Why 2011 is the year of mobile payments

Breakthrough year for mobile payment tech

Imagine waving your phone in front of a cash desk to buy fuel or food. Or zooming into the drive-thru lane and paying with a smartphone instead of a credit card.

That's the promise of mobile payments, an emerging technology that will depend greatly on software, hardware chipsets in the phone, and an infrastructure that aids both merchants and consumers.

In this case, the word "emerging" is important. Some providers, such as Fonwallet.com, are using software to initiate transactions.

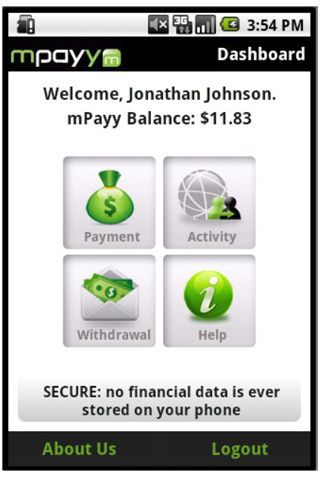

Some, such as Mpayy use text messaging as a way to buy goods on a website or send funds from one user to another.

MPAYYMENTS: Using text messages to pay for goods

Phones such as the Nokia 6212 have the capability to conduct transactions using a Near-Field Communication chip, but have not made much progress beyond some early pilots. The chip communicates over a wireless short-range signal for transmitting a small set of data. Nokia pioneered the technology several years ago, and it is popular in some Asian markets.

NFC in the iPhone?

Get daily insight, inspiration and deals in your inbox

Get the hottest deals available in your inbox plus news, reviews, opinion, analysis and more from the TechRadar team.

The next iteration of the iPhone and iPad may include an NFC chip, and Apple would likely be poised better than anyone to make it work by tying in mobile payments directly to the iTunes store.

Think of it this way: Apple could parlay their current ecommerce domination to include physical goods and proximity-based services you buy with a tap of your phone onto a terminal.

For now, the only big-name phones prepared for mobile payments is the Google Nexus S and Samsung Galaxy S2, which have an embedded NFC chip.

According to MordyKaplinsky, a co-founder of FonWallet.com, software upgrades for Android have moved towards enabling the mobile payment option on the phone.

Recently, O2 announced plans to develop an infrastructure for mobile payments where users would be able to store a set amount of money on a phone and transfer funds between other O2 users. Orange and T-Mobile have announced similar plans where an NFC chip is embedded don the SIM card.

What needs to happen

So where will that lead? For mobile payments to become a reality, three planets need to align: the NFC chip or some other transaction method has to be on the phone; the infrastructure has to be ready to handle the new transaction method; and software needs to use so-called "secret" keys that refresh every few seconds. The keys help reduce fraud if someone tries to hack into a phone.

"The top security requirement is to ensure that the user's secret keys are managed in strong tamper-resistant circuitry that is separate from the processors that handle user applications," says Paul Kocher, the president and chief scientist at Cryptography Research.

"This isolation is critical to prevent identity thieves from extracting and copying payment credentials."

Another challenge is that the infrastructure will need to support a wide variety of phones. Many Android devices look similar and provide similar features, but the firmware is often quite different: for example, the camera firmware on an HTC phone is different from the firmware used on a Samsung.

"[Mobile payment developers] will have to develop applications that run on a wide variety of devices and support a variety of NFC systems including situations where NFC comes built-in to the phone, NFC on the SIM card supplied by the carrier, NFC on a removable card like a MicroSD card," says David Eads, a spokesperson for Kony, a company that makes a mobile app platform.

One possible answer: Discover Cards has announced a program called ISIS where all of the 7 million terminals on the market would be capable of reading credit card information from a phone when the customer taps it on the terminal.

The platform is unique in that Verizon Wireless, AT&T and T-Mobile have all agreed to participate, so the there is a greater chance that the mobile payment system would become ubiquitous and support a variety of phones.

One of the best examples of how mobile payments are working is in Japan. The Sony Felica chip is embedded into a phone, and is now commonplace at train stations where smartphone users wave the phone over a terminal to buy a ticket.

Mobile payment vendors can learn a lesson about how the infrastructure developed: the chip started out as a smartcard RFID technology, then made its way onto smartphones. The technology is a joint venture between Sony and DoCoMo.

------------------------------------------------------------------------------------------------------

Contributor

John Brandon has covered gadgets and cars for the past 12 years having published over 12,000 articles and tested nearly 8,000 products. He's nothing if not prolific. Before starting his writing career, he led an Information Design practice at a large consumer electronics retailer in the US. His hobbies include deep sea exploration, complaining about the weather, and engineering a vast multiverse conspiracy.