Meta urged to act on rising consumer fraud scams

TSB Bank urges Meta to do more to help with fraud

Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

Consumers could lose up to $250 million from scams involving Meta in 2023 thanks to worryingly high levels of fraud if the social media behemoth doesn’t intervene, TSB Bank has warned.

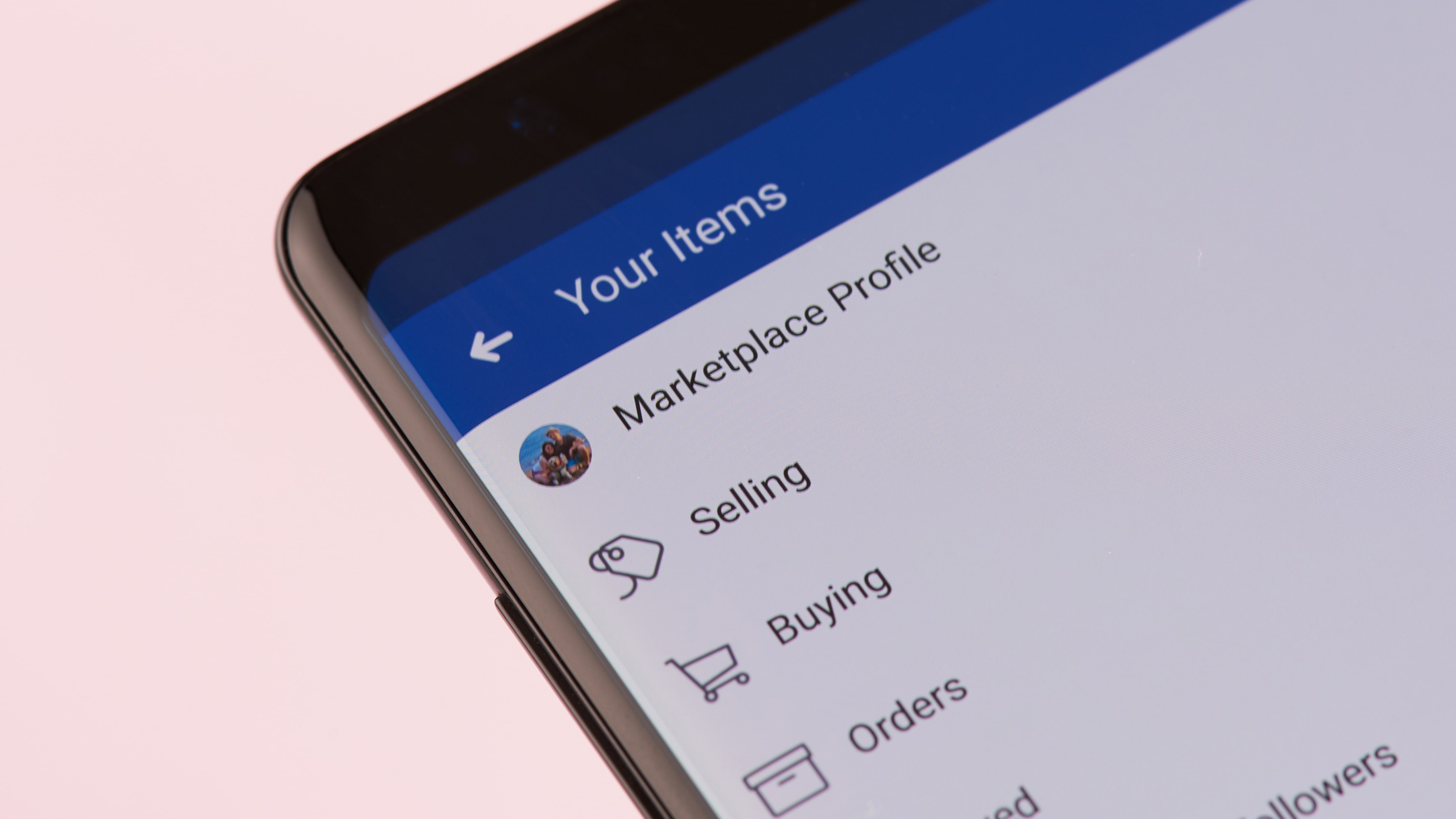

The bank’s data showed that in the last month alone, 80% of the fraud cases it registered in its three biggest fraud categories stem from Meta platforms. City AM, which is credited with reporting on TSB’s efforts to get Meta to step up, also highlights the two-thirds of online shopping scams that stem from Meta-owned platforms, including Facebook Marketplace.

TSB Bank CEO Robin Bulloch has addressed a letter to Meta outlining how the Zuckerberg-owned company should tackle rising scam, which may offer up some different banking perspectives over its social media-centric perspectives.

Meta fraud scams

Top of Bulloch’s list is payment, which is currently unregulated by the platform. Sellers and vendors can choose to exchange money in any way they see fit, including dodgy cash and bank transfers that never arrive. The TSB exec calls for a secure payment mechanism in place of the current system.

Also under scrutiny are the unregulated firms that are being allowed to advertise on Meta’s platforms, which should be subject to detailed and timely investigation. Meta says that advertisers on its site must be cleared by the FCA first.

TSB’s director of fraud prevention, Paul Davis, said: “Meta needs to face up to its responsibility: it has a duty of care to the millions of customers who use its platforms, which is all the more important when we see innocent people lose life-changing sums every day.”

The City AM report also raises concerns that the UK has become the world’s fraud hotspot amid a “fraud epidemic” that saw £1.2 billion stolen by scammers in 2022.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

A Meta spokesperson told TechRadar Pro:

"This is an industry-wide issue and scammers are using increasingly sophisticated methods to defraud people in a range of ways including email, SMS and offline. We don’t want anyone to fall victim to these criminals which is why our platforms already have systems to block scams, financial services advertisers now have to be FCA authorised to target UK users and we run consumer awareness campaigns on how to spot fraudulent behaviour. People can also report this content in a few simple clicks and we work with the police to support their investigations."

In an email to TechRadar Pro, the company also shared some background, including its collaboration with Stop Scams UK, its 'STOP. THINK. CALL.' scams awareness campaign, and other good practices.

- Check out our roundup of the best firewalls

With several years’ experience freelancing in tech and automotive circles, Craig’s specific interests lie in technology that is designed to better our lives, including AI and ML, productivity aids, and smart fitness. He is also passionate about cars and the decarbonisation of personal transportation. As an avid bargain-hunter, you can be sure that any deal Craig finds is top value!