TechRadar Verdict

PayPal credit card processing is but one aspect of a suite of products from this huge concern. With options ranging from e-commerce website integration through to physical card readers it’s easy to see why PayPal continues to be a major player in the marketplace.

Pros

- +

Competitive costs

- +

Highly flexible

- +

Handles all cards

- +

Straightforward

Cons

- -

More complex packages slightly daunting

Why you can trust TechRadar

PayPal credit card processing is a huge player in the business world and another handy facet of the products and services it offers, especially during coronavirus, is the ability to accept payments by plastic. One of the most appealing aspects of what PayPal does is that there’s no real long-term commitment needed, which is a bonus for smaller businesses.

Add to that no setup fees and the value it can add to your business is obvious. You can choose from different packages within PayPal to suit the scale of your turnover, so PayPal Checkout, PayPal Web Payments Standard and PayPal Payments Pro should all be investigated if you’re aiming to process credit card payments.

Comparable credit card processing products are also available from the likes of Sage Pay, Stripe, Authorize.net, Worldpay, PaySimple, Helcim and Clover.

- Want to try PayPal? Check out the website here

Pricing

PayPal, thankfully, likes to keep things relatively straightforward when it comes to its pricing structures. That’s always welcome news if you’re a smaller business or sole trader that doesn't want any hidden charges that can dent annual turnover. Simply adding basic PayPal functionality to your existing checkout comes with no annual fee plus 2.9% and a fixed fee for its Checkout option.

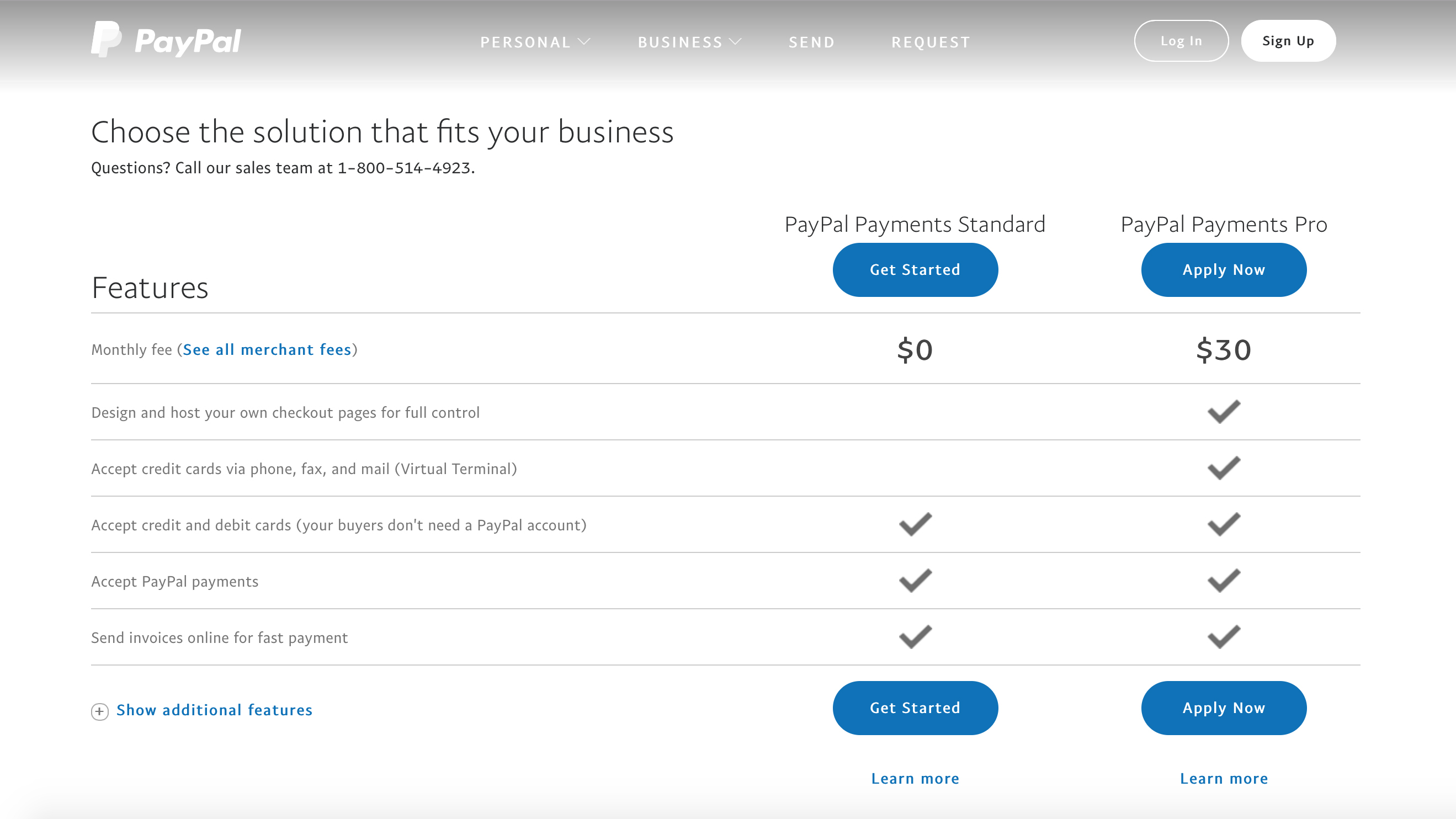

Adding PayPal buttons to your site is the same for the Website Payments Standard option, which currently starts with no monthly fee. However, for a one-stop credit card processing option then PayPal Payments Pro is a solid bet as it allows you to process transaction directly from within your website and that comes with a monthly fee of $30.

In addition, PayPal currently has two different free structures if you go down this route for, as it outlines on its site ‘a suite of functionality consisting of Express Checkout, Direct Payments API, Virtual Terminal and Fraud Management Filters as standard. Optional additional services include Advanced Fraud Management Filters and the Recurring Payments Tool.’

Features

PayPal has something for everyone within its product portfolio. With PayPal Payments Pro you effectively get a one-stop solution that can handle all of your transactions in one place. It’s also pretty flexible in that you can adapt it and customize features in order to tailor it to your individual business needs.

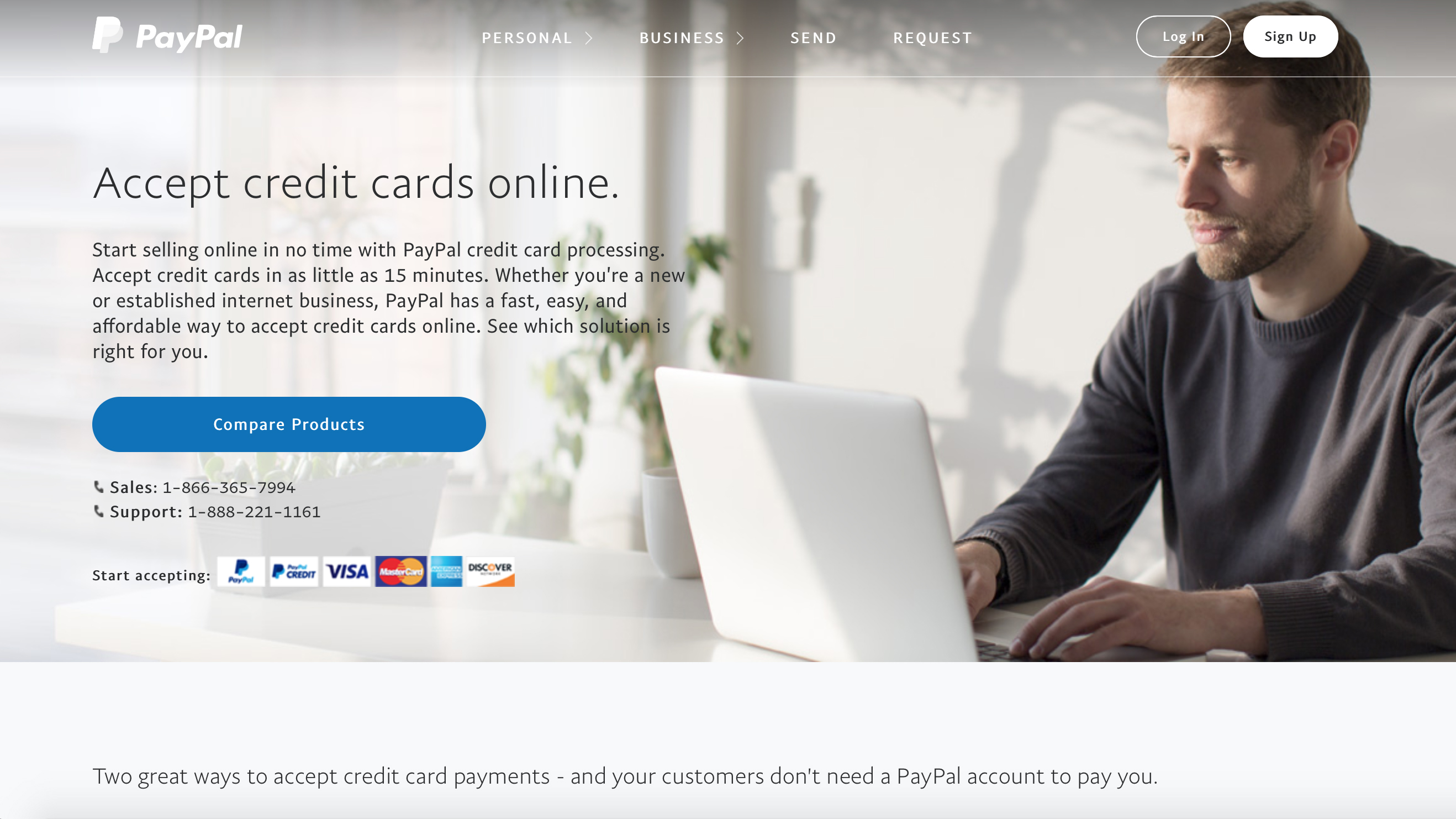

PayPal lets you accept all major credit cards too, including the ever-popular likes of Mastercard, Visa and Maestro. A big benefit with PayPal is that you have one account, where you can keep tabs on payments coming in and going out.

Sign up to the TechRadar Pro newsletter to get all the top news, opinion, features and guidance your business needs to succeed!

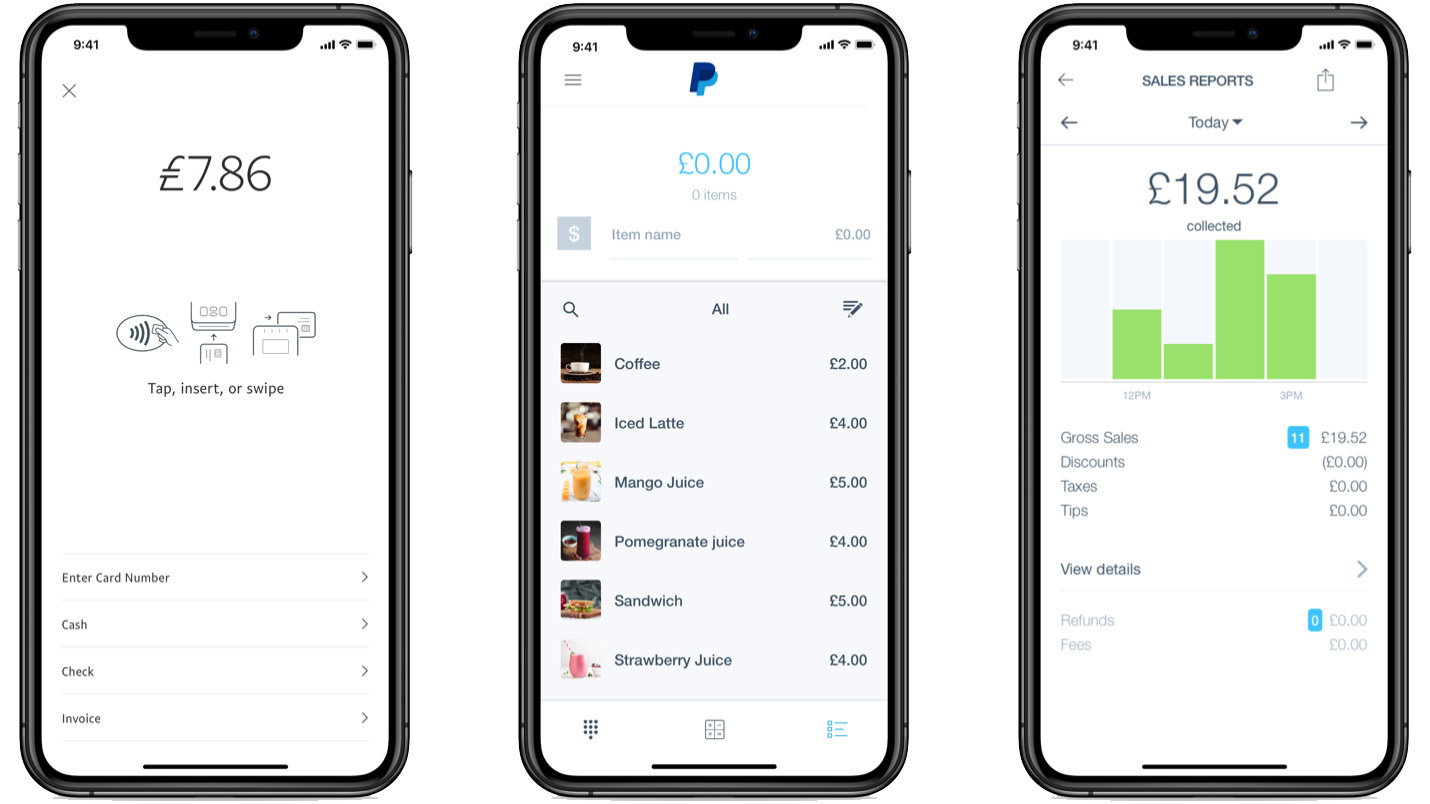

PayPal delivers fast payments and can also be easily integrated into a website, while there is also the provision for taking payment via a card reader if you deal with physical customers.

Performance

As you’d expect from a large and efficient machine like PayPal credit card payment processing is generally seamless and smooth, no matter what sort of e-commerce site or physical business location you have.

Perhaps the most useful aspect of PayPal is the way it performs much the same irrespective of whether you’ve integrated a transaction button on your website or have a physical card reader.

In addition, with one PayPal account to coordinate all of your transactions you should find performance is painless and, potentially at least, pleasant too.

Ease of use

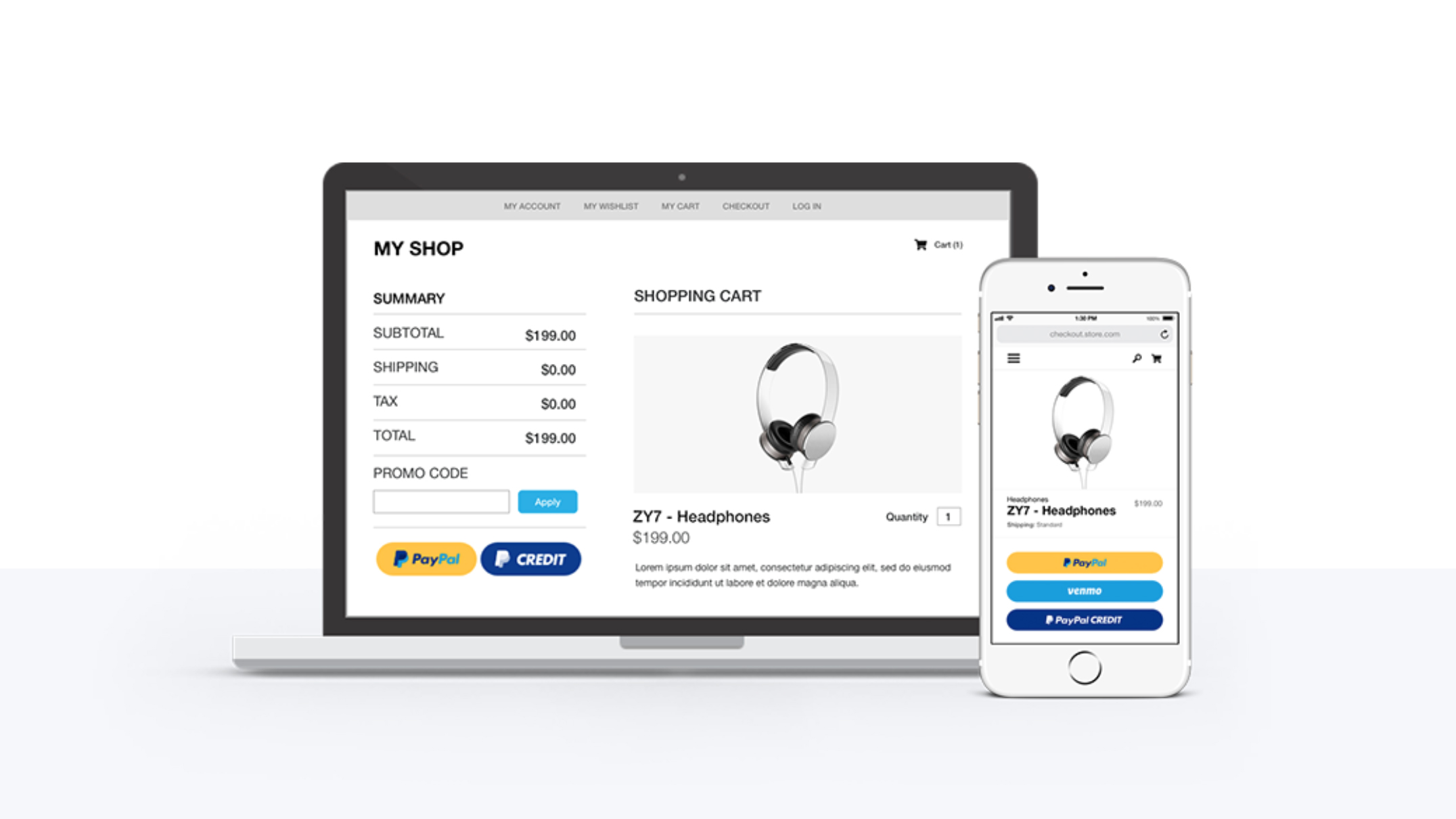

In terms of usability then an integrated PayPal solution is not only easy to implement to your website but it’s also a breeze for customers to use too. After you’ve added the PayPal payment feature to the e-commerce aspect of your site customers can simply head to your shopping pages, select items to buy and then pick from a PayPal, debit or credit card payment option.

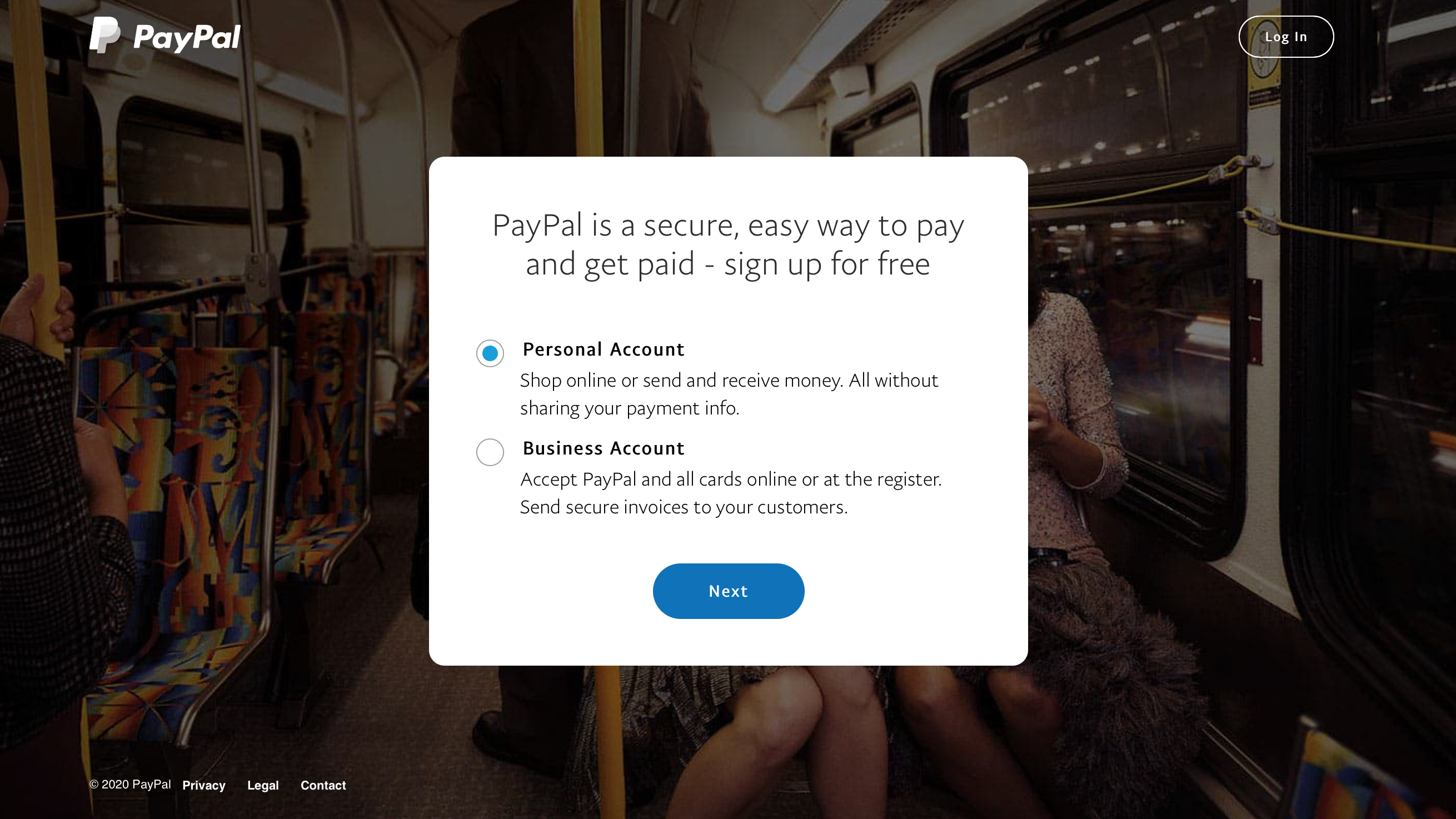

After entering their details transactions are handled by PayPal. If you’re signing up to PayPal for the first time then you’ll need to get yourself an account, which can be done via an online form. PayPal also has trained staff to help you pick through the finer points of setup and integration into your site. They will also offer best advice if you need physical card readers and/or POS terminals.

Support

The bonus of having a more powerful Payments Pro account is that it gets you all of the benefits of being a PayPal merchant. That means you’ll gain access to the PayPal Business Support team, who are available by phone and email during business hours.

Adding value to the experience is the way you have easy access to help and advice for more complex payment issues. This could involve finding out how to integrate website payments with physical ones as well as joining all of the dots together so that you get a more seamless experience.

Final verdict

You can see why PayPal has become the go-to option for a lot of businesses, particularly those with smaller levels of turnover. The real plus with PayPal is that there is a service option for just about anyone. However, deciding which one is best for you is less straightforward although PayPal does use its website to do a decent job in laying out the various options.

If you want to process credit card payments then PayPal lets you do it in any capacity, while there’s also the scalability to consider if you think you’ll be growing your business over time.

- We've also highlighted the best budgeting software

Rob Clymo has been a tech journalist for more years than he can actually remember, having started out in the wacky world of print magazines before discovering the power of the internet. Since he's been all-digital he has run the Innovation channel during a few years at Microsoft as well as turning out regular news, reviews, features and other content for the likes of TechRadar, TechRadar Pro, Tom's Guide, Fit&Well, Gizmodo, Shortlist, Automotive Interiors World, Automotive Testing Technology International, Future of Transportation and Electric & Hybrid Vehicle Technology International. In the rare moments he's not working he's usually out and about on one of numerous e-bikes in his collection.