TechRadar Verdict

Accountants can make use of Fluidly to improve their financial projection services as well as offering dynamic insights into business health and wealth.

Pros

- +

Automated forecasting

- +

Easy to use

- +

Impressive support

Cons

- -

Still a work in progress

Why you can trust TechRadar

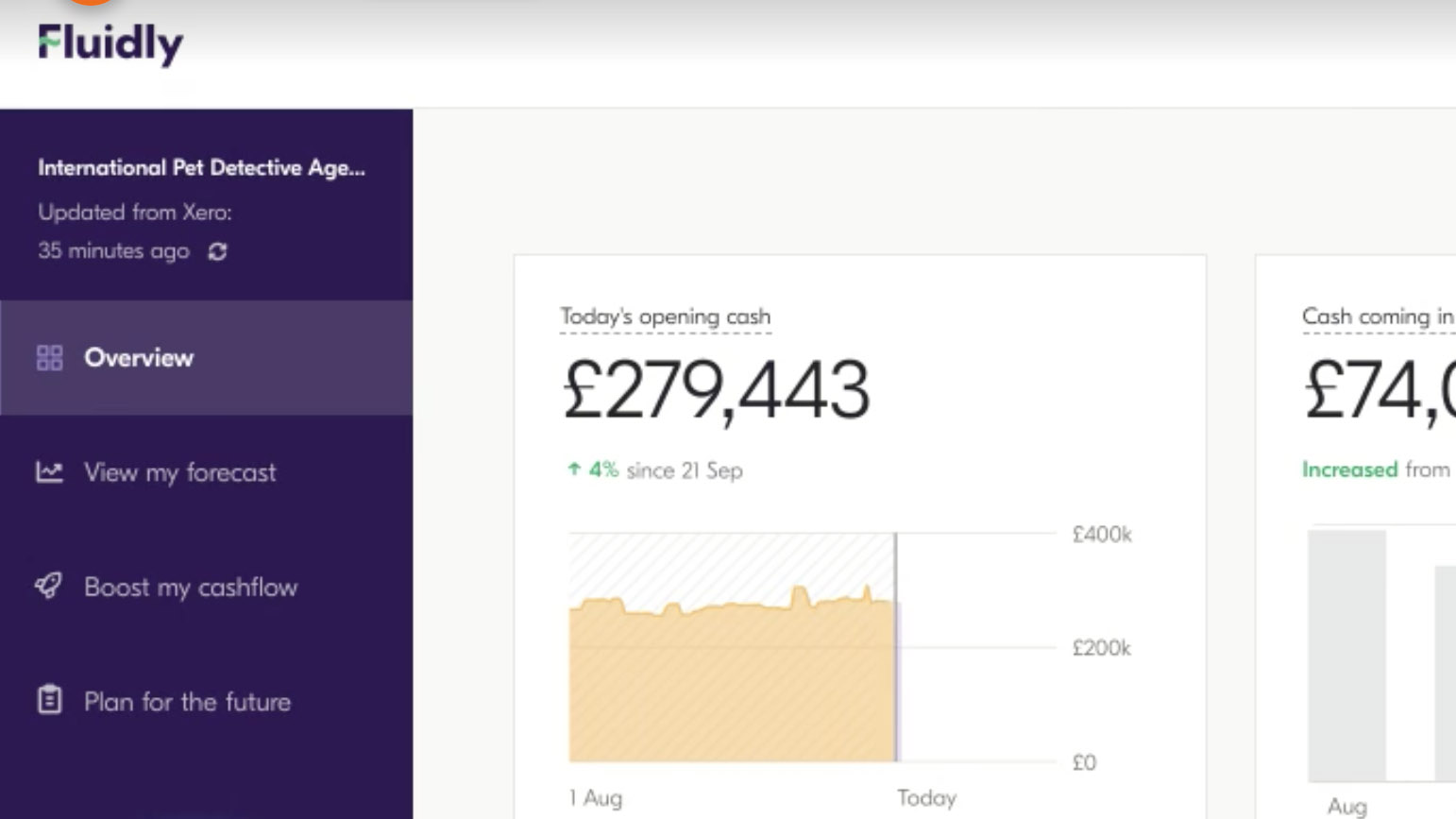

Fluidly is a financial management software package that lets you keep track of your cashflow and shape how your company is going to tick moving forwards. It uses artificial intelligence to help you create future projections for your business by analyzing cash movements. From that Fluidly can produce live cash flow forecasts, which include payroll, tax payments and debtor information. The software offers a fast and efficient route for accountants to help small, medium and larger-sized business make plans for their future along with offering an automated way of carrying out credit control.

- Want to try Fluidly? Check out the website here

It’s still early days for Fluidly as the company was only launched back in 2017, although the startup has already helped over 30,000 businesses and has worked with over 500 different accounting partners. The tools and options found in Fluidly are aimed largely at accountants looking to offer a more dynamic financial forecasting aspect to their services. However, there are also three package options for business owners to choose from.

Pricing

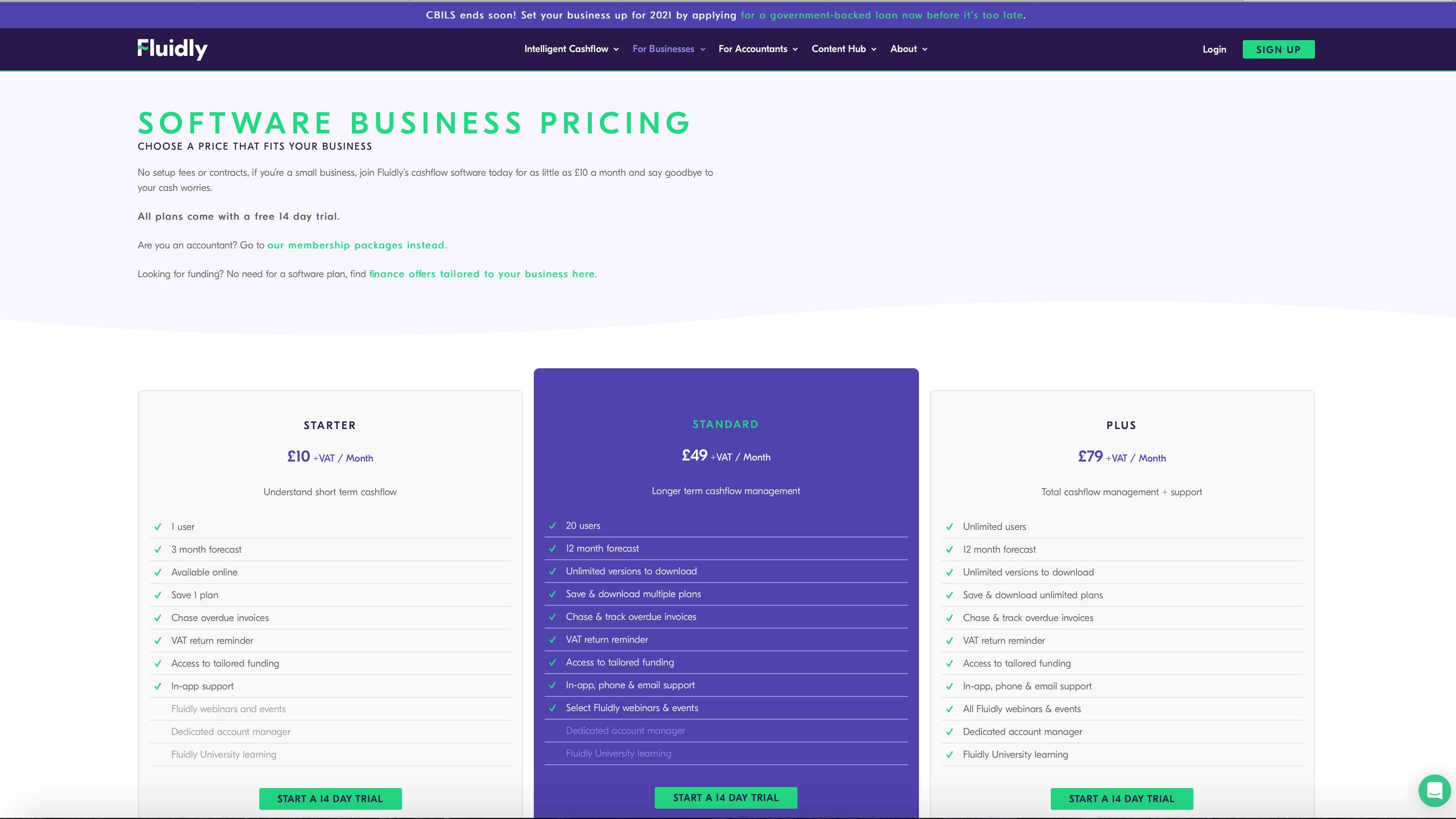

There are two different routes for potential users of Fluidly. One is for accountants, and the other for business users. We took the business selection, which lets you try out the service free for 14 days. There are currently three options to choose from, which includes a Starter package, for £10 plus VAT per month. A Standard package follows that for £49 plus VAT per month.

There’s also a Plus edition, which costs £79 plus VAT per month. In order to access the trial you’ll need to have an Intuit QuickBooks account or be set up with Xero and then connect those accounts to your trial package. You’ll also need to enter your card details to proceed, although you will not be charged until the end of the 14-day free trial.

Features

While there are clearly still features to be added to the arsenal of tools inside Fluidly this is a package that packs plenty of punch. Accountants will find it highly useful as it lets you provide what Fluidly calls intelligent cashflow to clients. Users need to first sync their accounting data with Fluidly, which can then be used to provide an accurate and dynamic overview of cashflow in and out of a business.

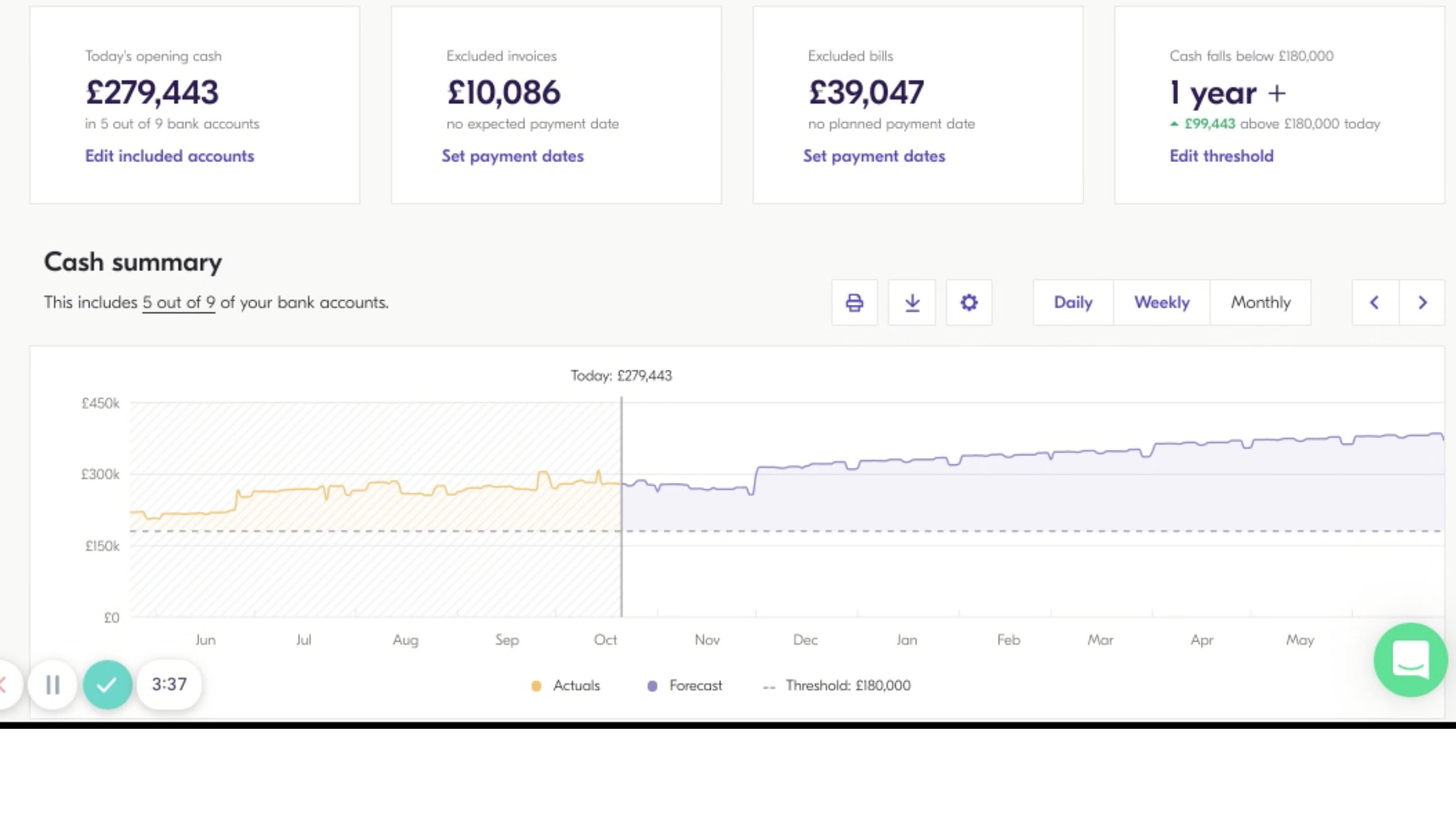

In terms of forecasting, Fluidly has been designed to work in tandem with the data produced by your QuickBooks or Xero account, which it uses to create a constantly updated base forecast. With the forecast in place Fluidly can then produce a plan that lets you see several different models based on various cashflow projections.

If you sign up for the Starter package you get 1 user allowance, 3 month forecasting, the ability to save 1 plan, chase overdue invoices, get a VAT return reminder and gain access to tailored funding. The Standard package comes with a 20 user limit, 12 month forecasting, unlimited versions to download, the ability to save and download multiple plans along with getting VAT return reminders. There’s also access to tailored funding.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

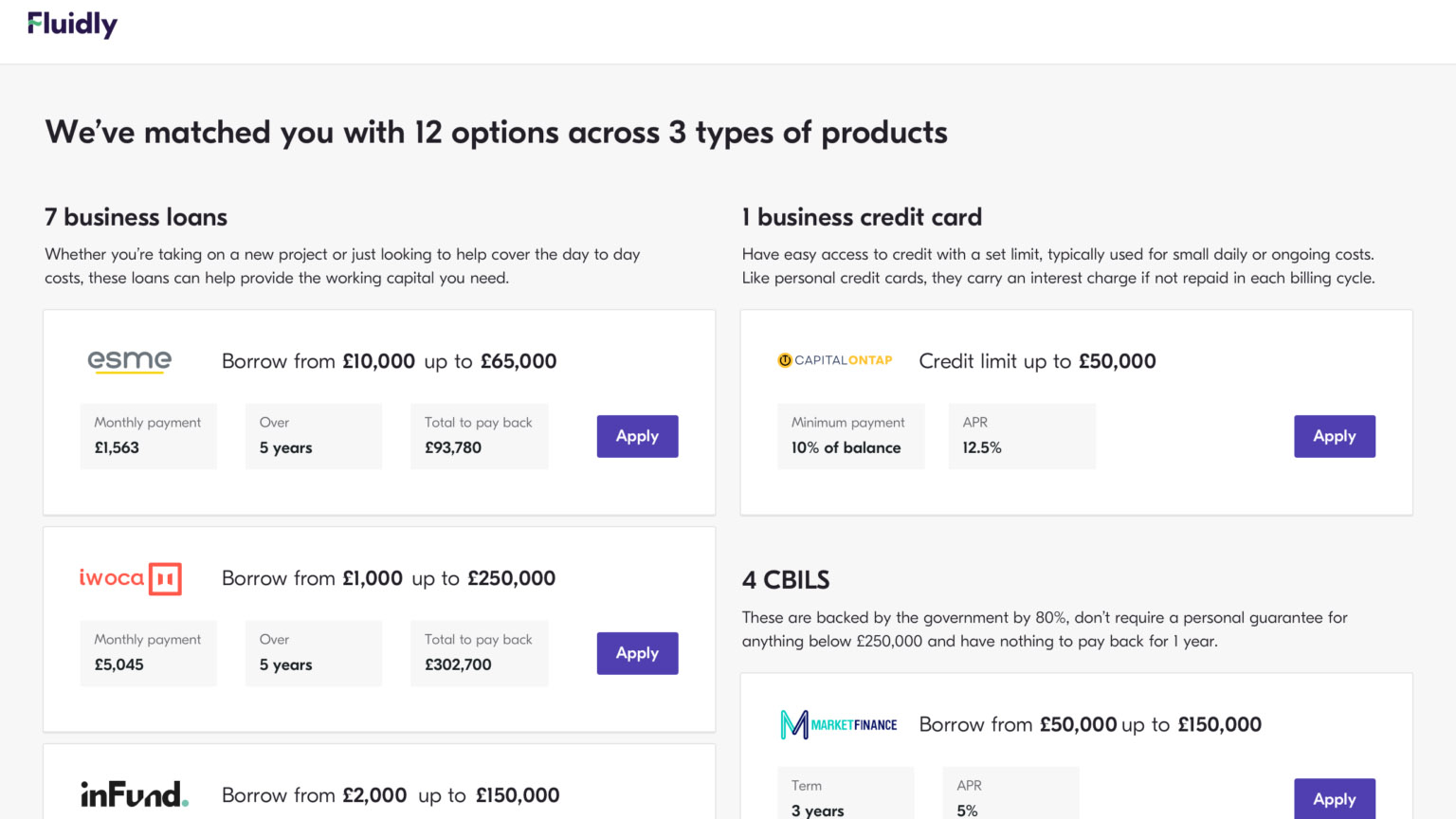

The Plus edition boasts unlimited users, a 12 month forecast capability, unlimited versions to download, the option to save and download unlimited plans plus chase and track overdue invoices. There’s a VAT return reminder and, again, access to tailored funding. The latter essentially gives you access to funding options.

Performance

Fluidly has done a great job by developing its software to work fast and efficiently even though its results are driven by artificial intelligence. More importantly the data that the Fluidly system returns is dynamic and shows results in real time. As the company points out, traditional cashflow forecasting has always been limited by its habit of being somewhat out of date by the time results are produced.

However, Fluidly’s dynamic reporting performance means that accountants and businesses alike can get much more rapid data results, which come with the benefit of being bang up to date.

Based on the data Fluidly can offer help to find you tailored business funding, which might be relevant if your business is running low on cash in the bank reserves. Similarly, Fluidly has also been designed to help you achieve better credit control and chase up any late payments more effectively.

Ease of use

One of the main things that makes Fluidly appealing is the way it has been designed with ease of use firmly in mind. Despite the fact that this software application relies on AI to make many of its predictions and forecasts, the user interface is actually very simple to use.

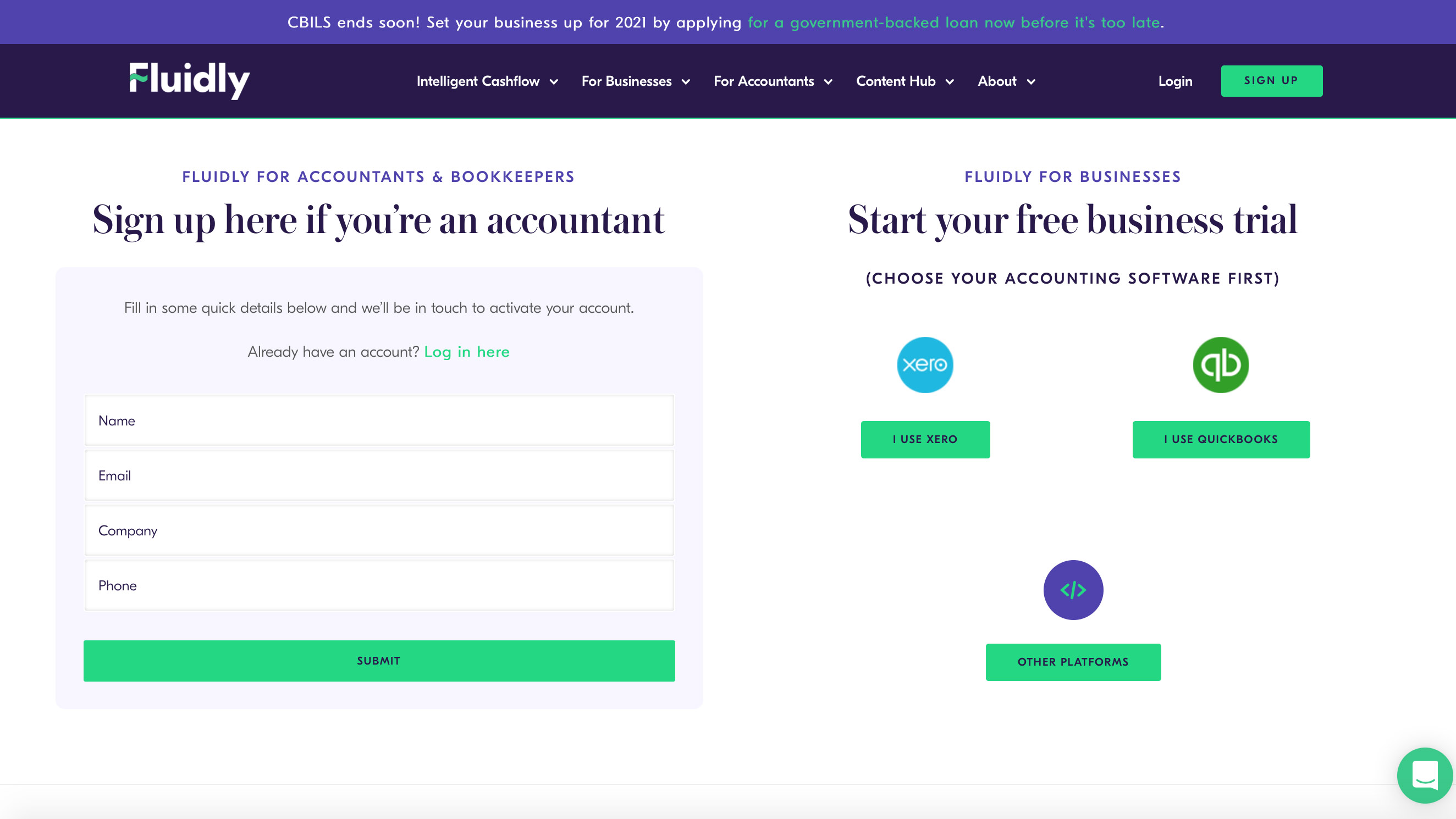

Prior to that you’ll need to sign up, which in itself is pretty straightforward. In fact, if you're looking at Fluidly for business needs then it’s possible to make use of a free trial to get a useful understanding of the way it works. You’ll need to choose your accounting software first though, with the core options being Xero or QuickBooks.

While Fluidly is in the process of looking at integrating other platforms, these are the only two supported options currently. Meanwhile, accountants and bookkeepers will need to sign up using a slightly different process, whereby Fluidly will get in touch to activate your account.

Support

Your support options somewhat depend on which of the three packages you go for. The Starter edition features in-app support, while the Standard package provides users with in-app, phone and email options to choose from. Similarly the Plus edition of Fluidly gets you in-app, phone and email support, plus access to all of the Fluidly webinars and events.

This high-tier package also secures the services of a dedicated account manager along with access to Fluidly University learning. Both of these features will be of obvious interest to companies with larger amounts of data to process.

Final verdict

Fluidly is an interesting proposition and one, which on its own admission, is still a work in progress. However, in the three years or so since the startup has been going the evolution of this cloud-based solution is clear to see. If you’re running a business or happen to be an accountant that deals with several business clients and need to reduce time spent on cashflow analysis Fluidly could be the answer.

Fluidly uses its intelligent cashflow projections, which are driven by artificial intelligence to provide a real-time overview on where businesses are getting it right, and wrong. While Fluidly can currently only be integrated with Xero and QuickBooks accountancy software it shows a lot of promise. And, even in its existing development phase Fluidly is already making plenty of friends in the business community. It definitely looks to be a great little timesaving option.

- We've also highlighted the best accounting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.