Bye Bye MLC: QLC and TLC to be dominant SSD technologies amidst AI's ravenous appetite for NAND — and PLC won't probably happen till the era of Petabyte SSDs

Global MLC NAND capacity will decline over 40% YoY in 2026

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

- MLC NAND now serves industrial, automotive, medical, and networking equipment exclusively

- Samsung’s exit leaves MLC supply gaps that competitors partially fill

- TLC and QLC increasingly handle consumer and enterprise storage demand

As storage technologies evolve to meet growing data demands, the trajectory of NAND Flash memory is undergoing a clear shift.

New TrendForce data has said MLC (Multi-Level Cell) NAND Flash is steadily moving away from mainstream storage markets and into narrowly defined niches.

Demand remains concentrated in industrial control systems, automotive electronics, medical equipment, and networking infrastructure, where long qualification cycles and predictable behavior outweigh cost efficiency.

Major suppliers reduce exposure

The segment that currently controls demand prioritizes endurance and supply continuity, yet its overall growth prospects remain limited.

As a result, MLC no longer aligns with the volume-driven economics of the SSD market, especially as capacity requirements continue to scale rapidly.

Strategic exits by large NAND manufacturers primarily drive the contraction of MLC supply - Samsung decided to discontinue MLC products, with final shipments scheduled for mid-2026, which removed the market’s largest contributor.

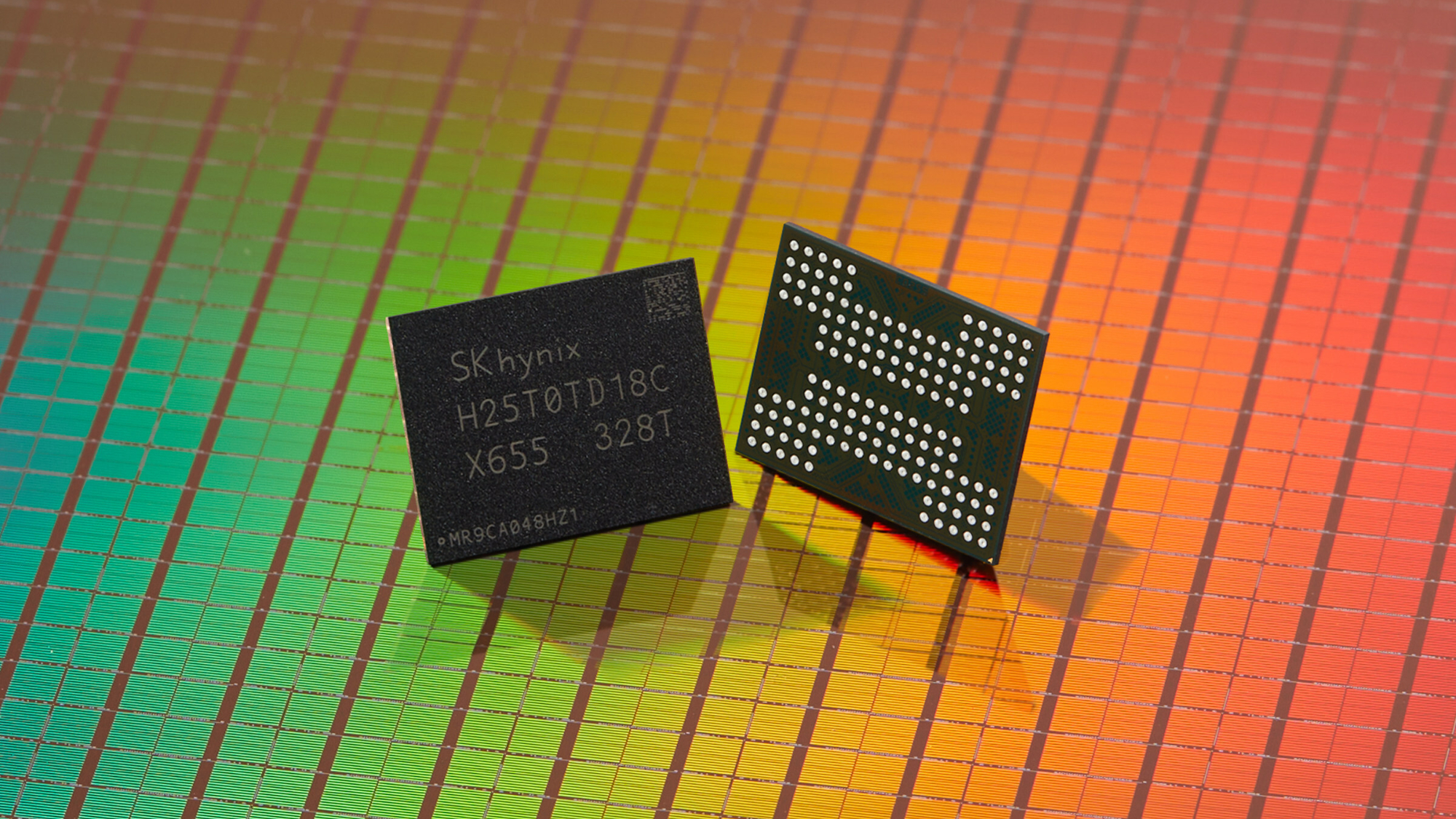

Kioxia, SK hynix, and Micron have followed by restricting production largely to existing contractual obligations.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

TrendForce estimates that global MLC NAND capacity will decline by 41.7% YoY in 2026.

This reduction reflects deliberate capital reallocation toward advanced TLC (Triple-Level Cell) and QLC (Quad-Level Cell) process technologies rather than short-term supply disruption.

As international suppliers withdraw, companies focused on embedded and high-reliability memory gain relative influence.

Macronix, traditionally associated with NOR Flash, has shifted portions of its capacity toward MLC NAND to serve customers facing supply gaps, which reduces global NOR Flash output while increasing supply concentration.

TrendForce suggests this change may provide firmer pricing support for mid- to high-density NOR Flash products.

It will also likely reverse years of pressure caused by excess manufacturing capacity across the flash drive market.

The rapid decline in MLC output, combined with the absence of replacement capacity, triggered early volume commitments beginning in late first quarter 2025.

Buyers accelerated procurement to secure long-term availability, driving sharp price increases that have persisted.

Although these conditions benefit the remaining suppliers in the short term, they reinforce MLC as a legacy technology rather than a scalable foundation for future storage.

As MLC recedes, TLC and QLC increasingly absorb demand across consumer and enterprise segments.

Their cost-per-bit advantages align with rising capacity expectations driven by data-intensive workloads and expanding AI tools.

Most modern SSD designs now favor these technologies, accepting trade-offs in endurance through controller-level management and workload optimization.

In this context, PLC (Penta-Level Cell NAND Flash) remains speculative, with TrendForce suggesting it may not become viable until petabyte-class SSD capacities become economically justified.

Follow TechRadar on Google News and add us as a preferred source to get our expert news, reviews, and opinion in your feeds. Make sure to click the Follow button!

And of course you can also follow TechRadar on TikTok for news, reviews, unboxings in video form, and get regular updates from us on WhatsApp too.

Efosa has been writing about technology for over 7 years, initially driven by curiosity but now fueled by a strong passion for the field. He holds both a Master's and a PhD in sciences, which provided him with a solid foundation in analytical thinking.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.