From hype to hibernation - what happened to the NFT crypto art craze?

NFT frenzy: Rise, Fall, Uncertainty

Three years in, and the 2020s are already shaping up to be a decade to remember, producing plenty of fads such as the cryptocurrency phenomenon and NFTs.

NFT stands for “non-fungible token” which doesn’t help clarify a whole lot. But, what happened to them?

NFTs are actually unique digital entities which exist on a blockchain during its circulation. A blockchain is an ongoing ledger which contains lists of records of uniquely identifiable digital entities like crypto coins and NFTs. That’s the “non-fungible” part of the term, meaning it can’t be replicated (which itself is debatable to those of us that appreciate the screenshot function).

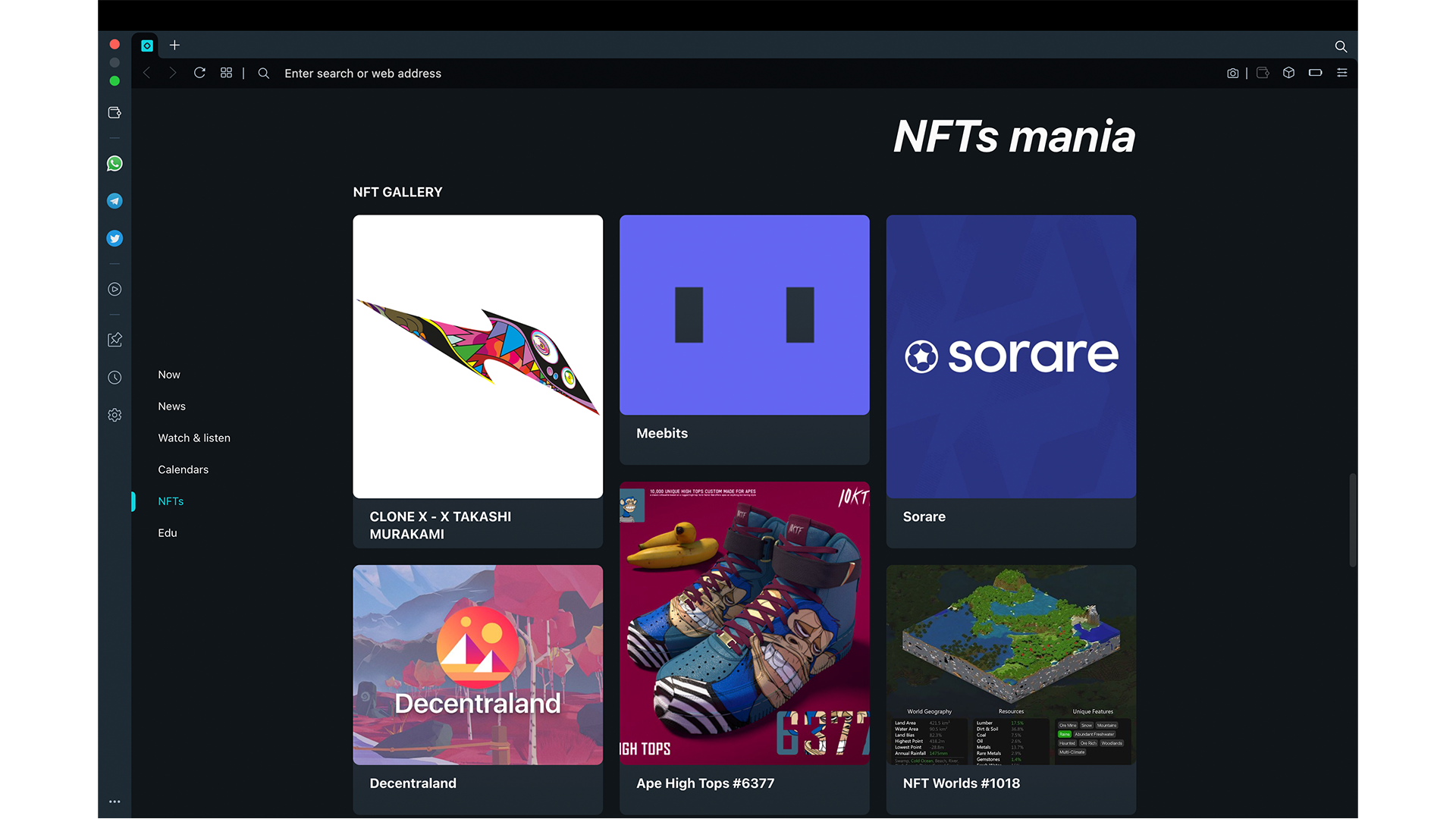

They came to the public attention and enjoyed huge popularity in 2021 and 2022. You may even have heard of Bored Ape NFTs, a collection of digital illustrations depicting, you guessed it, apes in a variety of seemingly random costumes. There was a sort of mini gold rush, especially after the explosion of Bored Ape NFTs, to launch the next must-have collection.

Those digital drawings could really get up there in price, and collectors tried to push them as the next evolution of art. Everydays: the First 5000 Days by Beeple sold for $69.3m to a single owner and The Merge by Pak was sold for $91.8m to 30,000 collectors that pooled their funds together, according to Dextero.

The economy NFTs created has sparked plenty of debate about the social, societal, and artistic merits of the scene.

A rude awakening after the daydream

Unfortunately (well, for the people who spent a fortune on them), it looks like NFTs haven’t become the next great art movement, and even celebs and other investors that championed NFTs have lost millions after buying them.

Sign up for breaking news, reviews, opinion, top tech deals, and more.

Now, a study by dappGambl, a community of blockchain enthusiasts that discuss aspects of the crypto market like crypto gambling, has put out an extensive report that claims that the NFT market has crashed. According to dappGambl, the “vast majority” of NFTs are now worthless.

The study looked at more than 73,000 NFT collections, and the results showed that nearly 70,000 of those (almost 96%) were valued at 0 ETH. ETH is short for Ethereum, the second biggest cryptocurrency after Bitcoin. However, zero times anything is still zero.

According to dappGambl, the “vast majority” of NFTs are now worthless.

Beyond that, the study goes on to claim that over 79% of NFT collections were never sold in the first place. The market phrase that Dextero (and other outlets) are using is “demand is outstripping supply” which is a jargon-y way of saying most NFTs aren’t worth very much at all, much to their creators’ dismay.

Dextero does try to throw NFT creators a bone by providing a counter to the study’s claim, saying that dappGambl’s analysis might be skewed as anyone can mint an NFT or a whole collection of NFTs.

It seems they’re implying that the sample of 73,000 could include a large number of these everyday-person-minted NFTs, which are not very attractive to buyers.

But what if you look at the “top” NFTs? dappGambl also analyzed the top 8,850 NFT collections according to CoinMarketCap, a top cryptocurrency price-tracking app. It found that 18% of these collections are valued at the floor price of $0.

Meanwhile, 41% are “modestly priced” in the range of $5 to $100. Less than 1% of the analyzed NFTs hold a price of over $6,000. If you compare that to some of the eye-catching big-ticket sales of NFTs’ heyday, it’s quite a tumble.

Dextero reports that throughout 2021 and 2022, the NFT market was trading at above $2 billion a month. That has fallen to $80 million, which considering the distribution of values that dappGambl suggests, it still means a pretty large volume of NFTs being traded. Just that they’re not worth a great deal individually.

What happens next? (Who knows?)

Trying to predict if this is NFTs’ swan song is hard, but things don’t look so hot at the moment and it’s unclear if they’ll ever pick up steam again. Bitcoin has seen huge rises and falls in price, and NFTs might have a similar up-and-down pattern, too.

In any case, if you invested in any NFTs, it would perhaps be wise to check how they’re doing price-wise and if they hold any value, and perhaps sell them while you can still get some money for them.

YOU MIGHT ALSO LIKE

Kristina is a UK-based Computing Writer, and is interested in all things computing, software, tech, mathematics and science. Previously, she has written articles about popular culture, economics, and miscellaneous other topics.

She has a personal interest in the history of mathematics, science, and technology; in particular, she closely follows AI and philosophically-motivated discussions.