Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

P2P lending is proving increasingly popular with investors according to a new report released by Croatia-based fully automated P2P platform Robo.cash.

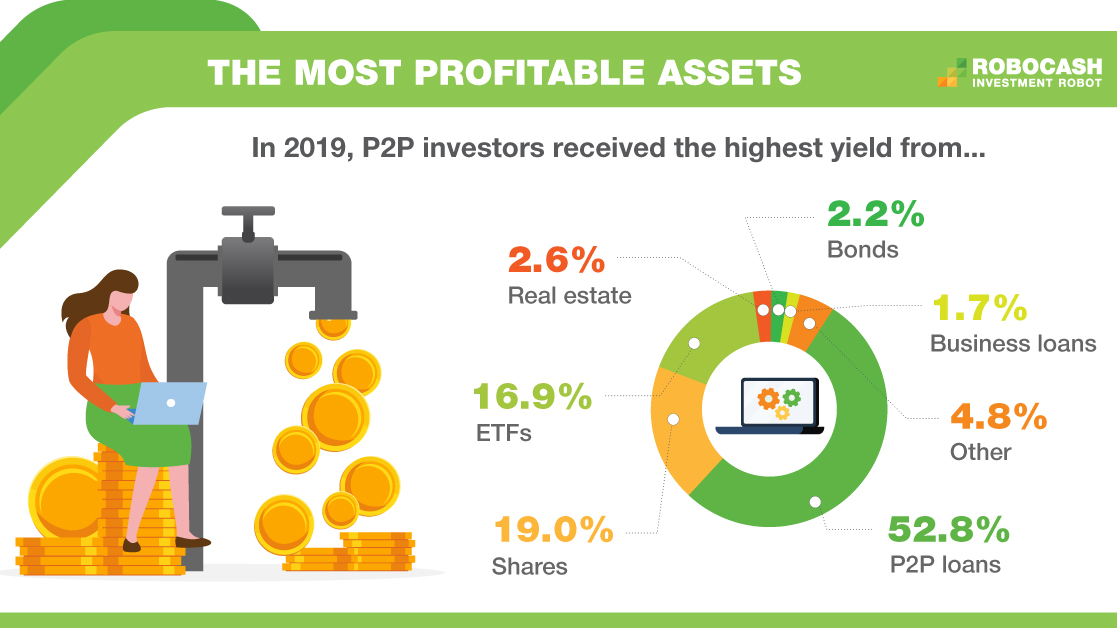

It recently completed a survey of European P2P investors dedicated to their financial results in 2019. Over half of the participants said that the alternative lending brought them the highest returns last year. The company expects that despite the coronavirus pandemic, the segment will keep the leading positions in 2020.

According to Robo.cash P2P loans have proved to be the most profitable asset type in the past year, as indicated by 52.8% of respondents in the survey. The next most popular answers, albeit with a significant gap, were shares and ETFs, mentioned by 19% and 16.9% of investors respectively. Some other profitable investment assets included real estate (2.6%), bonds (2.2%) and business loans (1.7%).

- The best tax software

- Have a look at the best accounting software

- Best budgeting software

- Check out the best money transfer apps and services

Boosting efficiency

Realizing the solid performance of the P2P segment, 84% of investors increased its share in their portfolios last year. 24.2% increased it by 25%-50%, 21.2% by 50%-100% and 16% more than doubled it.

Sergey Sedov, CEO of Robocash Group, shared his expectations over P2P investments this year: “We hope that the attitude of investors towards the P2P segment will not significantly change during 2020 despite the current situation in the markets. According to our poll in March, 79.5% of European investors’ P2P portfolios were not affected by the pandemic.

Moreover, this year, investors can benefit from even higher interest rates on P2P loans, as many platforms increased them to adapt to the changing market conditions. At the same time, the income from these investments remains stable compared to other assets, such as shares.

It is important, however, to choose a financially sustainable company with a strong track record and strict borrower scoring policy to invest in.”

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

- We've also highlighted the best accounting software in 2020

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.