TechRadar Verdict

Sage Business Cloud Accounting will suit any small business users who don't need or want unnecessary features and functions. It ticks most boxes though for more scalability you’ll want to tailor a package when purchasing.

Pros

- +

Free trial

- +

Cloud-based

- +

Feature-packed apps

- +

Offerings for all business sizes

Cons

- -

No payroll option

- -

No time-tracking

- -

UI could be simpler

Why you can trust TechRadar

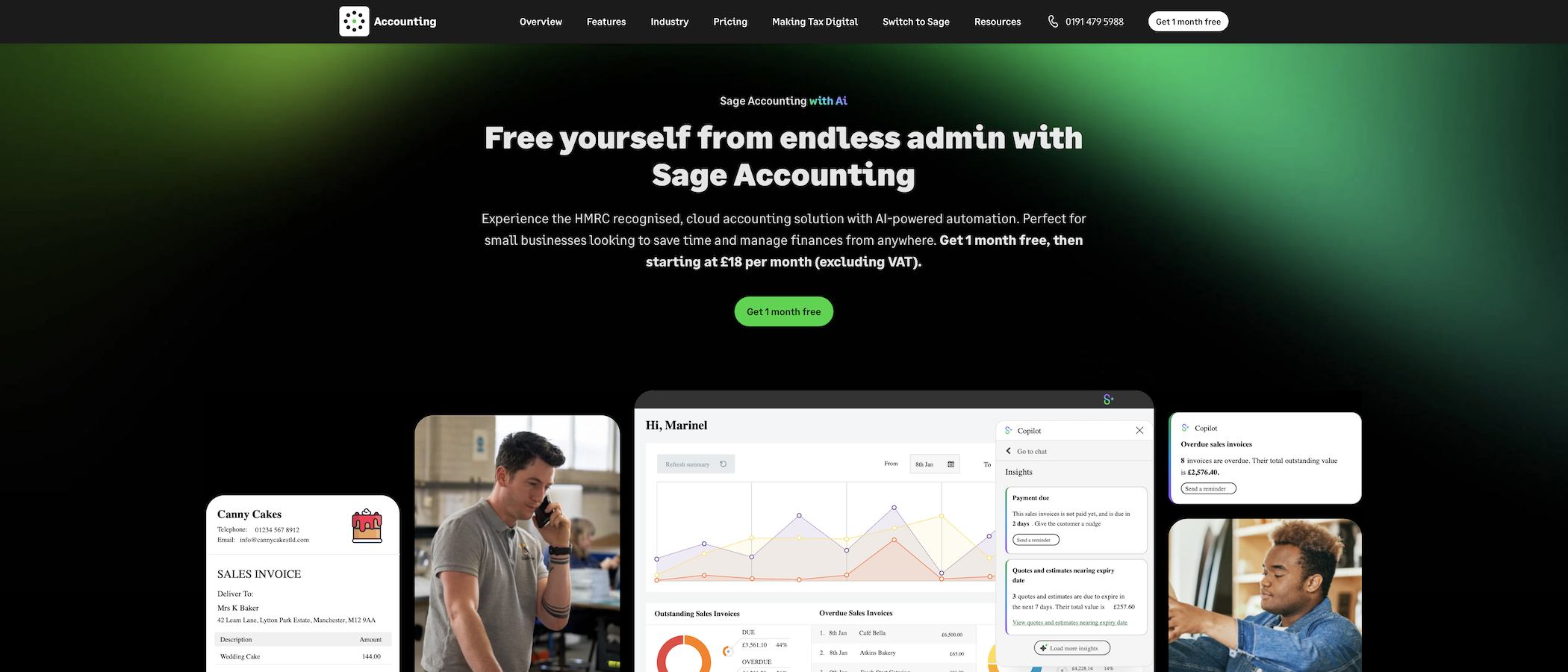

Sage is the British company that has been offering accountancy software solutions for many years. The business currently offers Sage Intacct and Sage50 Accounting under its umbrella Sage Business Cloud Accounting, which offers the flexibility and dependable edge provided by an online solution.

Due to its size and breadth of appeal, the Sage product range can tend to be a little bewildering. For example, Sage One has now morphed into a beefier package that differs from Sage’s 50cloud option. However, the most obvious benefit of Sage Business Cloud Accounting in whichever bundle you choose, is that you gain the flexibility and scalability provided by having a cloud back-end.

Sage is constantly evolving too, with the UK market having its own products dedicated to small business including specific accounting, payroll and HR packages. Equally, Sage also covers the medium-sized business arena with the aforementioned Sage Intacct, Sage200cloud and the more specialised cloud-based ERP Sage X3. Professional accountants and bookkeepers are, of course, also catered for with partner accounting and payroll options with an increasing focus on automation.

Competitor software services worth considering include QuickBooks, Xero, Zoho Books, Kashflow and FreshBooks.

- Want to try Sage Business Cloud Accounting? Check out the website here

Sage: Pricing

If you like the look of the most recent edition of Sage Business Cloud Accounting then the good news is that there’s a free trial available. This is a great way of experiencing the cloud-based accountancy service head on.

A broad range of packages fall under Sage's 'Accounting' umbrella, starting with Accounting Individual Free. It serves as a basic bookkeeping service for managing income and expenses and generating a self-employed tax summary.

Self-employed workers can upgrade to Accounting Individual, which adds support for sales invoices, bank account connections, 10GB of document storage and more. It costs £7+VAT per month.

For larger registered businesses, there are three separate tiers: Accounting Start (£18+VAT per month), Accounting Standard (£39+VAT per month) and Accounting Plus (£59+VAT per month).

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

There are also separate packages for Payroll and HR, as well as a more comprehensive suite under the Sage 50 brand which offers payment processing, automation and budgeting.

Sage: Features

Sage Business Cloud Accounting gets regular updates and its latest version is perfect for small businesses that need a relatively straightforward solution that ticks all the boxes.

Once you’re signed up Sage Business Cloud Accounting lets you tackle accounting, but it’ll also simplify sales tracking, reporting and pull contact together.

You’ll be able to accept and receive payments, create and send invoices as well as stay on top of bookkeeping chores all within the space of a cloud-based service.

The additional benefit of Sage Business Cloud Accounting is that it lets you enjoy the same powerful features on your computer, tablet or phone. That way you’re on top of your accounting no matter where you happen to be.

It's worth noting that Sage offers slightly different variants of its accounting software for different regions – and that's a good thing because the company is clearly willing to tailor its products to different tax scenarios and setups to help users get the most out of Sage.

Users in the UK get a variation on the theme. Sage offers small businesses an Accounting package, which lets you handle invoicing, cash flow, tax, payments and more. It also has a Payroll option, which allows you to pay up to 50 employees and is fully HRMC-compliant.

Sage even takes care of HR issues with its refreshed Sage HR package, which used to be called CakeHR. It is a constantly evolving picture to stay in line with new rules and regulations, along with the changing face of business.

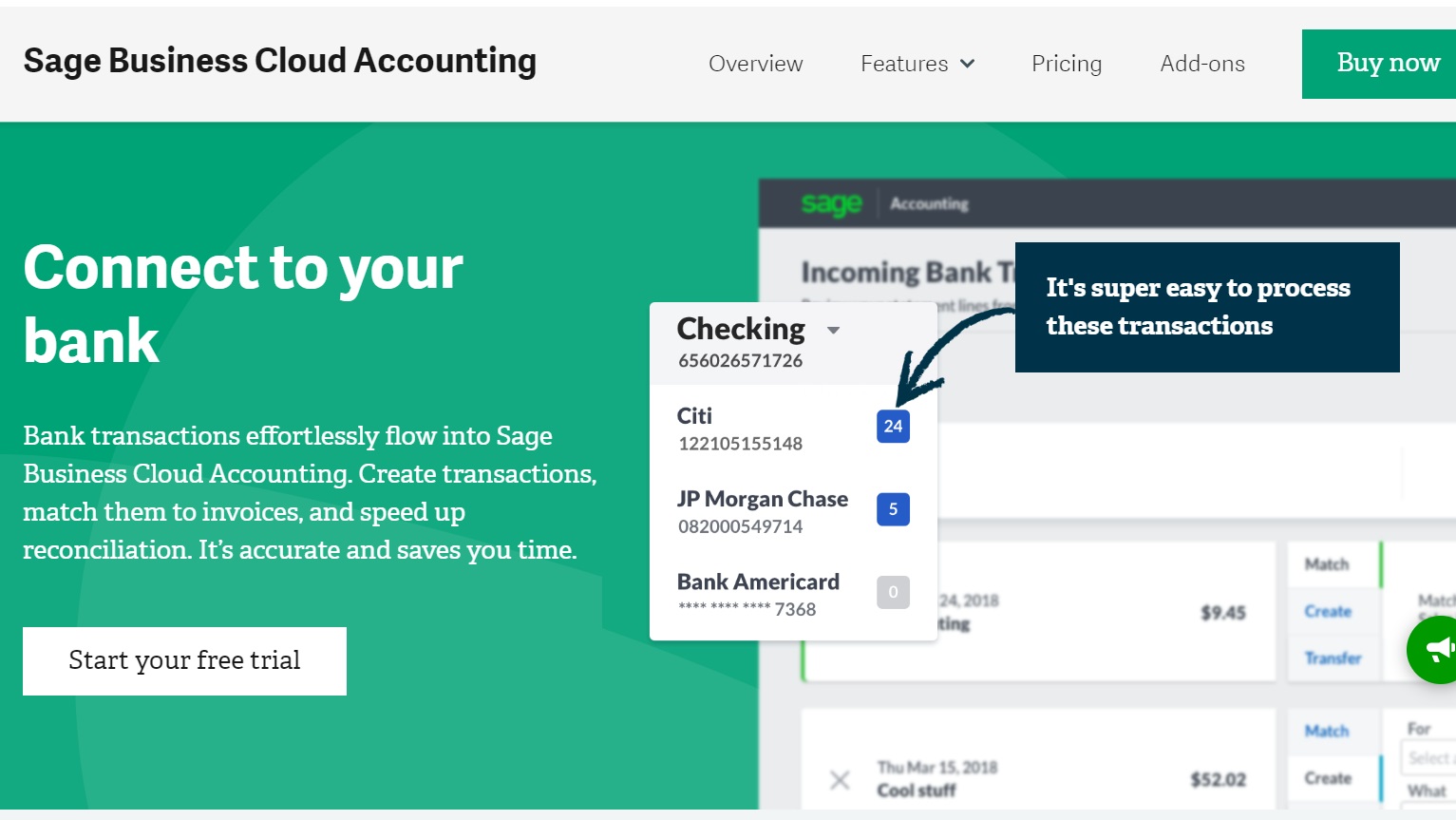

Although setups differ regionally, Sage specializes in areas like invoicing and quote generation, expense management, reporting and forecasting, inventory management and bank feed monitoring.

Sage also works with third-party systems, besides its own ecosystem, like Xero or QuickBooks, which makes managing larger businesses or migrating from other platforms far easier.

Sage: Performance

Sage has been around long enough to realize the potential of offering a product that can be used by the many and varied users that need accountancy solutions. As a result, there are versions available for Windows, Mac, Android, iOS devices like the iPhone and iPad plus the web-based edition for anyone with access to a browser.

As you’d expect from a cloud-based solution, it depends on an internet connection but all data is stored in the cloud. Sage delivers a reliable service in that respect and the performance has been carefully honed over the years to help you enjoy a pretty decent experience.

The reporting and core accounting modules are generally solid, though users sometimes note that they're not designed for heavy customization or complex workflows. Still, if you're a bigger business with more complex demands, you should be able to benefit from one of Sage's higher-tier platform subscriptions.

Sage: Ease of Use

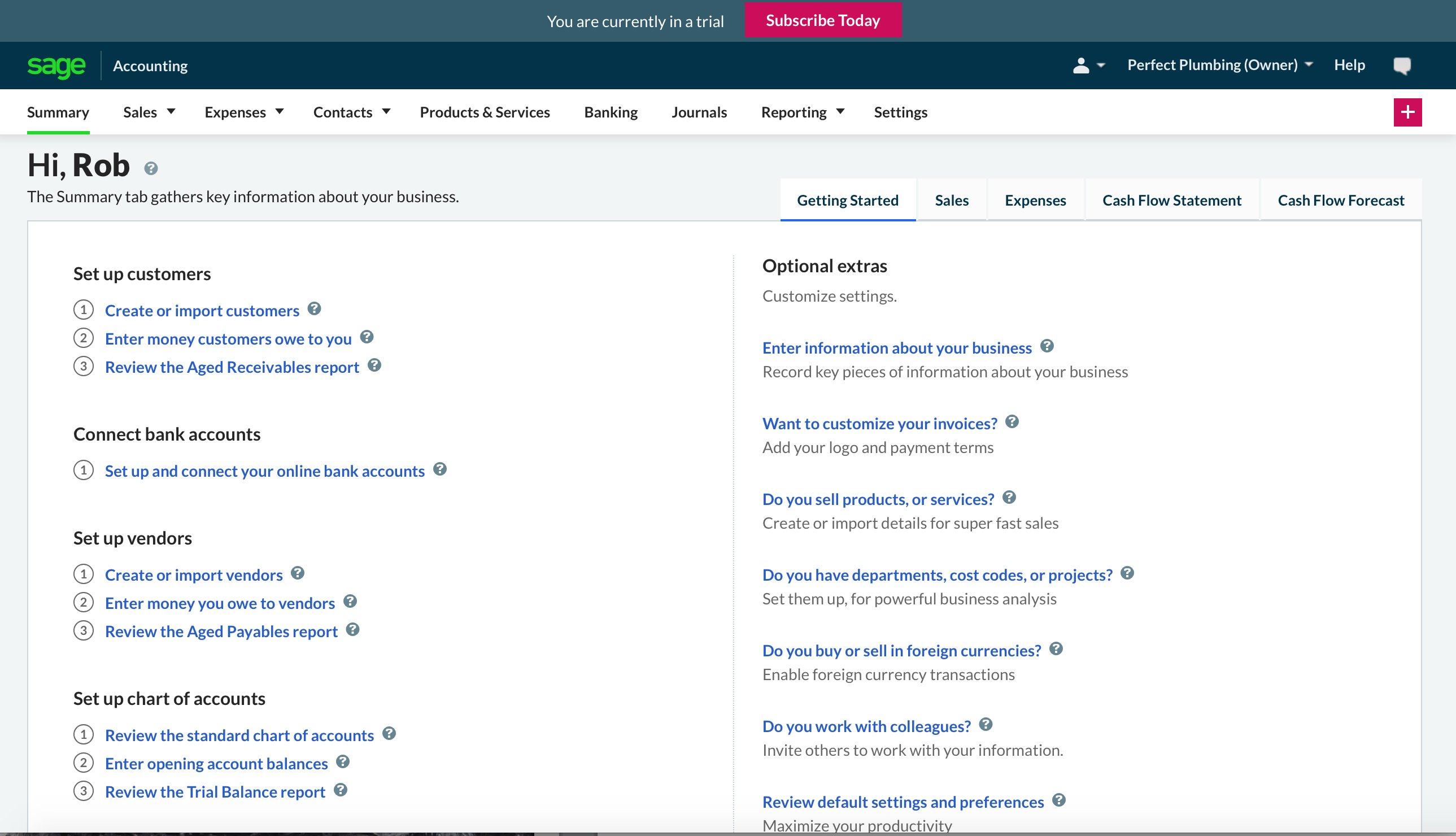

Sage Business Cloud Accounting is quite a dry experience in that it’s less easy on the eyes, but certainly offers a comprehensive suite of features and functions. Consider it generally dated or utilitarian, but it's far from lacking in features.

If you’re a newcomer to its functionality then you might find it a little hard going as there’s quite a lot to get through during initial setup. This is done via a Getting Started screen, which incidentally can be switched off if preferred.

You can, of course, import a lot of your data or pull it in from integrations, as well as connect to your financial institutions, which means that most of your accounting figures will self-populate the various categories.

Some of the workflows, such as expense tracking, can be slightly less intuitive than we'd hoped, so it can take more clicks than you'd expect to get simple, administrative and repetitive data logged.

Nevertheless, there is still quite a lot to digest within the Sage Business Cloud Accounting interface, though once you’ve become familiar with it progress is much more streamlined.

Sage has done an impressive job at shoehorning the same experience into its mobile apps too, with iPhone and Android experiences surprisingly good. You can even get it for the Apple Watch, though we can't imagine users getting any real benefit out of that.

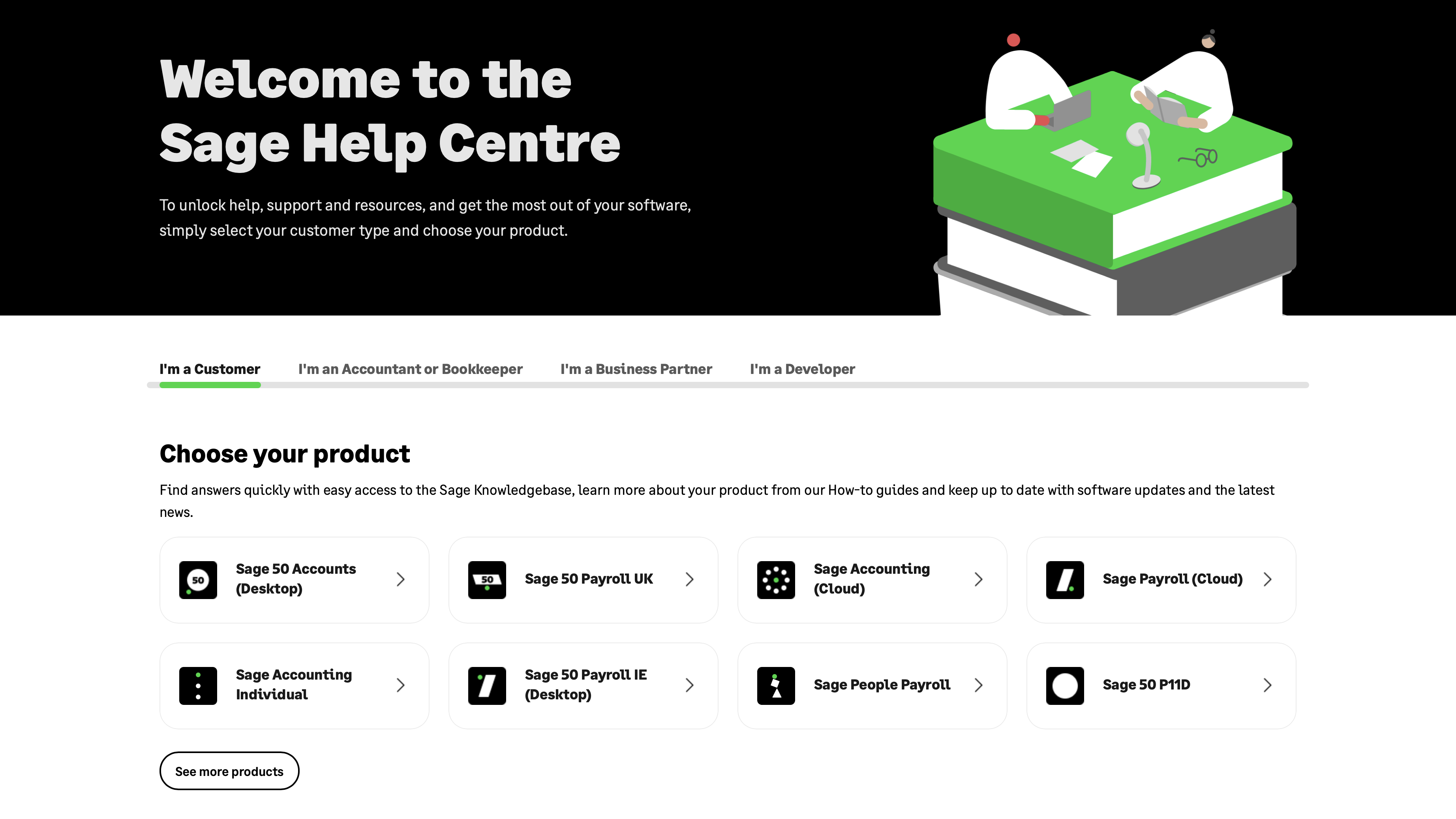

Sage: Support

You’ll find plenty of options available to you if you need to call upon some support, and that's partly because you're dealing with a highly established, big player in the space. Sage has got this aspect of its business down to a fine art, with email, phone and also live support options all available.

For ongoing issues that can’t be resolved with a quick answer then there is also the provision for raising support tickets, whereby your query will be put into a queuing system and hopefully resolved as quickly as possible.

You also get the benefit of a healthy community spirit within the world of Sage, while easily accessed and comprehensive FAQs also get to the bottom of many everyday questions and quandaries.

Sage: Final verdict

Sage Cloud Business Accounting has been a reliable option for quite some time and proves consistently popular with many sole traders and smaller businesses. It's packed with most of the features that you'd likely to need, but we'd like to see future generations of Sage's tools look slightly more polished.

Some elements of the workflow seem unduly labored and with missing features such as time tracking and payroll options Sage Cloud Business Accounting is at risk from the competition. While everyone might instantly know the name of Sage this cloud-based accountancy solution doesn’t satisfy in quite the same way as something like QuickBooks Online.

We find the lowest tier, while well priced, somewhat limiting, and only useful for a true micro business. On the other hand, the upper tier is quite a bit more capable, and the 50cloud variant has deep integration with Microsoft365, although the cost rises considerably from the lowest plan. For a medium to larger small business, without dedicated accounting resources, these higher plans become an affordable solution.

To this remark, we think the multiple levels of subscriptions can become complicated, and because lower-tier memberships are more limited, businesses could be compelled to upgrade without fully understanding which tier they need. A quick chat with customer services could help them figure this out, though.

- We've also highlighted the best accounting software in this roundup

Jonas P. DeMuro is a freelance reviewer covering wireless networking hardware.

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.