TechRadar Verdict

TaxSlayer has a well-proven track record and continues to improve with age. It’s got all the features and functionality you’d expect, with more for the pricier options, but there are a few weak areas too.

Pros

- +

Well-rounded range of product options

- +

Simplistic but effective layout

- +

Dependable functionality

- +

Premium offers good support

Cons

- -

A few idiosyncrasies

- -

Less impressive app version

- -

Help sections could be better

- -

Trickier for tax novices

Why you can trust TechRadar

TaxSlayer has been designed to take on everything your tax situation throws at you and it has been nicely adapted to suit changes in the law. With a portfolio of options tailored to suit a variety of filers, from the single and students through to those with tangled tax situations and the self-employed, it’s got a lot to offer. There's also an edition aimed at accountancy professionals called TaxSlayer Pro.

TaxSlayer has also honed its options, therefore simplifying the completion of tax filing duties. What’s more, the software service is all online and, via the completion of step-by-step wizards, you can quickly and efficiently e-file your affairs within the context of a well-proven suite of products. Lookout for other options in this crowded marketplace though, including TaxAct, Jackson Hewitt Online, Credit Karma Tax and FreeTaxUSA.

- Want to try TaxSlayer? Check out the website here

TaxSlayer: Pricing

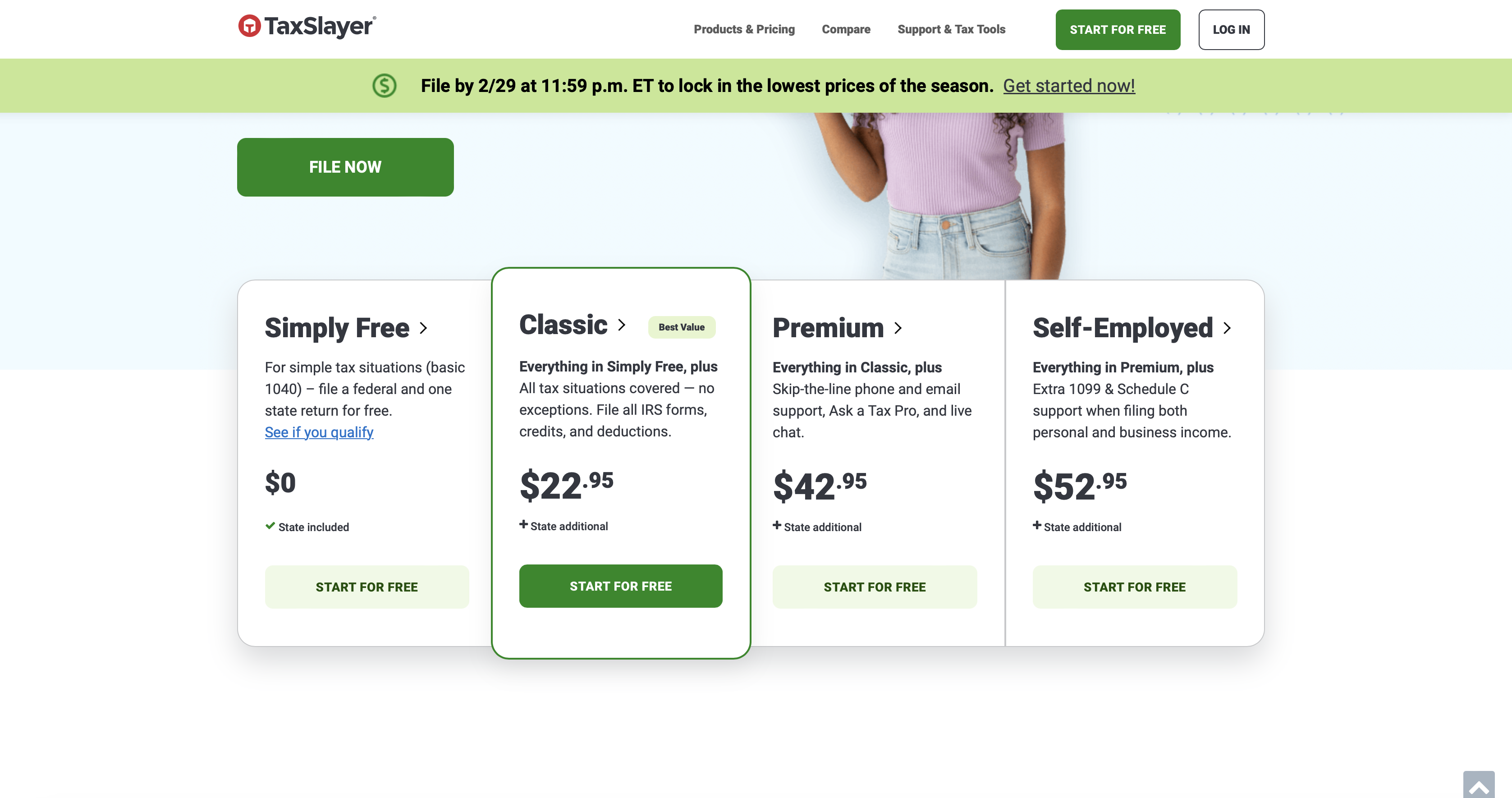

TaxSlayer delivers a solid selection of product options, with one to suit pretty much any kind of individual. If you’re starting out, have relatively simple tax affairs and are single, married and filing a joint return or a student then the similarly basic Simply Free option is a good one. It allows you to file for no outlay with $0 state included to pay.

TaxSlayer’s stated ‘most popular’ package is the next one; Classic which is suited to all tax situations, can be started for free and costs $22.95 plus state additional. Meanwhile, Premium offers up a swift way to prepare and e-file, with the added bonus of priority support as and when you need it. That costs $42.95 plus state additional.

Finally, TaxSlayer’s Self-Employed product will set you back $52.95 and also has the state additional charge.

TaxSlayer: Features

The latest incarnation of TaxSlayer certainly comes with an impressive list of features. And, as its creators like to remind you, they’ve engineered an experience specific to your tax filing needs.

Therefore, once you’ve signed up for an account you will be able to pay tax with your refund, enjoy personalized tax tips and reminders specific to you, get more ways to receive your refund as well as having access to new tools that enable faster more efficient filing. TaxSlayer is also adept at managing your financial situation year-round.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

In it's most basic form, TaxSlayer's Simply Free is a basic, functional way to prepare, print and e-file taxes, though does add in new coverage for education deductions and credits.

TaxSlayer: Performance

Step on up to the Classic edition of TaxSlayer though and you enjoy everything Simply Free has along with timesaving options, such as being able to import your W-2. This edition also includes all deductions and credits.

Performance really steps it up a gear with the Premium edition, however, with IRS Audit Assistance (delivering a 3 full year $29 value no less). You’ll also be able to work smarter and a lot more quickly, thanks to the ability to speak to a ‘real’ tax professional.

Naturally, being an online service means it chunters away nicely enough with a dependable internet connection, while there’s a dedicated mobile edition for those who might be tempted to file via phones or tablets.

TaxSlayer: Ease of use

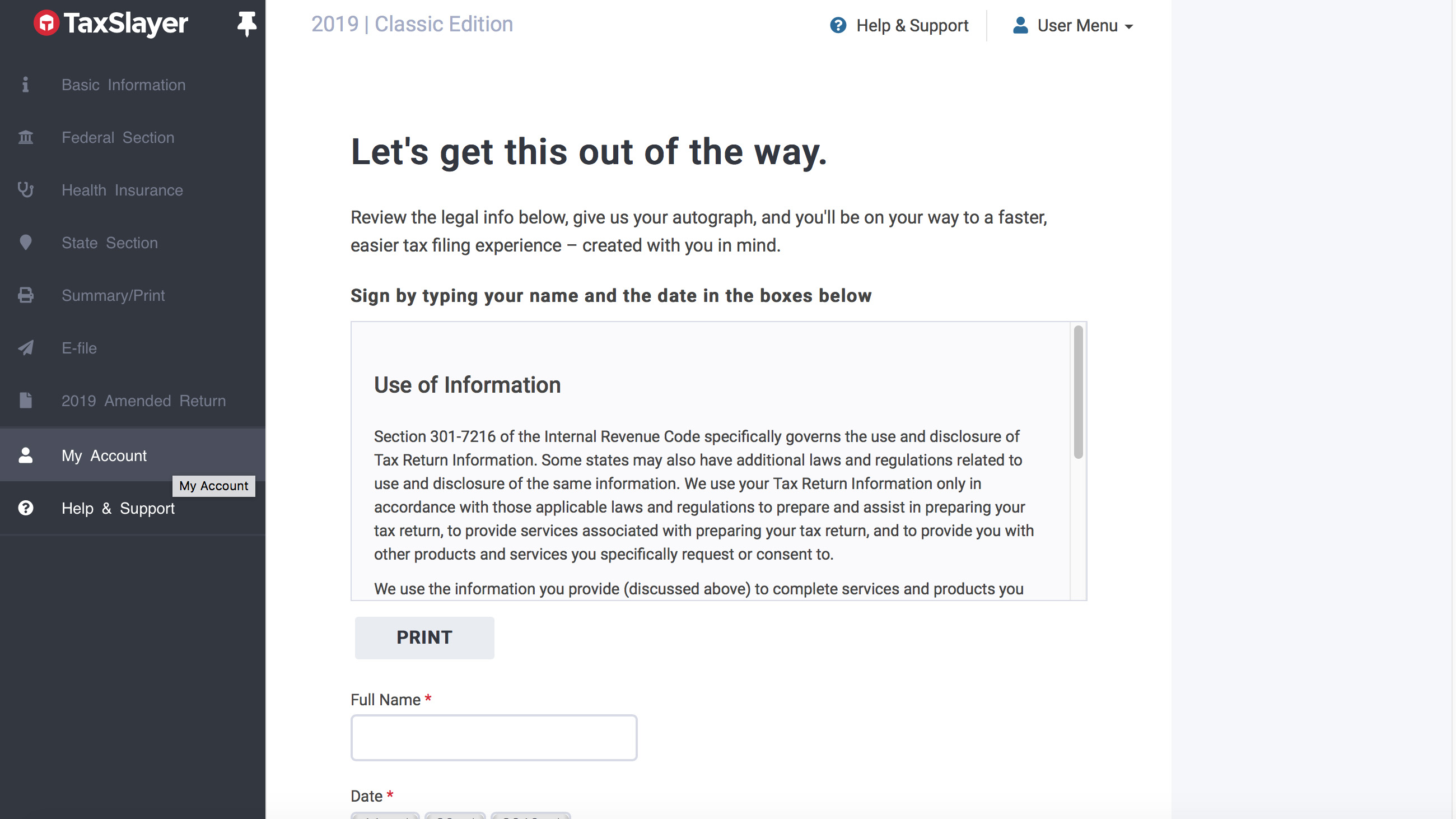

TaxSlayer takes you on a reasonably enjoyable journey through your e-filing duties and it is to be commended for its ease of use. The likes of basic 1040 filers and those with W-2 income will find it very accessible, with a series of relatively simple screens to fill in.

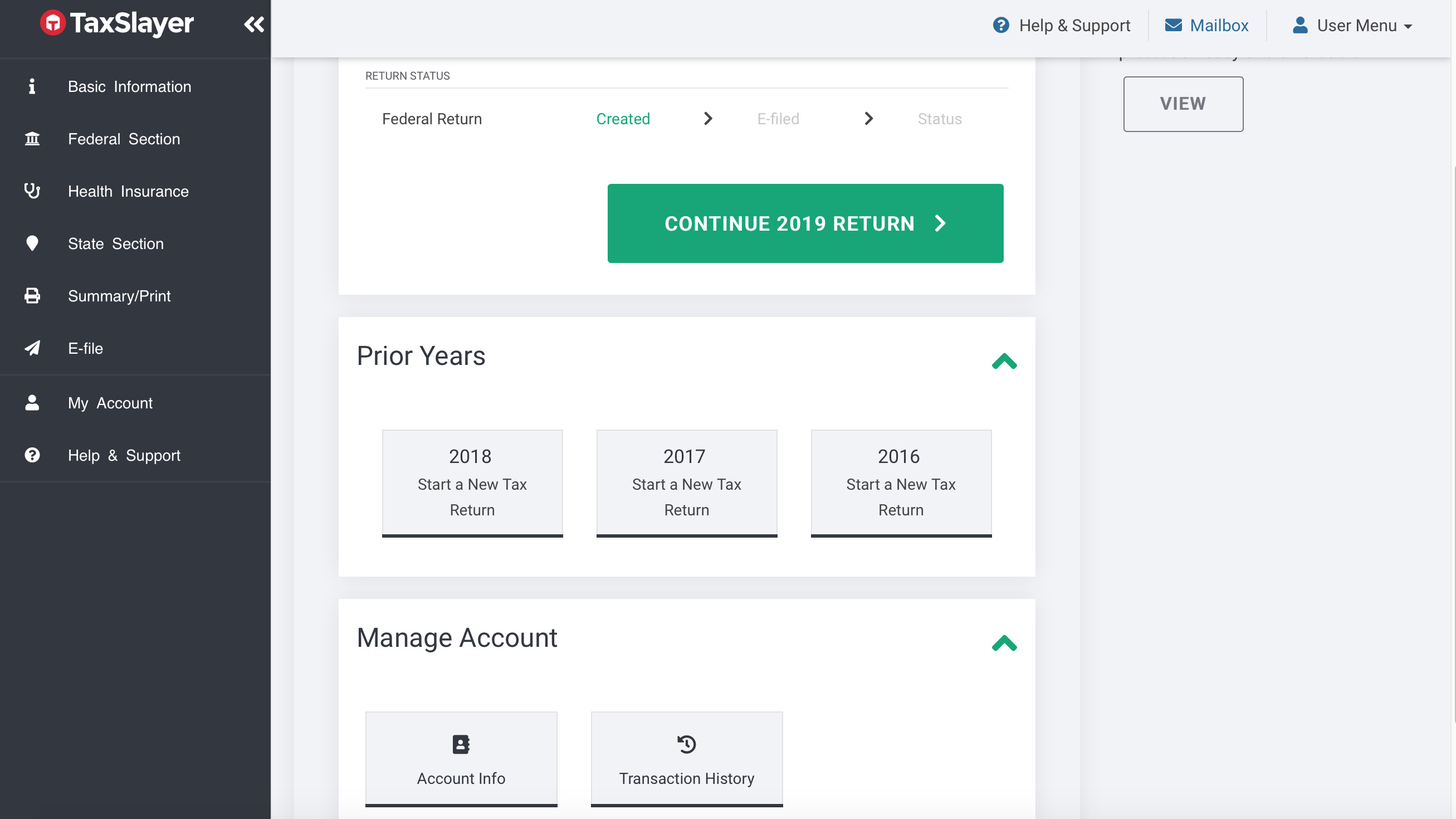

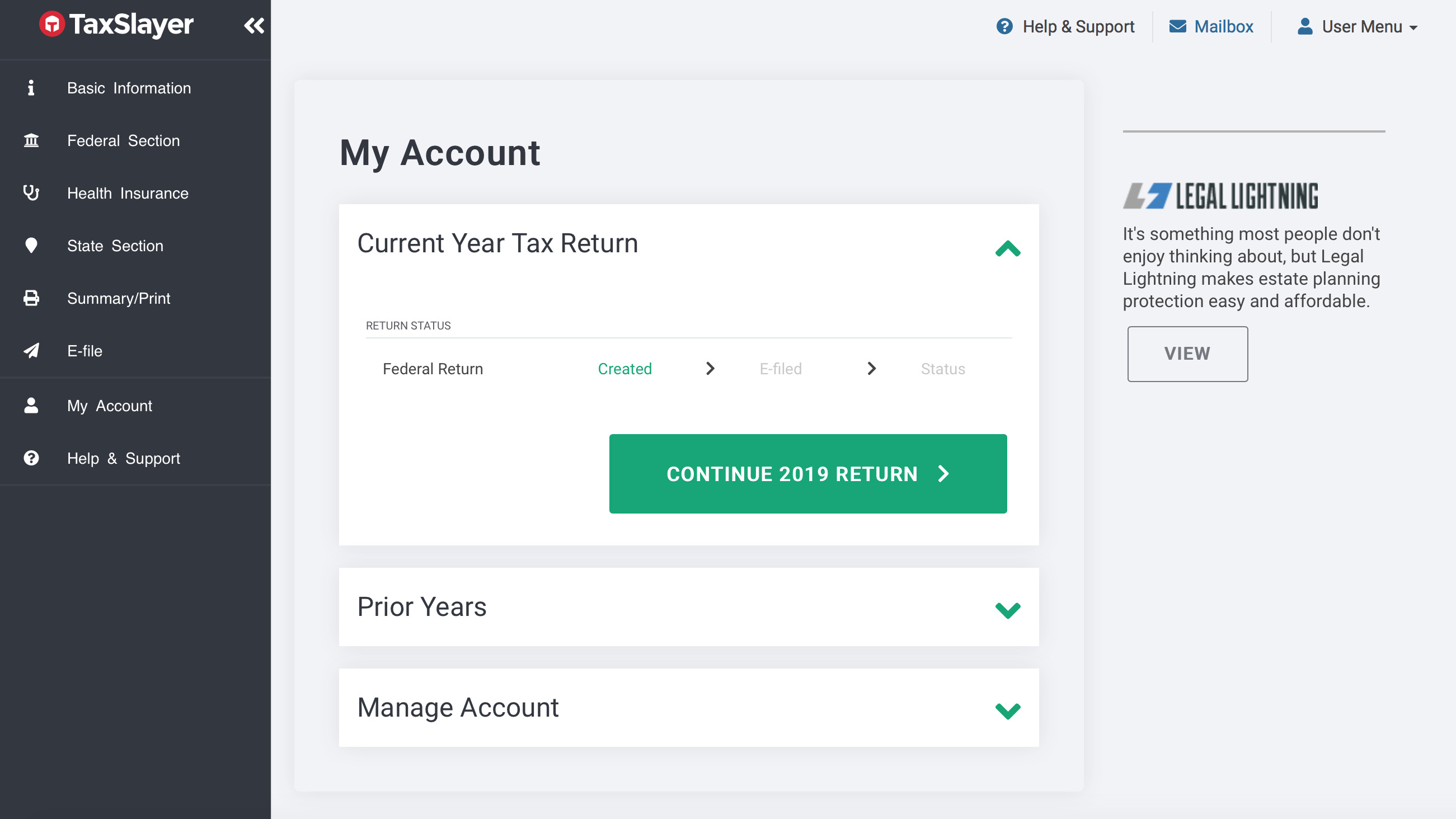

This process starts out with the familiar sign up and register screen and from there on in you work your way through the various tabbed sections, with a left-hand menu on screen to show where you are within the context of Federal, State and Health Insurance topics.

While TaxSlayer might not have quite the same level of finesse as witnessed within other online software filing solutions, it does reward the patient thanks to its methodical structure.

TaxSlayer: Support

Though it has to be said there is less in the way of support for those starting out at the lower end of the TaxSlayer product portfolio things do take a turn for the better when you arrive at Premium. Within this option there is the aforementioned support from tax professionals, plus the ability to make the most of live support, both by phone and via email.

The live chat avenue also delivers more on the support front, so it soon justifies its price tag. Self-Employed types can also get support from tax professionals, particularly those with knowledge of this specific tax arena. That’s a definite boon, especially as this package also features a new personalized guide to self-employed taxes.

TaxSlayer: Final verdict

The latest version of TaxSlayer ticks a lot of the e-filing boxes, but there is still room for improvement. We like the overall look and feel of the online system, and layouts are solid, if a little idiosyncratic in places.

Help and support is at hand, though you’ll really need to invest in the more expensive editions if you’re to enjoy the benefits of wall-to-wall support including help from real tax professionals. Nevertheless, TaxSlayer also has plenty to offer the fledgling e-filer with its competent basic edition.

- We've also highlighted the best tax software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.