Huawei to cut smartphone production targets for 2021 - who'll gain the most?

US sanctions take a toll

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

Huawei has put some great smartphones in the past such as the Huawei P30 Pro. Amidst the US sanctions hitting the company's access to chips and semi-conductors, reports now suggest that Huawei's smartphone production targets for 2021 could be cut by as much as 74% compared to it's expected shipments this year.

The company targets to produce only about 50 million devices as against 190 million units estimated to ship in 2020 and the 240 million units it had shipped during 2019, South Korean media reports said quoting local subcontractors to the Chinese brand.

The reduced shipment target is largely due to the US sanctions that effectively bars Huawei from sourcing semiconductors starting September 15. Both Samsung, LG and HK Hynix have already stated that they would stop shipments, leaving Huawei with the limited option of acquiring DRAM and NAND flash chips.

- Forced out of 5G race, Huawei now eyes PCs, smart screens

- Huawei MatePad T8 launched in India

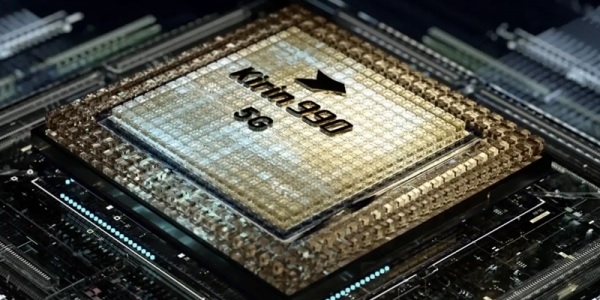

- Huawei’s 2021 flagships might not be powered by Kirin chipsets

A report published on South Korean news site The Elec quoted unnamed sources in among Huawei's subcontractors in the region to reveal that the company plans to manufacture only 50 million smartphones during 2021. The direct co-relation to the US ban is a result of Huawei using chips from its inventories but not having access to enough of the latest processors that its rivals would have.

When the US had imposed the sanctions initially, it did not apply to memory chip makers. However, the Trump administration added semiconductor manufacturers using hardware or software technologies from the US, had to seek and obtain special permission from the State Department to do business with Huawei.

Although the original sanctions didn’t apply to memory chip manufacturers, the new rules imposed by the US government state that any semiconductor company that uses hardware or software technologies from the United States has to obtain approval from Washington before trading with Huawei.

Though Chinese smartphone makers have complained of growing delays in the import of parts in India due to the federal government's stricter norms, Huawei isn't one of the affected companies, given that their share in India's growing mobile phone market is way below others such as Xiaomi, Oppo and OnePlus.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

In comparison, the markets hare for Huawei's smartphones in 2019 saw sales from Europe accounting for 24% (206 billion Chinese yuan), a figure that could drastically drop this year and the next. Over the years, the company had launched its flagships first in Europe before expanding it to other geographies.

Samsung or Xiaomi?

An immediate beneficiary of Huawei's reduced numbers in Europe will be Samsung which, while retaining its top slot, saw shipments during January-June 2020 decline. The Korean tech major is reportedly aiming to ship 300 million smartphones across Europe in 2021, based on the gap left by Huawei's problems.

Samsung had shipped 295 million smartphones in 2019 and has set a reduced target of up to 260 million devices this year, a decline caused by the Covid-19 pandemic. It could be the top challenger for filling the supply gap in India, where Huawei holds a 2.5% marketshare as against Samsung's nearly 20% share in 2019.

However, it remains to be seen if Samsung can aim for a larger share in Huawei's local market. In 2019, the Chinese giant had accounted for 59% of the market and any drop in numbers may not benefit the Korean company, which had shut down its smartphone manufacturing in China since late last year.

Therefore, it is more than likely that Xiaomi could be the biggest beneficiary from Huawei's troubles. The company has also taken a share of the European market by becoming the largest mover of devices to the region. Market research firm Canalys indicates that Xiaomi's share in shipments grew by 65% in the second quarter.

From an Indian perspective, Huawei's challenges on the smartphone front is minimal compared to the issues it faces vis-a-vis the 5G network development. Companies such as Samsung, Apple, Karbonn, Lava and Dixon have sought approvals from the federal government to export devices worth $100 billion from India.

Apple and Samsung plan to export phones worth $50 billion each over the next five years. Samsung exports around $2.5 billion phones from India currently and is setting itself up ramp up its production. Samsung is contemplating a plan that would make India its smartphone production hub.

A media veteran who turned a gadget lover fairly recently. An early adopter of Apple products, Raj has an insatiable curiosity for facts and figures which he puts to use in research. He engages in active sport and retreats to his farm during his spare time.