TechRadar Verdict

FreeTaxUSA is a powerful and highly effective online service that lets you file taxes without breaking the bank.

Pros

- +

Fast and free

- +

Straightforward to use

- +

Even the Deluxe edition is cheap

- +

Decent mobile version

Cons

- -

State filing incurs a small cost

- -

No dedicated app edition

- -

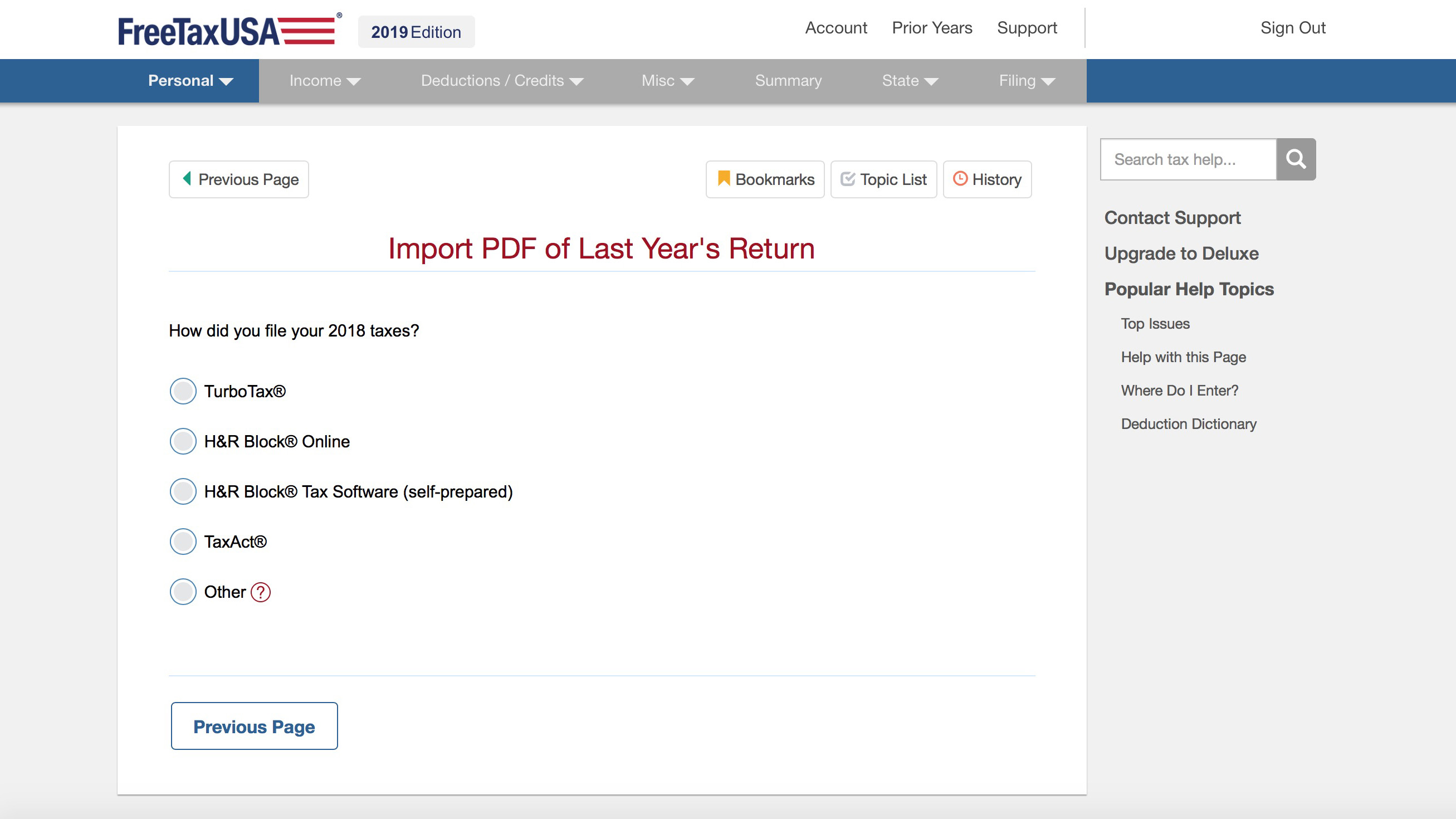

Limited import functions

- -

Live support only via the Deluxe version

Why you can trust TechRadar

FreeTaxUSA is a great solution for anyone looking to reduce the costs involved with keeping accounts in order and filing tax returns. And, considering it is kind on your wallet, the tax preparation service packs plenty of features that let you pick your way through the filing process with relative ease.

While FreeTaxUSA isn’t as sophisticated as other options such as TaxAct, TaxSlayer, Jackson Hewitt Online or Credit Karma Tax, it covers all bases in terms of working with relevant IRS forms and, ultimately, lets you file your federal taxes. For the state tax route though you’ll need to pay a fee, albeit a small one.

A downside, it has to be said, is the lack of ability to import your W-2 or 1099 forms, which something like TurboTax can do. Other than that, FreeTaxUSA impresses with its overall look and feel.

- Want to try FreeTaxUSA? Check out the website here

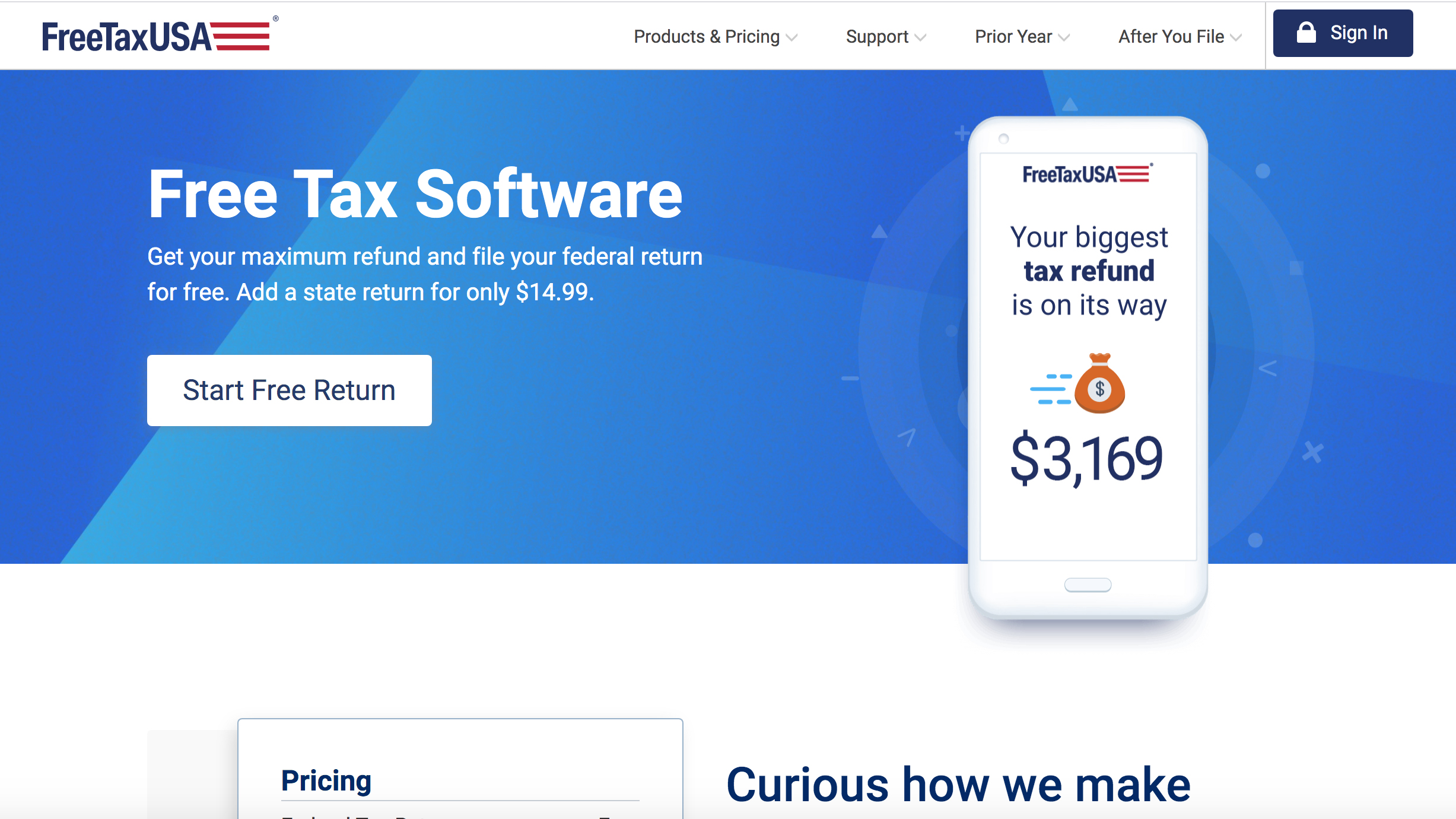

FreeTaxUSA: Pricing

Although FreeTaxUSA, as the name implies, is largely free to use there is cost involved, albeit nominal. So, the service will charge you $14.99 for a state return though federal filing costs zero dollars.

There’s also a Deluxe Return edition, that comes with a pretty trifling $6.99 price tag attached to it and for that you get the benefit of being able to submit unlimited returns if you’ve needed to make amendments. Better still, there is fast-lane access to live chat support, and these tax specialists can help guide you in the right direction if you’re getting stuck at any stage in the process.

Dig deeper into the service and you’ll find there’s also no charge for tax extensions, while prior year tax filing comes in at $14.99 for state and $0 for federal. It’s the same pattern for self-employed and small business owners too.

FreeTaxUSA: Features

Considering that FreeTaxUSA is, by and large, free to use it still packs a decent punch. Once you get into it you find that it’ll handle all of the main areas required for filing those 1099 forms. That means retirement, government payments, debt cancellation, payment processing, sale of your home, tuition program distributions, social security as well as stocks and interest too.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

The self-employed are also well catered for. Indeed, you’ll find that FreeTaxUSA ultimately has the ability to deal with each and every state and federal form, including common credits, which is quite something given its miserly charges.

FreeTaxUSA: Performance

FreeTaxUSA is an online service and, as such, works fine and dandy just as long as you have the obvious internet connection. There’s a mobile version too, for both iOS and Android, although in reality this is less of an app and more of a version of the same site you’d use on the desktop edition.

Nevertheless, FreeTaxUSA works nicely enough if you don't mind filing your tax details in the rather confined working area, especially on a phone. The tablet experience is rather better though, but we still tend to favour the desktop FreeTaxUSA experience over the mobile one.

The designers have worked hard to make both editions reasonably enjoyable and either version feels nicely optimized to work without trouble.

FreeTaxUSA: Ease of use

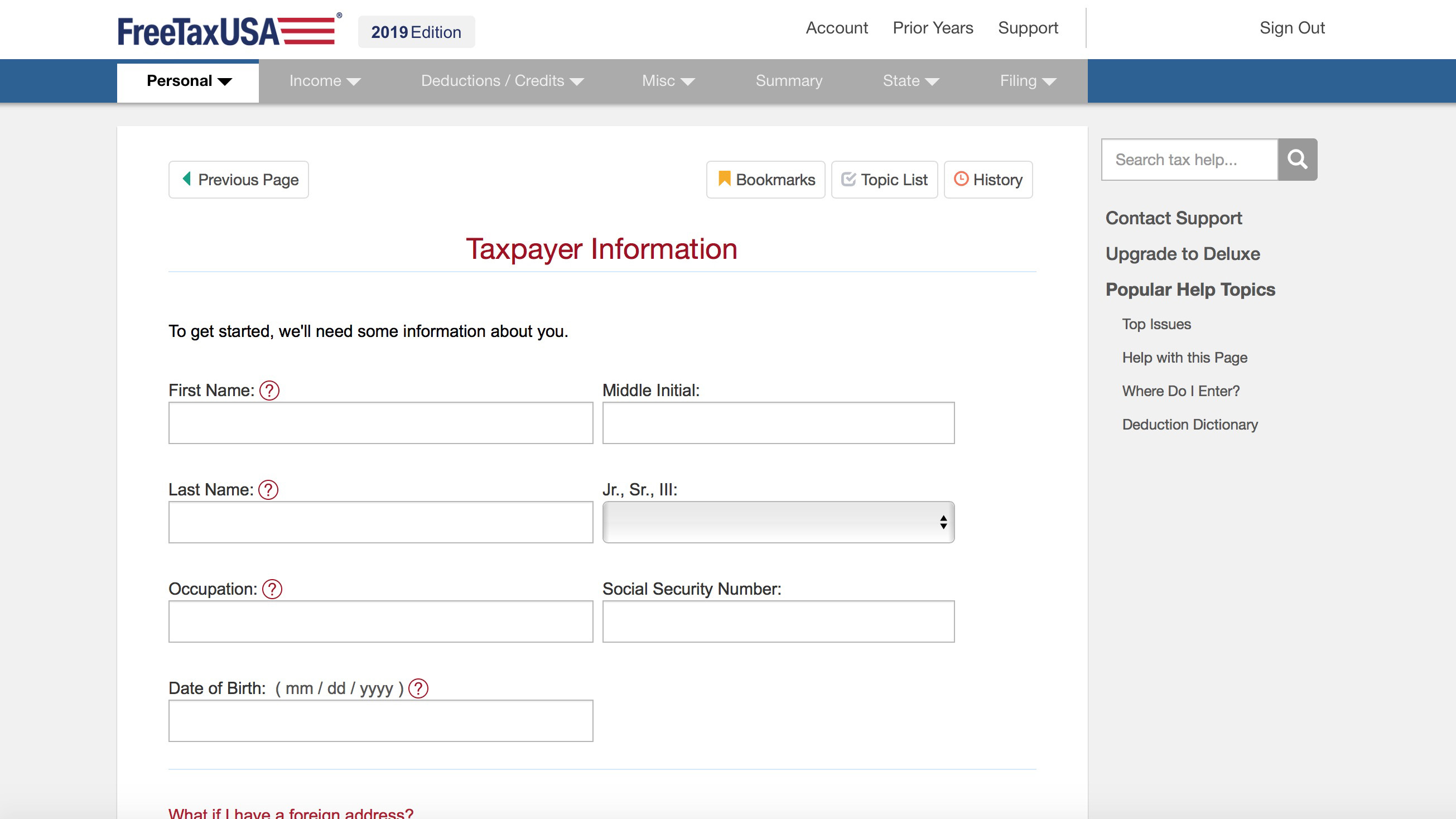

There’s nothing too intimidating about the FreeTaxUSA interface, with a pretty basic though effective page layout. Before you deep dive into the step-by-step stages there’s also a neat primer screen, which highlights the features and functionality of the following site content. From there on in it’s much like the other filing packages, with text boxes to populate with all of your data.

Overall it's a nicely laid out affair that emulates all of the sections of the 1040. As mentioned earlier though, a weakness with FreeTaxUSA is the inability to import W-2s and 1099s, which is something that makes TurboTax such a handy option for its one-stop-shop feature set.

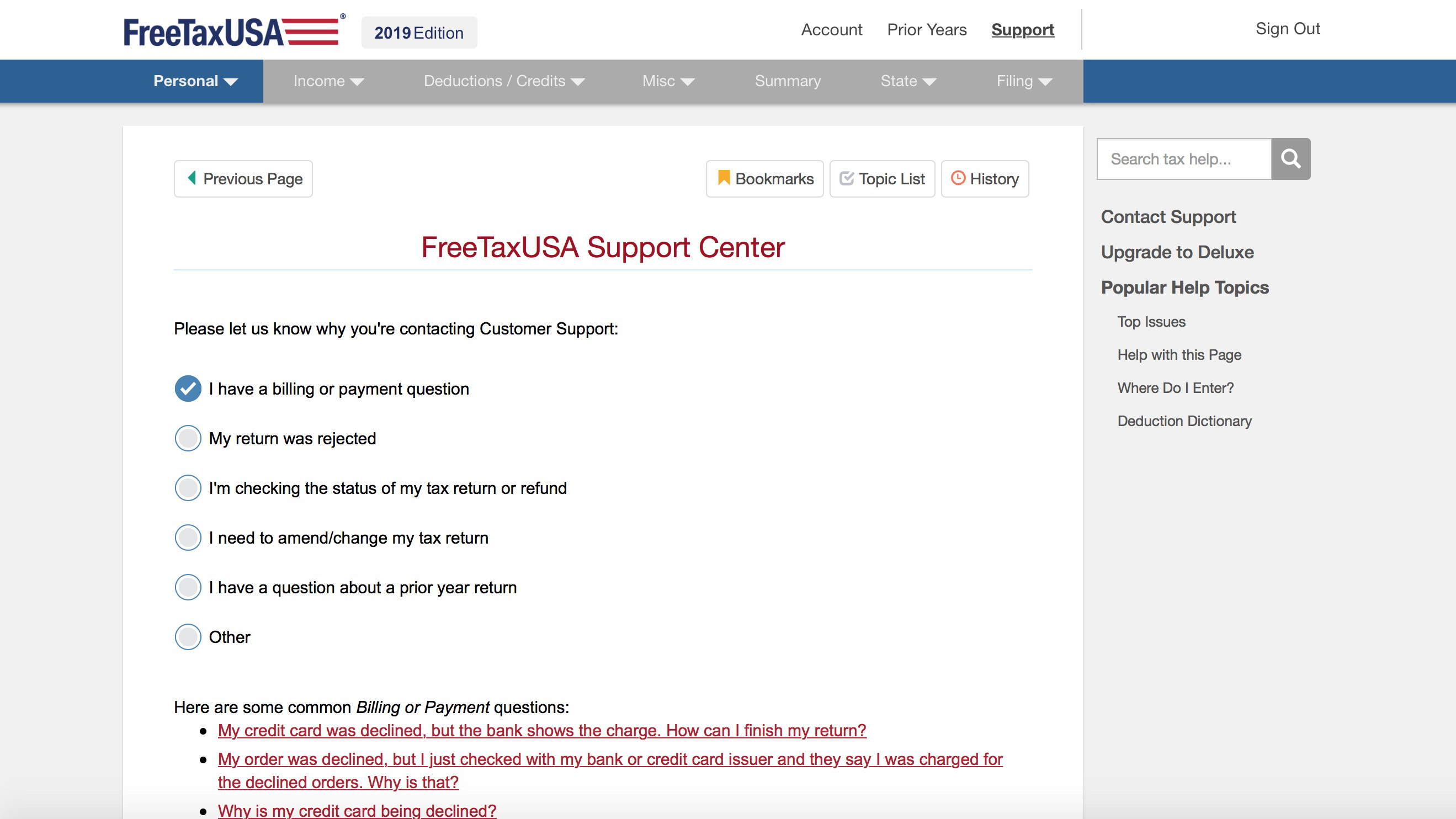

FreeTaxUSA: Support

Much like the other aspects of FreeTaxUSA, customer support is certainly not overly complicated, but it is available as and when you need it. Customers can head along to a dedicated area on the FreeTaxUSA website and type in a basic query to search the help database. That’s okay and does a no-nonsense job of answering more obvious queries.

However, if you need additional assistance then that’s at hand while you’re signed in, or using an online form, plus there’s a dedicated email address to send messages to. Better still though is the Live Chat feature, which you get if you upgrade to the still good value Deluxe package, that hooks you up with real people, who can hopefully offer real answers to your questions.

FreeTaxUSA: Final verdict

FreeTaxUSA is a good bet if you want an uncomplicated and, crucially, mainly free way of e-filing your taxes. While the Deluxe version beefs up what's on offer in terms of support, if you’re reasonably competent with your bookkeeping and have kept an organized pile of paperwork in the run up to file time then the basic incarnation is perfectly acceptable.

There are some drawbacks here, as we’ve outlined above, but if you’re keen to keep your overheads to an absolute minimum then FreeTaxUSA will get you to filing point without putting a dent in your finances.

- We've also highlighted the best tax software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.