How to buy Bitcoin

Our rundown of all the ways you can buy Bitcoin

Bitcoin is the world's first and most famous cryptocurrency and the sudden rise in price has meant more people than ever are looking to own the virtual currency.

There are multiple methods by which you can acquire Bitcoin, including setting up a PC to mine it yourself, paying for a professional mining contract, or trading in an altcoin.

Alternatively, you can simply buy Bitcoin with your local currency via a crypto exchange, of which there are many.

- Here's our list of the best mining rigs out there

- Check out our guide on how to mine Bitcoin on your Android smartphone

- We've built a list of the best mining GPUs on the market

Since Bitcoin is not a physical currency, but a virtual one, it also needs to be held in a digital wallet.

While some exchanges also provide a digital wallet feature, we do not recommend this route. In the past, cyberattacks on crypto exchanges have seen millions in cryptocurrency stolen, but a non-custodial wallet gives you total control of your holdings.

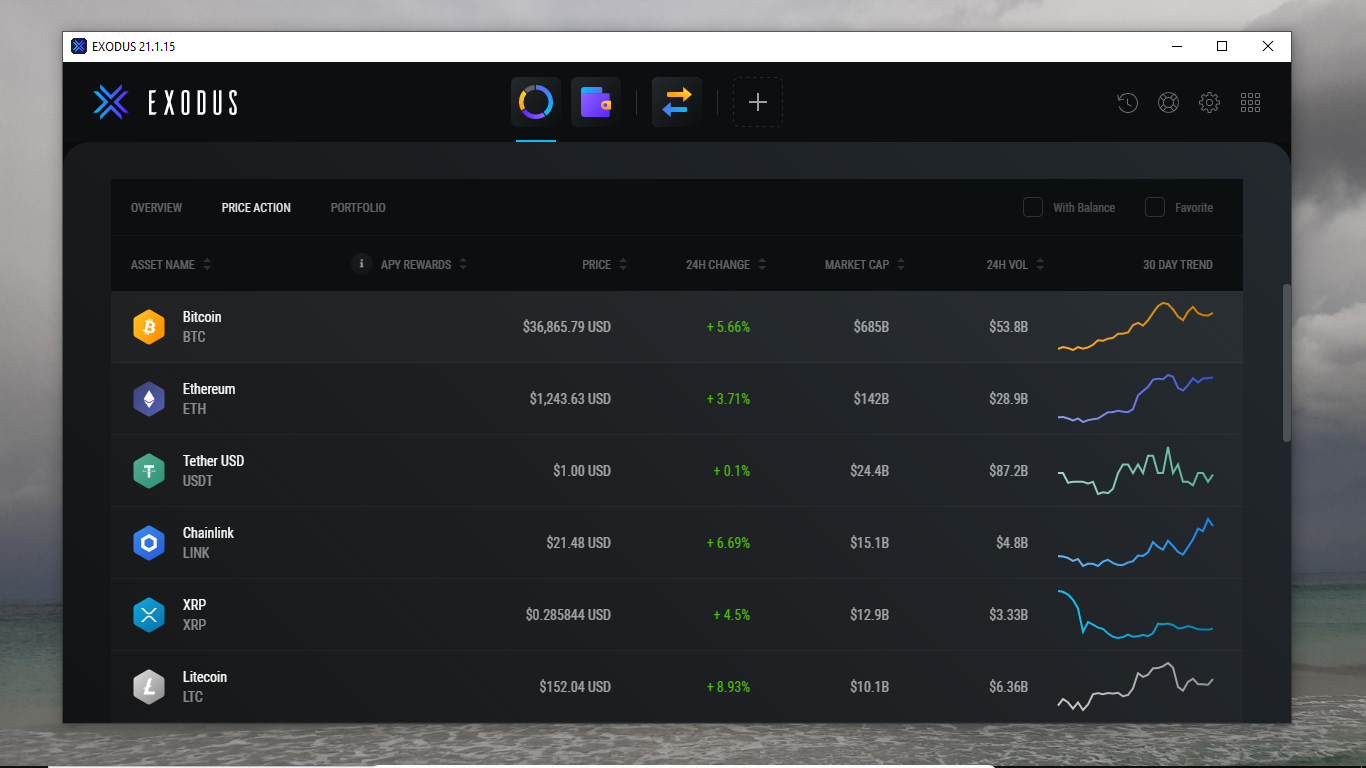

A leading example is the Exodus wallet, which supports multiple different cryptocurrencies and sets itself apart with design features aimed specifically at newcomers to the world of crypto.

Bitcoin exchanges

In order to purchase Bitcoin, you'll need to go to a Bitcoin exchange that deals in your own fiat tender (i.e. your national currency).

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

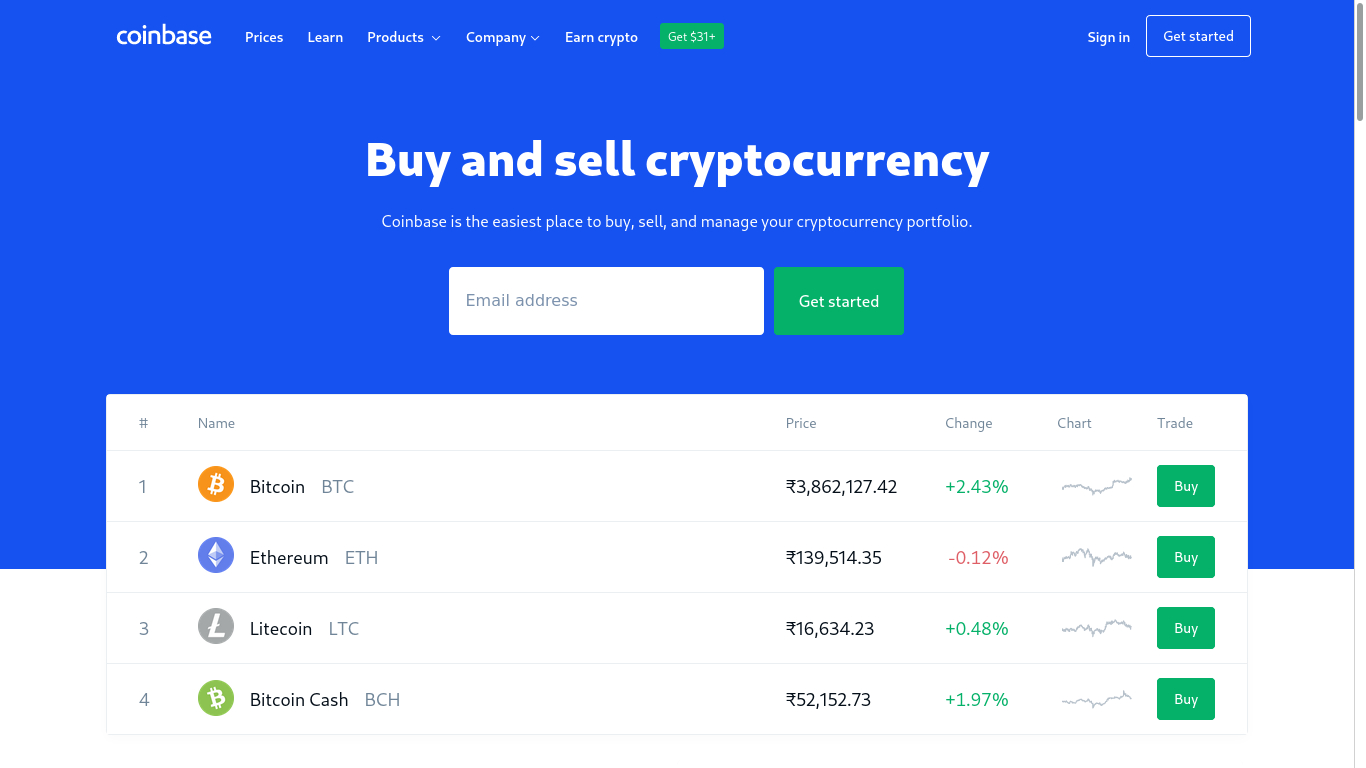

A popular option is Coinbase, which has an excellent track record, has exchanged over $455 billion into crypto and is available in more than 30 countries.

In order to perform a purchase on the Coinbase exchange, first you must set up an account. This requires some basic information to be supplied: a name, email, password and location (to make sure your particular location is supported). You also need to be 18 years of age or older.

Once the account is created, the next step is to link it with a bank account. Purchases can be made from the linked bank account or with Mastercard and Visa credit cards.

Users then decide how much Bitcoin they would like to purchase. By default, the value of Bitcoin is shown in US dollars, though this can be changed under account settings.

After purchasing Bitcoin, we strongly recommend you transfer it from Coinbase into a wallet under your own control, whether a hot wallet or cold wallet.

However, note that transferring crypto to an external wallet outside Coinbase will incur a fee that Coinbase calculates based on the prevailing mining fee.

While Coinbase is a popular place to purchase Bitcoin, it’s hardly the only exchange in town. Other exchanges and platforms that offer this service include eToro, SoFi Invest and Robinhood.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Although many options are available, users should only deal with regulated Bitcoin exchanges (which display all credentials on their site).

Bitcoin ATMs

While an online exchange is the most common way to purchase Bitcoin, there are certainly other options available.

Bitcoin Depot, for example, offers a series of ATMs across several states in the US that facilitate the purchase of the virtual currency. This is hard to beat for convenience if you happen to be located close to one of these Bitcoin ATMs. The purchasing process is a breeze; it’s as easy as depositing your cash into the machine, then you own the Bitcoin once the purchase is confirmed.

However, users complain of high transaction costs of about 9%, not to mention a lack of support when an issue arises, and furthermore, unfavorable dollar to Bitcoin exchange rates that are not disclosed upfront.

Despite these shortcomings, the Bitcoin ATM is a growing trend with over 15,000 of these specialized ATMs installed worldwide, with a majority of them in the US, according to Coin ATM Radar.

Furthermore, the number of Bitcoin ATMs is increasing at a healthy rate, so chances are a machine could be near you in the not too distant future.

LibertyX and investment funds

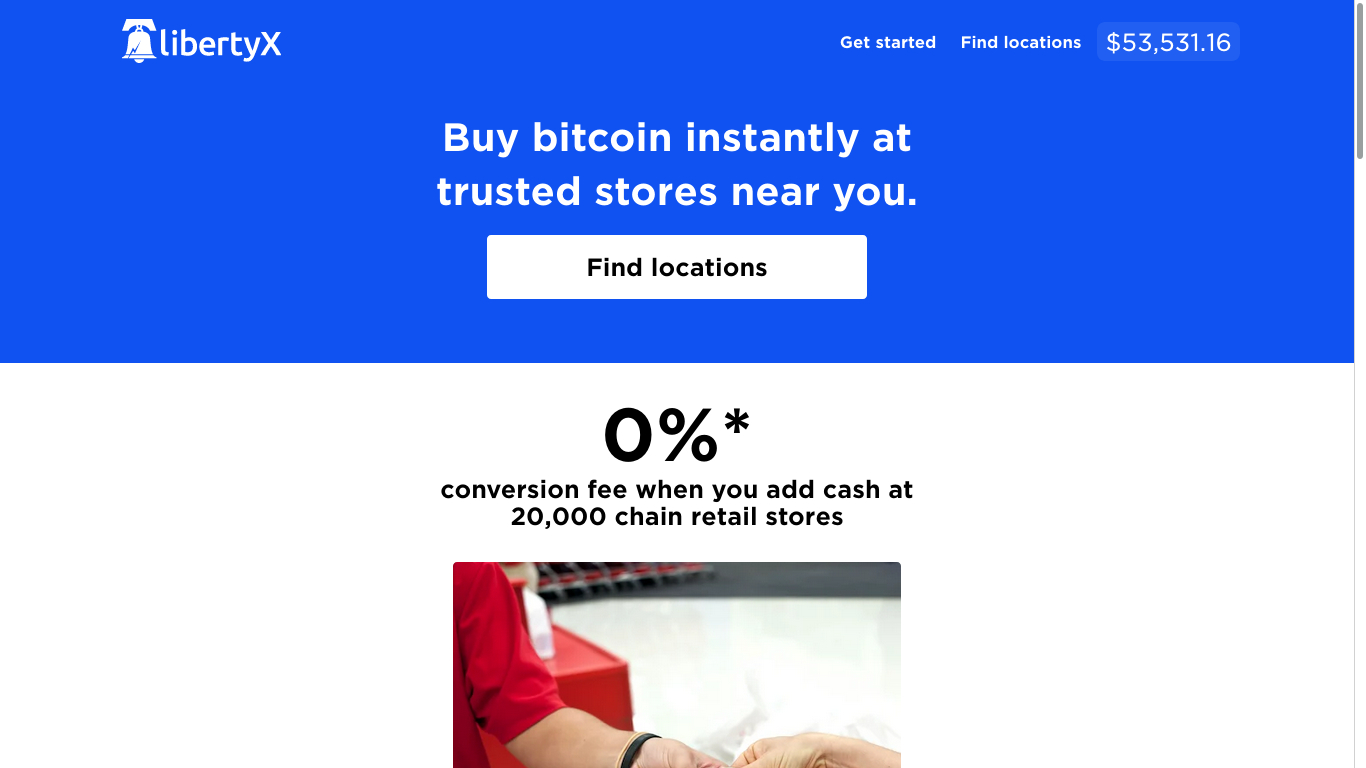

For those looking for something more personal than a Bitcoin ATM or online transaction, LibertyX offers Bitcoin purchases at retail stores, a service more akin to a Western Union or Moneygram.

So far this is limited to the US, but LibertyX has over 20,000 locations in the country. After users go through a verification process, including providing their mobile phone number, their cash can be changed to Bitcoin, with the reassurance that a clerk is there in case something goes awry. Users can search on the LibertyX website by zip code to find a local retailer near them.

Some folks prefer to invest with expert oversight, by putting their money in investment trusts or funds that pool the resources of a number of investors and own a range of assets to minimize risk.

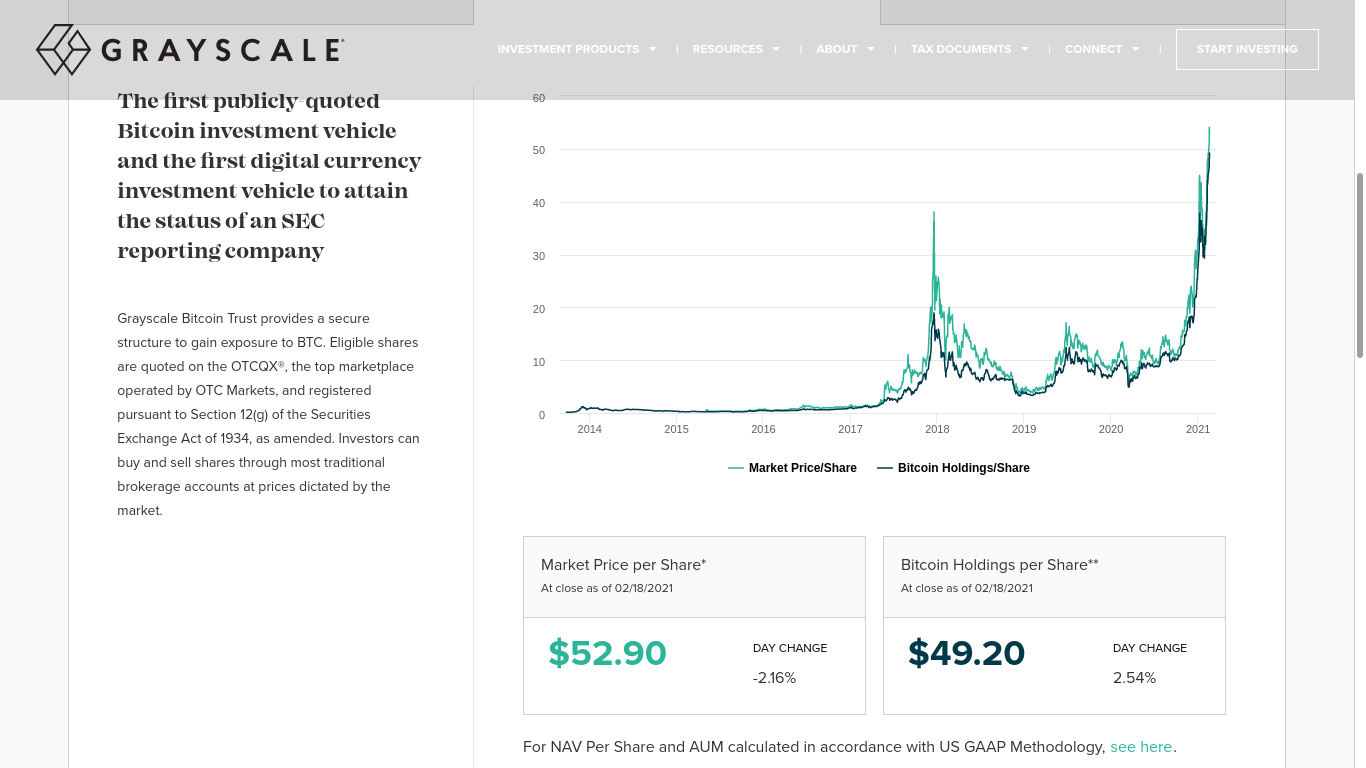

Grayscale’s Bitcoin Investment Trust applies this approach to cryptocurrency trading, claiming to be the “first publicly quoted Bitcoin investment vehicle” . It gets traded on the OTCQX, which is the highest tier of the OTC Markets Group for trading over-the-counter stocks.

This fund has been around since September 2013 and now has over $34.0 billion worth of assets under management (AUM). While most would not recommend it as a safe investment, but rather consider it more speculative, the YTD performance as of February 2021 (+65.31%) is certainly solid.

With so many options available, Bitcoin is easier to acquire than ever before. It is no wonder that people from all walks of life are buying, owning, and yes, even spending Bitcoin.

As ever, though, it's important never to invest more than you can afford to lose, especially when it comes to a volatile asset like Bitcoin.

- Here's our list of the best cloud mining services right now

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.