How to choose your perfect invoicing software

Looking to fine-tune your finances? Here are some of the key considerations when comparing invoicing software

Invoicing software is a vital bit of kit, because it's often the first thing that business owners and clients deal with when getting paid.

Whether you're a freelancer/sole-trader, a small business owner, or you're running a much bigger operation, good invoicing software helps ensure you're making a strong impression.

Much more than that, though, the best invoicing software can help you track payments and manage your cashflow more effectively.

Save time and unlock growth with integrated business tools and AI automation all in one place. See our plans and pricing here. No commitment, cancel anytime and free human product support.

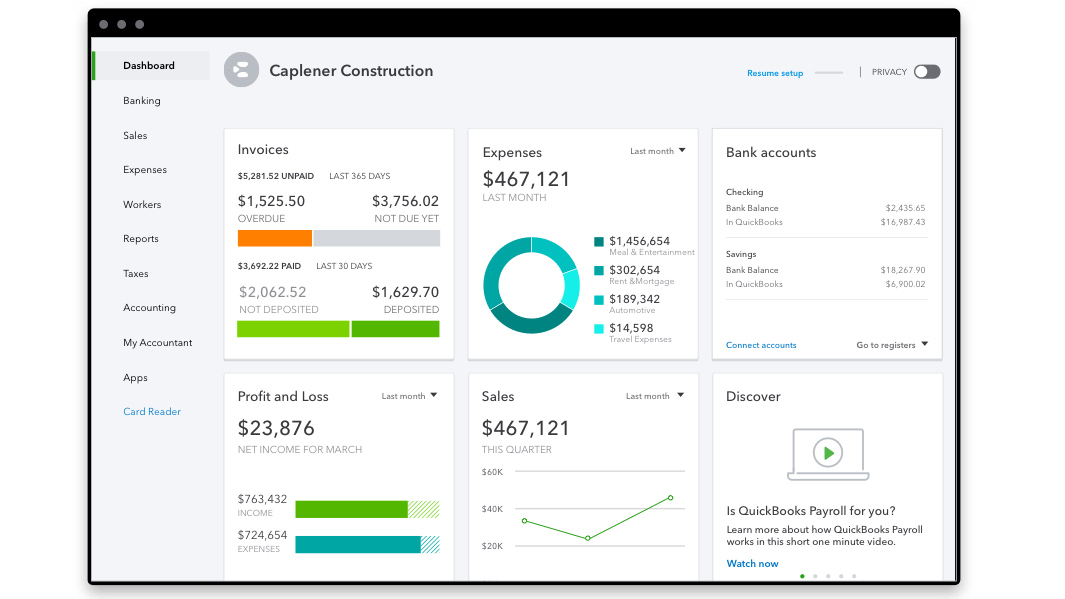

Also, be aware that some invoicing software gets bundled with further accounting tools. Having everything under one roof is one way to save money if you need all the features on offer.

Use this guide to prompt you to consider some of the features that the best invoicing software offers, and take it from there to separate what you need from what you can save money on.

What is invoicing software?

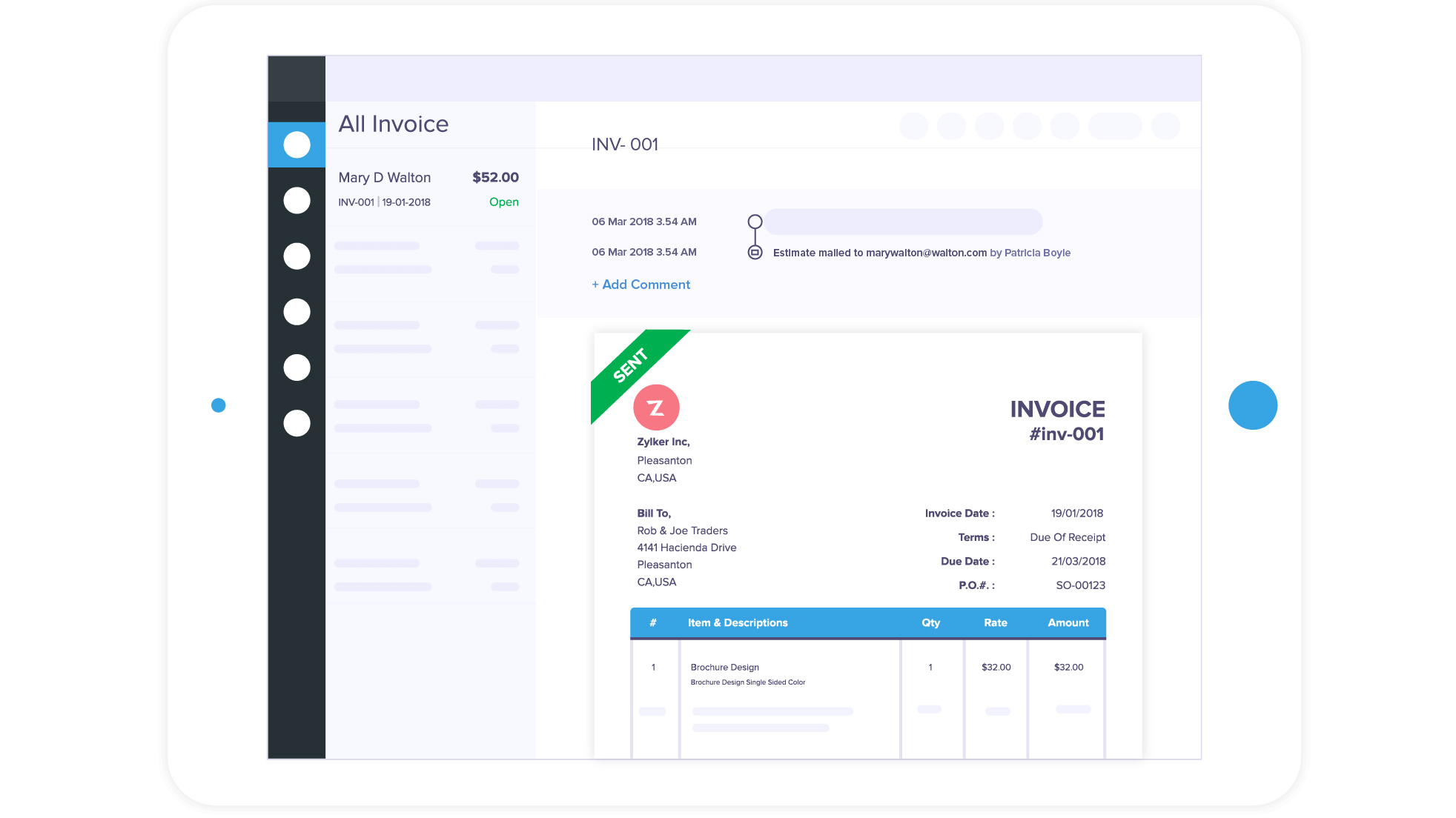

Invoicing software is primarily there to help you design and generate invoices. You should be able to create your own template, using your branding, logo, typeface, and colour palette, so that you can quickly recreate professional-looking client bills with ease.

Behind the scenes, you will often be able to save key products that you come to time and time again. So instead of remembering how much you charge or referring to a price list saved elsewhere, you can just tick a box and select the quantity to automatically include those services or products in your invoice.

These documents should also be tailored to your client – whether that's simply including their details so they know it's defined for them, or giving them quick access to your payment terms or payment methods to reduce the friction involved with paying a bill.

Why choosing the right invoicing software matters

We've already covered many of the key functionalities of good invoicing software, but choosing the right suite matters much more than just creating bills.

There are further, secondary benefits to speak about, such as reducing late payments associated with slow invoicing or difficult payment methods, a more professional look to establish repeat business, and better record keeping for when it comes time to report back to the HMRC.

What are the key features to look for

Custom invoice templates

No two businesses are the same, so you should have some sort of an admin portal where you can set up invoices to adhere to your own branding.

Look for things like logo uploads and custom colours and fonts, but also support for multiple invoice layouts. This helps your business not only look professional but also build trust and reputation with your clients.

Online payments

Whether your invoicing software offers its own solution or integrates with third-party software, it's a good idea to make payments as easy as possible.

Digital invoices may include links, and paper copies may include QR codes. The more payment methods your business can support, the better – so seek software that works with conventional card payments, open banking payments, PayPal, and mobile wallets like Apple Pay or Google Pay.

Automatic reminders

Late payments are more common than you think, so automated reminders can certainly help.

Check if the software allows you to schedule reminders, customise messages, and send nudges before the due date. Sometimes, friction like complex payment methods prevents speedy payments, but sometimes customers just forget.

Recurring invoices

If your business charges clients regularly, then recurring invoices are a must.

They're ideal for monthly retainers, subscription services, or ongoing contracts, so instead of sending one out each time, the system will automatically generate one for you.

Saving time is key because wasting time on invoicing won't generate you any extra cash.

Expense tracking

We all know that some expenses are allowable under HMRC's guidance, so we can ultimately pay less tax on items or services we bought for business needs.

However, if you're buying these products for a customer (for example, a plumber may need to install certain hardware), then you can link these costs to a specific job. It's not essential, but it improves transparency, which may lead to repeat custom.

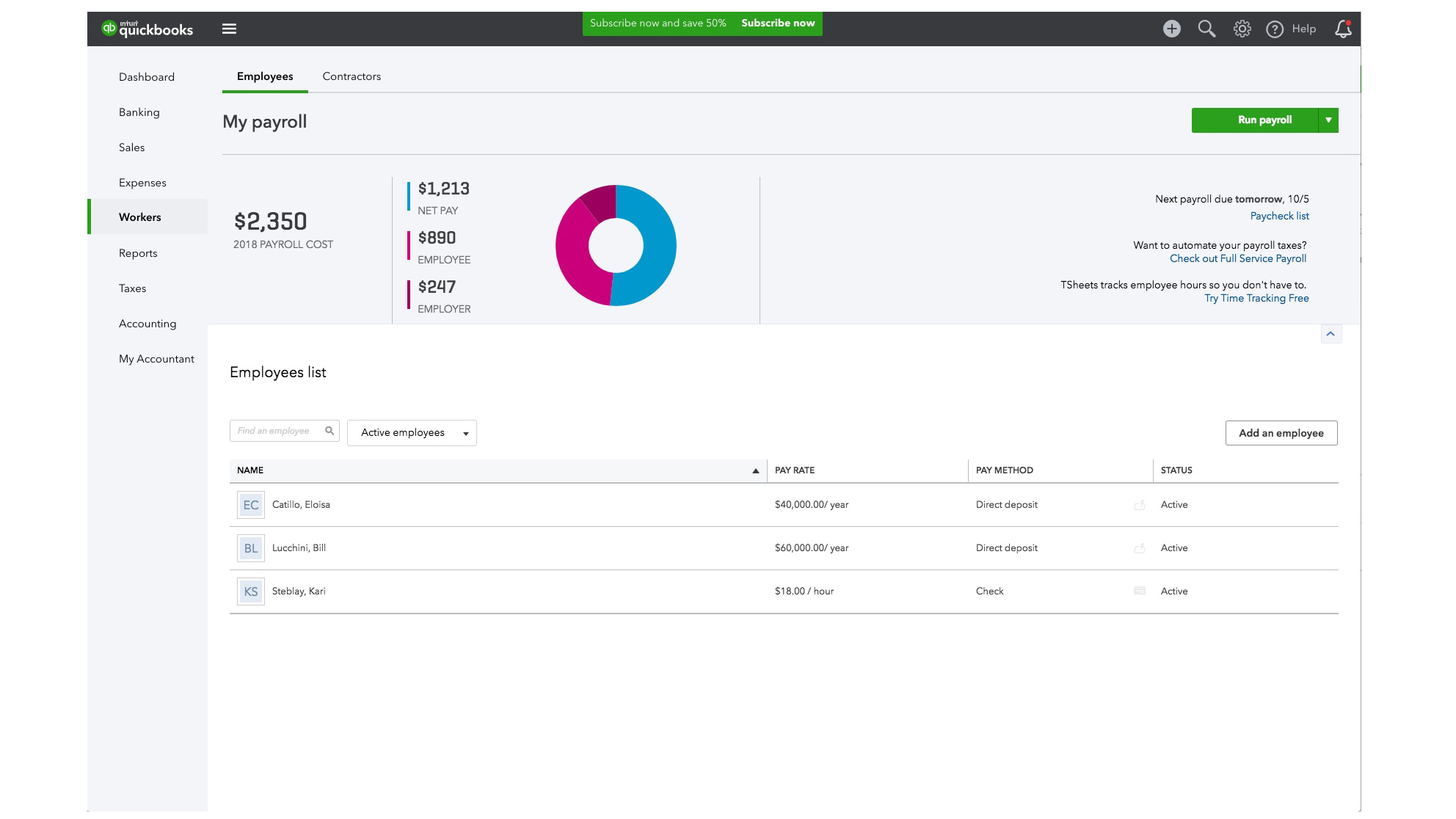

Reporting and insights

Beyond getting paid, you'll need to refer back to your finances in the future to pay the relevant taxes.

Whether it's quick visibility across outstanding invoices, summaries of your monthly income, or payment history for individual clients, you can unlock some pretty potent insights from your data.

HMRC compatibility

The Government is asking more and more business types to report back to it throughout the year, and much of this falls under the new Making Tax Digital (MTD) directive.

Even if it doesn't affect you now, it might in the future, so seek an MTD-compliant suite to avoid a future migration.

Mobile access

Sometimes a big screen is good for a more detailed view, but if you're on the road a lot, being able to generate invoices on the go and check whether your client has paid from a mobile app or optimised website speeds things up a little.

How much does invoicing software cost?

Prices vary depending on the features you need and also the size of your business or the number of accounts that need access to the platform – often known as 'seats'.

There are free versions around if you only need the basics, but expect to pay more for higher-end features. You'll generally see seasonal discounts and free trials, too.

Some things worth watching out for are charges for adding extra users (not really relevant to sole traders) and VAT/tax tools.

If you plan on taking payments through the software, check for any payment processing fees, as these may be higher than if you were to use other payment gateways.

Summary

It might seem like a pretty simplistic necessity, but choosing the right invoicing software can make a considerable difference later on down the line when you want to integrate it with accounting software, send payment reminders or check revenue patterns.

Instead of looking at your business in isolation today, we recommend considering how things may change as you grow to save you from having to go through the whole saga of picking more suitable invoicing software later on.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

With several years’ experience freelancing in tech and automotive circles, Craig’s specific interests lie in technology that is designed to better our lives, including AI and ML, productivity aids, and smart fitness. He is also passionate about cars and the decarbonisation of personal transportation. As an avid bargain-hunter, you can be sure that any deal Craig finds is top value!