Why financial companies should care about machine learning?

Let’s see why financial companies should care, what solutions they can implement with AI and machine learning, and how exactly they can apply this technology.

Machine learning in finance may work magic, even though there is no magic behind it (well, maybe just a little bit). Still, the success of machine learning project depends more on building efficient infrastructure, collecting suitable datasets, and applying the right algorithms.

Machine learning is making significant inroads in the financial services industry. Let’s see why financial companies should care, what solutions they can implement with AI and machine learning, and how exactly they can apply this technology.

- We've also highlighted the best accounting software

Definitions

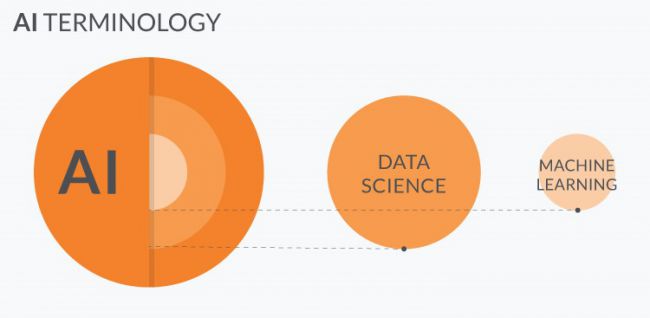

We can define machine learning (ML) as a subset of data science that uses statistical models to draw insights and make predictions. The chart below explains how AI, data science, and machine learning are related. For the sake of simplicity, we focus on machine learning in this post.

The magic about machine learning solutions is that they learn from experience without being explicitly programmed. To put it simply, you need to select the models and feed them with data. The model then automatically adjusts its parameters to improve outcomes.

Data scientists train machine learning models with existing datasets and then apply well-trained models to real-life situations.

The model runs as a background process and provides results automatically based on how it was trained. Data scientists can retrain models as frequently as required to keep them up-to-date and effective. For instance, our client Mercanto retrains machine learning models every day.

In general, the more data you feed, the more accurate are the results. Coincidentally, enormous datasets are very common in the financial services industry. There are petabytes of data on transactions, customers, bills, money transfers, and so on. That is a perfect fit for machine learning.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

As the technology evolves and the best algorithms are open-sourced, it’s hard to imagine the future of the financial services without machine learning.

That said, most financial services companies are still not ready to extract the real value from this technology for the following reasons:

- The R&D in AI and machine learning is costly.

- Businesses often have completely unrealistic expectations towards machine learning and its value for their organisations.

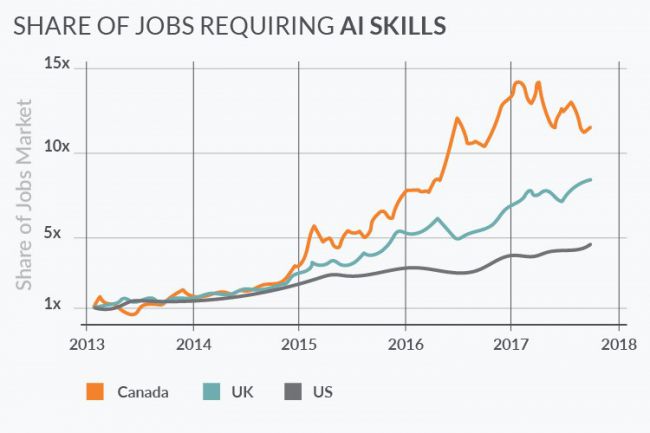

- The shortage of DS/ML engineers is another major concern. The figure below illustrates an explosive growth of demand for AI and machine learning skills.

- Financial incumbents are not agile enough when it comes to updating data infrastructure.

We will talk about overcoming these issues later in this post. First, let’s see why financial services companies cannot afford to ignore machine learning.

Why consider machine learning in finance?

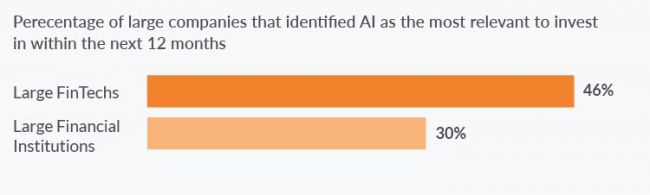

Despite the challenges, many financial companies already take advantage of this technology. The figure below shows that financial services’ execs take machine learning very seriously, and they do it for a bunch of good reasons:

- Reduced operational costs thanks to process automation

- Increased revenues thanks to better productivity and enhanced user experiences

- Better compliance and reinforced security

There is a wide range of open-source machine learning algorithms and tools that fit greatly with financial data. Additionally, established financial services companies have substantial funds that they can afford to spend on state-of-the-art computing hardware.

Tanks to the quantitative nature of the financial domain and large volumes of historical data, machine learning is poised to enhance many aspects of the financial ecosystem.

That is why so many financial companies are investing heavily in machine learning R&D. As for the laggards, it can prove to be costly to neglect AI and ML.

What are machine learning use cases in finance?

Let’s take a look at some promising machine learning applications in finance.

Process automation

Process automation is one of the most common applications of machine learning in finance. The technology allows to replace manual work, automate repetitive tasks, and increase productivity.

As a result, machine learning enables companies to optimise costs, improve customer experiences, and scale up services. Here are automation use cases of machine learning in finance:

- Chatbots

- Call-centre automation

- Paperwork automation

- Gamification of employee training, and more

Below are some examples of process automation in banking:

JPMorgan Chase launched a Contract Intelligence (COiN) platform that leverages Natural Language Processing, one of the machine learning techniques. The solution processes legal documents and extracts essential data from them. Manual review of 12,000 annual commercial credit agreements would typically take up around 360,000 labour hours. Whereas, machine learning allows to review the same number of contracts in a just a few hours.

BNY Mello integrated process automation into their banking ecosystem. This innovation is responsible for $300,000 in annual savings and has brought about a wide range of operational improvements.

Wells Fargo uses an AI-driven chatbot through the Facebook Messenger platform to communicate with users and provide assistance with passwords and accounts.

Privatbank is a Ukrainian bank that implemented chatbot assistants across its mobile and web platforms. Chatbots sped up the resolution of general customer queries and allowed to decrease the number of human assistants.

Security

Security threats in finance are increasing along with the growing number of transaction, users, and third-party integrations. And machine learning algorithms are excellent at detecting fraud.

For instance, banks can use this technology to monitor thousands of transaction parameters for every account in real time. The algorithm examines each action a cardholder takes and assesses if an attempted activity is characteristic of that particular user. Such model spots fraudulent behaviour with high precision.

If the system identifies suspicious account behaviour, it can request additional identification from the user to validate the transaction. Or even block the transaction altogether, if there is at least 95 per cent probability of it being a fraud. Machine learning algorithms need just a few seconds (or even split seconds) to assess a transaction. The speed helps to prevent frauds in real time, not just spot them after the crime has already been committed.

Financial monitoring is another security use case for machine learning in finance. Data scientists can train the system to detect a large number of micropayments and flag such money laundering techniques as smurfing.

Machine learning algorithms can significantly enhance network security, too. Data scientists train a system to spot and isolate cyber threats, as machine learning is second to none in analysing thousands of parameters and real-time. And chances are this technology will power the most advanced cybersecurity networks in the nearest future.

Adyen, Payoneer, Paypal, Stripe, and Skrill are some notable fintech companies that invest heavily in security machine learning.

Underwriting and credit scoring

Machine learning algorithms fit perfectly with the underwriting tasks that are so common in finance and insurance.

Data scientists train models on thousands of customer profiles with hundreds of data entries for each customer. A well-trained system can then perform the same underwriting and credit-scoring tasks in the real-life environments. Such scoring engines help human employees work much faster and more accurately.

Banks and insurance companies have a large number of historical consumer data, so they can use these entries to train machine learning models. Alternatively, they can leverage datasets generated by large telecom or utility companies.

For instance, BBVA Bancomer is collaborating with an alternative credit-scoring platform Destacame. The bank aims to increase credit access for customers with thin credit history in Latin America. Destacame accesses bill payment information from utility companies via open APIs. Using bill payment behaviour, Destacame produces a credit score for a customer and sends the result to the bank.

Algorithmic trading

In algorithmic trading, machine learning helps to make better trading decisions. A mathematical model monitors the news and trade results in real-time and detects patterns that can force stock prices to go up or down. It can then act proactively to sell, hold, or buy stocks according to its predictions.

Machine learning algorithms can analyse thousands of data sources simultaneously, something that human traders cannot possibly achieve.

Machine learning algorithms help human traders squeeze a slim advantage over the market average. And, given the vast volumes of trading operations, that small advantage often translates into significant profits.

Robo-advisory

Robo-advisors are now commonplace in the financial domain. Currently, there are two major applications of machine learning in the advisory domain.

Portfolio management is an online wealth management service that uses algorithms and statistics to allocate, manage and optimise clients’ assets. Users enter their present financial assets and goals, say, saving a million dollars by the age of 50. A robo-advisor then allocates the current assets across investment opportunities based on the risk preferences and the desired goals.

Recommendation of financial products. Many online insurance services use robo-advisors to recommend personalised insurance plans to a particular user. Customers choose robo-advisors over personal financial advisors due to lower fees, as well as personalised and calibrated recommendations.

In the next post, I shall describe how financial services companies can actually adopt machine learning technology with strategies like extensive R&D and third-party AI solutions.

Tetiana Boichenko, Marketing Manager at N-iX