Fighting back: how to report tax-related identity theft and safeguard your finances

If you have been the victim of identity theft, there are steps you can take to notify the IRS and protect yourself

Identity theft is a serious concern that can happen to anyone at any time. In order to protect yourself, it's a good idea to sign up for the best identity theft protection available. However, tax-related identity theft has become a particularly significant issue in the US. Criminals use your stolen personal information, such as your SocIdentity theft is a serious problem that affects millions of people each year. Unfortunately, it can happen to anyone at any time, and the consequences can be devastating. One of the most prevalent forms of identity theft in the US is tax-related identity theft. This occurs when criminals use stolen personal information, such as your Social Security number, to file a fraudulent tax return in your name. They then attempt to claim your tax refund, which can be a significant amount of money.

The impact of tax-related identity theft can be extremely distressing. In addition to the financial loss that can result from having your refund stolen, victims may also experience a range of other problems. For example, they may face difficulty obtaining credit or loans, as their credit score may be negatively affected by the fraud. They may also need to spend a lot of time and effort dealing with the IRS and other authorities in order to resolve the issue.

Given the seriousness of tax-related identity theft, it's important to take steps to protect yourself. One of the most effective ways to do this is to sign up for the best identity theft protection available. This can help to monitor your credit and alert you to any suspicious activity, such as new accounts being opened in your name. It's also important to be vigilant about protecting your personal information, such as your Social Security number, and to take steps to secure your online accounts and devices.ial Security number, to file a tax return in your name. They then attempt to claim your tax refund for themselves, which is clearly fraudulent and can cause a great deal of inconvenience and financial loss.

You need to act fast

It's important to stay vigilant about your personal tax affairs to detect any signs of identity theft. Knowing what steps to take next is essential if you become a victim. Unfortunately, many people don't realize they've been targeted until they receive a notification from the IRS. Therefore, it's wise to be aware of the warning signs.

Several indicators could suggest you've fallen prey to identity theft. One of the most common is receiving a letter from the IRS regarding a tax return you don't remember filing. Another indication is the inability to e-file your tax return due to a duplicate Social Security number in circulation.

Listen for the alarm bells

If you receive a tax transcript in the mail that you didn't expect, it could indicate that you've fallen victim to identity theft. Similarly, if you receive confirmation of a new online account created in your name, or if your existing account has been accessed or disabled without your knowledge, it could be due to identity theft.

Be on the lookout for any notices from the IRS regarding additional taxes owed or refund offsets. You might also experience collection actions for a year in which you didn't file a tax return. Additionally, IRS records might show you receiving wages or other income from an employer you've never worked for. All of these signs could point to identity theft and should be taken seriously.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

Taking action

If anything like this has happened to you and you feel you might be a victim of tax-related identity theft, then the IRS has excellent guidance on what to do next.

While the central issue might be that your Social Security number has been compromised, other areas where your details might have been stolen, too. If you suspect anything like this has happened, you must respond immediately to any notices you receive from the IRS using the phone number they supplied.

If you’ve already e-filed a return and it gets rejected, it may be because of a duplicate filing, possibly because someone has been using your Social Security number; you’ll need to complete IRS Form 14039, the Identity Theft Affidavit. It may be that the IRS instructs you to do this instead. Either way, use the fillable form via IRS.gov, print it, and mail the document using the official guidance.

Next steps

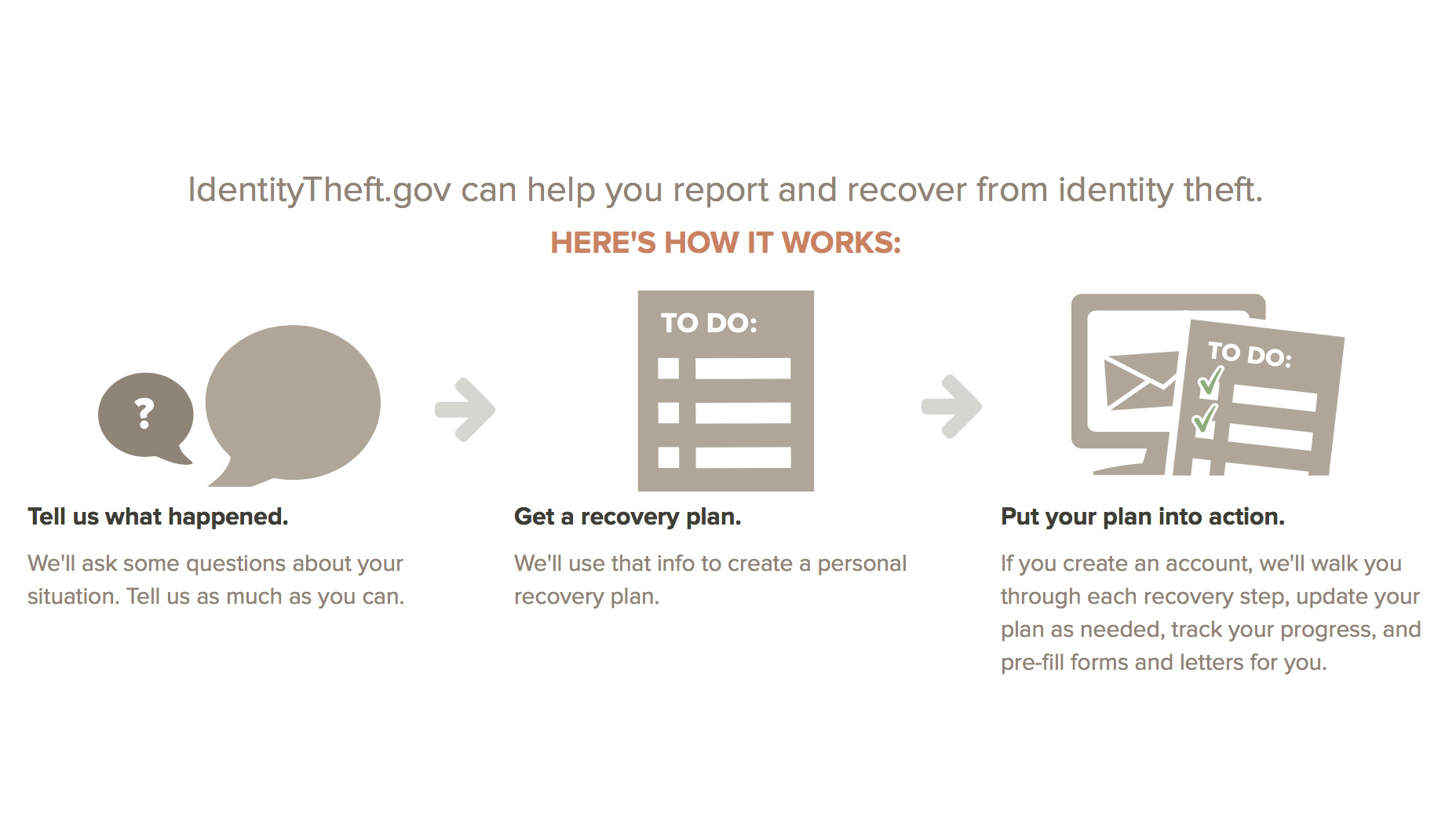

Following that move, the next port of call should be to visit IdentityTheft.gov, a hub dedicated to helping you through the following steps involved in post-identity theft. It’s got some excellent practical guidance on how best to proceed and the core things you need to do to minimize the fallout from having your details compromised.

Regarding prioritizing what you must do, the site sets out its stall nicely. First, you’ll want to call any companies where you think there might have been fraudulent issues relating to your details. You will still need to file your tax return and naturally pay any taxes you owe, which might have to be done using paper tax returns until the situation is resolved.

Make a point of keeping a record of who you contacted and the dates involved. In addition, be sure to retain copies of any correspondence.

Credit bureaus

The other thing to do is place a fraud alert by contacting one of the three credit bureaus, including TransUnion, Experian, and Equifax. You might only contact one, but they must tell the other two. You’ll also want your free credit reports from TransUnion, Experian, and Equifax. The IdentityTheft.gov site advises heading to annualcreditreport.com or calling 1-877-322-8228 to do this.

While this government advice hub can help if you’ve been the victim of tax-related identity theft, it is also an excellent resource if you’ve suffered from other forms of fraud. There is guidance on what you should do if you’ve been the victim of tax, medical, or child identity theft, along with a whole host of other topics designed to make the experience slightly less stressful.

Important preventative measures

Of course, the other thing to do if you don't already have measures in place is to secure your personal information. Choosing one of the best identity theft protection packages is an excellent way of combating fraudsters. Still, signing up for security software is also a good idea if you don't already have it.

Investing in a password manager is another prudent move, which will help secure all those passwords that we accumulate now that so much of our daily lives are online. Even taking steps to reduce conventional junk mail flow is another way to reduce your profile.

Simply making it less easy for ID thieves to get hold of your details is one thing, while remaining vigilant about protecting your personal information is another critical issue to address. The threat might always be there, but you can at least do your bit to reduce it.

More from TechRadar Pro

Bryan M. Wolfe is a staff writer at TechRadar, iMore, and wherever Future can use him. Though his passion is Apple-based products, he doesn't have a problem using Windows and Android. Bryan's a single father of a 15-year-old daughter and a puppy, Isabelle. Thanks for reading!