Sign up for breaking news, reviews, opinion, top tech deals, and more.

You are now subscribed

Your newsletter sign-up was successful

Google is transforming its Google Pay app into a personal finance powerhouse, which can help users with transferring money and budgeting amongst other things.

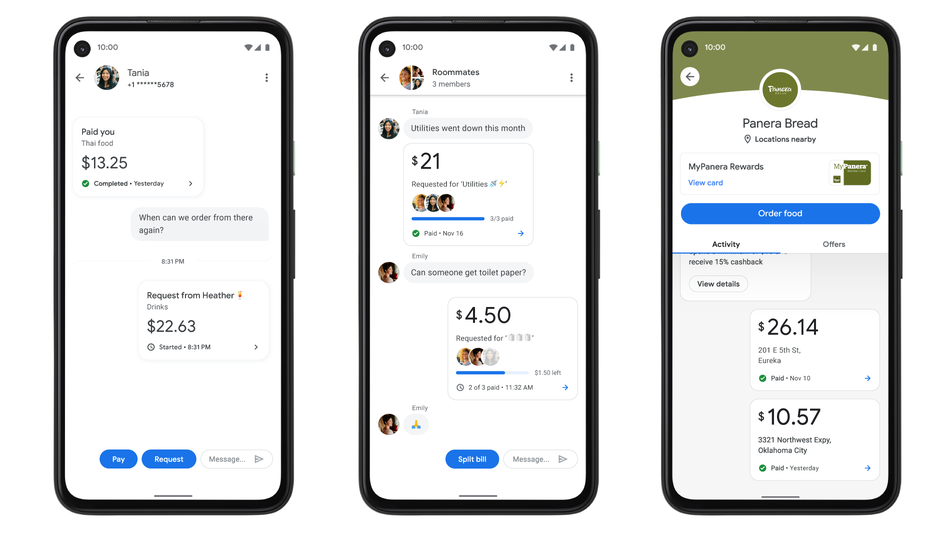

The revamp focuses on users friends and businesses, making it much easier to ping funds to them in a similar fashion to the likes of Venmo with a new group payment feature.

The app will let you pay your bill at commonly used outlets, such as restaurants and gas stations as well as redeem money off discounts and other promotional offers. Money transfers can, however, only be seen by you and the recipient.

- We've also featured the best UK tax software

- Take a look at the best bookkeeping software

- Check out the best free accounting software for small business

Google Pay update

The revamped app offers other practical new features too. Fans of food outlets will be pleased to hear that it will be possible to order and pay for meals at over 100,000 outlets across the US directly from within Google Pay. It also automatically catalogs your transactions and these can be quickly located by tapping on the outlet’s icon, which is stored in your phone.

The functionality will also extend to receipts you’ve stored in Gmail for added convenience. This feature will be particularly useful for anyone needing to make expense claims, and works in a similar fashion to other software apps that let you keep on top of your expenses without the need for a wallet full of creased paper receipts.

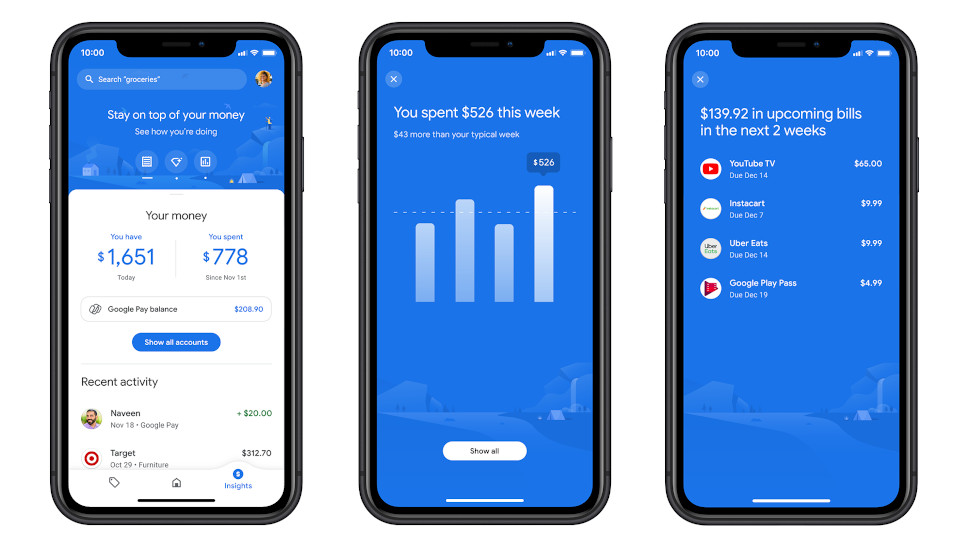

Another useful day-to-day feature is the way Google Pay can now give you an insight into your spending habits (pictured above). Similar to other budgeting apps out there today, Google Pay’s tool lets you get financial information from your connected bank accounts along with your credit and debit cards.

Adding extra weight to this feature is the way it can showcase your spending habits over specific periods, remind you when bills are due to be paid and, crucially, flag up any potential cases of fraudulent activity in relation to you and your finances.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Google will be adding more muscle to the functionality of Google Pay by partnering with 11 banks, so users can lookout for a new bank account option next year. The mobile-focused bank account, called Plex, will boast no monthly fees and come with no overdraft charges or minimum balance requirements either.

Google Pay is set to be rolled out during November for Android and iOS users, with Google presumably hoping to boost the ranks of the already sizeable 150 million users it currently has for the software application.

- Also, check out our roundup of the best budgeting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.