Best billing and invoicing software of 2025

Paid, online and free billing and invoicing platforms

We list the best billing and invoicing software, to make it simple and easy to manage your income and expenses.

Even better, many options cost little to use, or are even free for light use. Free trials are commonplace too, allowing you to test packages without commitment. This is a great route for startups or small businesses to see which option works best for them – and even enterprise versions are available.

Many of the best invoicing solutions run from the cloud, so there are usually no downloads, just a web portal from which your invoices and billing can be set up, accessed, sent, or edited using mobile apps. Crucially, this can be done no matter where you are located.

Additionally, it’s not just plain invoices that are provided, but workflows that factor in the likes of estimates and time taken, as well as delivering a breakdown of costs, even for team collaborations.

Some invoicing software works as a standalone package, but others work as a part of a wider accounting software platform, which means you can upgrade to something more complex as you need to. Additionally, invoicing software can also work with some expense tracking apps and software.

Below we list what we think are the best invoicing software currently available.

Zoho's accounting software offers a free plan and works seamlessly across web, smartphone, and desktop apps. It features custom templates, role-based permissions, multiple payment options, automated invoices and reminders, inventory tracking with automatic stock updates, and reorder alerts for streamlined financial and inventory management.

Preferred partner (What does this mean?)

Reader Offer: 75% off for 3 months

FreshBooks' accounting software features double-entry accounting tools, expense tracking, and automatic mobile receipt scanning. It connects to your bank or credit card and provides detailed reports on profitability, cash flow health, and spending for comprehensive financial management.

Preferred partner (What does this mean?)

We’ve also highlighted the best payment gateways.

The best invoicing apps of 2025 in full:

Why you can trust TechRadar

Best billing and invoicing software overall

Reasons to buy

Reasons to avoid

FreshBooks makes invoicing and billing easy, with simple to make and edit templates, and a raft of features to ensure the overall process is streamlined and effective for a range of business models.

This includes being able to charge a deposit, and automate reminders. Additionally, everything is stored online in the cloud so you can access your saved data using mobile apps from any device. You can also keep track of your business billing and expenses, and there’s an especially handy feature which allows you to connect to your bank account to import the data for easier expenses management.

If you charge for your time rather than products, there’s also a timer feature that allows you to keep track of how much billable time you spend on a project. This also applies if you run a team and need to keep tabs on how much work each person has spent on a project for setting up an overall charge against a specific client.

Furthermore, this can also be presented in a broken-down format for the client so they know what they’re paying for. If the client is concerned about costs on a project, you can also allow them to access any estimates in the cloud as required.

Read our full FreshBooks review.

FreshBooks - Get 50% off for 3 months

You'll start saving right away with FreshBooks, with a 50% off for 3 months deal running currently. Choose from four different packages, including Lite that's just $7.50 a month, down from $15.00. Or, FreshBooks most popular option is Plus, which is just $12.50 down from $25.00 a month.

Best billing and invoicing software for billing

Reasons to buy

Reasons to avoid

Well organized and easy to use, Zoho Invoice is a comprehensive invoicing software solution for small to medium-sized businesses. It comes with many features that are simple to navigate, and a number of these can be automated to save you time with billing.

Zoho Invoice also offers its own report generator and as it’s run through the cloud you can access and update it through the available apps. This product is also integrated with 11 payment gateways and can bill internationally, so there shouldn’t be any problems with taking payments.

If you’re looking for a solution for managing invoicing, billing, quotes, contacts, and expenses, Zoho Invoice covers all these and can be further integrated into other Zoho products, such as Zoho Mail, Zoho CRM, and Zoho Books.

For up to five users the software is free to use, and that could be very useful for a startup looking to test the waters and see whether Zoho Invoice is worth continuing with.

While there is a more expensive plan for unlimited customers, it might be worth upgrading to Zoho Books instead of taking that option, as the latter offers both the invoicing software as well as comprehensive accounting software. So for heavy users, unless you have an alternative in place, it might be better to upgrade the product rather than the plan.

Read our full Zoho Invoice review.

Zoho Invoice - Get started for free

Explore the powerful features and functions of Zoho Invoice with no money down thanks to a currently available $0 cost option . Small businesses will find it's perfect for billing multiple customers through to sending automated payment reminders. You can also accept payments via cash, checks and ACH.

Best billing and invoicing software for options

Reasons to buy

Reasons to avoid

Invoicera is another billing and invoicing software platform for managing payments, time tracking, and project costs. Like most others, it’s cloud-based so can be accessed using apps when you’re out and about. Setup is simple but the software has a number of features that will allow you to cover almost any aspect of billing outside of direct accounting.

Although Invoicera doesn’t have as many templates as other providers, the ones offered are fully customizable. There are also a number of options for automation, including recurring invoices and subscriptions, all of which can be paid for through a comprehensive range of payment gateways.

Additionally, Invoicera has a nifty feature for automatically adding late payment fees where applicable. Another interesting option is the ability to operate multiple trading names or companies through the same account.

There’s a free starter package for up to three clients, after which there are a variety of paid plans are available.

Read our full Invoicera review.

Invoicera - Try a 15 day trial for free

Perfectly designed plans for business users with a range of options to choose from. Invoicera's most popular option is just $29 per month, but there's something for any size of business from the free Starter edition through to Pro for $15 per month right up to Infinite for $149 per month.

Best billing and invoicing software for simplicity

Reasons to buy

Reasons to avoid

As the name suggests, Simplybill is a simplified billing software which includes all of the basic features you would expect for setting up and sending invoices, including the ability to set up automatic tax rates (even for different countries).

The product runs in the cloud, allowing you to access your account on the go through mobile apps, and you can elect to receive push notifications in the event that an invoice becomes overdue.

One drawback is that there is no support for any payment gateways currently, although Simplybill allows for PayPal subscription links.

Read our full Simplybill review.

SimplyBill - try it free for 14 days

Get to grips with everything SimplyBill has to offer thanks for a 14-day free trial, which has no hidden fees and you can cancel at anytime. Like what you see? Choose from Basic at $5 per month, Enhanced for just $15 per month and a Premium edition that's great value for just $25 monthly.

Best billing and invoicing software for control

Reasons to buy

Reasons to avoid

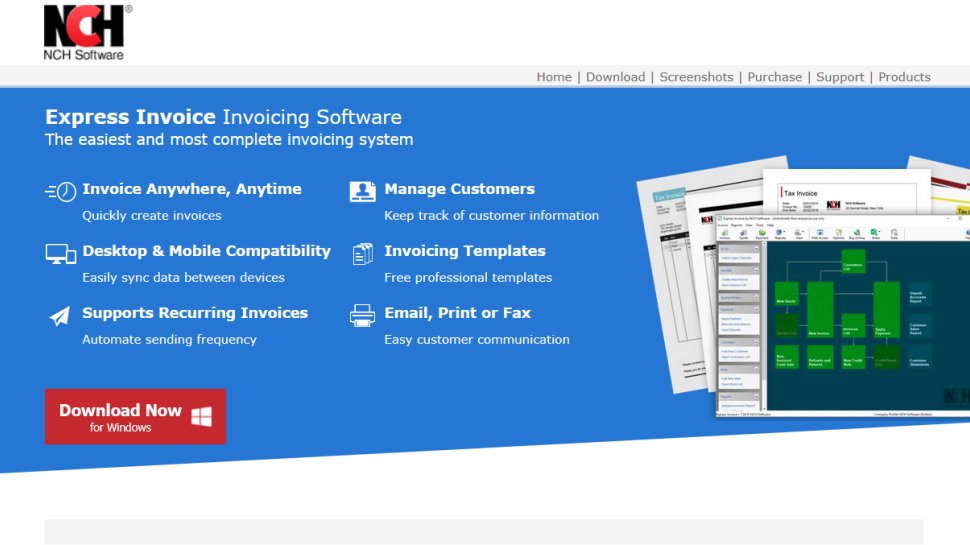

For those business owners who want more direct control over their data, Express Invoice from NCH Software is a downloadable billing and invoicing software that runs on your own business computer or network, rather than in the cloud.

This offers the benefit of being able to directly print or fax invoices rather than simply sending them as an email as with other solutions. It also means you have control of your own business data, rather than a third-party having responsibility for it. Although there are no mobile apps, Express Invoice does allow you to sync other devices such as laptops, Android phones, and even Amazon’s Fire tablets.

Furthermore, it’s a simpler app than others featured here, focused on the quick and easy generation of invoices from quotes, rather than handling direct billing and payment.

Pricing starts with a free Basic version, although a paid-for version is also available for handling multiple businesses. Also bear in mind that because it’s a downloadable program, you can add users without it costing extra.

Read our full NCH Express Invoice review.

NCH Software - buy online and get 30% off

Get the most from this easy invoicing software to manage and track your billing on Mac or Windows machines. NCH currently has big discounts on its software, with Express Invoice Plus down from $129 to just $79.99. Express Invoice Basic, meanwhile, currently costs just $69.95 down from $99.

Best billing and invoicing software for ease-of-use

Reasons to buy

Reasons to avoid

Paypal offers one of the simplest and easiest to use ways to invoice clients - and get paid. Invoices can be sent or transferred from multiple currencies, and Paypal can automatically convert payments into the currency of choice when you need to bank it.

Individual invoices can be sent by email, and there are subscription options. However, that's about as automated as it goes, which is why Paypal is better suited to small volumes, and while might be a good solution for freelancers who only need to make a few payments per month, it's not so suitable for retail unless built into existing ecommerce platform, which is perfectly possible with some of the best ecommerce platforms.

Where Paypal really shines is in the simplicity of use. You don't need to download software or keep it updated, you simply login to the website and select the options you need, then copy out the code for a payment button.

Paypal also keeps a record of all payments and transactions available on its website so you have a clear record when it comes to accounting as required. Additionally, transferring payments from Paypal to your bank account is usually a fast and worry-free process.

Read our full PayPal invoicing review.

PayPal - Send an invoice for free

PayPal makes it easy to manage your billing and get paid from virtually anywhere. Customers can make a payment securely in just a few clicks and you can receive your money in minutes. Right now it's possible to send an invoice for free too, and all you need to do is sign up for a PayPal account.

Best free billing and invoicing software

Reasons to buy

Reasons to avoid

Invoice Expert is free software dedicated to helping small business folk streamline their invoicing tasks without the need for any expenditure. As a result it comes with a surprisingly well-developed array of tools, which can speed up workflow and improve office business efficiency.

Alongside allowing you to send out invoices, the program can turn its hand to a wider range of billing duties and also help you manage your inventory.

While the software is aimed primarily at the small business end of the spectrum, Invoice Expert can be used by larger concerns and workflow can be managed all from within a Windows-style dashboard area, making it of universal appeal.

The Invoice Expert Lite edition is just that, it’s a slightly pared down version of the Advanced version. While Lite is completely free to use, the Advanced option has a lot more features for a one-time fee.

Read our full Invoice Expert review.

InvoiceExpert - Get started for free

If you're looking for a quick and easy invoicing solution then Invoice Expert Lite is just that. Better still, you can make use of it's powerful features for free. Need more functionality? Try the Advanced package, which currently costs just $69.95.

Best billing and invoicing software for analytics

Reasons to buy

Reasons to avoid

BillingPlatform is a cloud-based software solution for businesses that want to offer subscription billing and invoicing services. It combines a range of tools including billing management, products and pricing, accounts receivable, account management, revenue management and business intelligence.

As is the norm for many SaaS packages the BillingPlatform software does not come with an off-the-shelf pricing structure per se. You can do the routine thing of organizing a demo with them initially, which will allow you to see if it’s going to be a good fit for your business.

The account management side of things delivers powerful control of accounts and their hierarchies, with a central customer portal offering insights into invoices, outstanding balances and payments. There’s also a sizeable revenue management capability on offer that features a configurable sub-ledger that can be customized to suit.

Rounding it out is an accounts receivable side to BillingPlatform that takes control of payments, credits and refunds plus any dunning issues too. Finally, the business intelligence part of the BillingPlatform equation delivers complex reporting and analytics along with dashboards.

Read our full BillingPlatform review.

BillingPlatform - A complete billing solution

Larger businesses will love the appeal of BillingPlatform as it can be scaled to suit the size of your company. The best way to decide how well it can help your business become more efficient is to request a free demo.

Best scalable billing and invoicing software

Reasons to buy

Reasons to avoid

Gotransverse is a cloud-based software platform that allows businesses to handle all of their billing and associated financial management tasks. Due to the bespoke nature of the Gotransverse package options there are no obvious off-the-shelf prices available. But, the added benefit is that Gotransverse offers a scalable solution, meaning that you can boost its capabilities if your business grows over time.

Gotransverse is a SaaS solution that offers all of the convenience you get with the cloud. It also comes packed with a good selection of features, with several key areas that leave a lasting impression. Account holders can make use of the Usage & Rating aspect of the software, with a product catalog that acts as home to all of your products and services.

It’s possible to manage subscriptions here, in a variety of different connotations, while the usage and rating tools themselves provide a great insight into exactly what your customers are doing with your product and allow you to tailor pricing accordingly.

The Billing & Invoicing aspect of Gotransverse offers easy management of accounts, bill calculation and invoicing too, all of which can be integrated with your CRM, ERP and other applications. Revenue Management, meanwhile, offers general ledger and revenue recognition tools. What’s more, there are several add-on products available too. These include mediation, collections and dunning management, plus tools for managing tax.

Read our full Gotransverse review.

Gotransverse - Free demo available now

Get to grips with advanced billing needs using the power of this leading SaaS specialist. Gotransverse enables adoption and revenue growth in companies through our billing platform designed for sophisticated pricing, high volumes, and rating.

Also consider these billing and invoicing software options

There are a large number of billing and invoicing software options available, and while we've featured the leading five, there are plenty of others worth also considering. This is either because of their simplicity and ease of use, automation, or available features that might give your business an edge.

So it's also worth checking down through the list below to get a view of your other options for small business use. Xero, for example, has become hugely popular with a lot of business owners thanks to its powerful array of features and affordable setup. Similarly, Wave and Invoicely represent great value and can be useful to small businesses of all shapes and sizes.

Xero

An excellent solution to invoicing that provides a decent amount of automation and a reporting dashboard to ensure you're fully up to date with payments in real-time. Reminders can be sent automatically, and it's easy to keep track of outstanding invoices and payments made to date. Xero runs as a cloud-based app, which makes it accessible on any device. There's expense management, purchase orders, and a mini-accounting package feel too.

Wave invoicing

A neat invoicing app that can work as a standalone, or as part of a wider suite of Wave accounting software. It's easy to create customized invoices that look professional, and recurring billing is simple to set up. You can opt to receive alerts to your smartphone or mobile device when an invoice is paid, which makes it easy to keep track of payments. It's free to use as Wave takes a percentage of fees generated.

Invoicely

Comes with a free tier that allows for unlimited invoices, billing in any currency, and can be run for multiple businesses. Paid plans begin from $9.99 which opens up features such as recurring payments, timetracking along with mileage and expenses, as well as online payments. More expensive plans are available for more staff.

Invoice2Go

Allows for invoices and estimates to be sent on the go via mobile devices, and offers a range of invoice templates. Features include credit and debit card payments, tracking of when invoices are sent, opened, or overdue, as well as receipts and expenses. There are also analytics built in so you can generate reports and automated payment reminders.

We've also reviewed other billing and invoicing packages including Procurement Express and Turbine, which offer a variation on the more standard theme.

You might also be interested in the best credit card processing services.

Best invoicing app FAQs

Billing and invoicing features explained

Affordable solutions

Billing and invoicing software for your small business doesn't need to cost the earth. Shop around for deals on packages like the ones outlined below and you could find something that fits your budget. The main thing is not to commit to a package that does more than you need it to.

Easy integration

Look for a billing and invoicing system that will compliment other areas of your small business. Check that it will integrate with other software packages too, so that your staff will be able to use it to carry out a variety of different tasks and improve overall efficiency.

Stock management

Picking the right billing and invoicing software for your small business will often allow you to take better control of stock levels too. Most packages work in a dynamic fashion, meaning that it's possible to get an accurate and up to the minute picture of your stock levels.

Cloud and mobile appeal

Thanks to technology it's possible to store your data in the cloud, allowing access to it when and where you like. Look for packages that also have a strong mobile presence, so you can manage billing and invoicing on the go.

Solid support

Look for plenty of support, especially if you're implementing a billing and invoicing system for your small business that is going to be used by staff members. Things can and do go wrong, so having support on hand is valuable.

Reporting potential

Billing and invoicing software needs to be helpful for your small business and much of that will lie in its reporting capabilities. Look for a package that can deliver comprehensive feedback on transactions and help with projections for future business moves.

How much does the best invoicing software cost?

Thanks to stiff competition you should be able to find a billing and invoicing software solution to suit any kind of budget. The packages show below offer up a valuable snapshot of what's available, although keep an eye out for new deals and sign-up incentives that appear at different times of the year.

If you're on a tight budget there are options for less financial commitment, while you'll often find that larger discounts come with packages that involve signing up for longer periods. FreshBooks, by way of a popular example, has a 50% off for 3 months deal running currently. Similarly, Zoho Invoice has a no money down package up for grabs at the moment.

Check the deals box below to make the most of the latest deals and offers, although bear in mind that these can also be updated regularly, which could mean further savings.

How to choose the best invoicing software

If you want to choose the best invoicing software then one of the main factors will be to consider how much time it will save you. Time is money, so the best invoicing software needs to be efficient and help you with shorter invoicing times, getting payments in faster and also assisting with business management duties.

Of course, which of the best invoicing software packages you choose depends on what your budget is, along with what sort of industry you're involved with. However, all the best invoicing software packages can cover most, if not all bases, which is the reason they've been included here in the first place.

So, along with those factors you'll also want to factor in ease of use, cost, their ability to integrate with other accounts and tax software packages, plus any other features and functions that add value.

How we tested the best invoicing app

As outlined above, there are several key areas that we scrutinise when looking for the best invoicing software packages to include in our guide. Cost, value for money and ease of use are main aspects that we consider, but anything that adds extra value is always a bonus.

Many business owners operate on the go and so having access to app-based invoicing software is a real boon. If you can use your chosen invoicing software when you're out of the office then efficiency will definitely be improved. This has become an even more important consideration now that many of us are working at home, or remotely.

We'll test all of the packages included in our guides using both the desktop and app editions, if they exist, and on any platforms they've been designed for.

Read more on how we test, rate, and review products on TechRadar.

Get in touch

- Want to find out about commercial or marketing opportunities? Click here

- Out of date info, errors, complaints or broken links? Give us a nudge

- Got a suggestion for a product or service provider? Message us directly

- You've reached the end of the page. Jump back up to the top ^

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.