Presented by

How to use Acrobat AI to summarize and double-check your tax return before you file

US tax season is here – but it doesn't have to be overcomplicated

As we hit the mid-point of February, the US tax season is well and truly here.

If you’ve already done the hard part – pulling your documents together and getting your numbers into a completed US tax return – the last thing you want is a simple mistake slowing everything down.

That’s where Acrobat’s AI Assistant can help.

Instead of re-reading every page line by line, you can use it to summarise your Form 1040 return in plain English, pull out the key figures into a quick checklist, and point you to the exact pages and lines worth checking twice.

Acrobat's AI tools make filing and getting information about your taxes simpler and easier.

Before we start, it's worth saying that this is not a substitute for tax software or professional advice. But as a final pre-filing review step, it can make your return easier to verify before you submit it.

To help you get your returns sorted for the 2025 US tax year, we've compiled a helpful list of the best tips and tricks for Adobe Acrobat.

Please note: All of the information is correct as of February 2026. Adobe regularly updates its products, so some steps or features may change. While this guide focuses on US tax returns, Acrobat's AI summary will work with PDFs in other territories, and the general steps outlined here are the same.

What you need

This guide assumes you’ve already prepared your federal return and exported the full PDF packet, not just a filing summary.

For most people filing a calendar-year return, that means the 2025 version of Form 1040, ready for a final review ahead of the April 2026 deadline.

To follow along, you’ll want three things: the complete return PDF, the source documents you used to build it (W-2s, 1099s, and any other statements you’re reporting), and Acrobat on desktop with access to Acrobat AI Assistant.

For more information, check out the IRS' tax filing website.

Step 1: Confirm the PDF packet is complete

Before you ask Acrobat’s AI Assistant anything, make sure you’ve opened the complete return and not a brief filing summary or confirmation page.

In Acrobat on desktop, scroll the first few pages to confirm you can see Form 1040 (tax year 2025) and then the attached schedules/forms that apply to you.

If your tax software exported multiple PDFs, combine them into a single packet first. AI tools work best when they can follow totals through the same document, and you’ll find it much easier to jump between things.

Step 2: Generate a plain-English summary

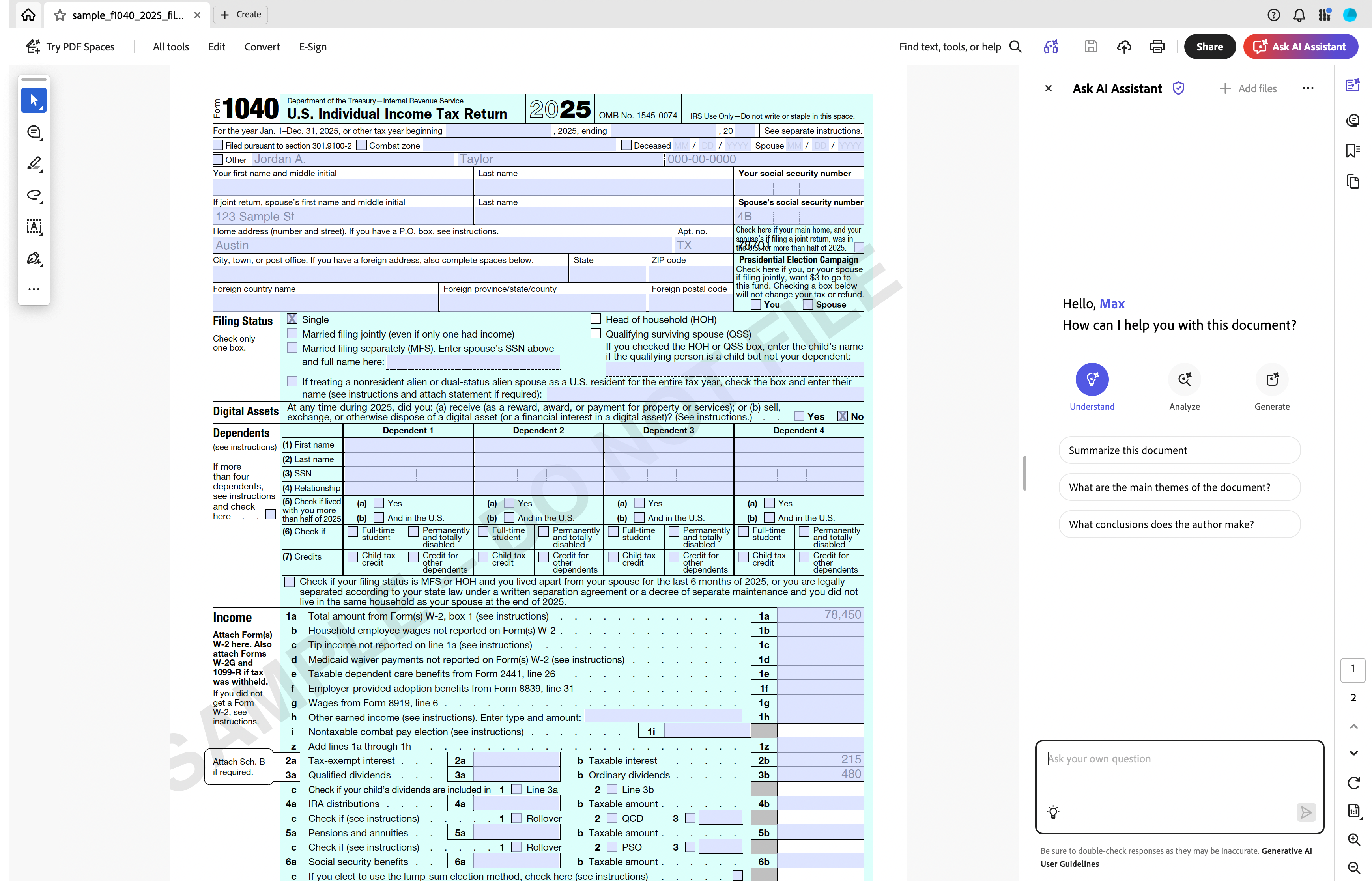

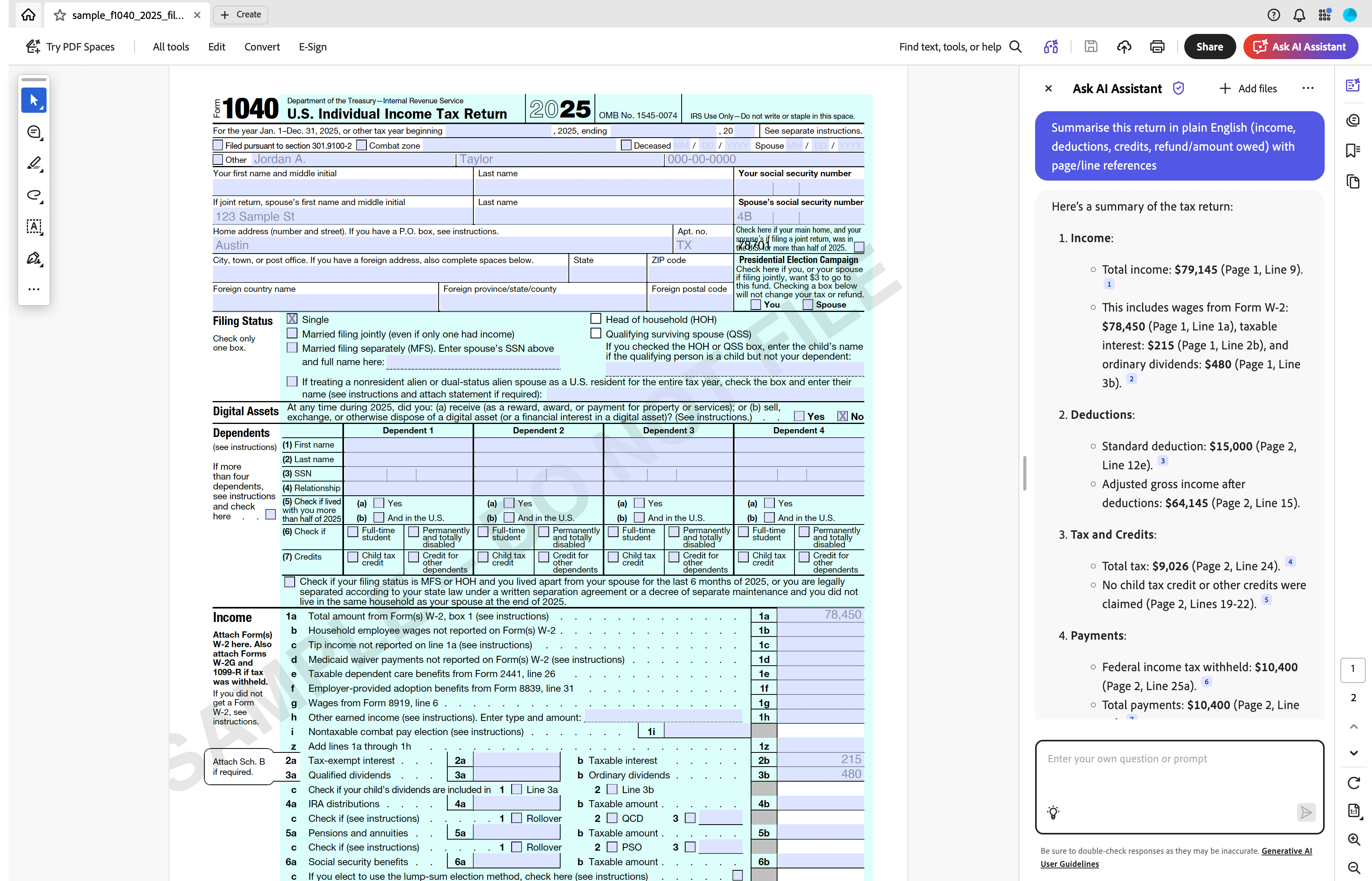

Once you know you’re looking at the right document, use Acrobat AI Assistant to produce a high-level summary of what the return is saying in plain English.

The point isn’t to “approve” the numbers for you, but to surface the headline figures quickly, making it easier to spot anything that feels off before you dig into line-by-line checks.

Prompt to use in Acrobat AI Assistant: "Summarise this return in plain English (income, deductions, credits, refund/amount owed) with page/line references."

If you need something more custom or specific, change the wording of the prompt to include that, and you can take multiple stabs at getting it right.

As you read the response, look for obvious surprises. For example, the wrong filing status, a deduction type you didn’t expect, or a refund/amount owed figure that doesn’t match what your tax software showed on the final screen.

If something looks wrong, click through to the referenced pages in the PDF and confirm what’s actually on the form.

Step 3: Extract a "key numbers" table

Now it’s time for the most useful sanity check in the whole process: extracting the headline totals from Form 1040 into a simple table, then verifying them directly on the form.

Prompt to use in Acrobat AI Assistant: "Create a table of the main 1040 figures (AGI, taxable income, total tax, payments, refund/amount owed) with the page/line for each."

As with the prompt above, add any additional information to the prompt for a more customised output.

When the table appears, keep it open and click through the PDF to confirm each line item yourself. Treat the AI output as a starting point, not the authority.

Step 4: Cross-check schedules

With the headline figures checked, the next job is confirming that any attached schedules are feeding into Form 1040 where they should.

Prompt to use in Acrobat AI Assistant: “For each schedule or form in this PDF packet, tell me which Form 1040 line(s) it feeds into, and list the totals that should match.”

As you work through the list, do a simple, visual confirmation: click to the referenced schedule total, then jump to the corresponding 1040 line and make sure the figures match exactly.

In general, if AI flags a mismatch, assume it could be a reading error first, but treat it as a nudge to re-check the calculation chain.

Step 5: Reconcile against your source documents

At this point, you’ve checked that the return is internally consistent, so now you want to confirm it matches the documents it’s based on.

Acrobat AI Assistant can’t tell you whether something is missing unless you have a point of comparison, but it can quickly locate where key totals appear.

Prompt to use in Acrobat AI Assistant: “Find where wages and federal income tax withheld are reported in this PDF packet, and where totals for interest, dividends, and any 1099 income appear. List each figure with its page/line."

Use the results as a checklist, then compare the numbers to your W-2 and 1099 statements. If you spot a mismatch, go back to your tax software or preparer’s workflow and correct it there.

Step 6: Check for errors

Okay, we promise you're nearly there...

Even if the main totals look right, it’s still worth doing one final sweep for the kinds of issues that are easy to miss when you’ve stared at the same PDF for the past hour and a half.

Prompt to use in Acrobat AI Assistant: “Scan this return for potential issues: missing checkboxes or blank required fields, duplicate forms, totals that don’t match between schedules and Form 1040, and so on. List each concern with the page reference.”

Once the AI returns its feedback, check each against your original documents.

Should I use Acrobat on desktop or mobile?

Desktop Acrobat is best for a full review because you can keep the AI chat open while jumping between pages and cross-checking schedules without losing context or your place in the document.

We recommend using Acrobat on the web or mobile for quick spot checks, not the main audit. Filing your taxes definitely feels like more of a "desktop job".

Privacy and limitations

A tax return PDF contains some of your most sensitive personal information, so keep this workflow on a trusted device and avoid public Wi-Fi or shared computers. Make sure to store drafts somewhere secure.

And while Acrobat AI Assistant is useful for summarising and locating figures, we should note that it can misread tables or infer the wrong context, so please always verify anything important.

As we said at the start, Acrobat AI Assistant is not a tax software substitute.

FAQs

- Do I need Acrobat Pro? Not necessarily. AI Assistant is typically an add-on.

- Will Acrobat AI change my tax return? No, it analyses what’s in the PDF and responds in chat.

- Can it check my state return too? Yes. If your state forms are in the same PDF packet, you can run the same prompts.

- What if my return is password locked? You’ll need to open or unlock it in Acrobat first.

- Can Acrobat AI tell me if I’m “doing taxes right”? No. The tool is best for summarising, locating, and consistency-checking.

TechRadar Pro created this content as part of a paid partnership with Adobe. The company had no editorial input in this article, and it was not sent to Adobe for approval.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Max Slater-Robins has been writing about technology for nearly a decade at various outlets, covering the rise of the technology giants, trends in enterprise and SaaS companies, and much more besides. Originally from Suffolk, he currently lives in London and likes a good night out and walks in the countryside.