WhatsApp to foray into online payments and credit

Why pay now when you can pay later?

The personal finance segment in post-Covid-19 India is likely to become a battleground of sorts with the expected foray of Whatsapp as a payments and lending platform.

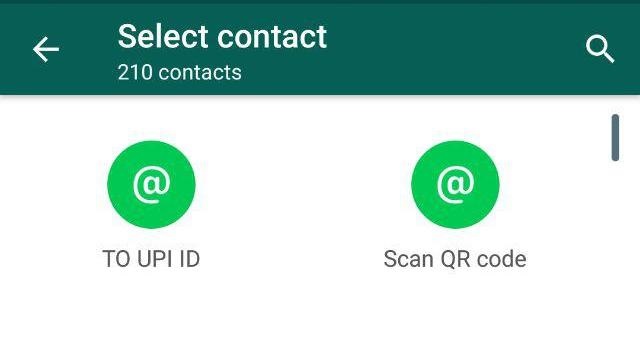

Whatsapp has been testing its mobile payments feature in India since 2018 and once it receives the assent from New Delhi, it could officially commence providing credit or loans in India, as per reports.

Existing payment platforms such as Alibaba and SoftBank-backed PayTM and Flipkart’s PhonePe have been widely accepted and used by individuals and merchants alike. PayTM Money, which provides loans, insurance and investing service has over 3 million users, while PhonePe has over 175 million users and 8 million merchants who do PhonePe transactions.

The Covid-19 crisis in India has further boosted online transaction habits of people in India which has burgeoned to over tens of millions.

Whatsapp already has a mass appeal and the Facebook-owned messaging platform could easily transition into the personal financial services space. Whatsapp’s head in India Abhijit Bose had said at an event in Bangalore that “the mobile payments market in India, which has attracted dozens of local and international firms in recent years, is still at a very early stage in the country and may eventually see firms move beyond just offering a way for people to send money to one another”.

Huge buzz in payment platforms

Ajit Mohan, Facebook VP and India head, has been quoted by TechCrunch as saying "only one million Whatsapp users in India have access to its mobile payment service."

Recently over a dozen payment services platforms have added online to their business model in the country in a move to consolidate their market penetration and profits. At the moment, PayTM and MobiKwik offer only small ticket credit to millions of Indians. With the entry of Whatsapp the competition is likely to get fierce.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Amazon had been another major player in the Indian personal lending via their Amazon Pay EMI services since September 2018. The Washington-based tech giant has launched a credit service called Amazon Pay Later for its customers in India. It is a rebranding of Amazon Pay with additional benefits such as instant credit on products listed on its online marketplace, including credit to buy groceries and pay utility bills.

The Indian government’s demonetisation of Rs 500 and Rs 2000 banknotes in November 2016 and the simultaneous boost to online payment apps such as PayTM had Indians adopting online transaction mode in the millions.

Nitesh is a writer at Techradar india. He has spent 12 Years as Journalist, Content Writer, Editor with Newspapers and Magazine, English language, Email. Nitesh went to Nagpur University.