What is Bitcoin? Understanding BTC and other crypto-currencies

Everything you need to know about Bitcoin

TechRadar is supported by its audience. TechRadar does not endorse any specific cryptocurrencies or blockchain-based services and readers should not interpret TechRadar content as investment advice. Our reporters hold only small quantities of cryptocurrency (under $100 in value), as is necessary to perform wallet and exchange reviews, and do not hold shares in any publicly listed cryptocurrency companies.

Bitcoin has grabbed headlines over the past year for its massive spike in value and the ensuing rush to regulate it. However, the real story is the degree to which Bitcoin democratizes global financial systems.

Bitcoin is not just a cryptocurrency, but also a new financial system comprising many components. It was invented in 2008 by the mysterious Satoshi Nakamoto and released shortly after to the public.

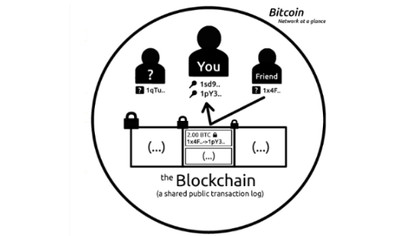

Most importantly, Bitcoin is not controlled or owned by any individual, corporation, or government. It extensively uses cryptography and relies on a peer-to-peer network.

What is Bitcoin?

While Bitcoin may often be referred to as anonymous money, its blockchain is also perfectly transparent and may be inspected by anybody at will. That apparent contradiction makes it a revolutionary way for people around the world to realize greater financial freedom: Bitcoin does to money what the internet did to information by providing indiscriminate access to a decentralized financial system.

- Here's our list of the best mining rigs out there

- Check out our guide on how to mine Bitcoin on your Android smartphone

- We've built a list of the best mining GPUs on the market

The Bitcoin protocol lays out the rules of this financial system, including how many Bitcoins can exist, and how they are created and transferred between participants. This protocol is incredibly difficult to change, as any change requires overwhelming consensus from its participants.

Bitcoin software refers to programs that use the Bitcoin protocol to verify its rules and individual transactions. These programs act as nodes in the distributed Bitcoin network. Nodes can also act as miners, meaning they will use cryptographic proofs of burned electricity to secure the network, for which they are rewarded with newly minted Bitcoin.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Virtual money, real impact

The idea is that you use cryptography to control the creation and transfer of money, rather than relying on central authorities.

Since the success of Bitcoin, there have been over 8,000 other virtual currencies (as of February 2021) introduced with varying degrees of success and popularity such as Ethereum, Litecoin, Monero and Dash. There have even been crowdfunded cryptocurrencies such as Lisk.

Many other cryptocurrencies have just died because of lack of interest, and the simple fact that no one used them. Non-Bitcoin cryptocurrencies are collectively known as altcoins and they are more or less based on the same idea of a decentralized digital medium for exchange.

Their success depends on how much ‘cash’ (the total value of transactions) they have sloshing about the peer-to-peer network (i.e. the virtual economy). Since Bitcoin is open source, anyone can develop their own cryptocurrency using the same technology.

A short lesson in scarcity

Bitcoins derive their value partly through their scarcity, which is defined by a cryptographic lottery. You can buy Bitcoins on online cryptocurrency exchanges or you can earn them through a process known as ‘mining’.

Since Bitcoin is not a physical currency, but a virtual one, it also needs to be held in a digital wallet, which can be be a hot wallet or a cold wallet.

Bitcoin mining programs compute an encryption function called a hash on a set of random numbers. Coins are awarded to whichever miner happens to compute a number below a certain threshold.

Originally, Bitcoin mining was handled by standard PCs with powerful graphics cards, but as the hash difficulty has increased, the preferred method to mine Bitcoins is to employ a Bitcoin ASIC, a chip that has been designed specifically for this task. However, with the higher value of cryptocurrency – in particular Ethereum – and recent advances in GPU processing power, miners have once again been turning to graphics cards for mining.

This lottery favors those with the biggest and fastest machines, and as of February 2021 there are over 18 million Bitcoins in circulation. Note that the total number of Bitcoins in (virtual) circulation will never exceed 21 million because of the way the system was designed.

As the Bitcoin network gets bigger, the hash gets more complex, and miners get fewer Bitcoins for their trouble, hence they always need better hardware and higher Bitcoin prices to make it worthwhile.

Over the years, Bitcoin has also improved its profile as a currency. In fact, as per a 2020 survey by HSB, 36% of small-medium businesses in the US now accept Bitcoin.

Since Bitcoins can be spent on the internet without the use of a bank account, they offer a convenient system for anonymous purchases, which also makes it possible to launder money and buy illegal products. Since there is no money stored anywhere, accounts can't be frozen by police or PayPal administrators.

That said, since the use of Bitcoin can be tracked, cryptocurrency exchanges that operate under federal regulations have been known to lock out users who use their Bitcoins for illegal activities.

While once a curiosity of the internet, Bitcoin and other cryptocurrencies are considered by some to be the money of the future. However, over the last several years, Bitcoin has certainly had its ups and downs – literally.

Ideal for small transactions?

Bitcoin was once regarded as an ideal system for small electronic payments – so-called micropayments – as it is difficult to transmit small amounts of currency efficiently with existing systems. Credit card fees, also known as swipe fees, can often exceed the value of the purchase, making this costly for retailers. However, the steadily increasing transaction fees for Bitcoin (also known as miner’s fee) have proved to be a barrier preventing it making inroads into the world of micropayments.

Another problem with Bitcoin is the volatility of its value which exceeds the volatility of other currencies and gold, resulting in huge fluctuations in comparison to the US dollar. In 2013, the value of Bitcoin went from $10 to over $1,000 and in February 2021 is around an eye popping $50,000!

Because its supply is ultimately limited, prices will need to vary to accommodate shifts in demand, not the other way round. Unlike gold, Bitcoin has no intrinsic value from alternative uses that could anchor its price.

What caused the Bitcoin boom?

While Bitcoin has existed for some time, one of the earliest spikes had been largely attributed to the economic crisis in Cyprus. Cryptocurrency suddenly offered a more appealing way of housing money with the promise of constant access.

But while the extent of that relationship was debated, it was just the spark that lit the fuse. Dr Vili Lehdonvirta, economic sociologist and researcher of virtual economies at the London School of Economics, reminded TechRadar that the real culprit is the media for propelling the attention.

The irony doesn't escape us here, but it's still an important point to make.The limited number of Bitcoins means that inflation just doesn't happen. So intrigue leads to demand, and the only way is up.

"The question now," said Lehdonvirta at the time, "is how many people buying Bitcoin are buying it to start using it as a means of payment, and how many are buying it because they are hoping that the price will continue to go up in value?"

But with too many people looking to make a quick buck, a bubble burst has seemed imminent. More and more people want a slice of the Bitcoin pie, despite the fact that the currency is only accepted by a small but growing number of outlets.

"What Bitcoin needs to achieve is wider acceptance as a means of payment as an exchange mechanism," says Legdonvirta. "Until it does that, this kind of value driven up by people hoping to stash their money in a safe place from the tax man is not sustainable."

Is Bitcoin safe?

The cryptographic technique that Bitcoin is based on is the same type used by commercial banks to secure their transactions.

"The thing with Bitcoin is that it's purposefully designed to be non-manageable," Lehdonvirta adds. "There's an inbuilt algorithm which determines the number of Bitcoins in circulation at any given point in time."

So technologically speaking, it should be pretty robust. But there are always risks, and if loopholes were to be exposed, it could have dire consequences.

And it's because of these risks that Bitcoin hit the headlines for less positive reasons, when the virtual exchange Mt.Gox was hit with a DDoS attack by a group of hackers in 2013, and Bitcoin's value took a dip.

But as Lehdonvirta quickly reminds us, it's not just these sorts of attacks that are a problem - we need an eye on the future at all times.

Not fit for business?

As a currency, Bitcoin is not stable enough for most businesses. The value of a Bitcoin fluctuates dramatically and because there are no controls there is nothing to stop money vanishing if the price tanks.

Bitcoin payment processors, such as CoinsPaid offer a way of getting around this problem, as they convert the transaction to hard currency almost instantaneously. Many companies want regulation to provide them with some security and protect them from potential big losses on the cryptocurrency.

Bitcoin's future

There are some signs that governments are starting to look at regulations and this is clearly proving difficult.

All these factors are significant barriers which are diminishing Bitcoin’s chances of becoming a more widespread and popular currency. Major economies such as India are even mulling banning cryptocurrencies altogether, which will further have a negative impact on the virtual currency that is largely driven by sentiment.

Despite all this, Bitcoin's market capitalization touched $1 trillion in February 2021.

Previously, Goldman Sachs has said that it was more plausible that Bitcoin could have a significant impact in terms of its innovation on payments technology, "by forcing existing players to adapt to it or co-opt it."

However, the Goldman Sachs report also said that Bitcoin's ‘biggest hurdle’ will be maintaining its cost advantage in the face of greater regulation, higher operating costs, and competition from entrenched players.

Fitch Ratings came to a similar conclusion and found that Bitcoin stands to lose much of its appeal if Bitcoin companies are forced to deal with the added cost of regulation, rendering the near frictionless Bitcoin network much less cost-effective than it is today.

It seems that the sheer success of Bitcoin which has seen it leap from being a shadowy entity to an all-star affair overnight has also hurt its long-term viability. It remains to be seen if Bitcoin can move beyond its niche to gain wider acceptance, and for the time being the cryptocurrency remains quite volatile, and a gamble to investors that has been likened to the tech bubble of the 1990s.

- Here's our list of the best cloud mining services right now

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.