bristling with lots of features and there's also 50% off for 3 months.

Best small business accounting software for multiple users

Specifications

Reasons to buy

Reasons to avoid

Sage Accounting makes a good first impression with its clear and gimmick-free pricing. The top Sage Accounting plan offers decent value and there is also a 30-day free trial with no credit card requirement. It offers cross platform support as it is a native cloud based software offering, to be used via any web browser, and connections to Android and iOS apps.

For this, you get modules to manage quotes, invoices, handle and submit VAT online, smart bank feeds and reconciliation, cash flow forecasting, some detailed reports, multiple currency support, project tracking and more, all available from your desktop or via a mobile app.

All this is well presented and generally easy-to-use. If you run into trouble, detailed web help and video tutorials are only a click or two away. We found several options to get support, including a community forum, a knowledge base of articles, year end tips, and even a ‘Sage University,’ that should help make any newbie comfortable. However, for direct support, the only option was for a chat, and we did not find a direct phone number, support portal or email.

Sage also has a more basic offering called Accounting Start. This doesn't include support for quotes, estimates or vendor bills, and has no cash flow forecasts, but it could be enough for start-ups as well as small businesses. It does support creating and sending invoices, it can create and send invoices, and offers automatic bank reconciliation.

Read our full Sage Accounting review.

Sage - Best SMB accounting solution for multiple users

Sage delivers a slick but simple to use accountancy package that will appeal to small businesses. The British company has been for 40 years or so, and as a result has evolved its software to suit the needs of a very diverse portfolio of customers. The great thing about this package is its flexibility and can be configured so that multiple users can make use of its many and varied accounting tools. Buy now and save 70%.

Best small business accounting software for automation

Specifications

Reasons to buy

Reasons to avoid

Zoho Books is just one small part of a much greater business concern based in India that offers all manner of solutions for anyone and everyone’s accounting needs. With its clean and simple cloud-based interface Zoho Books makes a great cost-effective option if you’re a freelancer, sole trader or someone running a small business.

While the desktop route is a solid one Zoho Books also has an impressive app presence, making it a good mobile bet too. The free plan gets limited to a business with less than $50k in revenue, 2 users (as in yourself and your accountant) and maxes out at a pretty generous 1,000 invoices for the year5 automated workflows. It otherwise does offer plenty of features including a mileage tracker, the ability to import credit card statements, payment reminder automation, and multilingual invoicing, making it more than capable for those that are within the other limits.

Moving up the tiers, the next one is also the most popular package, Standard, which comes with up to 5,000 invoices, 3 users, timesheet and billing and sales tax tracking at a cost of $15/month (paid annually). Professional, the next plan higher, meanwhile, is a full bells-and-whistles experience that offers recurring bills, 5 users, vendor credits, and automatic exchange rates.

The most popular package is Standard, which comes with up to 500 contacts, 3 users and 10 automated workflows. Professional, meanwhile, is a full bells-and-whistles experience that offers 500 contacts, 10 users and 10 automated workflows.

Incidentally, you can pay month to month, but the cost goes up. Zoho does offer additional add-ons for some flexibility in building a plan, such as an additional user for $2.50 monthly, and snail mails for $2/credit. There’s also a free 14-day trial available.

Read our full Zoho Books review.

ZohoBooks - Best accounting software with an automated edge

ZohoBooks is just one of many different software packages available from this software publisher. It makes a great choice if you’re a small or medium-sized business owner who needs plenty of features and functions. It’s made even more appealing thanks to a high level of automated functionality. Get the Standard package for just $15 per month.

Best small business accounting software for ease of use

Specifications

Reasons to buy

Reasons to avoid

Choosing an accounting package often involves browsing a complicated comparison table, looking for hidden catches and trying to figure out which is the best product for you. Kashoo avoids all that and delivers just about everything you're likely to need in a single tier offering that is a decent package. While that may please some users, it is hard to be all things to everyone, and realize that there is no free, but limited tier, and also no free trial. To patch those potential holes, there is introductory pricing that is downright cheap at $2 for the first year, and also a more entry level, although still paid package appropriately called Truly Small Accounting.

Kashoo shines when it comes to multi-currency support, an important feature for today’s global economy. It also supports credit card transactions for all the major carriers such as Amex, Visa and Mastercard – at a competitive fee.

You also benefit from unlimited invoices and connections to over 5,000 financial institutions to reconcile accounts online. We liked the uncluttered interface of this product, and the dashboard that provides a good summary of your current financial situation at a glance.

Kashoo also offers customer support across the gamut of email, phone, live chat and social media – this company will even respond to an old-fashioned letter! There is also an abundance of self help support available with almost 100 articles to address a myriad of topics, such as “Kashoo Classic: Migrating to Kashoo from QuickBooks,” and most were updated recently as well to keep the content fresh and relevant to users.

While there was previously noted to have mobile app support only for iOS, this shortcoming has been addressed, and now there is an Android app as well that was recently introduced. Overall, for users that find that Kashoo has what it needs in the single tier offered, than this is a plenty reasonable choice

Read our full Kashoo review.

Kashoo - Best hassle-free accounting software

Kashoo is aimed squarely at small and medium-sized businesses and, while it’s certainly easy to use, this is a cloud-based accounting package that has plenty of muscle. It’s also useful if you’re dealing with a global customer base as there’s multi currency support. So, alongside all of the usual accounting tools you’ll get the ability to handle more complex issues. Get advanced accounting for just $30 per month.

Best value small business accounting software

Specifications

Reasons to buy

Reasons to avoid

With more than two million users, Wave is one of the most successful online accounting services - and it's completely free for accounting, invoicing and receipts., However, keep in mind that if you want personal technical support you'll need to pay for it, making this less attractive if you need the handholding. Payroll, an often needed service, also isn't included in the free service either and runs $40 per month, with an additional $6 per active employee or an independent contractor, and furthermore, you do get the occasional advertisement – (just as you do with pretty much any free online service).

It's a very well designed and carefully thought out application, and while it's probably a little basic for medium-sized businesses it's a good option for sole traders, freelancers and small firms. We also appreciate the option for an Advisor for some support from an expert which is a nice option to have for a business starting out.

However, note that while Wave has plenty of free offerings, you still pay per transaction. For start-ups and businesses with low sales volume this may not matter, but for businesses with a significant sales volume, they may be able to find a more competitive pricing model that takes into account the higher volume of their business.

Read our full Wave review.

Wave - Best value accounting software for small business use

Wave makes a great accounting software option if you’re looking to use other features within your business, such as payroll and credit card services. The cloud-based accountancy package is well suited to small businesses because its basic accounting and invoicing tools are free to use. However, if you want to exploit the rest of the power tools you'll need to pay for them. Sign up for free.

Best simple small business accounting software

Specifications

Reasons to buy

Reasons to avoid

KashFlow, which is now part of the Iris software group, prides itself on keeping things simple, which is always good news when you’re dealing with your accounts and anything tax-related. This cloud-based software solution can be used from anywhere and at any time, just as long as you can get connected.

The service comes armed with a full suite of tools, which can not only let you tackle your accounting chores, but can also be used to take on payroll and HR duties too.

The Starter package is aimed at sole traders, contractors and small businesses. You can send unlimited quotes and 10 invoices, along with reconciling 25 bank transactions. Although it’s only a single user account that works with bank feeds, it also has a mobile app along with a customizable dashboard.

The Business edition is aimed at growing businesses and limited companies. This has the benefit of allowing unlimited quotes and invoices, plus you can reconcile unlimited bank transactions. It’s multi-user and lets you manage and submit VAT returns online.

Finally, KashFlow offers a Business and Payroll package, which has all of the aforementioned features along with added payroll functionality. At the time of writing KashFlow also had more competitive pricing based on an Annual payment plan, rather than the monthly costs shown above. If you’re happy to commit a year at a time, then that should offer savings.

Read our full KashFlow review.

KashFlow - Best simplified online accounting option

KashFlow is a cloud-based accounting package that comes bristling with lots of features and functions, all designed to make life easier for the small business owner. One of the main benefits is its scalable range of packages, meaning you can extend the reach of its features as and when your business needs them. That avoids spending cash on unwanted features. Try it now for free.

Best free small business accounting software

Reasons to buy

Reasons to avoid

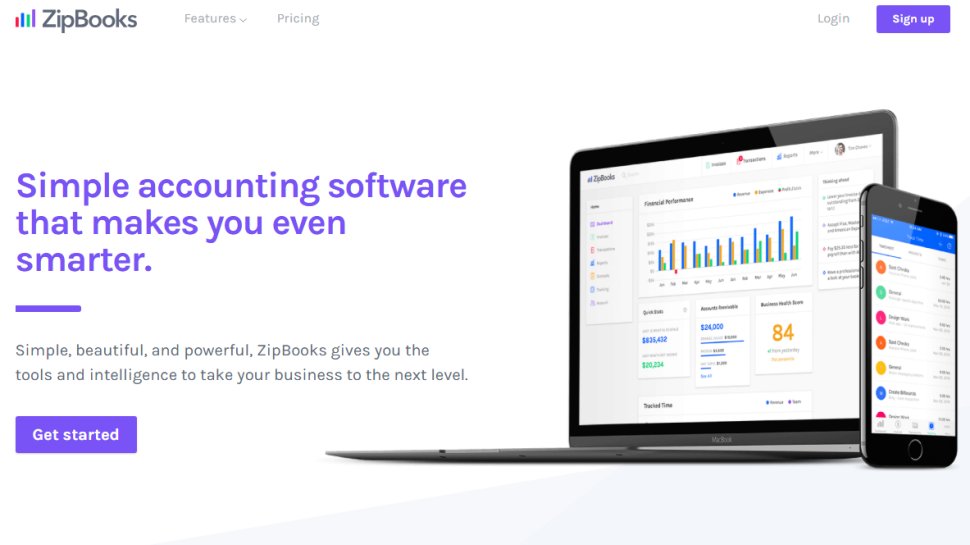

ZipBooks offers accounting software that has a contemporary interface along with a robust feature set. It promises to make accounting easy so the user can save time, and get on with other tasks.

The Starter tier is available for free. It provides unlimited invoices to an unlimited number of customers, making it less restrictive than some other free accounting offerings. It can also be used for unlimited bookkeeping, and can accept payments from credit cards and PayPal. If it sounds too good to be true at that price, just realize that it only supports a single user, and only basic reports can be generated.

Paid tiers include most of the features you'll ever need, including advanced ones such as smart tagging, with advanced reporting and intelligence.

Read our full ZipBooks review.

ZipBooks - The best free accounting software bar none

ZipBooks is a great free accounting software package for small businesses. It comes packed with plenty of accounting features aimed at smoothing the process for SMB's. Lookout for reporting functionality, bank syncing and billing tools too, while it's also possible to use ZipBooks for day to day administration duties including expense tracking and invoicing.

Reasons to buy

Reasons to avoid

Another superb open source tool, Money Manager Ex is well designed and packed with enough features to rival premium software. It's easy to understand, and you'll have your accounts and transactions set up in no time. Money Manager Ex's simplicity makes it a particularly good choice for sole traders or your own home finances. We like that there are no tiers, and there is only a single version of the program.

This free accounting software is a portable app, so you can save and use it straight from a USB stick without even needing to install it. However, realize that a downside of working off a flash drive is that unlike the cloud app approach, data can be lost when the USB drive flakes out (in all fairness there are options to run backups locally, but this is not as easy as a cloud based app where it is built in by default). There's an Android app for updating your accounts on the move, too.

Read our full Money Manager Ex review.

Money Manager EX - Best no messing free accounting software

Money Manager EX is the perfect solution if you've got relatively simple and straightforward accounting tasks to handle and don't want to sign up for a paid-for cloud-based package. It's therefore a good bet if you work for yourself and have a workload that can be easily tracked without the need for too many features and functions.

Reasons to buy

GnuCash is accounting software designed for individuals and small businesses, and was initially conceived as an open source alternative to apps such as Intuit's Quicken.

This app has been around since the late 1990s, and is available for Linux, GNU, OpenBSD, Android, macOS and Windows.

It handles invoicing and credit notes, accounts payable and receivable, employee expenses and some payroll features too, and it's quite happy with multiple currencies, cards and accounts. Its sheer flexibility makes it our top choice when it comes to accounting software for kitchen table businesses.

Read our full GnuCash review.

GnuCash - Best simple approach option for accounting

GnuCash is pretty simple to look at and even more straightforward to get to grips with, making it suitable for small business owners with simple accounting needs. The accounting software has been around for a long time, so it works surprisingly well for a package that can be used for free.

Reasons to buy

Reasons to avoid

It's not going to win any awards for aesthetics, but VT Cash Book isn't there to look good: its priority is to record day to day cash transactions with the least amount of fuss. It uses Autocomplete to speed up data entry, supports multiple bank accounts and bank reconciliation, can be used to prepare VAT returns and enables you to create profit and loss, balance sheets and ledgers.

The free accounting software installs alongside its companion program, the paid-for VT Transaction+, but you don't need to buy the latter to use the former.

Read our full T Cash Book review.

VT Software - Basic free bookkeeping software for accounts

VT Software has to have one of the most minimalist interface out there, which if you're starting out in business might be a boon. It's certainly appealing as the accounts package is free, but the tools inside are also reasonably potent. VT Software is therefore really useful for small business owners, particularly those working for themselves who don't need a more sophisticated cloud-based accounting bundle.

Reasons to buy

Adminsoft Accounts is a software accounting package that's powered by advertising to generate revenue, making it free to download and use. It delivers a surprisingly thorough free accounting system (and an refreshingly honest set of terms and conditions).

It can handle not just invoicing and statements but remittance advice, stock control, purchase orders, budgeting and some HR functions too. It's a UK program so the default is pounds sterling, but it works happily in other currencies too.

There is a paid-for version you can buy to run the software without advertising with a slightly higher cost if you also want to include AutoManager or Shop/Cafe Manager.

Read our full Adminsoft Accounts review.

Adminsoft Accounts - Complete accounting for SMBs

Adminsoft Accounts will fit the bill if you need a small business accounting package that can also cover a raft of other common administration tasks. So, alongside bookkeeping you can tackle invoicing, budgeting and other SMB focused chores. The fact that the UK-based company has built in functionality that allows it to work with other currencies makes it popular in a variety of territories.

Also consider

The best accounting software marketplace might be dominated by the big names above, but there are other options if you're a SMB with with additional needs. Alongside bookkeeping software and small business accounting software you might need to track expenses, manage inventory and carry out all of those other tasks related to running a business. Here are just a few of your additional SMB software options.

1. Certify

Certify is a solution for tracking expenses rather than full accounts, but could be very useful to have in addition to some of the platforms above, not least because not all of them can track expenses with such dedication. This is especially the case for small businesses with a number of employees, where expenses might not always be reported or submitted properly, even though there is a potential tax deductible saving for the business for doing so.

2. Financial Force/Certinia

Financial Force, or Certinia as it it now known, is specifically designed to provide a cloud accounting and finance solution for Salesforce. This means full tracking of customer accounts across multiple workbooks, as well as recording assets, payables, collections, and more. This makes it less of a simple accounting platform and takes it into the realm of enterprise resource planning (ERP), and it is potentially very useful for those businesses already running Salesforce software.

3. Holded

Holded is another software platform aimed more at small and medium businesses, offering an ERP that brings together sales, accounting, inventory, project and time management into a single dashboard. However, despite these diverse elements, the accounting feature is fully developed, and includes automated billing, along with instant reports on profit/loss, and the balance sheet.

4. Tipalti

Tipalti is another big ERM platform and bills itself as the only end-to-end solution to automate the entire global payables operation in a unified cloud platform. At this point we're talking about a platform that goes well beyond accounting and into direct tax compliance and financial risk assessment, clearly intended for Fortune 500 companies that need full audit trails on a global scale, which is probably why Amazon is advertised as a customer.

Also worth a look are the likes of Connected Accounting, ZarMoney, Avanquest Bookkeeper and Finsync.

We've also featured the best personal finance software.

Best small business accounting software FAQs

Best small business accounting software essentials

Flexible friend

Check that your chosen small business accounts software can be adapted to suit your needs. Everyone has specific requirements that will differ between users, and knowing you can tailor your software to suit your needs will prove invaluable. It also means you can supplement a basic package as your needs grow over time.

How much will it cost?

Small business accounting software varies in price depending on your needs. Resist the temptation to sign up for something that has way more functionality than you'll ever need as costs can mount up too. Equally important, don’t saddle yourself with a package that can’t evolve, so pick an accounting package that can be expanded if business starts to boom.

Accurate reporting

Knowing your figures are correct, and as they should be is vital. Therefore, using a tried and tested accounting software brand is often the way to go for many. This route also ensures your software is reasonably future proof and is adaptable as requirements and legislation changes.

Technical support

If you're a small business, then you know that time is money, so check that your package will give you access to quality technical support. Having an expert on hand, either by phone or via email can be a huge help when you inevitablyif you run into problems. Some support is free, while other help is paid for.

Easy integration

If you're running a small business, then having an accounts package that can work with your other systems to streamline workflow is a vital piece to consider. Look for quick and easy reporting capabilities too, and the option to share data with your accounts people whenever needed.

Which small business accounting software is best for you?

When deciding which small business accounting software to select, first consider what your actual needs are, as sometimes free platforms may only provide basic options, so if you need to use advanced tools you may find a paid platform is much more worthwhile. Additionally, budget software options can sometimes prove limited when it comes to the variety of tools available, such as not including payroll, while higher-end software can really cater for every need, so do ensure you have a good idea of which accounting features you think you may require.

Bookkeeping vs Accounting: what's the difference?

If you're in business, or even if you just want to keep on top of your financial affairs, it's likely you'll encounter both bookkeeping and accounting. However, they are slightly different in that bookkeeping is the process of keeping tabs on daily financial transactions and recording them.

Accounting, on the other hand, is the process of compiling all of that information prior to filing tax returns. In both cases, you can make either task much easier by enlisting the help of bookkeeping and account software. Most packages now let you carry out both jobs and all within the framework of one interface.

The other bonus with using software to manage your books and submit accounts for taxation purposes is that the package will invariably come complete with tools for making the job that much easier. In many cases you'll simply need to add in your figures, collated from things like bank statements and receipts.

Thankfully that job is made much easier than it used to be because much of the information you need to record is captured digitally. Most bookkeeping and accounting software will allow you to import a lot of this digital data into your chosen program, meaning much less work is needed to stay on top of both your books and your accounts.

How we tested the best small business accounting software

Choosing our selection of the best accounting software has involved testing out each of the packages featured here over a period of time. Our real world testing scenarios include checking how accounts software performs generally, along with scrutinizing all of the features and functions.

Best accounting software aimed at SMB users needs to be straightforward and efficient to use too, because not everyone has experience of accounting. Therefore, simplicity and value for money are two major factors we also look out for.

Similarly, the best accounting software also has to be flexible and adaptable in order to suit the needs of business users as well as featuring compatibility with other software, apps and cloud-based backup tools.

Read how we test, rate, and review products on TechRadar.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.